The Model Portfolio Landscape in 5 Charts

What to know about the rapidly growing list of third-party model portfolios advisors have to choose from.

Third-party model portfolios are on the rise--more than 400 have been launched since 2018, according to Morningstar's 2020 Model Portfolio Landscape.

Two key reasons for the proliferation of these portfolios include:

- They offer financial advisors an opportunity to outsource some, or all, of their investment management responsibilities.

- Unlike traditional turnkey asset-management solutions, they are not directly investable. Instead, models are offered as a blueprint for asset allocation and fund selection. This gives advisors discretion over underlying fund selection, rebalancing frequency, and potential tactical asset-allocation tilts. Other investment vehicles, such as funds and separate accounts, do not offer this level of customization.

Like any nascent endeavor, the rapid growth of model portfolios has created a mix of opportunities and challenges for advisors looking to harness their potential.

Here, we take a closer look at some of the key findings of the report.

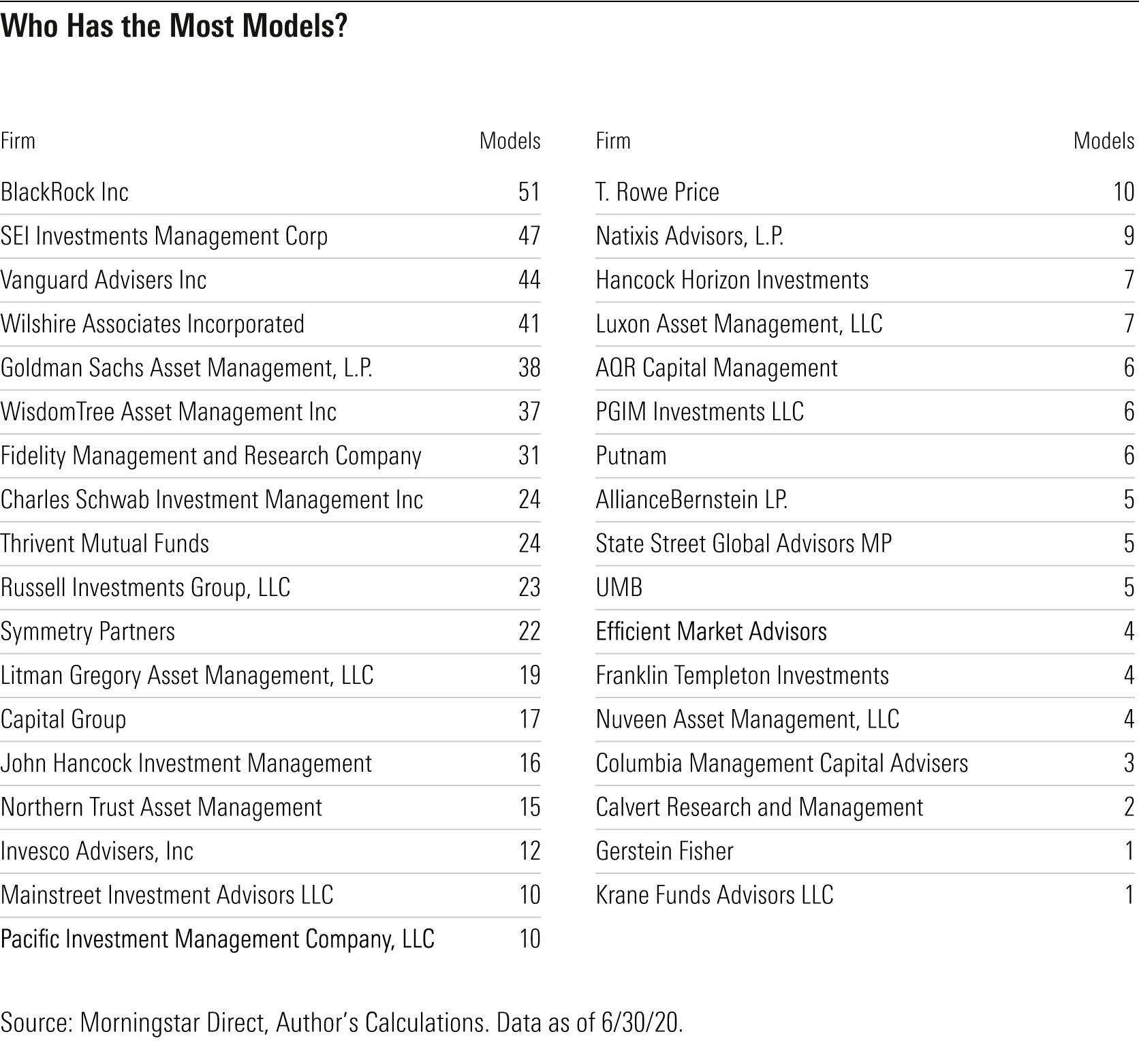

Who Offers Model Portfolios? Model portfolios aren't regulated, so we conducted our own screening to define the universe of model portfolios that report data to Morningstar that follow what we consider best practices.

We screened the universe to exclude model portfolios that:

- hadn't reported portfolios within six months of when we collected the data, and

- are offered by firms with less than $1 billion in reported firm assets under management if there wasn't also a separate account version of the model to validate the track record.

Only about half of the more than 1,100 model portfolios that reported data as of June 30, 2020 met that criteria. The firms that offer these model portfolios are shown in the table below.

BlackRock is an example of how granular model portfolios can get. The firm offered 51 model portfolios as of June 30, which mostly have one of two objectives: target-risk or income. Within those two buckets, they have models that only use passive funds, only use active funds, or blend both. They also have models that aim to maximize after-tax returns or are focused on attributes like environmental, social, and governance factors, or smart beta.

Other large firms offer a similar variety of models but haven’t proliferated their options quite as much. Offering this much choice puts the onus on the advisor to pick the best version of the model to meet their clients’ objectives rather than relying on the asset-allocation team’s best thinking.

