Who’s Growing Dividends in Today’s Market?

Morningstar indexes spotlight rising equity income streams.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Equity income investors have not had it easy in 2020. The global-pandemic-driven economic downturn has prompted many companies to reduce, suspend, or eliminate regular payouts to shareholders. Perhaps most shocking was Royal Dutch Shell RDS.A, which lowered its dividend for the first time since World War II. But it was far from the only big name whose falling profits prompted a dividend cut--from Disney DIS, Boeing BA, and Carnival CCL in the United States, to European stalwarts like UBS UBS, adidas ADDYY, and BT Group BTGOF, to three of Australia’s big four banks. Dividend suspensions have even been mandated by some regulators.

What's a dividend investor to do in this year of the falling shareholder payout? Take a breath and look beyond the headlines. According to analysis by Alec Lucas of Morningstar Manager Research, dividend cuts in the U.S. market have been concentrated in the consumer cyclical sector, oil and gas-related businesses, and small-cap stocks. The many companies that have maintained and even grown their shareholder payouts don't make the news. Even if high-fliers like Zoom ZM and Tesla TSLA don't pay dividends, there's still plenty of income to be had in today's equity markets.

Morningstar’s dividend growth indexes highlight companies that are not only paying dividends but whose track record of raising their payouts is likely to persist. When the Morningstar U.S. Dividend Growth Index and Morningstar ex-U.S. Dividend Growth Indexes rebalanced in late June 2020, they removed some dividend laggards and shifted weight to healthier payers. Examining the indexes’ positioning can therefore shine a light on stable, even rising, dividend streams.

Looking for Dividend Growth in All the Right Places Dividend-growth investing is not about maximizing current income. Rather than seek the market's juiciest yields, dividend-growth investors home in on companies whose consistent cash flows have allowed them to improve their shareholder payouts. Dividend growth not only helps investors keep pace with inflation, but it signals strengthening corporate fundamentals. Companies that increase payouts to shareholders tend to be competitively well-positioned.

The Morningstar U.S. Dividend Growth Index and the Morningstar Global ex-U.S. Dividend Growth Indexes screen for companies that have increased their payouts for five years and are poised for continued growth. Five years isn’t as long a history as some require, but the emphasis is more on the future than the past. After all, Shell’s decades-long track record foretold nothing this year. The indexes exclude constituents paying out more than 75% of their earnings in dividends, so they have scope to maintain and grow their payout. They also avoid stocks whose yields are in the top 10% of the market--as a means of screening out dividend traps--while selecting companies with positive earnings outlooks. Companies that indicate dividend suspensions can be eliminated at quarterly rebalancing.

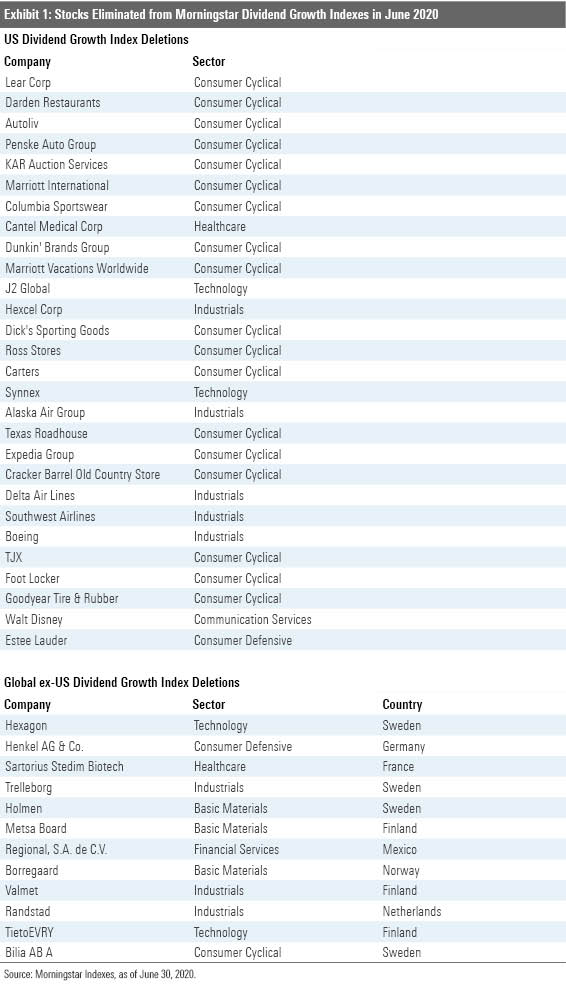

At their June 2020 rebalancings, the Morningstar U.S. Dividend Growth Index removed 27 constituents due to dividend suspensions, and the Morningstar Global ex-U.S. Dividend Growth Index eliminated 12. Unsurprisingly, constituents in the consumer cyclical sector were most affected, as shown below. Pandemic-related shutdowns and the economic slowdown have crushed discretionary retail, as well as airlines and other travel-related businesses. Basic materials-oriented companies have suffered from falling demand, though dividend payers throughout the economy have been affected.

