Whither Vanguard’s Active U.S. Equity Funds?

Their future is becoming decidedly uncertain.

Fewer Survivors The number of actively managed diversified U.S. equity funds offered by Vanguard continues to dwindle. The company terminated seven such funds last decade, another in 2020 (Vanguard Capital Value), and this week announced a ninth candidate: Vanguard U.S. Value VUVLX. Over the same period, the company has added but one new entrant, Vanguard U.S. Multifactor VFMFX VFMF, which was launched in 2018.

The fate of Vanguard U.S. Value is particularly symbolic, as the fund is to be merged into Vanguard Value Index VIVAX. Out with active, in with passive. This is not the first occasion in which Vanguard has folded an actively managed fund into an index fund, but it represents the first time it has done so for a diversified U.S. stock fund, save for a tax-managed vehicle. Might other instances follow?

The Money Trail The best way to address that question is to examine the asset flows. All sponsors, Vanguard included, dislike carrying funds that steadily undergo net redemptions. Unless the outflows are outweighed by market appreciation, such funds will suffer shrinking asset bases. Eventually, the organization will be forced either to hike the fund's expense ratio to compensate for the forgone revenue, or lose money on the operation. Neither option is attractive.

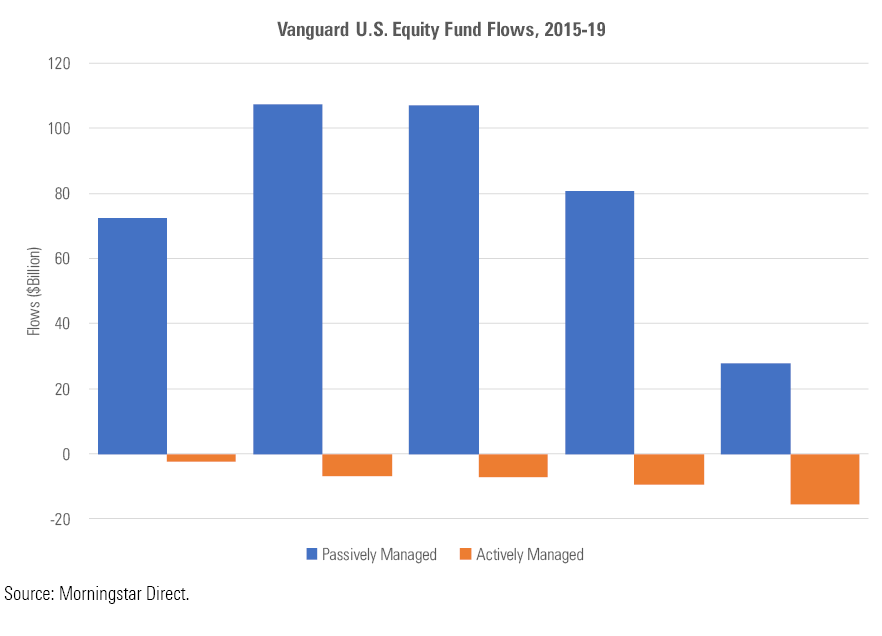

Vanguard’s actively managed U.S. equity funds have enjoyed somewhat better sales than have most of its rivals', but their aggregate flows have nonetheless been negative for several years now. Concurrently, its index funds have recorded record inflows. Below are the net flows into the company’s diversified U.S. stock funds for each calendar year from 2015 through 2019, separated into the two groups of passive and active.

The active-fund outflows remain modest relative to their aggregate assets of $315 billion (as of June 30), but their direction isn’t encouraging. Nor is the widening gap between the assets held by the passive and active funds. Counting both their mutual fund and exchange-traded fund versions, Vanguard’s U.S. stock index funds amount to a collective $2.2 trillion--7 times the total for the active funds. If every active U.S. diversified equity mutual fund were combined into a single offering, that new entity would be dwarfed by both Vanguard Total Stock Market Index VTSAX and Vanguard 500 Index VFIAX.

The company, of course, will take no such step, because Vanguard moves only gradually, and because the funds cover various investment styles. But if the company did institute a giant merger, it wouldn’t be huge news after the initial hubbub faded. In the grand scheme of things, Vanguard’s active U.S. equity funds have become a backwater. They aren’t news unless they are being abolished.

