Our Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

Several funds see value in basic materials and communication services

For roughly the past decade, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that reflect the most recent transactions of our Ultimate Stock-Pickers in a timely enough manner for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment. With 20 of our Ultimate Stock-Pickers having reported their holdings for the second quarter of 2020, we now have a good sense of the stocks that piqued their interest during the period.

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers' decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of April, so the prices paid by our managers could be substantially different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

Over the last few months, the world has seen its fair share of adversity, as large swathes of the global economy have been shut down as a result of the COVID-19 pandemic. While the market outlook appeared particularly bleak at the beginning of the quarter, improving investor sentiment led to a marked improvement in performance in the latter months. Even so, certain industries remain particularly hard-hit (eg. travel), though governments worldwide continue to take steps to mitigate wide-reaching economic impacts. The U.S. Federal Reserve cut the federal-funds rate to 0.00%-0.25% in the beginning of March as an initial step, and the U.S. government has taken many drastic measures since then to cushion the blow on the economy, including stimulus programs for consumers, easing pressures on debt markets, and establishing the PPP facility to help small businesses. Amid all this volatility and uncertainty, our Ultimate Stock-Pickers have managed to find value in certain stocks in a wide range of sectors such as basic materials, healthcare, consumer, and communication services.

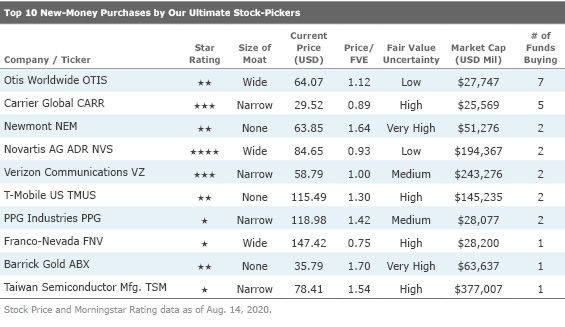

Looking more closely at the top 10 high-conviction purchases, the buying activity was distributed among different sectors, with marginally higher purchases in the communication services, basic materials, and healthcare sectors. Each of these sectors received two high-conviction purchases this quarter. It is interesting to note that bets are being placed in some sectors that are considered riskier (as compared with, for instance, consumer defensive) in the current market environment. As mentioned, the new-money purchases list is somewhat concentrated within the basic materials sector, with four stocks in the top 10 list. The industrials and communication services sectors had two stocks each in the top 10 list. As was the case during prior periods, a majority of the high-conviction buying was focused on high-quality names with defendable economic moats. Morningstar's analysts have concluded that eight out of the 10 companies that received the most high-conviction purchases have either a wide or a narrow economic moat. The three names we find most interesting on the high-conviction purchases and new-money lists are no-moat rated Newmont Corp. NEM, and narrow-moat rated Verizon Communications VZ and Taiwan Semiconductor TSM. Newmont had two high-conviction purchases, with both of them also being new-money purchases. Verizon had two high-conviction purchases, and Taiwan Semiconductor reported one new-money purchase.

As already mentioned, there was a moderate amount of crossover between our two top 10 lists this period, with five names appearing on both lists. This quarter, one stock received three high-conviction purchases from our Ultimate Stock-Pickers: Diamond Hill Large Cap DHLAX, Jensen Quality Growth JENSX, and Vanguard Dividend Growth Investor VDIGX made high-conviction purchases in wide-moat Procter & Gamble PG. Two stocks, Otis Worldwide OTIS and Carrier Global CARR, received seven and five new-money purchases, respectively. Artisan Global Value Investor AMANX, American Funds American Mutual AMRMX, Artisan Global Value Invsetor ARTGX, Boston Partners All Cap Value BPAIX, Dodge & Cox Investor DODGX, FPA Crescent FPACX, and Vanguard Dividend Growth Investor VPMCX all purchased Otis Worldwide. Meanwhile, American Funds American Mutual, Boston Partners All Cap Value BPAIX, Diamond Hill Large Cap, Dodge & Cox Investor, and Vanguard Dividend Growth Investor all purchased Carrier Global.

One high-conviction and new money purchase that we found interesting is Amana Growth Investor AMAGX and Allegheny's Y purchase of no-moat Newmont Corp., the world's largest gold producer. The name currently trades at almost a 65% premium to Morningstar analyst Kristoffer Inton's fair value estimate of $39. The Fed's decision to lower the federal-funds rate to 0%-0.25% significantly lowered the 10-year Treasury yield, reducing the opportunity cost of holding gold. Bullish investor sentiment toward gold as a result of the aforementioned factors combined with a high level of economic volatility has led to a historic runup in gold prices in recent times, which is one of the main contributors to the higher valuations the stock is currently seeing. However, Inton argues that this is not sustainable from a long-term perspective; the eventual slowing of investment demand and higher recycling supply should all drive gold prices lower. This will also be combined with a shift in jewelry demand and preferences from Chinese and Indian consumers in spite of rising incomes, which will further depress future gold prices.

Newmont was forced to place its Penasquito, Cerro Negro, Yanacocha, Eleonore, and Musselwhite mines under care and maintenance earlier in the year due to the impact of the COVID-19 pandemic. These mines accounted for about 16% of production on a combined basis in 2019. In May 2020, the company signaled 6 million ounces of attributable production at all-in sustaining costs of $1,015 per ounce, while pre-pandemic management guidance indicated 6.4 million ounces of production at $975 per ounce. However, all five mines have resumed production since then, and Newmont expects post-2020 production to not be as impacted, keeping expectations of 6.2 million ounces to 6.7 million ounces at all-in sustaining costs between $850 to $950 per ounce in 2021; costs should continue to decline in 2023 and following years.