The good news is that, as of May 2020, the vast majority of the Morningstar U.S. Dividend Growth’s 478 constituents and the Morningstar ex-U.S. Dividend Growth Index’s 721 constituents met payout requirements and remained in place. Turnover in June was higher than average for the past five years but far from extreme. A bigger shakeout will come in December when the indexes reconstitute (reset membership).

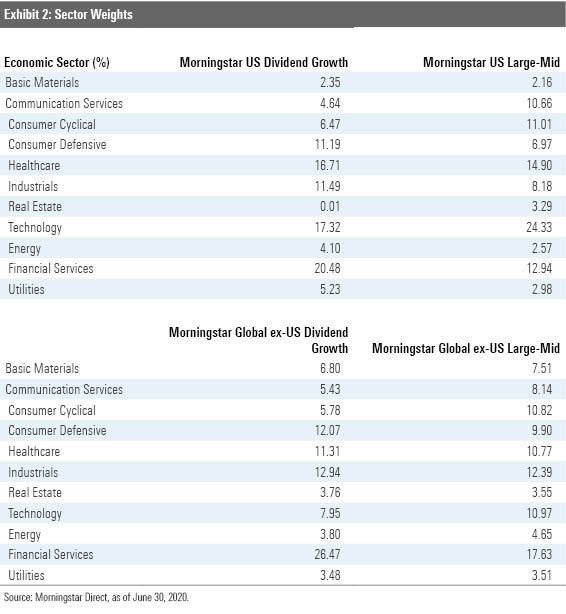

So where are the indexes currently finding dividend growth? Both the U.S. and ex-U.S. indexes dedicate above-market weight to the financial-services industry--from banks like J.P. Morgan JPM, Royal Bank of Canada RY, and Toronto-Dominion Bank TORDF, to payments companies Visa V and Mastercard MA. Both indexes are also overweight consumer defensive stocks--Procter & Gamble PG, Coca-Cola KO, and Costco COST in the U.S., and Nestle NSRGF, Danone GPDNF, and Kao KAOCF globally--and underweight consumer cyclicals stocks. While the growth-oriented technology sector consumes below-average weight for both indexes, it’s hardly an extreme underweight. Companies like Microsoft MSFT, Cisco CSCO, Apple AAPL, and Intel INTC feature in the U.S. index, while Taiwan Semiconductor TSM, SAP SAP, ASML Holding ASML, and Infosys INFY appear in the ex-U.S. index. Healthcare, also a growth-leaning sector, consumes above-market weight for both indexes. That’s especially driven by drug manufacturers like Pfizer PFE, Bristol-Myers Squibb BMY, Novartis NVS, and Sanofi SNYNF. While telecom is a mutual underweight, industrials like 3M MMM, Honeywell HON, ABB ABB, and Vinci VCISF are important to both indexes.

It’s no coincidence that all the companies named above have economic moats around their businesses, in the view of Morningstar Equity Research. Companies with sustainable competitive advantages are well-positioned to grow their dividends. Both indexes unsurprisingly have more exposure to wide-moat stocks and less exposure to no-moat stocks than their market equivalents.

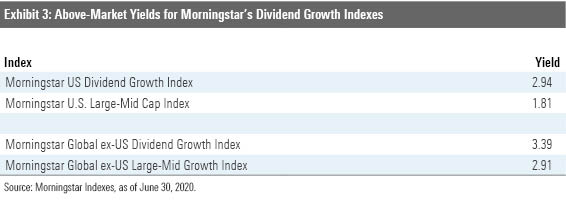

Dividend Growers for Income Many income-seeking investors are being pushed into equity markets because rock-bottom interest rates mean paltry yields on cash and bonds. Meanwhile, pension funds continuously look to dividend payers to meet their obligations. Dividend-growth stocks may not offer the highest yields in the market, but they do throw off an above-average income stream. As shown below, both indexes have produced a superior yield to the market over the past year.

Critically, this income stream does not come at the expense of quality and ultimately, an investment’s long-term total return. Equity income investors can get burned reaching for high-yielders, only to find themselves holding shares of a company in financial distress. Dividend cuts may be painful, but they’re not as bad as the permanent impairment of capital. Especially during economic downturns, the dividend landscape is best navigated selectively.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)