7 Superior Foreign Stocks to Buy

These undervalued wide- and narrow-moat names were recently added to the Morningstar Global ex-U.S. Moat Focus Index.

My colleague Ben Johnson has argued that investors have fewer reasons than ever for maintaining "home bias" in their portfolios. What's home bias? It's investors' tendency to tilt their portfolios in favor of domestic stocks versus foreign fare. He points out that U.S. stocks constitute about 55% of the world's public equity market cap, with foreign stocks representing the remaining 45%. But most U.S.-based investors' equity allocations are nowhere close to that breakdown.

"When it comes to investing overseas, many decide to ditch diversification at the border," Johnson notes.

Granted, there are good explanations for why this historically has been the case. Among them: Investing overseas can be costly; investors feel more "in-the-know" about companies that are domiciled in their home countries; the U.S. market is less prone to corporate governance problems and political risk than some others; and domestic multinationals provide exposure to overseas markets. However, as the world becomes smaller, Johnson thinks some of these explanations have grown "flimsier" over time.

"Furthermore, in my opinion, even when considering them all together, they don't warrant the degree of home bias that exists in many investors' portfolios today," he asserts.

In a nod to going global, we're sharing some interesting--and inexpensive--foreign-stock ideas.

As a reminder, Morningstar's approach to smart stock investing applies around the globe. First, favor companies with durable competitive advantages, or economic moats. These companies should be able to fend off competition and out-earn their costs of capital for years to come. Then, buy these companies when they're trading below what they're worth.

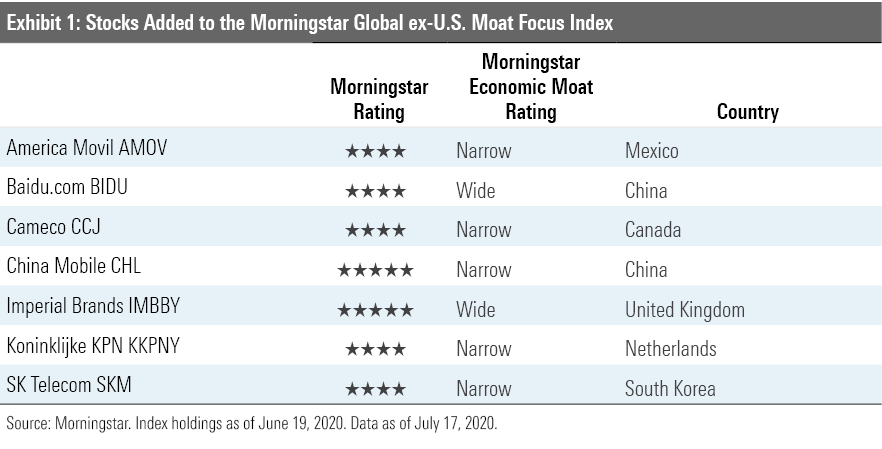

We've turned to the Morningstar Global ex-U.S. Moat Focus Index for opportunities. This quality-focused index is a subset of the Morningstar Global Markets ex-U.S. Index, a broad index representing 97% of developed-markets (ex United States) and emerging-markets market capitalization. Morningstar ranks the wide- and narrow-moat stocks in the broad index by lowest price/fair value to find the 50 cheapest wide- and narrow-moat stocks. These stocks represent the most compelling values among the global moat universe, according to Morningstar analysts.

For this article, we focused on non-U.S. stocks that were added to the index as of the latest reconstitution in June 2020. Seven of those newcomers have shares listed on U.S. exchanges (and are therefore easily accessible to U.S. investors) and are undervalued as of this writing. Stamp your passport!

Here’s a little bit about each stock from our analysts.

American Movil AMOV "With its broad diversification across Latin America and solid competitive position in many markets it services, we view America Movil as an attractive way to gain exposure to the region. That exposure comes with significant volatility stemming from political, regulatory, and economic uncertainty, but we expect Movil will create value for shareholders over the long term.

