Maybe There’s Something to the Shiller CAPE Ratio, After All

New research rehabilitates an old measure.

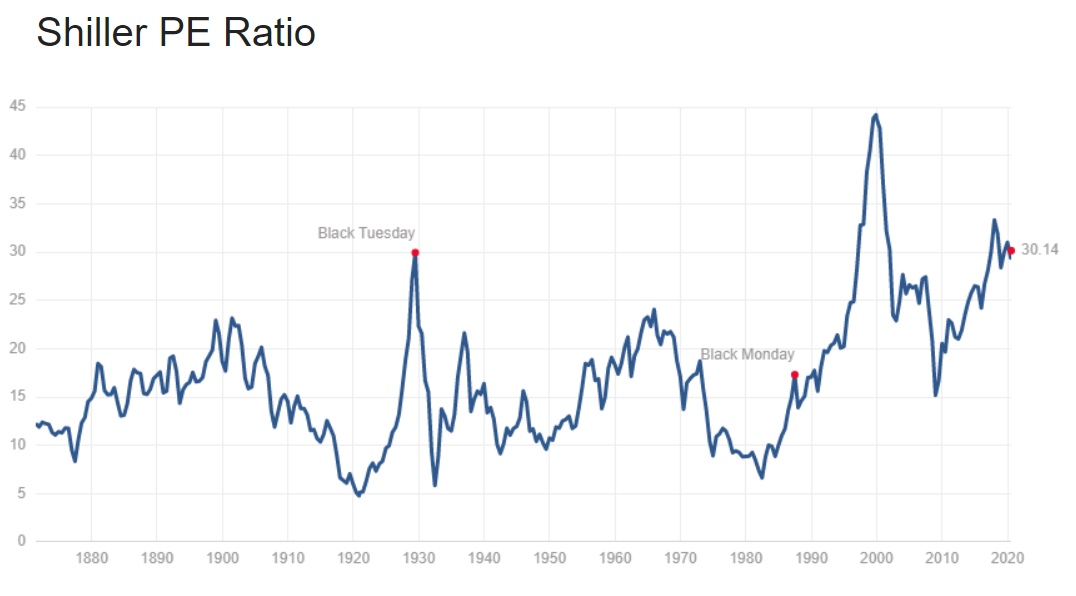

The Hope The Shiller CAPE ratio has long intrigued investment practitioners, and to some extent the academic community as well. Devised by Nobel Laureate Robert Shiller, the equation calculates the S&P 500's "cyclically adjusted price/earnings ratio," which is a fancy way of saying that the index's price is divided by average corporate earnings over the past decade, rather than by the most recent results.

Because that process stabilizes the output by smoothing an economic cycle’s peaks and valleys, the CAPE ratio would seem well-suited to gauge the stock market’s valuation across different periods. If the current CAPE ratio is 20, as opposed to 12 two decades ago, today’s stocks may be overpriced. Perhaps the CAPE ratio can be used to predict future stock market performance.

A glance at the CAPE ratio’s history encourages that belief. The two highest figures the CAPE ratio ever recorded were in 1929 and 2000, directly before brutal bear markets. Lesser spikes occurred in 1936, 1966, 1972, and 1987, each of which were also followed by severe losses. It’s tempting when viewing the CAPE ratio’s chart to conclude that astute investors could have heard the thunder before the rain arrived.

Source: Multpl.com

The Reality However, as pointed out in 2014 by Elroy Dimson, Paul Marsh, and Mike Staunton, that assumption is an optical illusion. It's one thing to construct forecasts after the fact, when viewing the established history, but quite another to do so before the data arrive. The trio was unable to derive realistic trading rules that could have been applied by investors at the time.

