Not All Core Bond Funds Are Created Equal

Our FIEA tool can help you dig deeper into a strategy's interest-rate and credit risk.

For investors seeking a diversified and relatively conservative fixed-income portfolio anchor, the intermediate core bond Morningstar Category is a good place to look. This category is home to strategies that invest primarily in high-quality U.S. fixed-income issues (with a maximum exposure of 5% in below-investment-grade-rated fare). Strategies in this category tend to have durations (a measure of interest-rate sensitivity) that run from four to seven years. While intermediate core bond strategies are generally built to offer protection in risk-off markets like we saw earlier this year, they can still differ significantly in the amount of interest-rate and credit risk they take on via government, corporate, or securitized debt.

The rocky ride this year provides a good example of this. In the first quarter of 2020, core strategies that had no below-investment-grade debt and lower exposure to BBB rated issues outperformed amid the coronavirus sell-off. In addition, strategies with more interest-rate sensitivity received a boost from the Federal Reserve's rate cuts over that stretch. The opposite was true in the second quarter, as the Fed's monetary policy supported credit markets while the federal-funds rate stayed near zero, boosting strategies that had a more credit-heavy profile and lessening the impact of duration on performance.

Fidelity Intermediate Bond FTHRX and John Hancock Investment Grade Bond TIUSX differ significantly in both the amount and type of interest-rate and credit risk they take. Fidelity Intermediate Bond, which has a Morningstar Analyst Rating of Silver, tends to carry significantly less interest-rate sensitivity, with an effective duration of 4.0 years as of May 31, 2020, compared with the category norm of 5.8 years. (The commonly used Bloomberg Barclays U.S. Aggregate Bond Index clocked in around 5.8 years.) Bronze-rated John Hancock Investment Grade Bond's duration was much closer to its typical peer's at 6.0 years. Both strategies had close to 30% of assets in BBB rated debt as of May 2020, nearly double the category norm, along with 1% to 2% in below-investment-grade debt.

These data points are a must for understanding a strategy's risk profile and are typically readily available on a company's website. However, a more granular breakdown of duration, credit-quality, and sector exposures and how they intersect isn't as easy to come by. Our new Fixed Income Exposure Analysis, or FIEA, tool within a fund's portfolio section on Morningstar.com provides a way to drill down into exposures to gain a deeper insight into its risk profile. (Small differences can occur owing to the various ways fund companies classify and report data, and the FIEA view is based on a fund's bond portfolio rather than its total assets.)