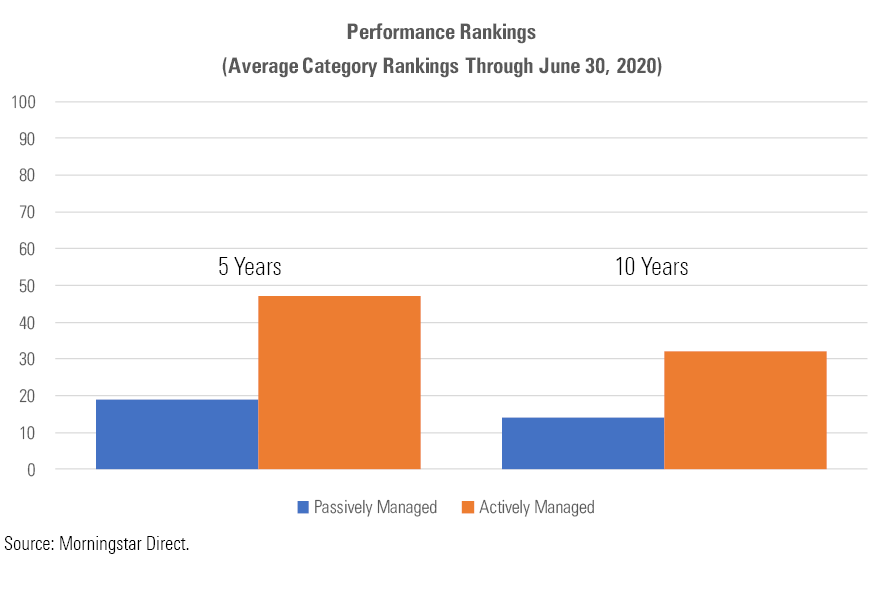

Assessing Performance The question then becomes, are these sales trends justified? The following chart depicts each group's average total return ranking within the relevant Morningstar Category (meaning that Vanguard's large-growth funds are compared against other large-growth funds, its small-value funds to other small-value funds, and so forth). The time periods are the trailing five and 10 years ended June 30, 2020.

(Properly speaking, I should evaluate risk-adjusted performance, but such figures are difficult to interpret. At any rate, such a comparison would not help the actively run funds, because in aggregate they are somewhat riskier than their passive rivals, although the difference is slight.)

With Morningstar’s return rankings, 1 is the highest mark and 100 the lowest. Thus, the chart indicates that Vanguard’s passive U.S. equity funds have handily outgained their actively run siblings over the past five years. Over the full decade, the performance gap narrows, but the case for the passive funds remains compelling. Their average 10-year return ranking is an extremely low 14, with all but two funds placing in their category’s top quartile, and those two in the second quartile. That’s as close to perfection as mutual fund lineups get.

What’s more, those results were achieved without casualties, as Vanguard has yet to extinguish a retail index fund. Thus, while shareholders of the company’s active funds run the not-insignificant risk of eventually possessing something different than what they purchased, or receiving their assets back as a distribution after their fund is liquidated, they can reliably assume that once they have bought a Vanguard U.S. equity index fund, they will continue to hold that fund.

In summary, while Vanguard’s actively run U.S. equity funds are sound, occasionally performing superbly (Vanguard Equity-Income VEIPX, Vanguard Tax-Managed Capital Appreciation VTCLX) and nearly always respectably, they are justifiably overshadowed by their indexed siblings. The active funds are praiseworthy, but simply being praiseworthy is insufficient given the fame and achievements of the index funds they compete against.

Looking Forward This conclusion is more pessimistic for Vanguard's active U.S. equity funds than when I last addressed this subject. Since then, the index funds have extended their lead, both in terms of sales and performance, and Vanguard has killed off three more of its active U.S. equity funds. The signal is clear: While the company is not issuing pre-emptive strikes, neither will it hesitate if veteran funds appear to have outlived their usefulness.

Increasingly, Vanguard's investment lineup resembles the holdings of endowment funds. The so-called "endowment model" largely bypasses traditional equity management, favoring instead index funds, alternative equities (such as hedge funds, venture capital, and private equity), or quantitative approaches that are run by microchips. This February, Vanguard announced a partnership with a private-equity organization. And its sole new active equity fund, Vanguard U.S. Multifactor, relies so heavily on rules that it exists as an ETF as well as a mutual fund.

That a company founded to serve retail investors is beginning to look like the elite institutional funds, and the elite institutional funds are starting to resemble the retail behemoth, is no accident. Ultimately, best investment practices are best investment practices, regardless of where they are implemented.

Note: Oh, the irony. After publishing this column, I learned that Vanguard Tax-Managed Capital Appreciation, one of the two “active” funds that I singled out for applause, is effectively an index fund. The fund tracks the Russell 1000, then adjusts the portfolio to minimize taxes. So it is not technically an index fund, but neither it is a traditional actively managed fund. That is the sort of detail that I used to verify by walking around the office and checking with an analyst. Such is the drawback of the Zoom work style.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)