The retirement savings gap in the United States is real no matter how you slice it. Nearly half of Americans have saved nothing for retirement, according to research by Morningstar’s Jake Spiegel. And for those who have saved, the median 401(k) balance is under $10,000, according to the Brookings Institution.

Many Americans are worried about retirement. In a recent EBRI survey, for example, only 17% of Americans workers felt very confident in their ability to retire comfortably.

But, this overall retirement outlook is already—somewhat—common knowledge in the research community, according to sources like National Institute on Retirement Security, EBRI, and others. We’ve just released a new study in which we asked: What can Americans, and their advisors, practically do to better prepare for retirement? In short, we find that this bleak picture can change—if specific actions are taken.

What works best?

We ran over 400 million simulations, based on a nationally representative sample of Americans and their finances, to analyze the effectiveness of eight actions on an individual’s retirement readiness. The actions fall into three categories:

- Financial planning: Adjusting one’s standard of living in retirement, delaying retirement, allocating more funds to the starting amount, and increasing contribution rates

- Investing: Increasing net returns from investing and using a more aggressive asset allocation

- Investor behavior: Signing up for increased contributions over time and choosing whether or not invest one’s savings at all

We found that the basic techniques—saving more, choosing to invest one’s savings, delaying retirement, and lowering one’s expectation of living—were most effective at increasing the likelihood of success for the majority of Americans.

Surprisingly, this is true for mass affluent households as well. These techniques are far more impactful than other investment and finance-focused levers. In addition, when individuals exercise these techniques at the same time, it multiplies their effect and decreases the need for austerity: significantly lower standards of living, delaying retirement by many years, etc.

Register for the Morningstar Investment Conference today to learn about the true cost of retirement.

Defaults do not replace personalized financial advice

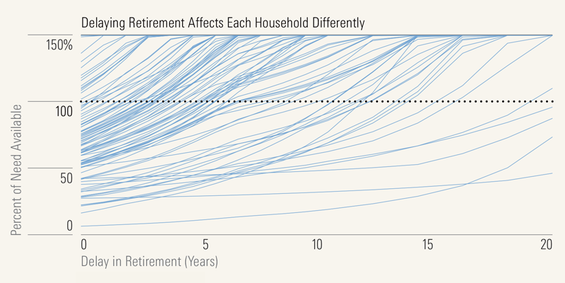

Each household, however, has its own demographic and financial situation. And what works for one, may not be particularly effective for another. For example, the following graph shows 100 randomly selected, real mass-affluent households from the Survey of Consumer Finances. It displays how a delay in retirement affects how much money households will have available for retirement. As you can see, there is a broad range, even in this random sample – delaying retirement has a widely different effect, depending on where a given household is starting.

In another example, in one of the common areas in which defaults are given—401k contribution rates—non-personalized advice is particularly limiting and ineffective. We found that a single contribution rate fit the needs of only 8.8% of households; everyone else needed a different contribution rate. In other words, the right answer isn’t a new default: it’s personalized financial advice based on what each household needs . Which, of course, is an area in which a financial advisor’s expertise and experience can significantly help individuals.

How personalized financial advice can be the solution

Our findings suggest that multiple tools can help Americans succeed when it comes to retirement, however these tools are most effective when more than one is put into action at the same time. To find this perfect combination, personalized financial advice is essential. To help Americans out of the rut that is our retirement future, personalized analysis of what each household needs is absolutely necessary.