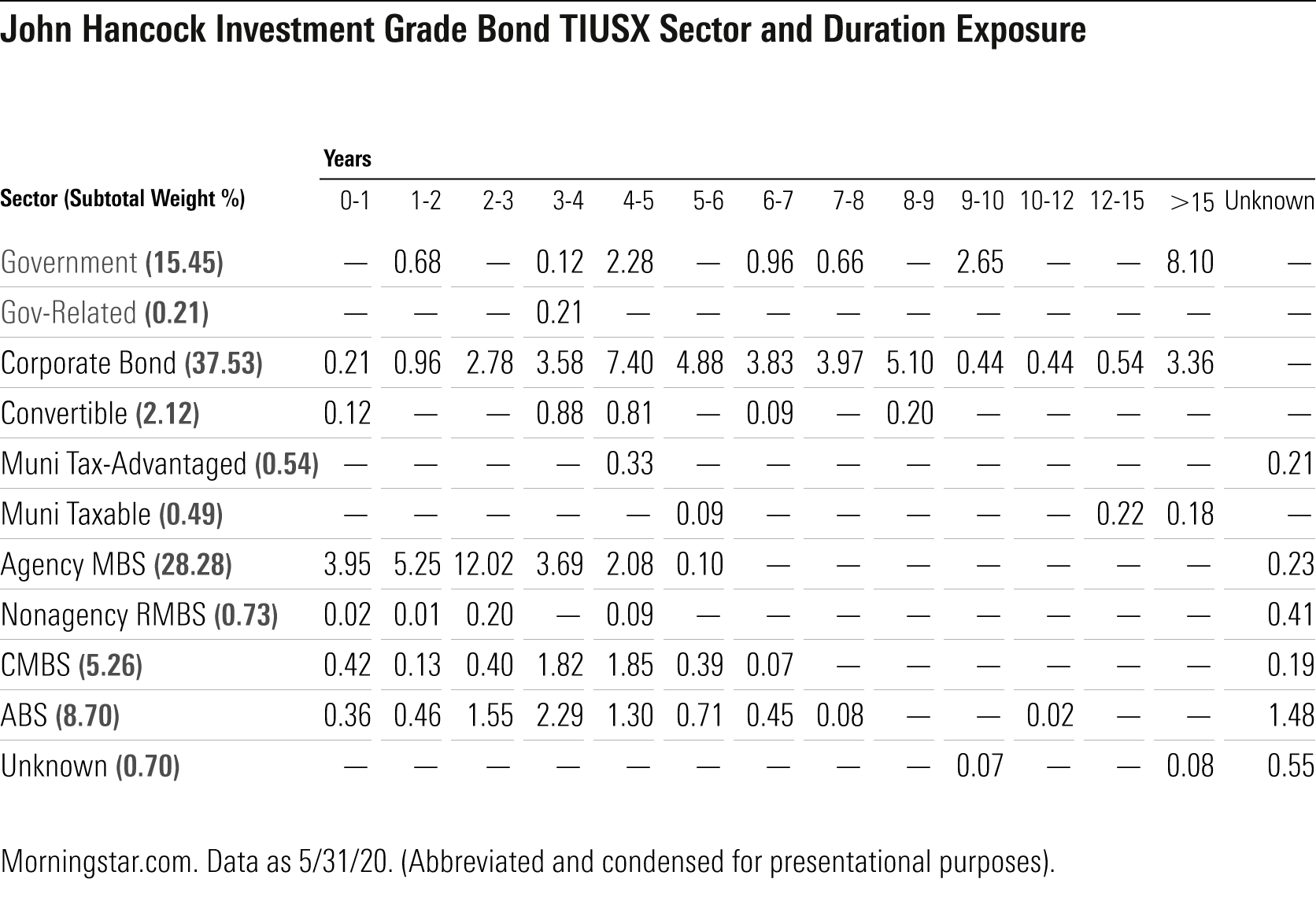

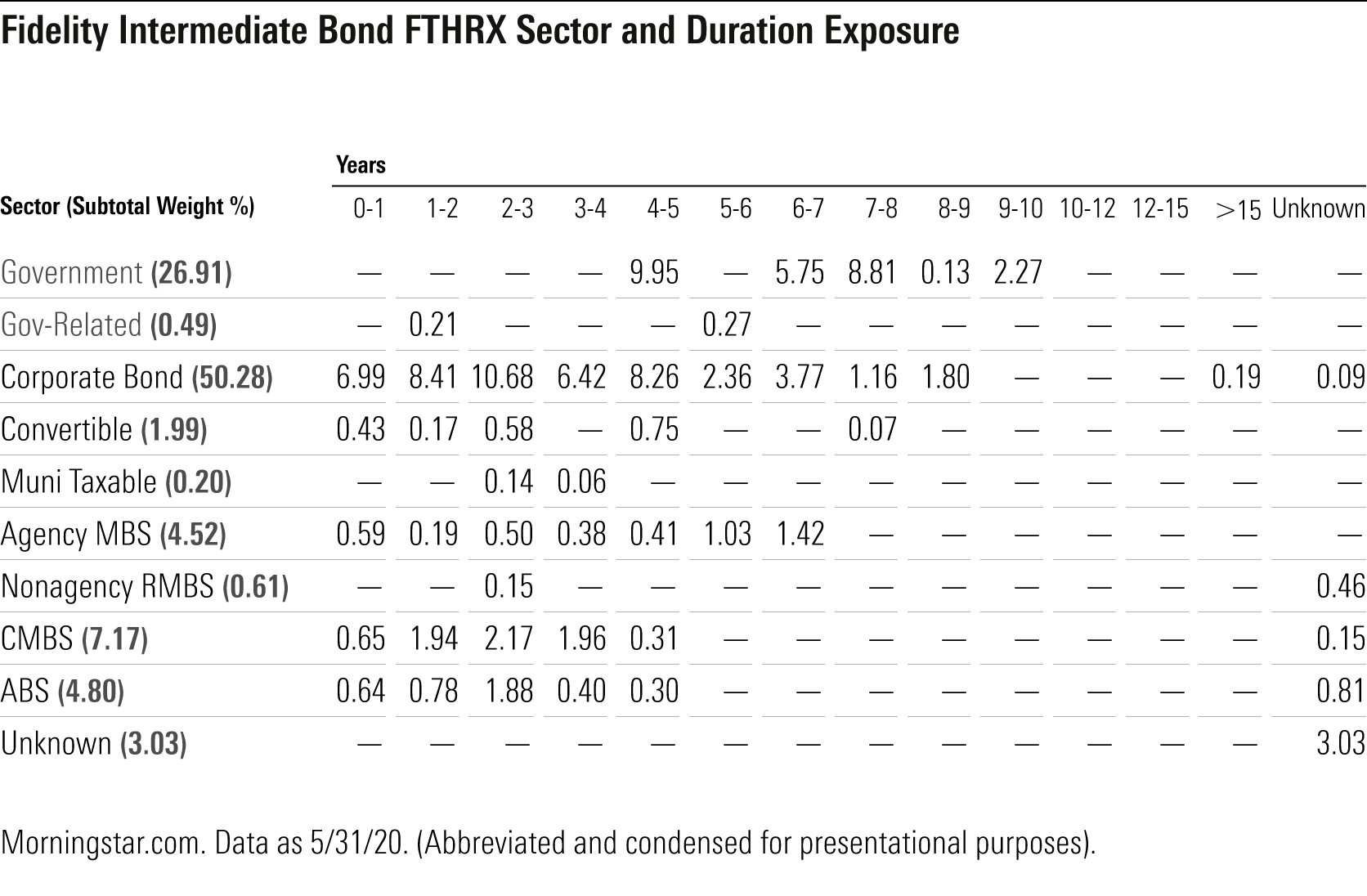

While we know that John Hancock Investment Grade Bond carries more rate-sensitivity than Fidelity Intermediate Bond, the FIEA tool allows us to see a breakdown of each strategy's duration by year and how that intersects with its sector exposures. This provides an indication of where a strategy is taking interest-rate risk and how it might react to changes in the yield curve. Looking at the FIEA data breakdowns for the two strategies, Fidelity Investment Grade Bond holds almost double the amount of government debt overall, concentrated in issues with a duration of four to 10 years. John Hancock Investment Grade Bond on the other hand, dabbles in more rate-sensitive government debt, with over half that exposure in debt with a duration of 15-plus years. Fidelity Investment Grade Bond prefers less rate-sensitive corporate credit, with the bulk of that in the zero to four-year range, while John Hancock Investment Grade Bond has been willing to invest in corporates as well as munis with longer maturities.

