This post was updated on March 12, 2018, to reflect data through Dec. 31, 2017.

When it comes to investing according to environmental, social, and governance (ESG) criteria, investors often worry about potential performance loss. Jon Hale, Morningstar’s head of sustainability research, has looked at the track records of sustainable investment funds and concluded that investors need not fret.

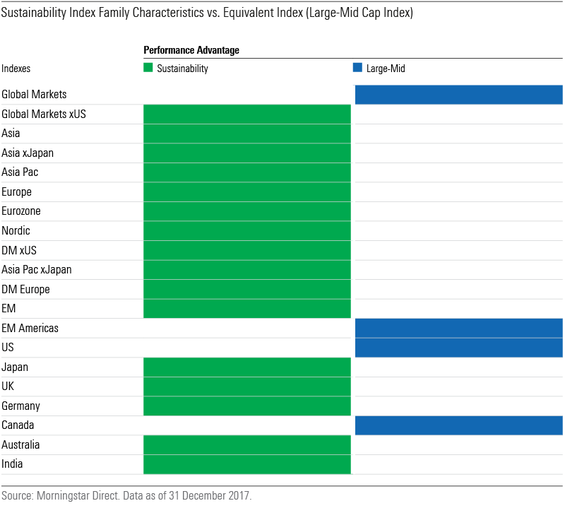

We recently studied the performance of the Morningstar Sustainability Index family and observed that sustainability does not appear to be a drag on performance at the market level either. Of the 20 equity indexes in Morningstar’s Global Sustainability Index family, 16 have outperformed their non-ESG equivalents over their lifespan. It is critical to note, however, that sustainability screens cause divergence from overall market exposure. They will add value during some periods and subtract in others. In recent years, the ESG indexes have outperformed in Europe and Asia but underperformed in the U.S. equity market.

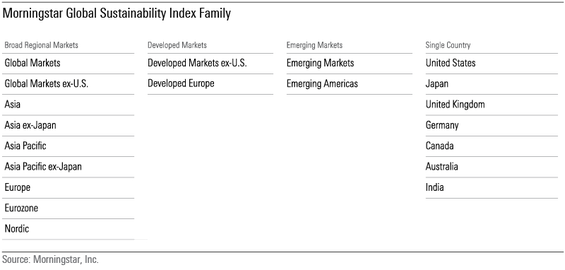

What is the Morningstar Sustainability Index family?

Morningstar’s ESG indexes are methodologically aligned with the Morningstar Sustainability Rating TM for funds. The sustainability indexes select the highest-scoring companies on ESG as rated by researcher Sustainalytics, then weights them by market capitalization. They exclude companies experiencing severe controversies as well as companies involved with tobacco and controversial weapons, such as land mines. Weights in regions and sectors are kept within two percentage points of their non-ESG benchmarks.

Morningstar Sustainability Index family results

Because Sustainalytics does not comprehensively cover smaller caps, the parent indexes for the Morningstar Sustainability Index family are large- and mid-cap focused. Returns are examined in U.S. dollars only for the purposes of apples-to-apples comparison. The indexes overlap. For example, the constituents of the Morningstar US Market Index consume more than 50% of the Morningstar Global Markets Index weight.

As displayed below, 16 of 20 sustainability indexes best their non-ESG equivalents.

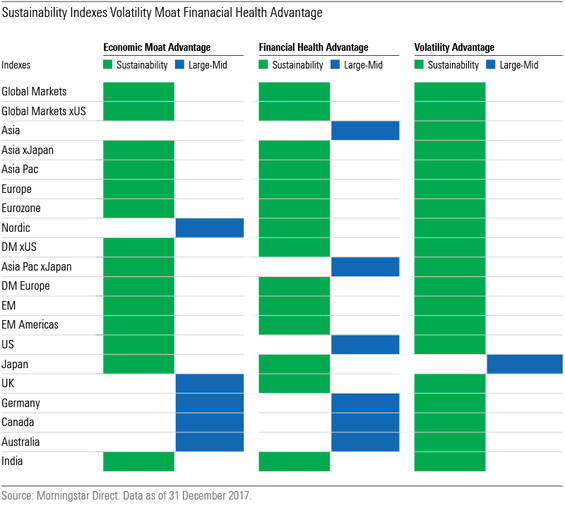

Sustainability favors less volatile, competitively advantaged, financially healthy companies

The members of the Morningstar Sustainability Index family tend to select companies that are less volatile and have stronger competitive advantages and healthier balance sheets than their non-ESG equivalents. This analysis relies on the Morningstar Global Risk Model, specifically the Volatility, Economic Moat, and Financial Health risk factors.

Sustainability screens add value during some periods, subtract in others

It’s likely that the biases toward Economic Moat and Financial Health will be more enduring than performance trends. The results of this risk model analysis are consistent with other Morningstar studies written by Jon Hale and Natalia Wolfstetter, a Morningstar manager research director.

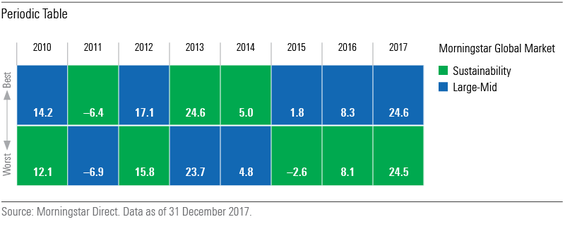

Performance, for its part, is highly time-period dependent. Sustainability screens will add value in some time periods and detract during others.

Just look at annual returns for the Morningstar Global Markets Sustainability Index versus its non-ESG equivalent.

This research was conducted using Morningstar Direct. If you’re a user, you have access. If not, take a free trial.

Dan Lefkovitz is a strategist for Morningstar's Indexes product group.