Not all advisors view client financial education the same way. Some see it as a primary service, while others aren’t convinced that it’s worth the effort. And some research on the effects of financial education on behavior suggests that the latter may be right.

We aimed to understand why this may be in “ Stop Teaching, Stop Coaching.” This research uncovered a few factors that may be to blame for the feebleness of financial education: financial literacy, materialistic values, impulsiveness, and one’s conceptualization of the future.

To rein in these disruptive factors, advisors can turn to the behavioral-coaching techniques outlined below.

Behavioral coaching can fill gaps left by financial education

The concept of behavioral coaching is different from teaching, though some elements overlap.

Teaching is about knowledge transfer, while coaching is about action and skills. Teachers may lecture and assign work, but coaches are right there with people as they make their attempts to excel.

3 ways advisors can have a positive impact on their clients’ financial behavior

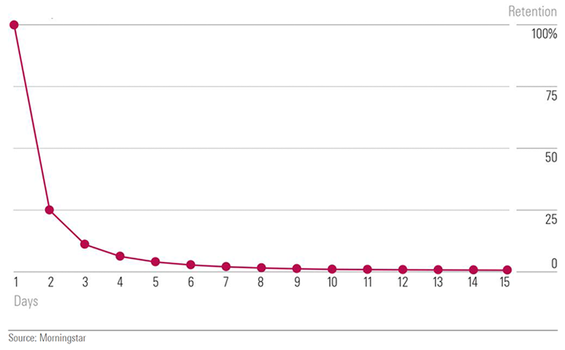

- Take a just-in-time learning approach to teaching clients. Memory retention research shows a clear pattern of knowledge decay over time. The rate of memory decay is exponential, meaning that it drops off extremely quickly. To combat this, research suggests that it may be better to offer important information just before it needs to be applied. In many ways, good advisors apply this rule intuitively. Information about the purpose and merits of annuities might fall on deaf ears if clients are focused on building a family. But as they approach retirement, and are curious about how to deploy their assets to ensure a stable income, they may make far better students. Advisors are in a unique position to foresee these changes and offer just what clients need to know at just the right time—before the memory fades.

2. Incorporating psychology in behavioral coaching techniques. Even with the best timing, memories decay. Here, we can turn to research on teaching and memory for additional tools to boost the likelihood of memory retention over time, such as the self-generation effect. Information is better remembered when it is generated from our own minds. Helping your clients remember an important concept may be as simple as asking them to put it into their own words.

3. Coach the whole person, not just the portfolio. Behavioral coaching goes beyond portfolio management to work with clients on developing and maintaining their motivation, fostering a sense of financial empowerment, and helping them create a vision for their financial future in which they are emotionally, as well as financially, invested. By understanding which areas of psychology have been shown to affect financial decisions, advisors can target their coaching efforts more efficiently.

While financial knowledge matters, it’s insufficient for changing behavior, especially when other mental factors work against our better judgment.

This blog post is adapted from an article that originally appeared in the April/May 2018 issue of Morningstar magazine. Read the full article or subscribe to the magazine for free.