Value in Disguise

Fundamental weighting doesn't explicitly target value stocks, but it can deliver similar exposure to traditional value index funds.

Value investing is simple in principle: Buy cheap stocks that are underpriced by the market. How to choose a portfolio that best deploys this straightforward logic is not as clear, as there are different, and often non-obvious, ways to channel value.

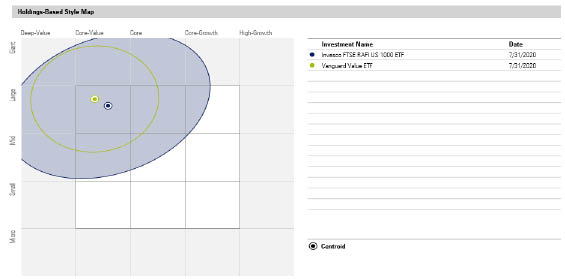

Invesco FTSE RAFI US 1000 ETF PRF, which weights its holdings by fundamental measures of size, is an unconventional value strategy. Although it’s not obvious upon first glance, a careful look at this approach reveals that it invites a similar degree of value exposure as conventional market-cap-weighted funds that screen for value stocks. This fund illustrates that the paths to value can be nebulous and that non-cap-weighted funds are often value strategies in disguise.

Market-Cap and Fundamental Weighting Traditional value index funds, like Vanguard Value ETF VTV, follow a similar blueprint. They use observable valuation metrics like price/book value and price/earnings to target stocks representing the cheaper half of the U.S. large-cap market and weight them by market capitalization. This weighting approach channels the market's collective view on the relative value of each holding. Firms that are seen as the most valuable have the largest market capitalizations and, consequently, the greatest share of portfolio assets.

PRF, on the other hand, does not screen for value stocks. It derives value through fundamental weighting, which uses a firm’s economic footprint instead of its market cap to dictate weighting. This approach combines stocks’ book value, sales, cash flow, and dividends to establish a fundamental size score and corresponding target weight for each stock. Should a holding’s price sink relative to its fundamental size, this fund will increase its exposure to that stock at the next rebalance to match its target weight. By buying low and selling high, this fund captures value without directly targeting value stocks.

Fundamental weighting breaks the link between prices and portfolio weightings that underpins traditional value strategies like VTV. Underweighting firms whose market-defined size exceeds their fundamentally defined size reduces PRF’s exposure to the most richly valued stocks. This approach begins to embody the modus operandi of value investing; it tilts toward stocks that are more likely to be underpriced.

PRF captures the value effect through its contrarian rebalancing approach, which increases exposure to stocks whose prices decline relative to their fundamentals and trims exposure to stocks that grow. If a stock’s price plummets while its fundamentals remain consistent, this fund will double down on its investment in that firm, betting that it will rebound to a price more congruent with its fundamentals.

Traditional index funds like VTV can benefit from mean reversion, too, but only on the value side of the style box. Many of these stocks have been beaten down and may be priced to offer better returns going forward. However, VTV capitalizes on mean reversion most effectively for stocks at the cusp of growth and value. Former growth stocks whose valuations decline migrate into value territory and are added to the fund, while former value stocks whose valuations expand become growth stocks and are sold by the portfolio. For these stocks, VTV’s process is similar to PRF’s; it is buying low and selling high. If those stocks’ valuations subsequently mean revert, VTV should benefit.

Now, suppose one of VTV’s existing holdings becomes cheaper. Because it weights by market-capitalization, that stock would become a smaller part of the portfolio. The fund can still benefit from mean reversion in valuations among those stocks, but probably not as effectively as it would for stocks that cross the value/growth selection threshold, as the change in the weighting is less dramatic. And, unlike PRF, VTV misses out on all mean reversion on the growth side of the style box.

PRF’s advantage lies in the fact that it can profit from mean reversion across the entire value-growth spectrum. It will benefit from stocks that mean revert while never leaving growth territory, which VTV cannot because of its valuation screens. Deep-value firms that see huge rebounds will also likely have a bigger positive impact on PRF than VTV because their fundamental weighting likely exceeds this market-cap weighting. PRF mines a huge field for value, driving much of this offering’s success.

Exhibit 1

- source: Morningstar

Performance Since PRF's inception in December 2005, it has outpaced VTV by 89 basis points annually. This is partially due to the strong run of growth stocks, which PRF includes but VTV does not. However, PRF is doing more than repackaging traditional value and growth exposures. Historically, there hasn't been a strong relationship between the performance of value and growth stocks and PRF's performance relative to VTV over a rolling one-year horizon.

Outperformance has come in bunches. In fact, PRF actually trailed VTV in over half of rolling 12-month periods since its inception. This fund should post excellent returns when stock prices mean revert sharply, as its heavy stakes in ailing stocks will deliver quick gains. These bursts, like the post-global financial crisis reversion of 2009, account for a disproportionate share of long-term performance. So, even though PRF may experience long stretches where it doesn’t outperform, it can still be worth sticking with.

That said, VTV is a terrific large-value option. It has turned in less-volatile performance over the trailing 10 years through July 2020, and it only lagged PRF by 9 basis points over that period. Additionally, it is 35 basis points cheaper, so its expenses will take a smaller bite out of returns.

Exhibit 2: FTSE RAFI US 1000 ETF Wealth Relative to Vanguard Value ETF

- source: Morningstar

Are There More Value Strategies in Disguise? PRF demonstrates that a strategy can target stocks from across the value-growth spectrum and still arrive in the large-value corner of the style box. This is not exclusive to fundamental weighting. SPDR S&P Dividend ETF SDY, which weights holdings based on yield, and iShares Core Dividend Growth ETF DGRO, a dividend-weighted strategy, don't explicitly target value stocks but, like PRF, harness value through non-market-cap-weighting approaches. It isn't always obvious when value is driving performance, but it's a powerful factor that can be found wearing a number of disguises, including fundamental weighting.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)