"The Mexican business is Movil’s most important, accounting for about 30% of revenue and profits. The Mexican telecom landscape has shifted dramatically over the past five years, but Movil remains dominant, with more than 60% wireless market share. The firm also serves about half of the Internet access market at Telmex, its fixed-line subsidiary. Lawmakers took aim at Movil’s position in 2014, creating a new regulatory framework and placing numerous conditions on the firm’s operations. That change prompted AT&T to enter the market in 2015 via two acquisitions, creating a wireless price war. Movil’s market share has fallen modestly as a result, but revenue and profitability have taken more sizable hits. After enduring heavy losses in the country, however, AT&T appears to be backing off competitively. Wireless pricing is rising again, and we think the worst of the impact from AT&T is over.

"Still, Movil and its primary shareholders, the Slim family, are likely to garner regulatory scrutiny in Mexico from time to time as officials seek to increase network investment and service adoption. We expect the firm will weather these storms thanks to its scale and management expertise, but predicting the political environment is difficult, at best.

"In Brazil, Movil’s second-largest market, the firm has assembled a solid set of assets as the second-largest wireless carrier and largest cable company in the country. Economic weakness and a challenging competitive environment have limited the firm’s ability to earn attractive returns on these assets. Eventually, we expect conditions will improve, enabling Movil to drive solid cash flow growth in the country."

Mike Hodel, director

Baidu BIDU "Baidu has the urgency to strengthen its mobile business because it has not developed another industry-leading business other than its mobile search app for years. Baidu's share of mobile time spend reduced to 6.9% in March 2019 from 7.3% year over year. Baidu positions its flagship Baidu app (173 million daily average users in March 2019) as a "super" app that can serve a wide range of users' needs, such as reading, watching videos, shopping, transportation tickets, food services, and so on, but we believe the app is less of a super app compared with Tencent's Wechat (1.1 billion monthly average users). It has copied the strategies of its peers by launching a mini program (181 million MAU in March 2019) and short video apps (sevenfold year over year increase to 98 million MAU in March 2019 as per Questmobile).

"We have not factored in the meaningful commercialization of Baidu’s AI-based services, such as voice assistant platform DuerOS, autonomous driving platform Apollo, and artificial intelligence cloud services. Search is driven by an AI-powered algorithm, giving Baidu a good foundation in this segment. Baidu is also one of the largest and earliest companies to start AI investments in China. Currently, Baidu uses AI to recommend feeds to the app’s users to generate advertising revenue.

"IQiyi, Baidu’s online video platform, has been a key growth driver stemming from increasing willingness to pay for premium content in China and continuous advertising demand on iQiyi. It accounted for 29% of Baidu’s revenue in the first quarter of 2019.

"In the near term, Baidu will invest heavily in its mobile business in terms of sales and marketing, and traffic acquisition. While meaningful monetization is uncertain, we expect Baidu to increase or maintain its research and development expenditure, which is at 17% of sales in the first quarter of 2019. To fend off major competitor Tencent Video, iQiyi needs to continue to invest in premium content. Therefore, we expect Baidu’s margins to be under pressure in the near term."

Chelsey Tam, analyst

Cameco CCJ "We think the market is mispricing narrow-moat uranium miner Cameco. Uranium offers a rare growth opportunity in metals and mining. China's structural slowdown portends the end of a decade-long boom for most commodities--but not for uranium.

"Uranium prices declined consistently from 2011 to 2017, owing to the supply glut caused by delayed Japanese reactor restarts. However, this situation is unsustainable as much of existing production would be unprofitable at these prices. Yet, because most uranium is transacted through long-term contracts negotiated years in advance, a disconnect between realized and spot prices makes it appear that lower prices are sufficient.

