Coronavirus Recovery: A Tale of Two Markets

The U.S. and Canada show the different impacts of market concentration.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

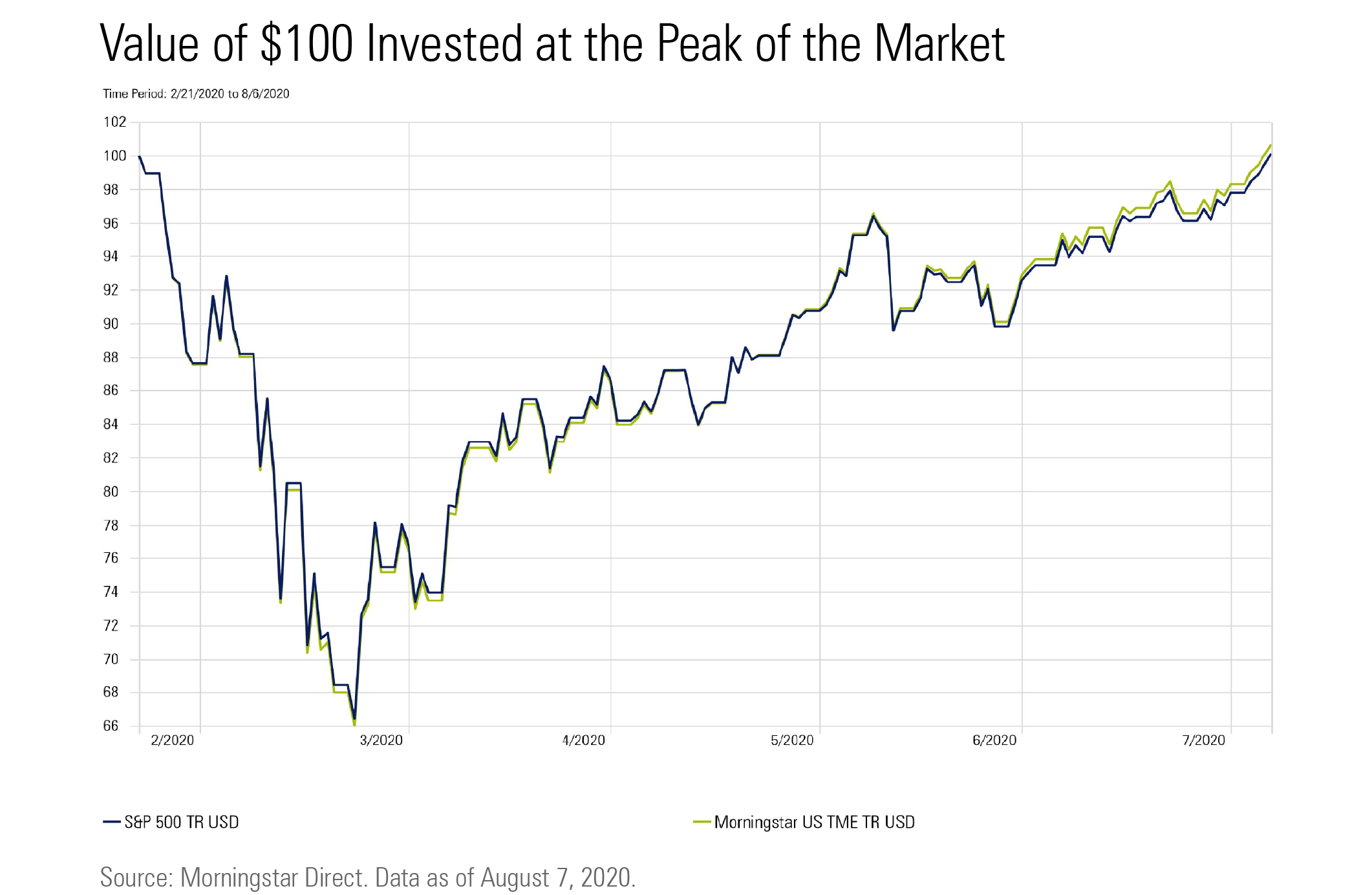

Well, that was quick. Despite bleak global economic outlook and the continued uncertainty brought on by the coronavirus pandemic, as of Aug. 6, 2020, the U.S. market recovered to its pre-pandemic high.

Using the concept of the "pain index" coined by my colleague Dr. Paul Kaplan, the COVID-19 bear market goes down in history as one of the least painful on record, lasting a total of about 120 trading days with a maximum drawdown of about 34%.