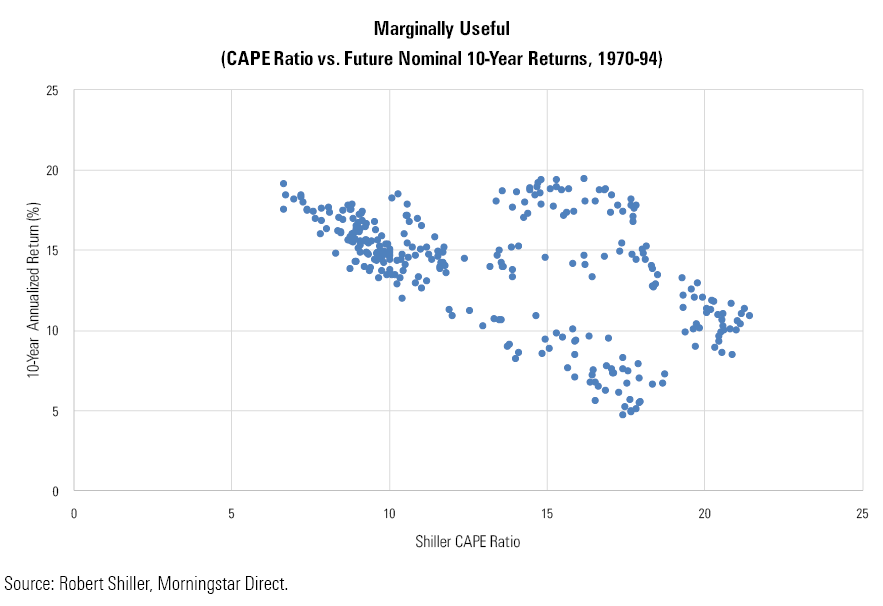

The chart below shows the CAPE ratios from February 1970 through December 1994, plotted against the S&P 500’s subsequent 10-year results. For example, the February 1970 CAPE ratio is matched with the index’s average annualized return, expressed in nominal terms, for the period from February 1970 through January 1980.

The direction is encouraging. In general, as CAPE ratios increased, the rate of total return declined. Regrettably, though, it would have been very difficult to put this information to use, because the relationship was too weak. Most of the highest future returns, at a flashy 19%-20% annualized, followed relatively steep CAPE ratios. What’s more, when the CAPE ratio reached peak levels, the ensuing performance was acceptable, at 8%-12%. No disasters ensued.

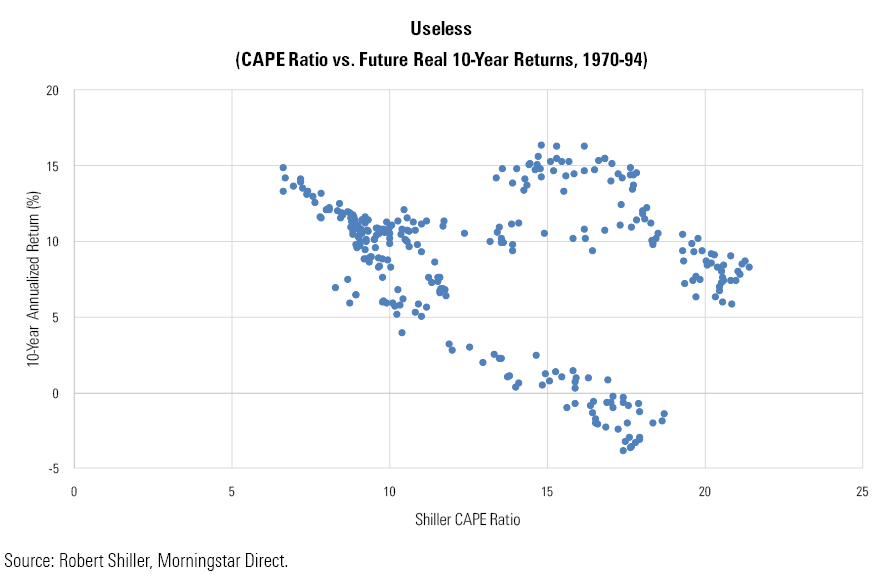

Switching to real returns--which is the correct way to judge investor success--offers no improvement.

To the measure’s credit, the very lowest CAPE ratios were reliably followed by good returns. Aside from that, though, its predictive powers were nonexistent. CAPE ratios that were middling to high delivered a wide variety of returns, ranging from the very best to the very worst, while the maximum ratios uniformly led to respectable results. Not only did no disasters occur after peak ratios, but there weren’t even disappointments. The wolf never arrived at the door.

A Fresh Look Knowing these results, and fortified by the research of Dimson, Marsh, and Staunton, I have long dismissed attempts to employ the CAPE ratio. The exercise is fun, but attempting to garner insight from the evidence is futile. However, a recent article, "The Remarkable Accuracy of CAPE as a Predictor of Future Returns," by Michael Finke of The American College of Financial Services, may have changed my mind.