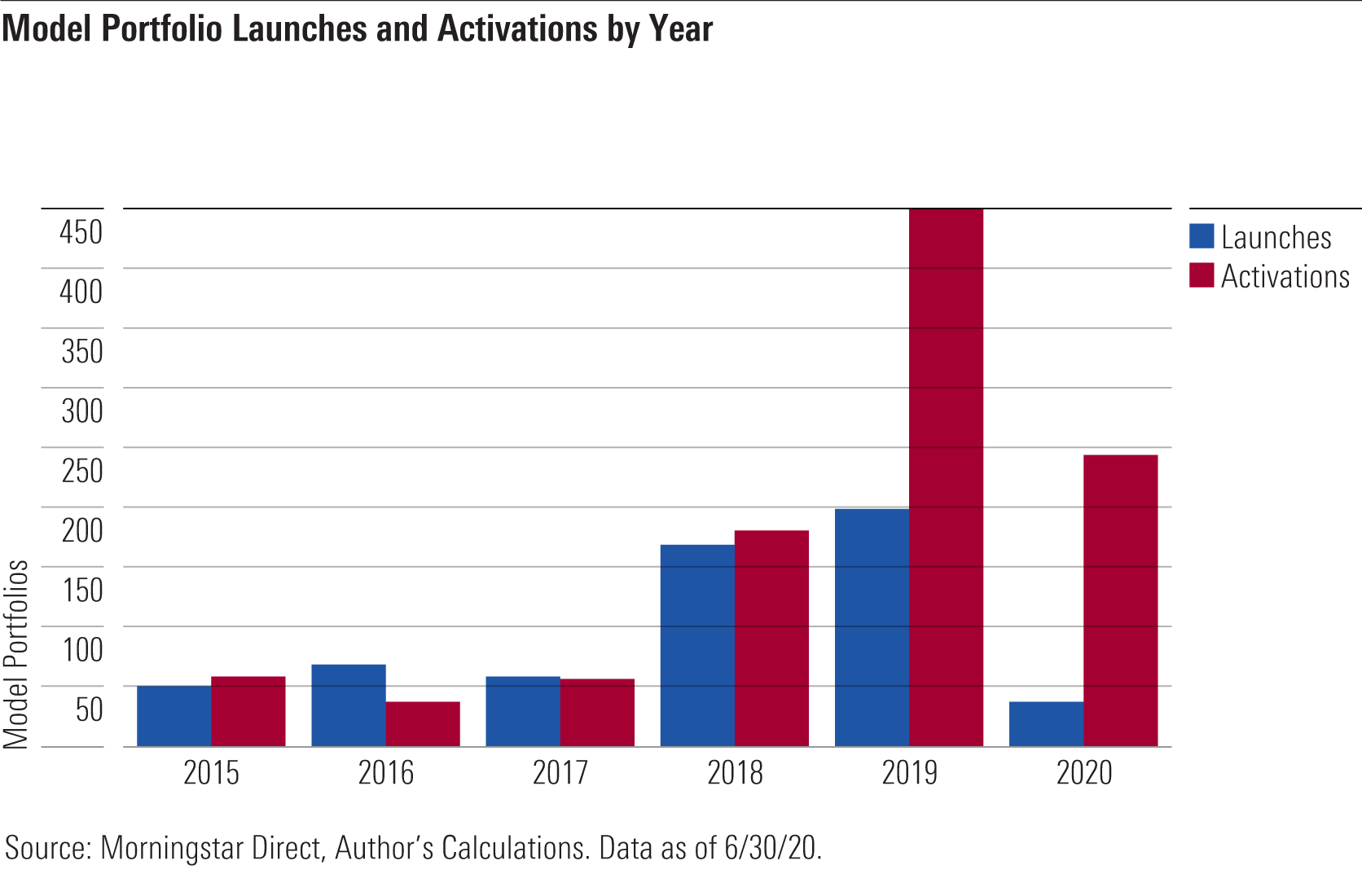

Model Portfolios' Track Records Should Be Viewed With a Healthy Dose of Skepticism Though the number of model portfolios is growing quickly, our data shows there is typically a lag between launch dates and the date models are reported to Morningstar.

Because model portfolios are not regulated with the same scrutiny as other vehicles, firms may self-select which models to report, and generally do not report until after the models build out hypothetical return streams. So, inception dates do not tell the whole story, and advisors should view model portfolios’ start dates with some skepticism. This is one of the reasons we conservatively screened the initial universe for this report.

For example, our Morningstar Direct data shows that 400 models report an inception date within the past 30 months (since the beginning of 2018). However, more than 870 were first reported to Morningstar’s database over the same time period, with most backdating their inception dates. This discrepancy is shown in the chart below.

The number of models being reported to Morningstar in 2019 and 2020 far outpaces the number of models that were launched in those years. Indeed, the median gap between model portfolios activated in 2019 and their reported launch dates was 30 months. Through the first six months of 2020, the median gap had narrowed to 12 months, an improvement but still far from ideal.