Inton has assigned Newmont a no-moat rating, as a majority of the company's mines do not exhibit enough of a cost advantage from a low-cost production perspective. While some of its mines do operate below industry average costs, overall cash costs of $700 and all-in sustaining costs of $950 are not enough to grant the company an economic moat. However, Inton points out that Newmont has exhibited strong operational performance and makes a good investment for those interested in gold exposure once shares are undervalued again.

Our Ultimate Stock-Pickers see some value in the communication services sector, with two high-conviction and two new money purchases within the sector. Narrow-moat Verizon Communications appeared on both lists, with American Funds American Mutual and American Century Value AVLIX both making high-conviction, new-money purchases into the company. The name currently trades at Morningstar analyst Michael Hodel's fair value estimate of $59.

Verizon is the largest wireless carrier in the United States. The company enjoys a narrow moat designation as a result of cost advantages stemming from scale in its wireless business accompanied by efficient scale in the industry. While Verizon is reorganizing its business via its customer lines, the wireless business segment still makes up approximately 70% of revenue and makes up nearly the entirety of Verizon's profits. The segment was formed as a joint venture with Vodafone in the 1990s and has since expanded almost entirely as a result of internal growth (with the exception of the Alltel acquisition in 2009).

Verizon, AT&T T, and (now) T-Mobile TMUS make up over 90% of the retail post-paid phone market. Being able to provide effective coverage nationwide means high levels of fixed investments in wireless spectrum and network infrastructure. As network utilization reaches optimal levels in locations nationwide, incremental investment costs are more efficiently absorbed while the greater proportion of costs remain fixed. Verizon is more efficient than peers on this front due to its scale and its persistently strong financial position, which allows it to precisely deploy its network more efficiently than peers.

This beneficial trend in terms of fixed-cost leverage and difficulty of differentiation in wireless generate efficient scale advantages in the industry (evidenced by massive industry consolidation and the inability of other smaller competitors to develop a strong foothold). Given the slow pace of growth in market share and three giants dominating the industry (Verizon, AT&T, T-Mobile), Hodel feels they will be less incentivized to poach each other's customers, while high costs of nationwide coverage and a much more diminutive size will prevent competitors like Dish from gaining large portions of market share.

Alongside Verizon's traditional residential and small-business telecom offerings, the company also serves large enterprise and carrier customers worldwide, and remains fairly well positioned due to its global reach and embedded technological capabilities. The acquisition of XO Communications in 2017 further helped Verizon add metro fiber rings in 45 out of the 50 largest U.S. markets. Hodel points out that these networks will aid Verizon's ability to service business customers and will also help it increase wireless network density. Hodel believes fixed-line networks will play an increasing role in fulfilling wireless capacity needs, giving Verizon an edge in the industry.

Verizon has recently undertaken a major fiber-expansion project, promising to remake Fios (its fiber optics system) to serve business and wireless customers and also add capacity in major U.S. markets. Hodel argues that this should benefit the firm's goal of leading the industry in 5G technology deployment and help service new customers, thus creating strategic benefits (though this will have less of an impact in the home broadband market).

Our Ultimate Stock-Pickers also invested in Taiwan Semiconductor with Sequoia SEQUX making a new-money purchase into the company. Taiwan Semiconductor is currently trading at a 54% premium to Morningstar analyst Abhinav Davuluri's fair value estimate of $51.

As the world's largest chip-dedicated foundry, Taiwan Semiconductor enjoys a narrow moat rating due to cost advantages that few other companies in the industry enjoy to the same degree. Fabless semiconductor customers continue to demand fabrication technologies that can produce cutting-edge chips with greater speed and power-efficiency but also have lower per-unit costs. Some of Taiwan Semiconductor's fabless customers include Apple AAPL, AMD AMD, Nvidia NVDA, Qualcomm QCOM, and Xilinx XLNX, which demand more advanced chips that provide differentiation in premium products such as computers, smartphones, and other electronic offerings. Davuluri points out that by focusing on this particular market segment, the company enjoys better pricing, and as a result, above-average gross margins. By generating these excess returns, Taiwan Semiconductor is able to remain in the lead when it comes to chip-manufacturing technologies as it continually reinvests excess returns into advanced process equipment such as EUV lithography systems, which can cost over $100 million.

Taiwan Semiconductor, like Intel's INTC pursuit of Moore's Law, targets the doubling of the number of transistors per unit area every two years. As process technologies continue to grow and develop, unit area per transistor declines, while the cost per unit area goes up. On a net-net basis, cost per transistor thus goes down. This cost reduction helps offset the capital-intensivity of manufacturing semiconductors. Even so, Davuluri points out that while expenses have gone up, they have not translated into as many performance improvements. Only a select few firms can continue to invest at high levels into research and development and afford huge capital outlays, with Taiwan Semiconductor being a standout in its capabilities in this area. Davuluri believes the firm's in-depth engineering knowledge when it comes to advanced process technologies creates intangible assets that are difficult to replicate, thus strengthening the company's narrow moat rating.

Competitors such as Samsung and GlobalFoundries have increased investments into their foundry endeavors, which could impact Taiwan Semiconductor's leading position in the long run. However, Samsung's internally designed processes remain a majority of its manufacturing capacity, as a result of which clients such as Apple are likely to remain reliant on Taiwan Semiconductor. Even so, there is evidence of such fabless clients switching between foundries on a pricing, process, and technological basis. These lower switching costs have been evidenced by these fabless clients switching between companies in recent years.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)