Morningstar proposes a more meaningful way of categorizing share classes.

By Aron Szapiro and Janet Yang

Funds

By Aron Szapiro and Janet Yang

Read Time: 2.5 Minutes

Clean shares were created to reduce conflicts of interest by eliminating, or at least leveling, payments from asset managers to the intermediaries that sell mutual funds. Intermediaries would then ensure their advisors’ compensations did not depend on the fund they recommended, reducing conflicts of interest.

While the idea of clean shares is good for investors, we have a few concerns with how they’re being presented. Below, we share our perspectives.

Our concerns with the umbrella term “clean shares” include:

To help investors and the industry untangle what these new share classes mean, Morningstar is labeling emerging share classes a little differently.

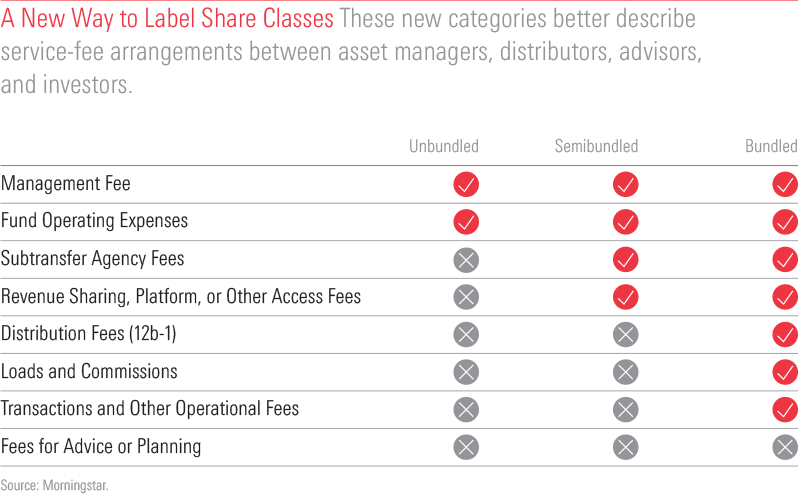

We aim to shed light on what an investor pays for directly (say, by writing a check to an advisor) or indirectly (via a fund’s expense ratio). As the chart below shows, we categorize the classes as unbundled, semi-bundled, or bundled.

One category isn't inherently better than the other; each of these service arrangements can be appropriate for different kinds of investors. Rather, investors and advisors should use them as starting points to have better-informed conversations.

Here’s how those groups may benefit from these categories:

Users of Morningstar Direct℠ and Morningstar® Advisor Workstation℠ can see these new labels for all U.S. funds at the share class level under “Clean Share—Service Fee Arrangement.”

This blog post is adapted from an article that originally appeared in the June/July 2018 issue of Morningstar magazine. Read the full article or subscribe for free.