Can Interest in ESG Investing Hold Up During a Pandemic?

Morningstar's latest behavioral research shows that interest in sustainable investing persists despite the coronavirus.

Interest in sustainable investing has grown tremendously in recent years, and our research has shown that this applies to most investors, regardless of gender or age. Given this rise in popularity, a growing number of asset managers and public companies are making sustainability-focused changes.

As Morningstar's director of sustainability research Jon Hale noted in his Sustainable Funds U.S. Landscape Report, many "companies started off 2020 by issuing significant commitments to sustainability." Along with these commitments, asset flows into sustainable funds increased fourfold in 2019 alone and continue to see record inflows so far this year.

Despite this unprecedented growth, some believe that interest in environmental, social, and governance investing is fickle and will dwindle when the going gets rough. In our research, we have found that interest in ESG investing can take the heat.

Putting Interest in ESG Investing to the Test To test the durability of investors' interest in ESG, we conducted an online experiment during the beginning of the extreme market volatility caused by the COVID-19 pandemic (March 26, 2020 to March 29, 2020).

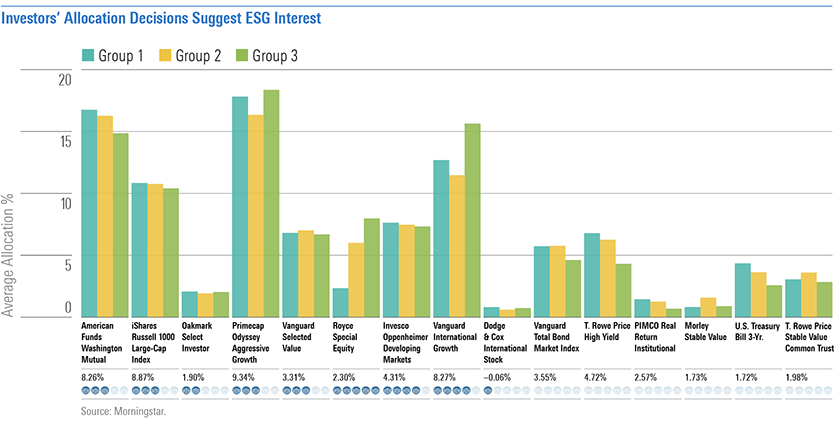

We asked 626 people to imagine they'd started a new job and were setting up a retirement account for which they needed to distribute assets among 15 fund options. The context of that choice varied in the experiment; the participants were randomly assigned into one of three groups:

- Group 1: Participants received standard metrics about each investment: the name, Morningstar Category (large value, mid-cap growth, and so on), five-year total return, 10-year total return, annual reported net expense ratio, and Morningstar Rating (the star rating).

- Group 2: Participants were offered the exact same lineup and information but were also given each investment's Morningstar Sustainability Rating.

- Group 3: Participants were given a questionnaire to help remind them of their personal ESG preferences (known as an identity prime questionnaire) and then received the exact same lineup and information as Group 2.

We then compared the average amount that each of the three groups invested in each option.

ESG Continues to Hold Investors' Attention One investment in this experiment that particularly required people to trade off between returns and a high sustainability rating was Royce Special Equity RYSEX, which has a 5-globe rating but a fairly low five-year trailing return.

Although Group 1 (which had no ESG information about the investment alternatives) largely ignored Royce Special Equity, Groups 2 and 3 invested substantially more money into it. In other words, this choice showed that investors do seem to be swayed by a fund's sustainability rating when making asset-allocation decisions, and moreover that identity priming isn't needed to encourage people to invest with sustainability in mind.

The exhibit below shows the detailed results of the average amount that each group allocated to each investment option. The globe symbols denote the funds' sustainability ratings, and the percentages are the funds' five-year returns.

These results show that the individuals in Groups 2 and 3, who had access to fund options' ESG information, increased the average sustainability rating of their portfolios by a statistically significant amount compared with Group 1.

Also, and most importantly, we found that the investment allocations in Groups 2 and 3 were less correlated with returns overall, suggesting that participants focused less on returns when they made their investment selections.

ESG Investing Interest Is Here to Stay This research suggests that even during a pandemic and extreme market volatility, investors continue to be interested and swayed by ESG information. In other words, interest in ESG investing is not going anywhere, and investment professionals would be well-served by incorporating it into their practices.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)