One More Potential Reason to Invest Abroad

Foreign companies tend to have less debt than their U.S. counterparts.

After a lost decade for foreign stocks relative to U.S. equities, many predict that foreign shares will win the 2020s. Such forecasts mostly boil down to the valuation gap between U.S. shares and their less-expensive international counterparts. As of June 30, 2020, Morningstar Investment Management's forecast was a nominal 10-year annualized return of 7.4% for international developed stocks versus just 1.9% for U.S. stocks.

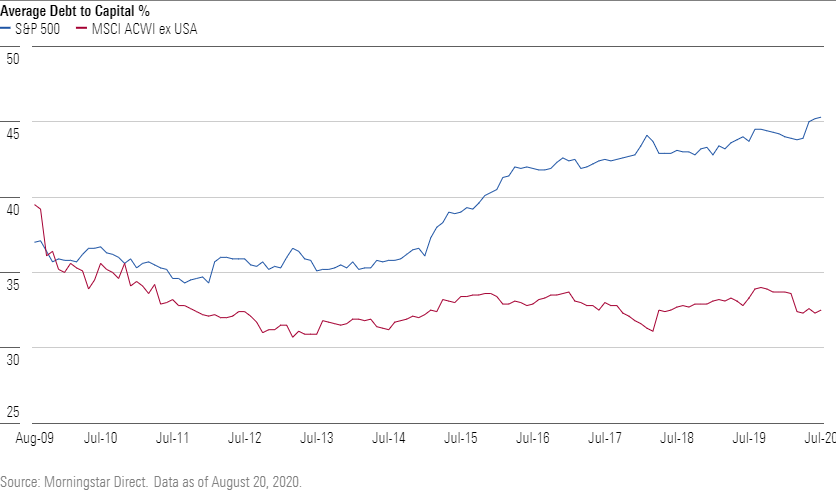

While all forecasts should be taken with a big grain of salt, this alone may compel you to increase your foreign-stock allocation. But there's another potential reason: balance-sheet risk. Overall, U.S. companies carry more debt than international ones. The companies in the S&P 500 have average debt/capital ratio of 45.4% versus just 32.6% on average for companies in the MSCI All-Country World ex USA Index.

The gap isn't quite as big when looking at financial leverage (that is, the equity multiplier), which measures the degree to which a company is financed by shareholders' equity. The greater the number, the more a company is financed by debt. The S&P 500's average financial leverage is 5.0 versus 4.8 for the MSCI ACWI ex USA.

But keep in mind that the MSCI ACWI ex USA has a much bigger weighting in financials--17.6% versus 9.8% for the S&P 500--which tend to be highly leveraged by definition (banks in particular). When financials are removed from the analysis, the gap grows considerably with the MSCI ACWI ex USA's financial leverage dropping to 3.2, while the S&P 500's drops far less, to 4.3.

Differences at the sector level are even more dramatic. For instance, consumer staples companies in the MSCI ACWI ex USA have an average debt/capital of 35.2% versus 55.4% for their counterparts in the S&P 500. In consumer discretionary, the MSCI ACWI ex USA's average is 27.1% versus 61.7% in the S&P 500. The only sectors where the MSCI index has higher average debt/capital are communication services (36.5% versus 28.9%) and energy (35.7% versus 29.5%).

To be sure, companies across the globe have gone on a borrowing binge since the 2007-09 credit crisis (spot the irony). The OECD reported that, "Between 2008 and 2019, the average global issuance annually was $1.8 trillion, which is double the average annual amount of $879 billion between 2000 and 2007." U.S. companies accounted for about half of this borrowing.

We have highlighted the risk of increasing debt in the past, but it has only grown more acute in recent years. According to S&P Global, "Since the beginning of 2019, the amount of U.S. corporate debt has grown by 10%, outpacing the 2% growth of European corporate debt." So far in 2020, U.S. investment-grade companies alone have issued more than $1.3 trillion in new debt. This is a record pace, and DoubleLine predicts that issuance could hit $1.9 trillion by year-end. Nonfinancial U.S. corporate debt is now about $10 trillion, about twice what it was in 2008.

While all this borrowing has led to a spike in the S&P 500's average debt/capital, that ratio has been flat for the MSCI ACWI ex USA. The gap between the two has widened considerably since early 2015, when U.S. issuance really took off and issuer quality also began to decline. U.S. companies got here in part because the United States has the world's most-robust corporate-debt market. While easy access to capital is often an advantage, it may prove to be too much of a good thing.

By contrast, European companies, for example, tend to rely more on traditional banks while also taking a more conservative approach to debt. However, this isn't to say that all companies outside the U.S. have pristine balance sheets. Corporate issuance has increased globally, especially in China. And the European Central Bank, like the U.S. Federal Reserve, has also started buying corporate debt.

Nevertheless, for those worried about U.S. corporate debt, it may be worth looking abroad. If the current recession continues and earnings get squeezed, foreign companies with less debt than their U.S. counterparts could prove more resilient.

For those interested in low-debt foreign-equity options, iShares Edge MSCI Multifactor International ETF INTF, which carries a Morningstar Analyst Rating of Silver, has an average debt/capital of just 29.3%. On the open-end side, Bronze-rated First Eagle Overseas SGOVX is defensive in most respects, including when it comes to debt. The May portfolio's average debt/capital was just 26.8%. Finally, Silver-rated Ariel International AINIX recently had average debt/capital of 28.9%. Manager Rupal Bhansali is vigilant when it comes to debt because she sees it as a major risk factor going forward.

Of course, shifting assets abroad won't fully insulate anyone from the risks of corporate debt. If the U.S. corporate-debt market were to implode, it would likely take global markets with it. But low-debt companies, whether in the U.S. or abroad, might have a better shot at long-term survival.

/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)