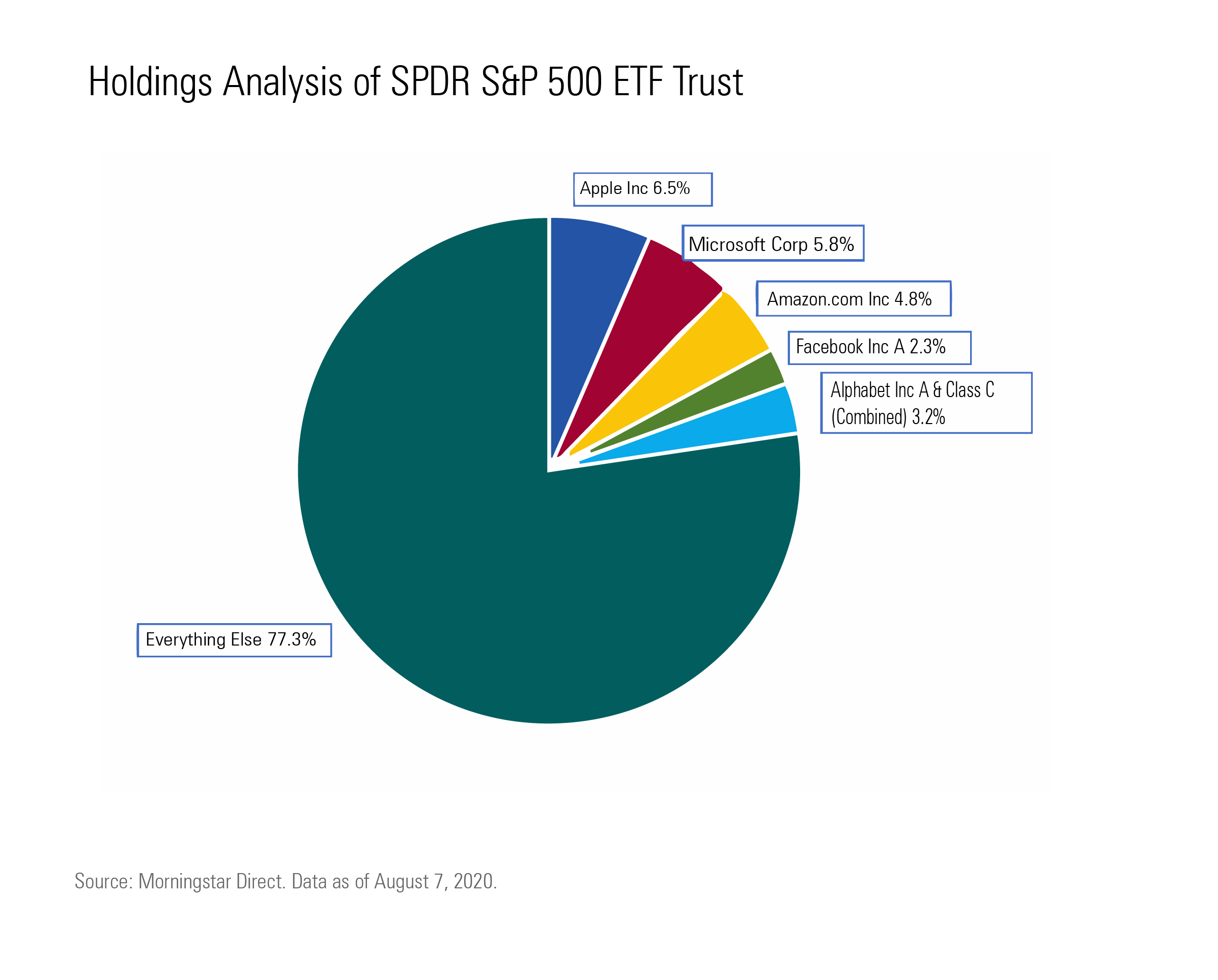

We could endlessly speculate on the reasons behind the recovery; however, it might be more productive to glean some concrete insights on its nature. To begin with, a quick look at the holdings of the SPDR S&P 500 ETF SPY shows us that the S&P 500 is concentrated.

The broad market index long known as a representation of the U.S. economy is somewhat concentrated on the five FAANG-type companies (that is, Facebook, Amazon.com, Apple, Netflix, and Google parent Alphabet [counted as one entity]), each of which has performed exceedingly well during the pandemic.