"Meanwhile, we expect global uranium demand to rise roughly 40% by 2025, a staggering amount for a commodity that saw next to zero demand growth in the past 10 years. We expect new reactor capacity to drive the strongest uranium demand growth in decades. A quadrupling of China's reactor fleet headlines this growth. China's modest nuclear reactor fleet uses little uranium today. That's set to change in a major way. Beijing is pivoting to nuclear in order to reduce the country's heavy reliance on coal. New reactors in India, South Korea, and Russia as well as eventual restarts in Japan lend additional support.

"Years of low spot prices have prevented investment in new mines, while existing mines have entered care and maintenance or are near the end of their lives. As such, the mined supply of uranium will struggle to keep pace amid rising demand and falling secondary supplies. Low uranium prices since Fukushima have left the project cupboard bare, and we expect a cumulative supply deficit to emerge by 2023. These shortfalls should begin to affect price negotiations in the next couple years, as utilities tend to secure supplies a few years before actual use. We forecast that contract market prices will rise to $65 per pound to encourage enough new supply.

"As one of the largest and lowest-cost producers globally with expansion potential, Cameco should benefit meaningfully from higher uranium prices. The company benefits from stellar ore grades, large scale, long life, and an attractive operating cost profile."

Kris Inton, director

China Mobile CHL "With more than 950 million customers, China Mobile not only dwarfs its Chinese competitors, but also is the world's largest wireless telephone company by far. It has more 3G/4G subscribers than its competitors despite being handicapped by the Chinese government, which required it to use the home-grown TD-SCDMA technology standard for 3G mobile.

"However, with the industry shift to 4G and now 5G, the technology playing field is more level, as the strong handset ecosystem development in the first few years of operation of China Mobile's TD LTE network means that the technology gap between its 4G version and its competitors is much smaller than it was for 3G. In addition, China Mobile had about a 12-month head start on its 4G network rollout, which helped it over 2015 and 2016 against its competitors, which gained national FDD LTE licenses in February 2015. However, the competitors have been more aggressive between 2017 and 2019 with China Mobile's mobile services revenue share dropping to 62% from 67% over that period.

"Owing to its early success, China Mobile has generated significant free cash flow. It has not only the strongest balance sheet among telecom companies worldwide, but also one of the strongest, period. At the end of December 2019, the firm had a net cash (including marketable securities) position of $58 billion. This cash provides the ability to build out its network faster than its competitors. It also provides opportunities to develop or buy products and services to use on its network to compete against over the top, or OTT, players. Indeed, management considers one of its major assets to be its 950 million customers and the information that it has about them. Management is actively investigating how it can best leverage this for its own digital services products to compete against the large Chinese OTT players.

"The government's tariff-reduction measures have negatively affected profit growth over 2017, 2018, and 2019, and following this, the company will be in the investment phase of 5G network and service rollout. We expect returns to increase again once this investment phase finishes in 2022."

Dan Baker, director

Imperial Brands IMBBY "Imperial Brands approaches its tobacco and next generation product, or NGP, portfolios with two distinct value creation models. In tobacco, the market repeatable model aims to achieve high-quality market share growth through investments in an optimized portfolio across target markets and dynamic pricing strategies. In NGP, the brand adoption model is focused on promoting the benefits of alternative products and nurturing brand loyalty.

"We think the success or failure of Imperial's strategy--and the reason for its recent valuation discount--will lie in its choice of targeted profit pools. Geographically, Imperial has materially increased its exposure to the U.S. through its 2015 acquisitions of assets from Lorillard and Reynolds American, a strategy we like because we believe the U.S. combustible market offers multiyear opportunities for price/mix driven growth. In its next-generation product portfolio, however, Imperial's focus remains firmly on vaping, a category that we believe is commoditized with fairly low barriers to entry. Competitors have invested more heavily in heated tobacco, a category that we suspect may have more success in attracting quitting smokers and could be more profitable. Imperial is currently test marketing Pulze, a heated tobacco product in Japan, but it may be too little too late, given other competitors' inability to win material share from category leader Philip Morris International. We expect Imperial's incoming CEO, Stefan Bomhard, to accelerate investment across a broader range of emerging categories, including heated tobacco and modern oral, funded by the announced divestment of GBP 2 billion of assets including the cigar portfolio.