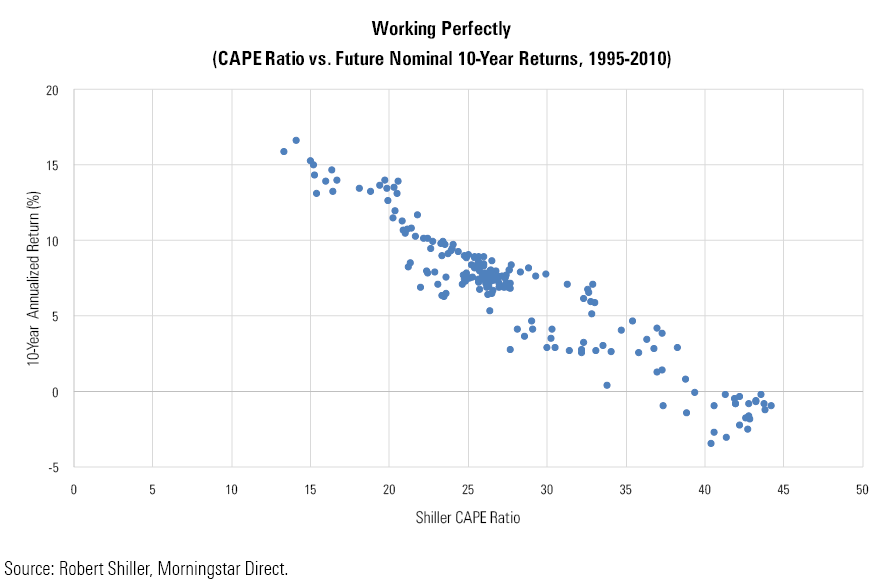

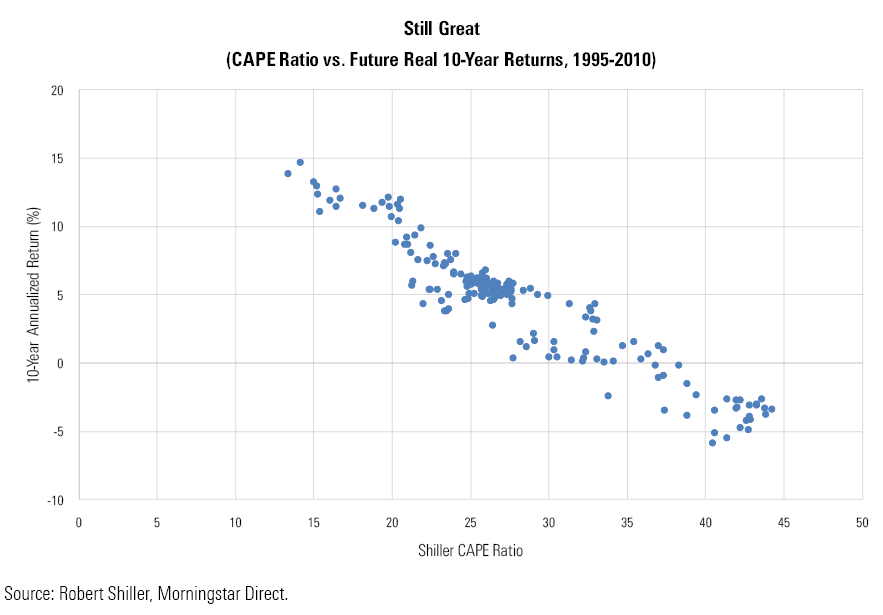

Finke conducted the same analysis that I have just shown, but from 1995 forward, meaning that his CAPE ratios come from 1995 through 2010, with the S&P 500 returns, expressed in nominal terms, concluding 10 years later, from 2005 through summer 2020. For consistency’s purposes, I have recreated his finding rather than reprint his chart. (But do check out his work; he deserves the clicks.)

Now that's a correlation. Have you ever seen such a tight fit between a stock-market signal and future performance? If so, let me know, because I cannot think of such an example. I believed that Finke's work was accurate given his background, as well as the reputation of the website that published the article, but I confess that I did not fully believe those numbers until I ran them myself.

Converting nominal returns to real does not alter the picture, for the simple reason that inflation was largely dormant during the period.

Practical Implications There is, I should point out, a very large catch. There was no reason for investors in the mid-1990s to suspect that the CAPE ratio's signal would suddenly become far more reliable. In addition, the ratio's signal moved northward. Previously, it had indicated that ratios of 15-20 were middling figures that would lead to widely varying returns. Under the new regime, though, such ratios have been relatively low and have consistently led to the highest gains.

Sadly, the CAPE ratio’s predictive power has not benefited investors. The few who believed in the calculation’s signals did not understand its changes. Early in the long bull market, in 2011 and 2012, CAPE ratio afficionados were warning that stocks were becoming pricey. That was true by the ratio’s long-term history but false over the past 25 years. Meanwhile, the many who doubted the ratio’s usefulness have paid the measure little attention.

Perhaps we skeptics should pay renewed attention to the CAPE ratio. That it abruptly became more predictable just when inflation was at long last tamed suggests that the ratio’s recent behavior may be driven by fundamentals rather than a statistical fluke. In a steady, low-inflation environment, the CAPE ratio may finally deliver on its implicit promise, to offer clues about future stock-market performance.

If that proves so, mute your expectations for accumulating wealth. Per its post-1995 history, the CAPE ratio’s current value of 30 is correlated with a real 10-year U.S. equity return of between 0% and 5%.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)