Our annual study on fund fees that examines the trends in fees across U.S. open-end mutual funds and exchange-traded funds shows that, on average, investors paid lower fund expenses in 2017 than ever before.Morningstar Research Services LLC (herein referred to as "Morningstar") publishes an annual study on fund fees that examines the trends in fees across U.S. open-end mutual funds and exchange-traded funds.

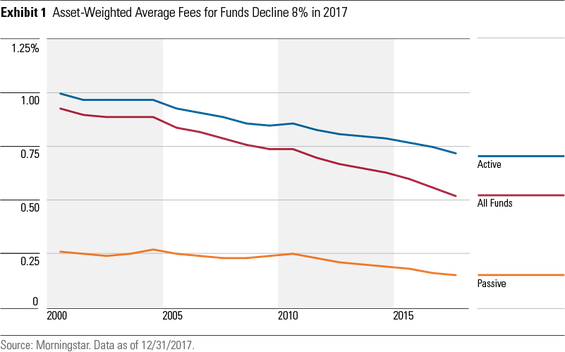

Last year, investors paid an average 0.52% expense for funds, as measured by the asset-weighted average expense ratio of roughly 25,000 U.S. open-end mutual funds and ETFs. This marked an 8% decline from 2016, which is the largest year-over-year decline that we've recorded since we began tracking this data in 2000.

We estimate this 8% decline translated into a $4 billion savings to investors in 2017. This fee decline is a big positive for most investors because fees compound over time and can diminish returns.

Below, we highlight some key takeaways from this year’s fund fee study.

4 learnings about trends in fund fees

- Investors’ shift to passive funds is pushing down fees. Over the last few years, one of the main drivers of falling asset-weighted average fees has been flows into lower-cost funds, primarily the migration from active to passive for U.S. equities exposure. Passively managed, core U.S. equity, taxable bond, and international equity index funds have also seen aggressive fee cuts, which in turn have drawn strong inflows. While most passive funds are already significantly cheaper than their active peers, asset-weighted average fees continue to decline at a faster clip on the passive side: Active fund companies have been more likely to introduce lower-cost share classes than to cut overall fees.

- Flows into cheaper funds have soared. Flows into cheaper share classes have been rising steadily since 2000, but have accelerated more rapidly in the last five years. Specifically, in 2017, funds with fees ranked in the bottom quintile of funds within their category group saw net inflows of $949 billion—a record high, and a 60% increase over 2016 levels. In 2017, passively managed funds accounted for 70% of the net flows into low-fee-ranked funds, while actively managed funds accounted for the remaining 30%.

- More expensive funds experienced widespread outflows. Since 2014, funds with higher fees ranking in the top 80% within their category groups have seen ongoing outflows. These outflows reached $251 billion in 2017, which marks a decline from 2016’s $414 billion, but higher than 2014 and 2015 levels of $66 billion and $212 billion, respectively.

- Most investors are in lower-priced funds. Currently, 83% of all assets are in open-end mutual funds and ETFs with fees that rank in the bottom two quintiles of their category groups, while only 6% are in funds with fees in the top two quintiles.

Read our methodology for calculating the Morningstar Fee Levels used to rank fund fees, and read the full guide for further information on the study. Please see below for important disclosure.