The Best Foreign-Stock Funds

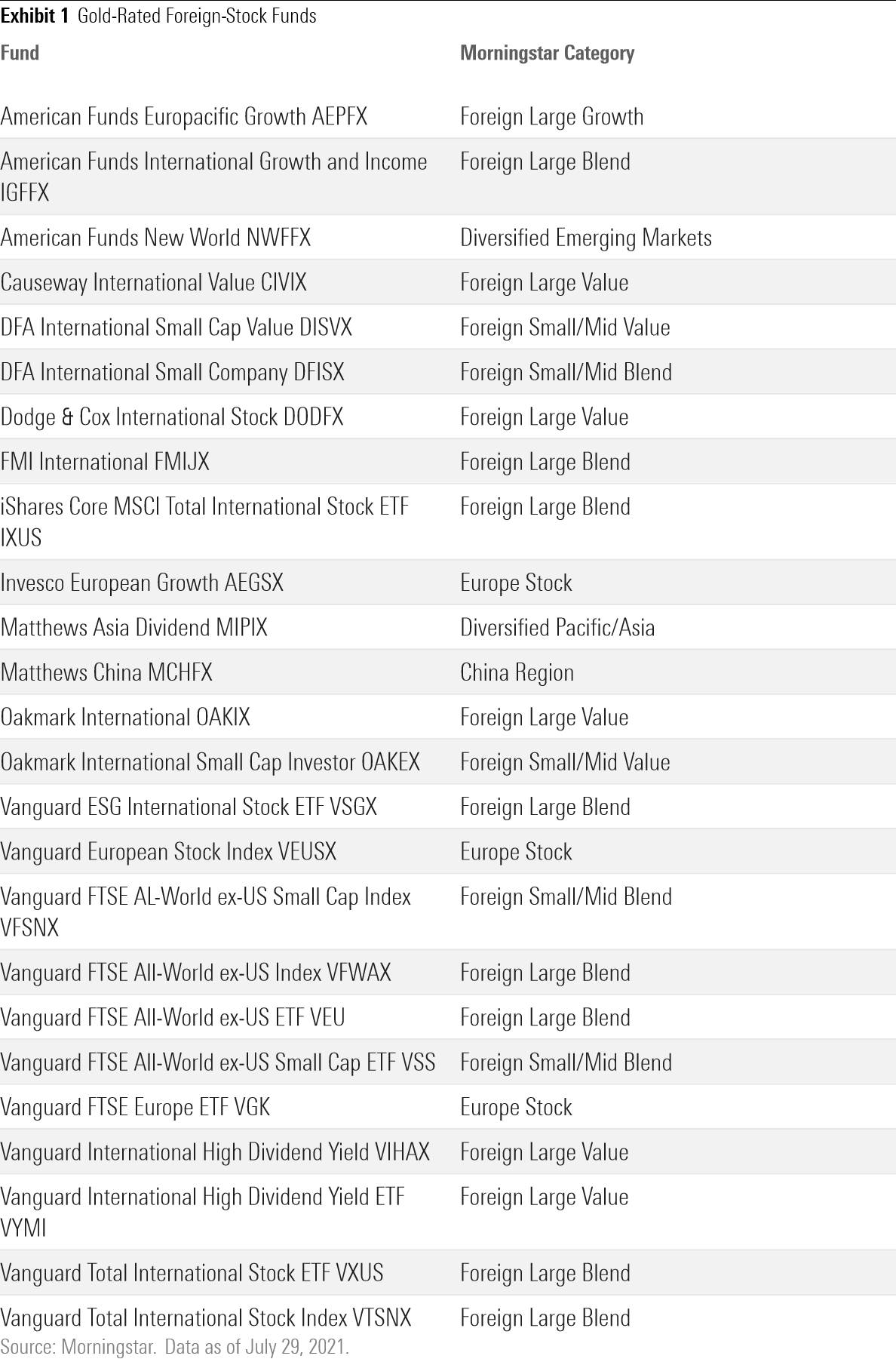

These international mutual funds and ETFs all earn Morningstar Analyst Ratings of Gold.

There are plenty of reasons to own international stocks in a portfolio. Some investors want foreign stocks in their portfolios to round out their exposure to the global stock market. Morningstar’s director of global exchange-traded fund research, Ben Johnson, points out that U.S. stocks constitute about 55% of the world's public equity market cap, with foreign stocks representing the remaining 45%. But most U.S.-based investors' equity allocations are nowhere close to that breakdown.

Others may want to tilt their portfolios toward foreign fare after a period of U.S. stock dominance, such as we've seen during the past several years. At 2021's midpoint, the average U.S. large-blend fund had trounced the average foreign large-blend fund by more than 8 full percentage points annually over the trailing three-year period.

Before adding an international fund to your portfolio mix, though, double check that you don't already have plenty of exposure to international markets through your core equity fund holdings; Morningstar's Instant X-Ray feature can help you determine your portfolio's current international stock stake. While there's no "right" allocation to markets abroad, Morningstar's Lifetime Allocation Indexes (which you can use to benchmark your asset allocation) suggest up to a 41% position in non-U.S. stocks, depending on life stage and glide path.

If you find you are, in fact, lighter in foreign-stock exposure than you'd like, you can turn to our shortlist of the best foreign-stock mutual funds and ETFs--those funds with at least one share class earning a Morningstar Analyst Rating of Gold--for ideas to investigate further.

Clearly there are a range of different international categories represented among our Gold-rated list, along with passive and active options.

Foreign large-cap funds tend to focus on Europe, specifically, established markets in France, Germany, Switzerland, the Netherlands, Spain, Italy, and the United Kingdom. They often hold significant positions in Asia, too. And although they dabble in emerging-markets stocks, they often cap their exposure to those markets to about 15% of assets. Foreign small/mid-cap funds often carry larger emerging-markets positions. And of course, emerging-markets funds provide the greatest exposure to developing markets.

These figures are only averages, though; actual fund breakdowns differ. Knowing how a fund's market exposure diverges from the averages allows for better performance expectations--and better investor outcomes. For instance, emerging-markets stocks tend to be more volatile than developed-markets stocks. As a result, stock funds with higher emerging-markets stakes will exhibit performance very different from their peers' when emerging markets soar or sink.

Low-cost index funds are well-represented on the list. Passive foreign-stock funds have posted competitive returns against their actively managed counterparts, thanks in large part to rock-bottom expenses and modest trading costs. They also tend to be more tax-efficient than active funds, and there's no star-manager flight risk.

That said, there are good reasons to go active in foreign markets. As portfolio strategist Amy Arnott notes, studies have shown that active managers in our foreign large-blend, foreign large-value, and diversified emerging-markets Morningstar Categories have a tougher time adding value than active managers plying smaller-company and growth strategies.

Regardless of whether an investor goes active or passive, there are dedicated large-cap funds, focused small-cap funds, and wide-ranging all-cap funds practicing different growth and value strategies. Understanding a fund's Morningstar Style Box placement and its strategy allows investors to find funds that match their risk profiles, fill portfolio gaps, and set performance expectations.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)