4 Easy Steps to Finding a Suitable ESG Fund

Morningstar's ESG Screener makes it easy to find the right ESG fund.

If you’re interested in learning more about ESG investing and finding some high-quality environmental, social, and governance funds, you’re in good company.

Morningstar keeps track of how much money people invest in different types of funds, and by our count, ESG funds are on track for their best year ever. In fact, through June 30, 2020, ESG funds have nearly matched the record $21.4 billion investor dollars they raked in during 2019. And the year is only half over.

In many ways, 2020 has presented a good backdrop for ESG funds to make their case. On one hand, ESG funds have performed well relative to conventional funds during some really volatile markets: After showing greater resilience than conventional funds when stocks plummeted in the first quarter, ESG funds more than held their own during the second-quarter rebound.

And many of the headline issues this year, such as COVID-19 and Black Lives Matter, have raised awareness of social injustice and economic disparity in the United States. Many more investors are searching for ways to invest in line with their social conscience, by directing their money toward companies with strong corporate diversity programs, anti-discrimination policies, and policies protecting workers' health and safety, among other considerations.

ESG 101 One of the most pervasive misconceptions about sustainable investing is that ESG concerns are matters of personal conscience that don't really pose material financial risks to companies.

The truth is, ESG considerations aren't just "nice-to-haves"; they can directly affect a company's financial results. Morningstar, along with increasing numbers of investors, has come to view how well a company addresses relevant ESG factors as areas of investment risk and opportunity. A company that ignores ESG issues or commits a misstep could incur significant economic costs that jeopardize its ability to earn long-term, sustainable profits. As such, ESG risk is measurable and quantifiable.

Sustainalytics, which was acquired by Morningstar, assesses company-level ESG risk. Their more than 200 research analysts evaluate the extent to which a company is exposed to material ESG risks and how well it's managing these issues. Importantly, the analysts also emphasize a company's measurable behavior, by examining incidents and controversies. (Sustainalytics now provides free access to ESG Risk Scores on over 4,000 companies.)

Environmental factors include company behavior and policies on issues like climate, pollution, energy efficiency, and renewable energy. The social factor evaluates things like a company's commitment to inclusion and diversity in the workplace, fair wages, forced labor, supporting the local community, customer privacy, and product safety. Finally, the governance factor measures things like executive pay, political donations and lobbying, bribery and corruption, and board-level attention to sustainability and climate issues.

How to Find Some ESG Funds Worth Considering As the number of funds claiming they invest with an ESG focus increases, investors may struggle to compare them. For one thing, there aren't consistent naming conventions among ESG funds--some call themselves "ESG," while others call themselves "sustainable." Beyond that, it can be difficult to know how large a role ESG considerations play in the fund's buy and sell decisions.