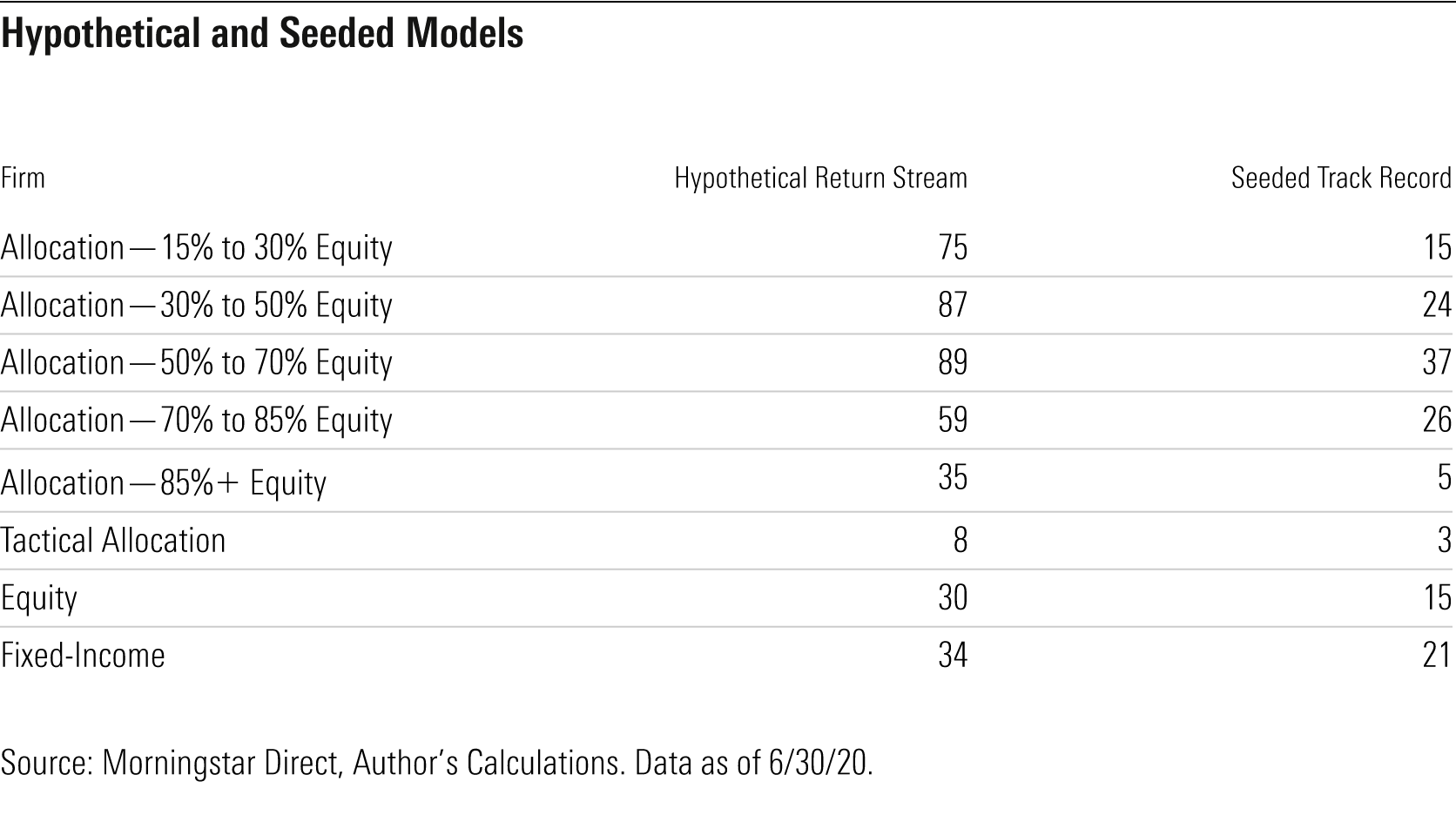

Model Portfolios' Representative Accounts Add Legitimacy We view having a representative separate account track record as a best practice and encourage providers to take this extra step to avoid any concerns over the legitimacy of the model's historical returns.

Unfortunately, few firms report separate account versions of their model portfolios, as shown in the chart below.