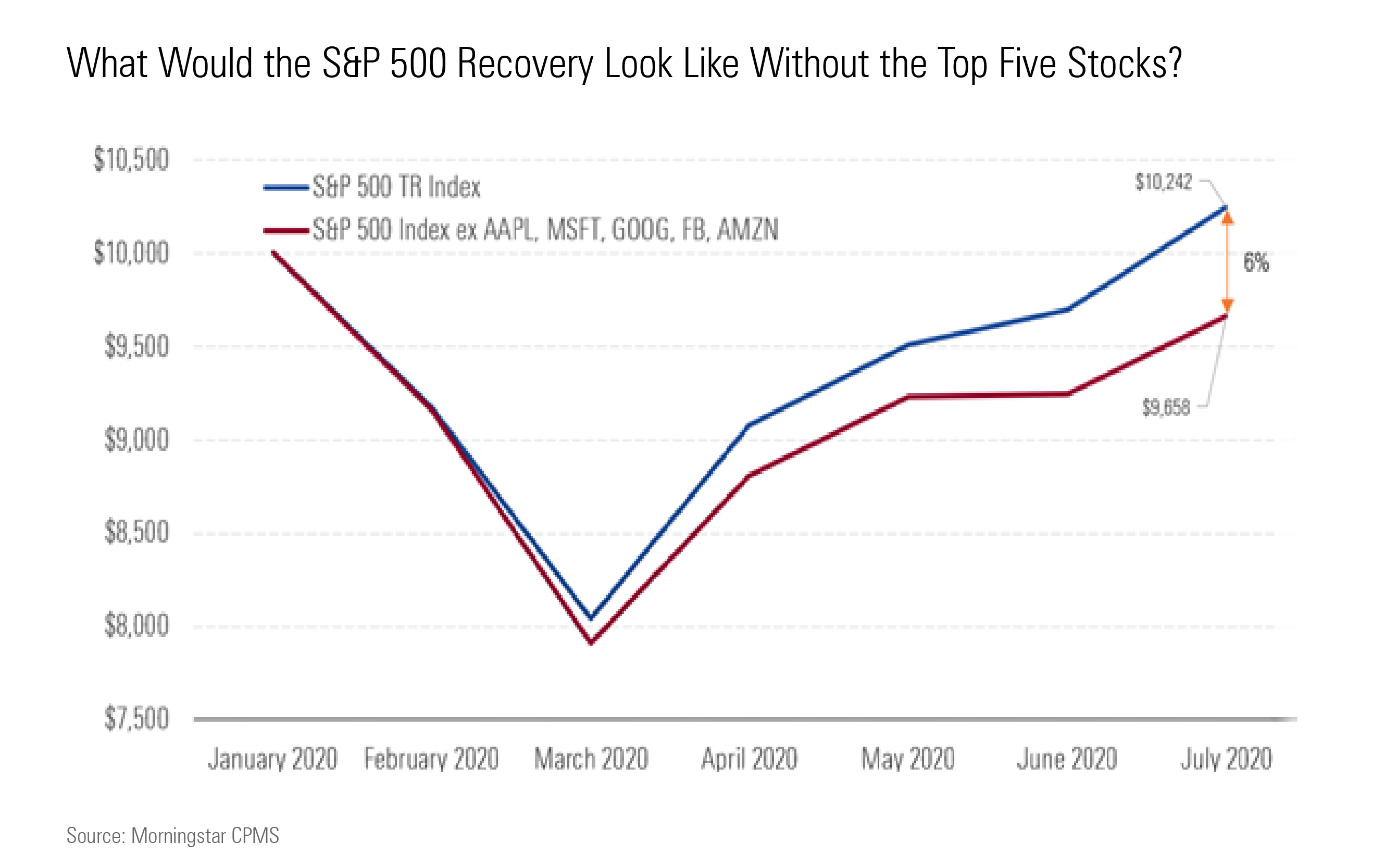

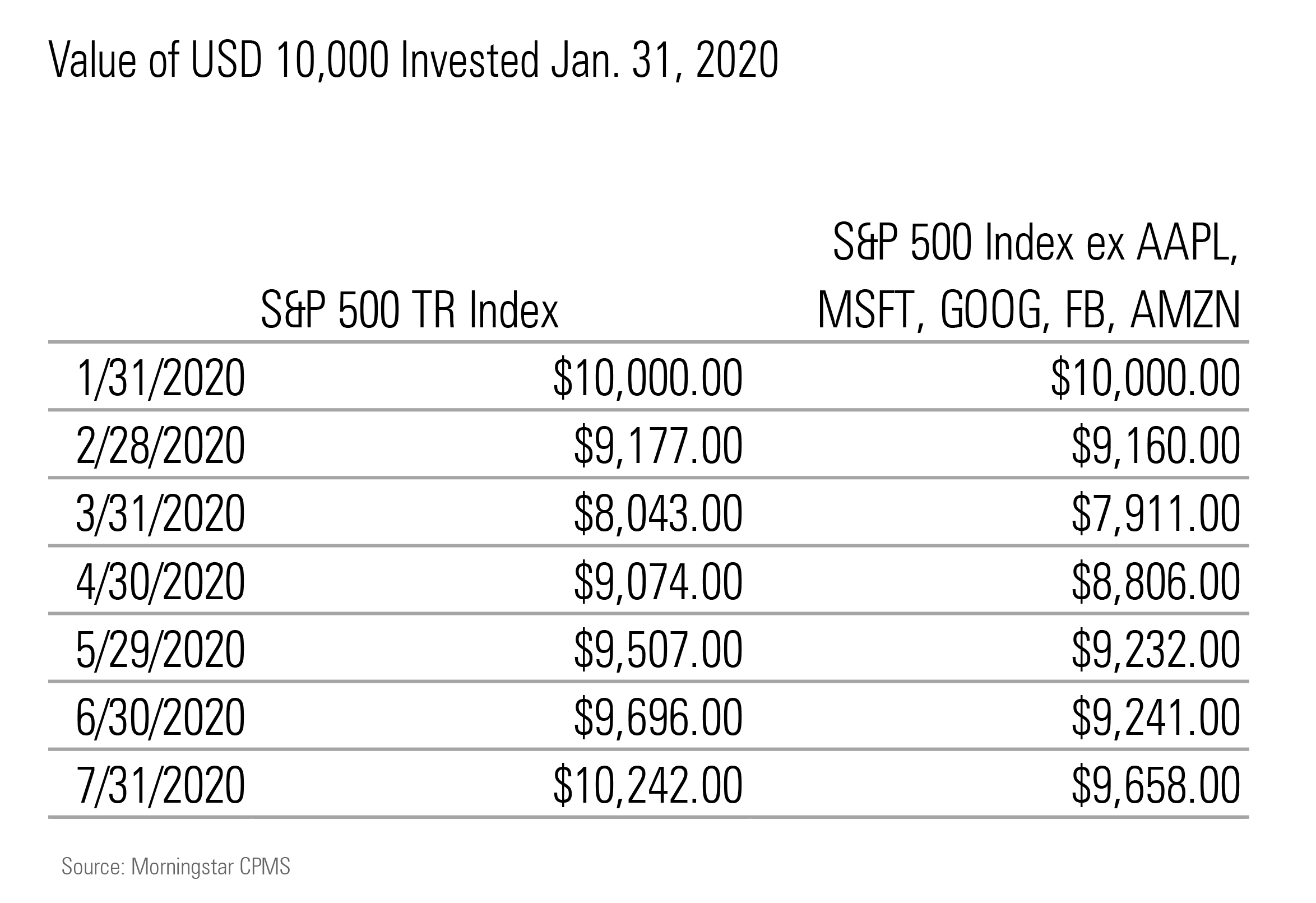

To understand to what extent these five names contributed to the index returns in this recovery, I ran a simulation of the S&P 500 without them. To do this, I leveraged the Morningstar CPMS back-testing engine by replicating a market-cap-weighted portfolio of 494 companies, specifically excluding the five largest companies (including both share classes of Alphabet) starting Jan. 31, 2020. The parameters of the test included a calendar-quarter rebalance at the end of March and June back to target weights, with all dividends being reinvested to mimic the index.

Let’s look at what that means in dollar terms.

The outcome of the test shows that without the five largest companies, the S&P 500 would still have recovered to peak or near-peak levels but would have been a full 6% lower in value at the end of July, assuming a common investment start date of Jan. 31, 2020. Although the market recovery can’t be attributed solely to the success of the FAANG-type stocks, these stocks certainly played a critical role in the recovery so far.

Canada's Recovery and Why Market Concentration Is a Bad Thing In the case of the U.S. market, having concentration in the top five names has helped performance during the recovery period of the pandemic. But market concentration can also lead to adverse outcomes, as demonstrated by the Canadian market's slow recovery from March lows.

Like in the U.S., Canada's S&P/TSX Composite Index also has 25% of its weighting in five companies, four of which have been around for at least 50 years. The fact that their performance (Shopify SHOP excepted) has been far from exceptional might explain why the Canadian market hasn't quite recovered. Moreover, as the sixth-largest energy producer in the world, over 10% of Canada's gross domestic product stems from the energy sector, which represents 13% in terms of weight of the benchmark index. Unfortunately, the pandemic brought with it a reduction in demand for energy, which ultimately led to depressed oil prices.

Canada’s concentration in energy has hurt its performance. As of Aug. 17, 2020, the S&P/TSX Composite Index is roughly 6% shy of its pre-pandemic highs. Without exposure to the energy sector, the index would have recovered back to pre-pandemic levels by the end of July. In other words, having exposure to the energy sector detracted 6.2% from the index performance.

Investors with a mix of passive index exchange-traded funds, active funds, and individual stocks may unknowingly be overexposed to a particular sector or, worse yet, a particular name. Single-stock risk, or unsystematic risk, is caused by this very issue and can easily be taken care of by ensuring that you have a well-diversified portfolio. Portfolio diversification is something all investors want to keep an eye on, especially during fast-moving markets.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)