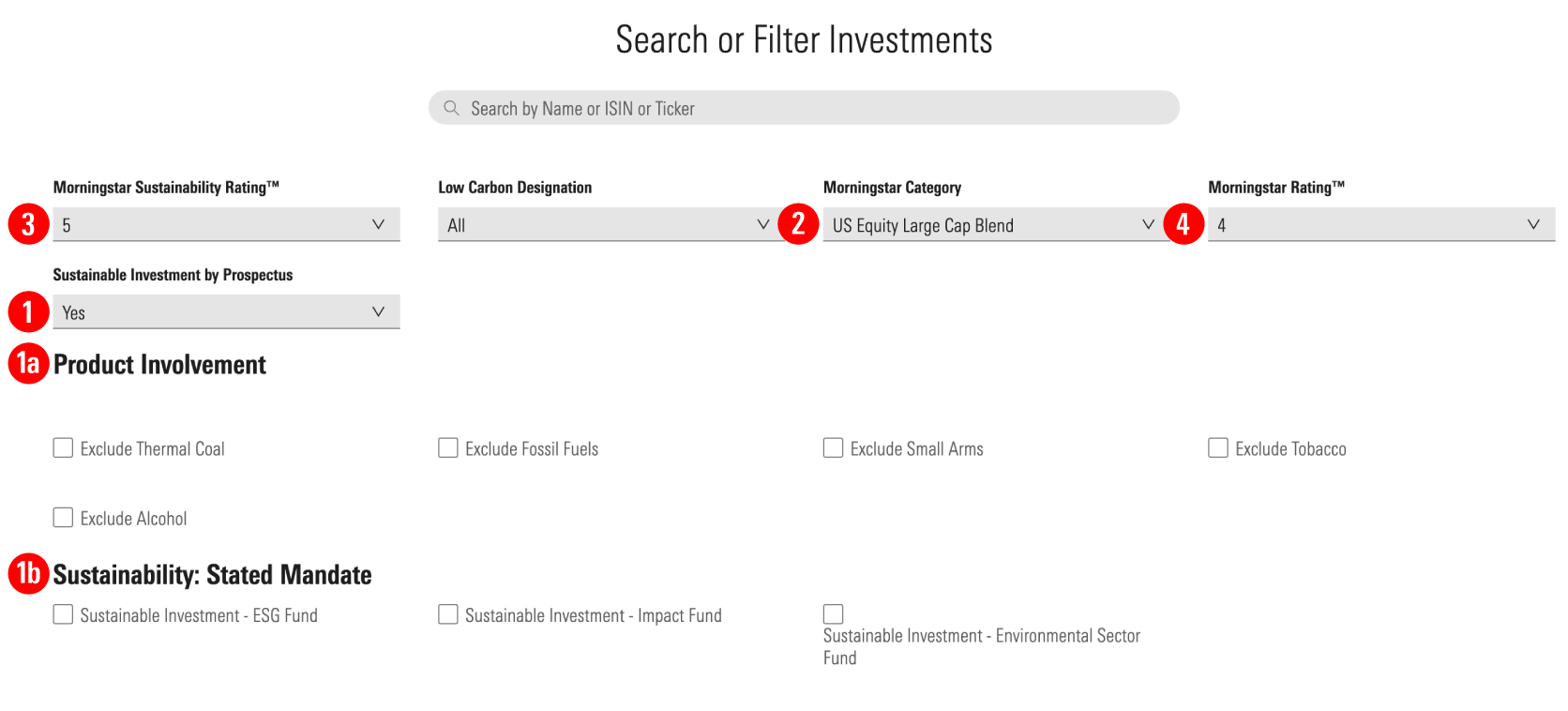

Our ESG Screener provides a way to easily filter Morningstar’s vast database to find mutual funds that intentionally integrate ESG analysis into their investment process. It also allows users to target those funds that have most effectively eliminated material ESG risk from their portfolios. And users can also home in on funds whose risk-adjusted returns have outperformed their Morningstar Category peers (which includes all funds in the category, not just those with an ESG focus).

Here’s how to do it:

1. Find the dropdown menu that says "Sustainable Investment by Prospectus" and set it to Yes.

This will narrow the results to only funds that explicitly state in their prospectus that they consider ESG factors (or any one of the three factors) in their investment process. (A prospectus is a document required by the SEC that explains a fund or exchange-traded fund's investment strategy, who runs it, how much it costs, and what its major risks are.)

If you want, you could stop there. But it's important to note that a fund need only say in its prospectus that it considers ESG factors in its investment decisions; it's difficult to know how large a role this analysis plays, if any. To reveal some more granular prospectus criteria, extend the “Show More/Show Less” screener menu. Using the Product Involvement criteria (1a), you can narrow your search to funds that state in their prospectus that they avoid stocks of companies involved in the sale and manufacture of tobacco, alcohol, thermal coal, fossil fuels, and guns/small arms.

If you want to narrow your search even further, Morningstar classifies ESG funds into three buckets based on their stated mandate within their prospectus (1b). "ESG Funds" primarily incorporate ESG factors into the investment process or engagement activities. "Impact Funds," in addition to financial return, seek to deliver a measurable impact on specific issues or themes like gender diversity, low carbon, or community development. "Environmental Sector Funds" are strategies that invest in environmentally oriented industries like renewable energy or water.