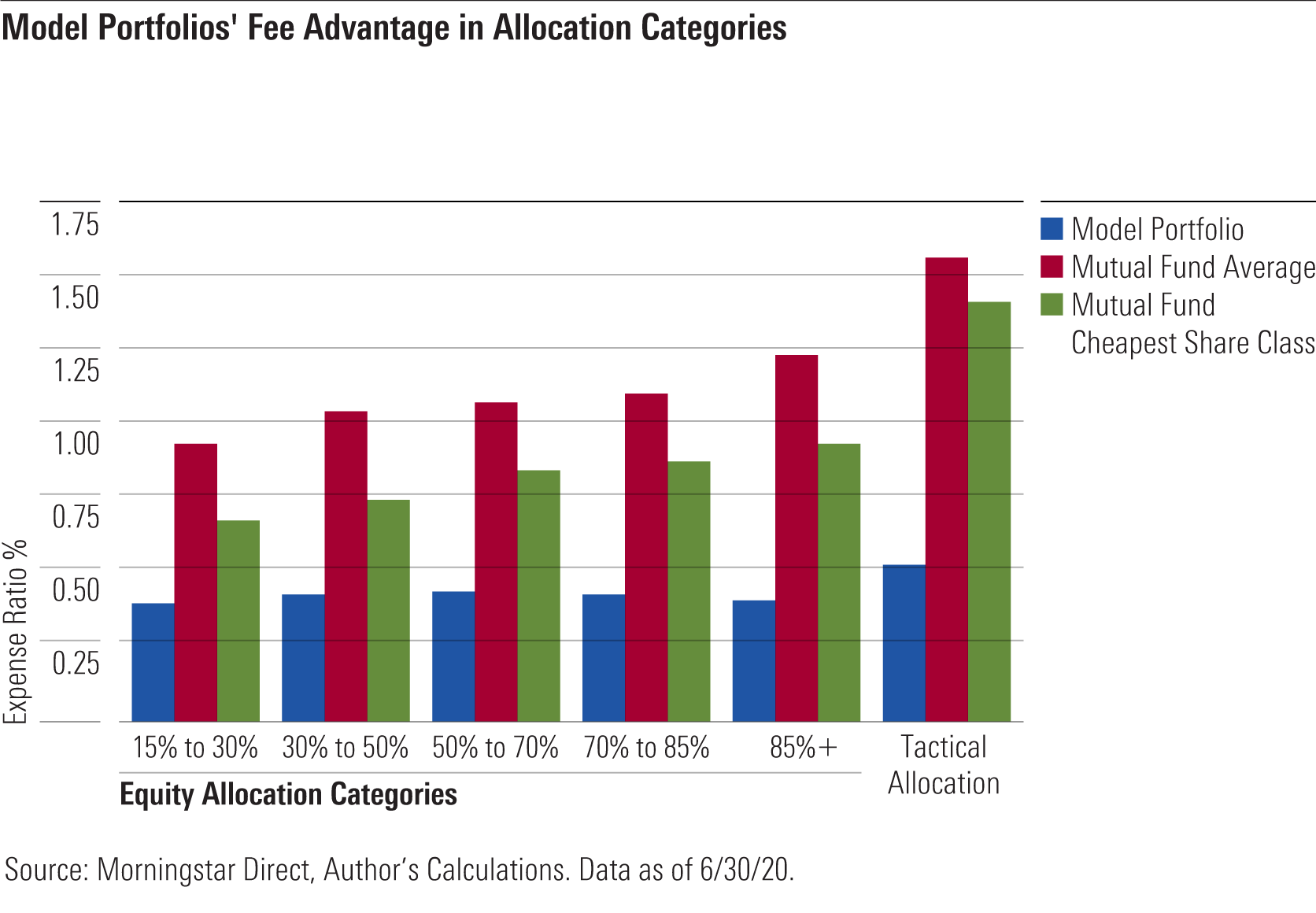

Model Portfolios Have a Clear Head Start Versus Mutual Funds When it Comes to Fees Low costs remain one of the most appealing features of model portfolios--even the highest-cost models are substantially cheaper than the mutual funds with the lowest fees.

To show the extent of this difference, we calculated the asset-weighted prospectus adjusted expense ratio of the model portfolio strategies included in this report. In the chart below, we then compared it with both the average mutual fund fee across all share classes and the average fee of each fund’s cheapest share class by category.

As shown, model portfolios had approximately a 0.75-percentage-point average fee advantage versus all mutual fund share classes, and a 0.50-percentage-point average fee advantage versus only the cheapest share classes.

That gives models a significant head start versus similarly managed mutual funds and explains part of their appeal for fee-based financial advisors.