"In some ways, Imperial is the lowest-quality business of the wide-moat-rated tobacco companies. It is heavily exposed to developed markets and is generally a price taker, with few dominant market positions. Nevertheless, it has been a strong executor in recent years and achieves best-in-class tobacco margins in the mid-40% range, as well as 90%-plus free cash flow conversion."

Philip Gorham, director

Koninklijke KPN KKPNY "KPN is the incumbent telecom operator in the Netherlands and is starting to show signs of growth. In 2014, the firm sold its E-Plus division in Germany to Telefonica and in February 2016, it completed the sale of Base--its Belgian operation--to Liberty Global for EUR 1.325 billion. These deals strengthened the balance sheet even after paying out some of the proceeds in special dividends.

"Increased competition and changes in customer behavior have pressured KPN's sales in the Netherlands. Its traditional consumer fixed-line business has been shrinking rapidly for years, as cable competition has been particularly strong and has increased with the creation of Liberty Global's joint venture with Vodafone in the Netherlands, named VodafoneZiggo. However, KPN is having some success bundling television and broadband services with its phone business. This has worked especially well in areas where the cable operator has only analog service. Providing the Spotify music service free to premium customers has also been a successful marketing tool. KPN now has about 29% of the digital pay-television market. It is also rolling out fiber to increase broadband speeds to help it compete. KPN has intentionally focused on higher-end subscribers with higher data usage, which has helped offset declines in voice pricing. However, pricing pressure continues, which pushed consumer revenue lower in 2018. While we expect revenue growth to be positive in future, it will likely be at a minimal level.

"The business sector is making some progress as new areas, such as IT services and consulting, are gaining enough scale to likely offset the continued declines in voice revenue starting in 2020. While management expects this segment to reach stability in the medium term, we believe it will take longer. On the enterprise side, we think KPN is too small to compete with larger global peers like AT&T, BT Group, and Orange, while on the small and midsize business side, it will increasingly compete with VodafoneZiggo. Thus, we remain skeptical regarding the stabilization of this division."

Andreea Matysiak, analyst

SK Telecom SKM "SK Telecom's telecom market position is very strong, and we like the free cash flow it generates. However, its capital-allocation decisions leave us underwhelmed. SK Telecom was Korea's first wireless operator, and we believe it has done a good job of maintaining a dominant position. The firm continues to claim just under 50% wireless market share, including the leading position among postpaid contract customers, which provides it with the highest average revenue per user among Korean wireless operators. However, this has come at a cost with wireless operating profit nearly halving between 2017 and 2019.

"To tap into the fixed-line market and protect itself from further encroachment by KT into its wireless business, SK Telecom acquired a stake in Hanaro Telecom (now SK Broadband), Korea's second-largest fixed-line operator, in 2008, which it subsequently turned into 100% ownership. While this acquisition immediately increased consolidated revenue, its earnings impact has been limited.

"To bolster its growth rate, SK Telecom has made several investments in other countries and industries over the years. At best, the firm has a mixed record here. Despite SK Hynix Semiconductor's strong stock price performance (SKT's $3.1 billion investment in February 2012 had increased in value by over 200% by end 2019), we remain disappointed with this acquisition from a strategic perspective.

"The firm has also been increasing its position in ancillary businesses, such as Internet portals and shopping, as well as financial operations and, more recently, security. While we see the potential here, we are not projecting significant success. These businesses generated operating losses in 2016, 2017, and 2018 but moved into profitability in 2019 on the back of several acquisitions in the security space that were immediately profitable. We would prefer SK Telecom to focus more on its core narrow-moat telecom business and return excess cash to shareholders, but this looks unlikely to happen."

Dan Baker, director

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)