2. Select a Morningstar Category.

I selected U.S. Equity Large Cap Blend because it’s a good hunting ground for “core” stock fund exposure. Funds in the large-cap blend category invest mainly in stocks of large corporations, and the overall portfolio tends not to be dominated by either growth stocks or value stocks. Funds that track the S&P 500 or total market index funds tend to fall into the large-cap blend category.

3. Find the dropdown that says "Morningstar Sustainability Rating" and set it to 5.

This step narrows the list of potential funds to those that are doing the best job of managing investors’ overall exposure to ESG risks.

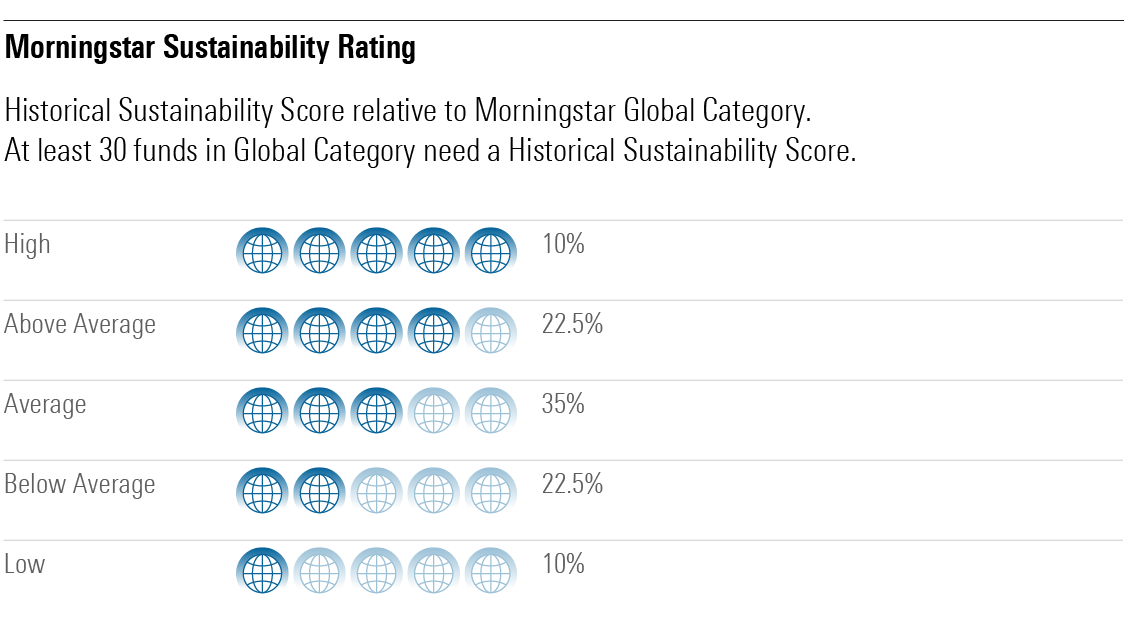

The Morningstar Sustainability Rating starts with each company's ESG Risk score, which measures the degree to which individual companies in the portfolio face financial risks from ESG issues. We then roll those individual scores up into an overall, portfolio-level score. The rating is easy to interpret: 5 globes means the overall portfolio has negligible ESG risk; 1 globe means it is exposed to significant ESG risk.

4. Find the "Morningstar Rating" dropdown, and select 4.

This will narrow the list to funds that have 4- and 5-star ratings. Though past performance is not always predictive of what is to come, funds with higher star ratings have earned higher returns than their peers (after adjusting for risk and accounting for sales charges).

Just these four criteria whittled down Morningstar’s sprawling U.S. fund database to 11 funds, 26 share classes in total (some funds have multiple share classes available to investors depending on how they are distributed).

Of course, this is only the beginning when it comes to evaluating potential funds for your portfolio. Whether funds have an ESG focus or not, it pays to look for funds with skilled, experienced management teams; sensible and repeatable investment processes; and low price tags, among other key factors.

Want to test your knowledge of sustainable investing? Take our quiz.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)