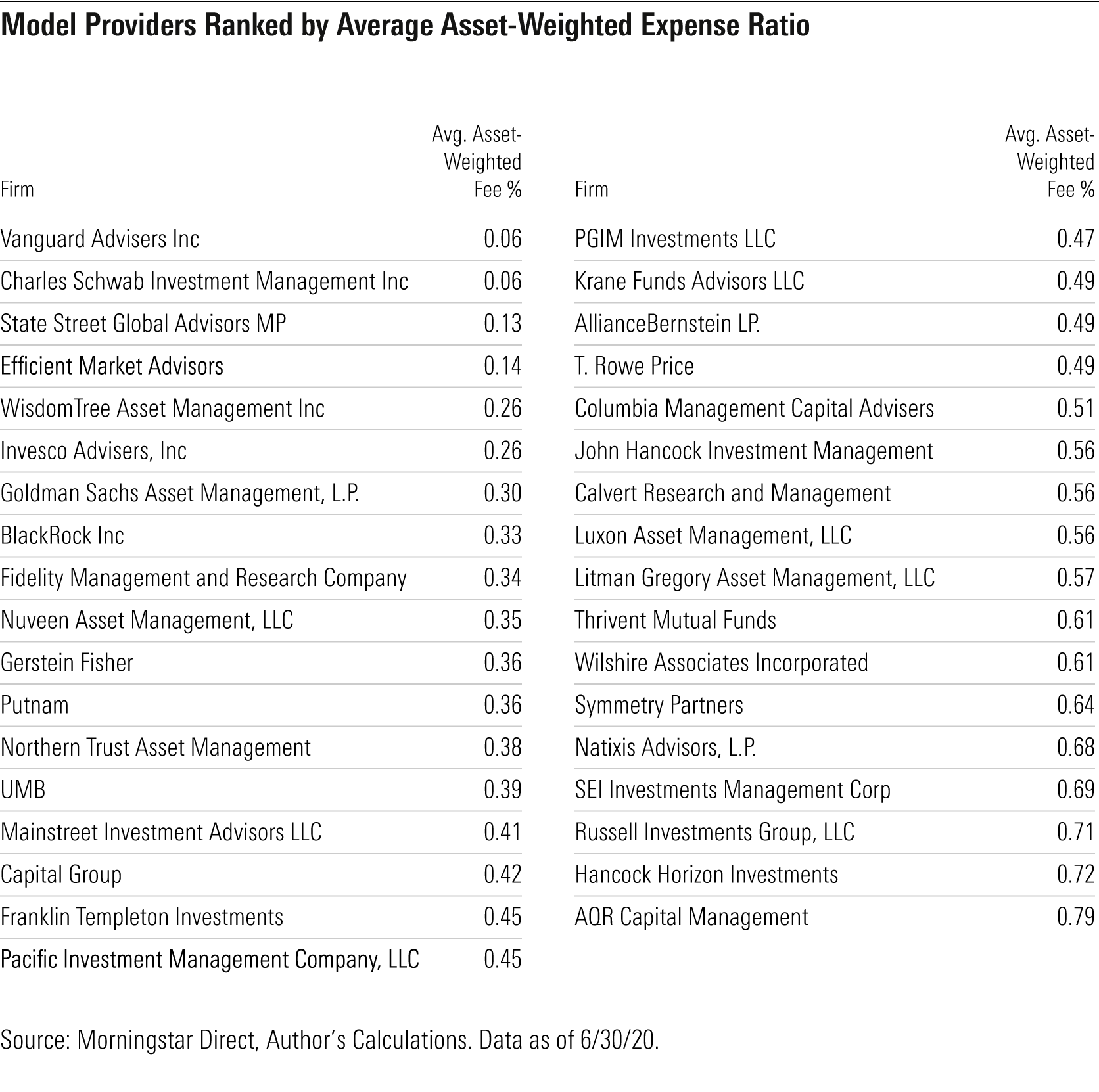

Firms That Focus on Low-Cost Funds Also Have Low-Cost Model Portfolios Not surprisingly, firms that have low-cost philosophies in general also have the cheapest model portfolios.

At Vanguard and Charles Schwab, for instance, the average asset-weighted cost of a model is 0.06%. State Street isn’t far behind, with an average model fee of 0.13%. That investors can put their entire wealth into a professionally managed portfolio with rock-bottom costs makes for a compelling proposition. The chart below shows the average recommended asset-weighted fee by model provider.

How Advisors Can Make the Most of Model Portfolios Model portfolios offer a promising solution for advisors looking to outsource some, or all, of their investment responsibilities. Third-party model portfolio providers have yet to coalesce around what we consider best practices, so advisors still need to proceed with some caution, particularly when it comes to evaluating track records.

This article is adapted from research that was originally published in Morningstar Direct's Research Portal. If you're a user, you have access. If not, take a free trial.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)