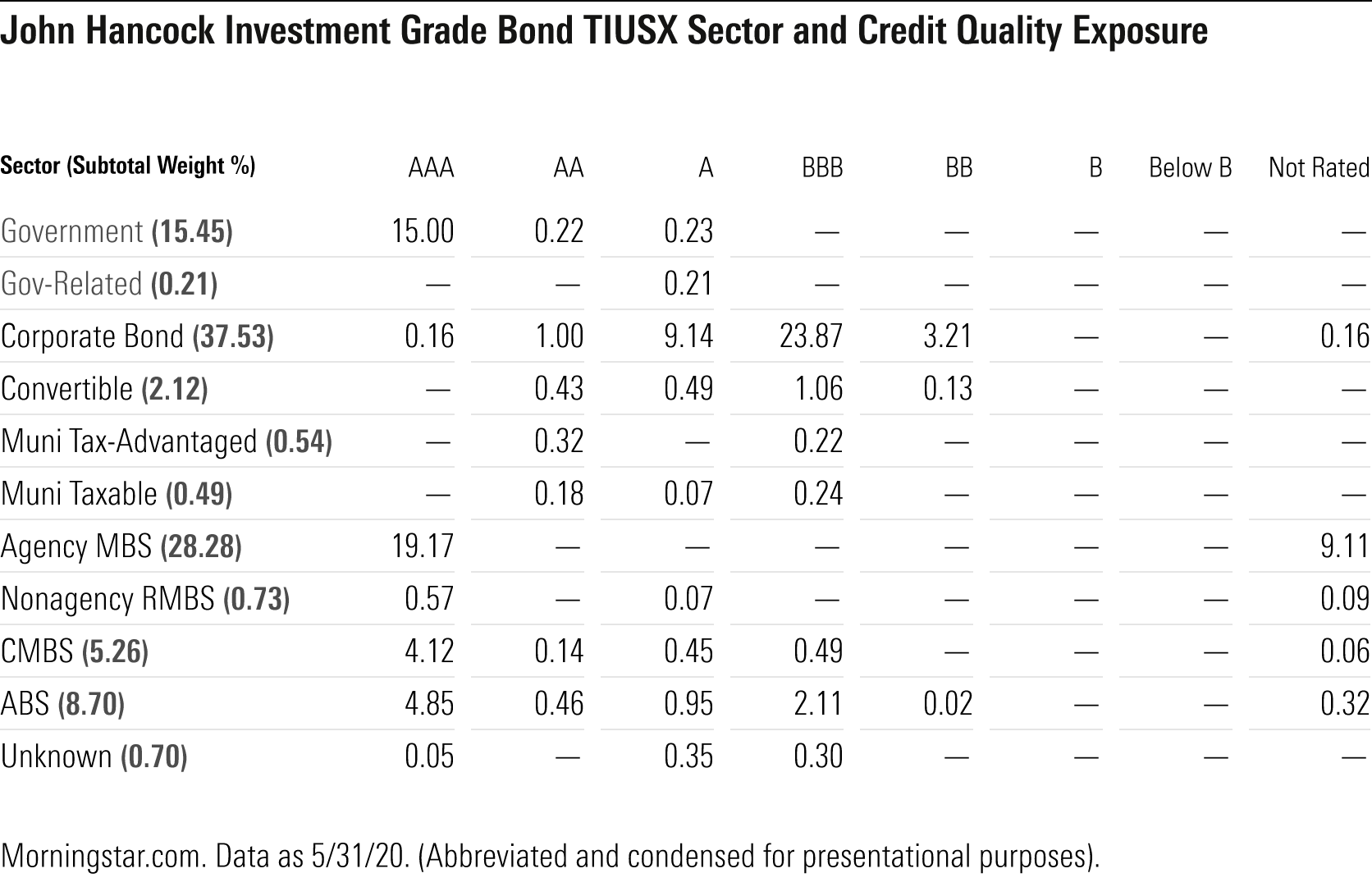

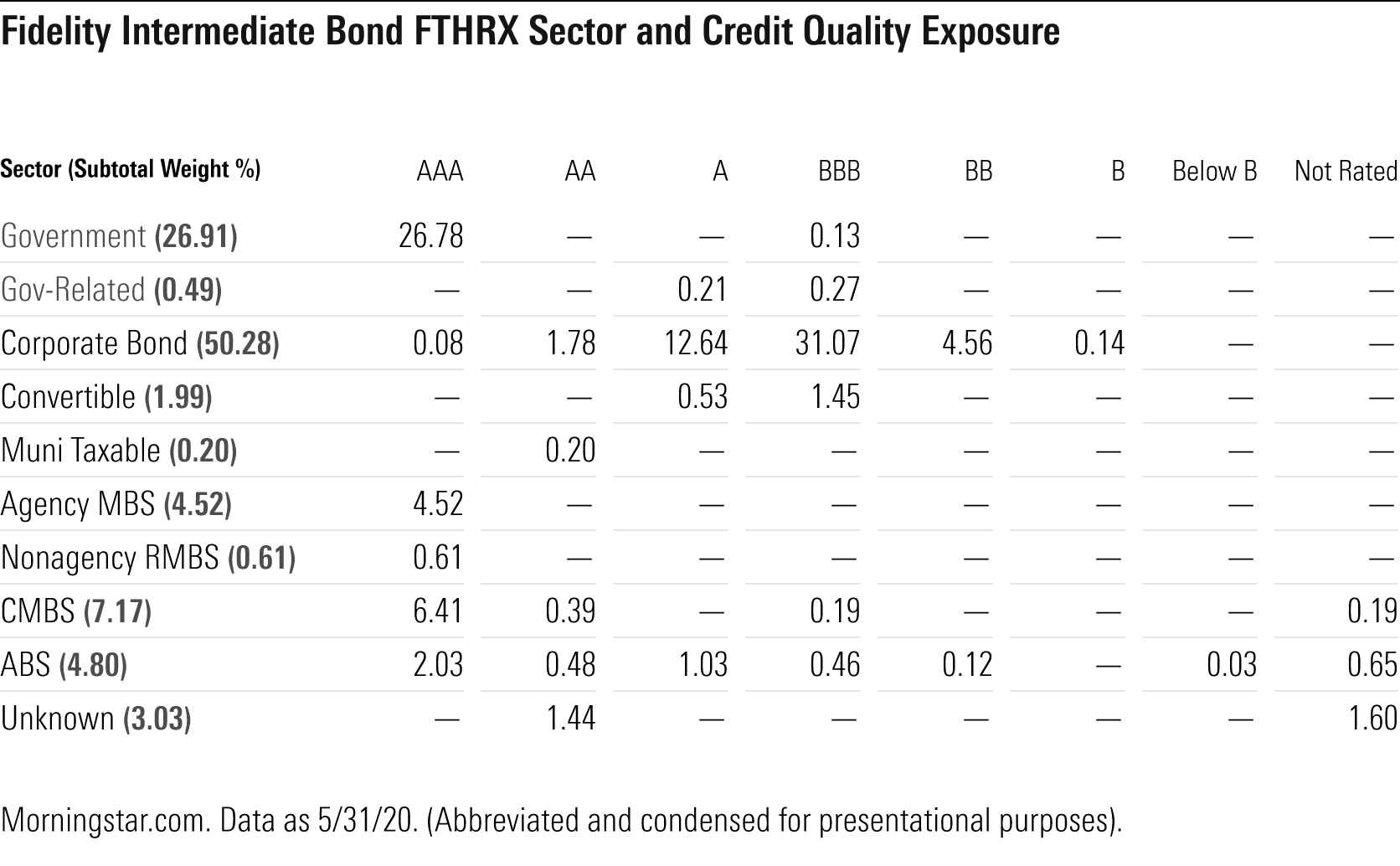

Morningstar's FIEA tool can also drill down into a strategy's credit risk. The FIEA credit quality by sector breakdowns for each strategy provide us with a deeper insight into where that risk lies. Both funds hold comparable amounts in AAA rated debt. However, John Hancock Investment Grade Bond gets the bulk of its AAA exposure from securitized debt (29%), particularly agency-backed fare, while Fidelity Intermediate Bond relies more heavily on government debt (27%) for its AAA exposure. While both strategies emphasize A and BBB rated corporate credit, Fidelity Intermediate Bond has 11 percentage points more in this space. Instead, John Hancock Investment Grade Bond prefers to take credit risk elsewhere, dipping further down the credit-quality spectrum in commercial mortgage-backed and asset-backed securities. Lastly, John Hancock Investment Grade Bond has 9% in nonrated agency mortgage-backed securities, which isn't necessarily a sign of lower credit quality, but it introduces liquidity risk.

Given that both strategies emphasize credit compared with the bulk of intermediate core bond peers, they've experienced a somewhat rockier ride so far in 2020. During the coronavirus sell-off from Feb. 20, 2020, through March 23, 2020, both strategies underperformed relative to the category, with John Hancock Investment Grade Bond's 5.0% loss lagging over 80% of distinct peers and Fidelity Intermediate Bond's 3.6% slide landing behind almost 60% of the cohort. Unsurprisingly, they both bounced back faster during 2020's second-quarter credit rebound, with each strategy placing in the best third of the category.

Both strategies are backed by well-resourced teams and play to their respective strengths well, with John Hancock Investment Grade Bond emphasizing a valuation-based approach to identify opportunities across corporate and securitized debt and Fidelity Intermediate Bond plying a disciplined approach that tends to focus on corporate and government issues. As such, each offering will take a different path through a variety of market conditions, which our new FIEA tool will help you keep a closer eye on.

/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)