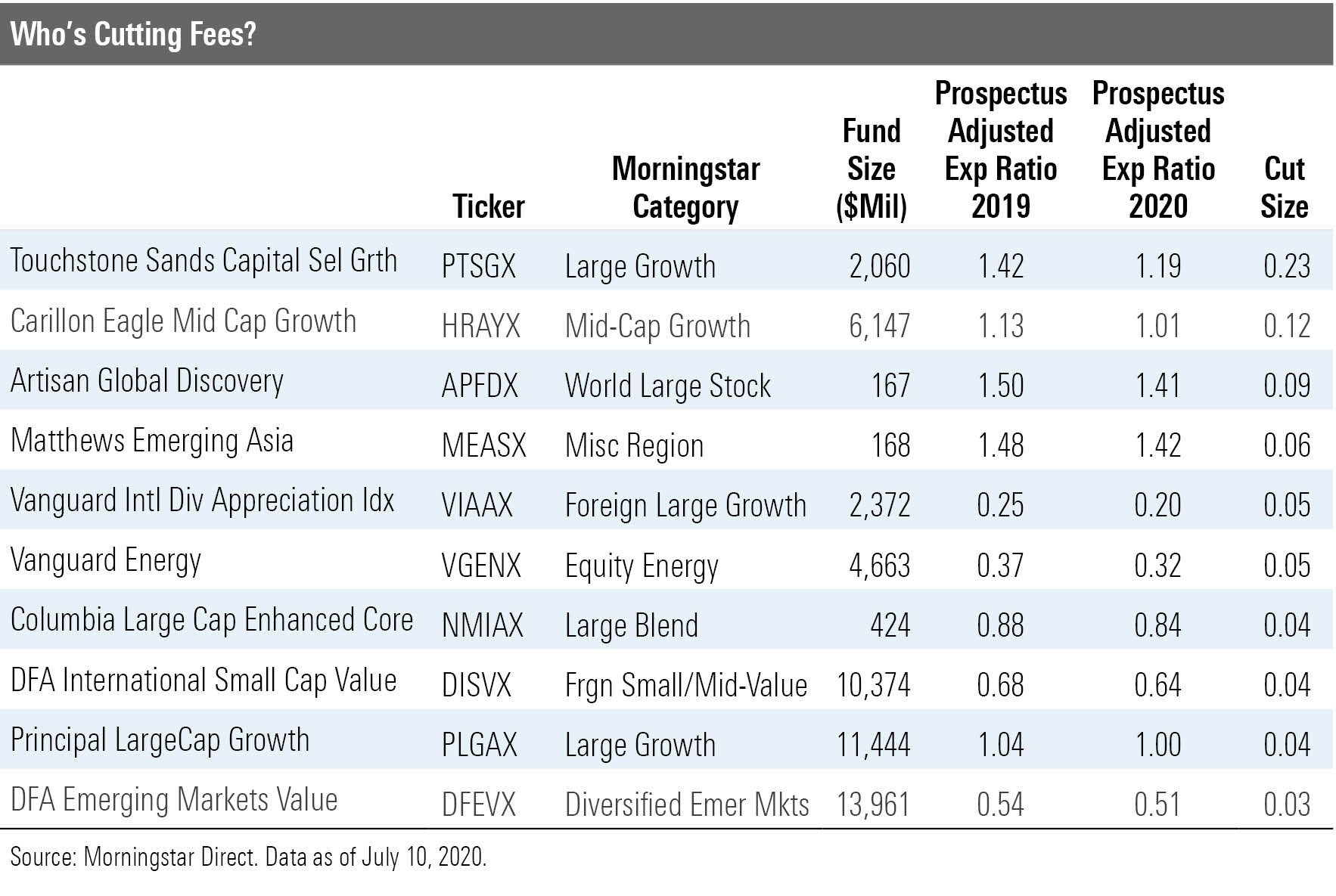

The 10 Biggest Fee Cuts of the Year

Some funds' fees are falling faster than others'.

Fund fees are coming down. Or at least they were prior to the bear market. As Morningstar's director of global ETF research Ben Johnson discussed recently, the average investor is paying a little less for fund management almost every year. (This year's steep decline in value stocks may cause some funds to post higher expense ratios for 2020 as funds fall through fee breakpoints.)

All this is important because fees are the best predictor or mutual fund success. I've found that every time I tested the thesis. Vanguard's founder, the late, great Jack Bogle, of course tested the importance of fees every which way and always found that "You get what you don't pay for."

I thought I would take a more granular route and look at what funds made the biggest fee cuts year on year. It serves the purpose of highlighting some funds that are now more attractive and also illustrates how these fee cuts are working on a fund level.

I found it interesting to see that many of the bigger cuts came at relatively small actively managed funds. It shows that fee pressure is now felt throughout the industry. It isn't just a competition among indexing giants. All fund companies are feeling pricing pressure. Active managers cut fees in order to pass more screens but also to improve their performance for investors who put past returns ahead of fees.

The expense ratio I look at here is the adjusted prospectus expense ratio, which you can find on each fund's quote page on Morningstar.com. Miriam Sjoblom and Jason Kephart have previously explained the case, but the short answer is that the adjusted figure strips out fees that the fund company does not collect, such as leverage and short interest, which can be volatile and make it difficult to make an apples-to-apples comparison.

Touchstone Sands Capital Select Growth PTSGX This fund's prospectus adjusted operating expense ratio was cut to 1.19% from 1.42%. That's a big step in the right direction, though the fund still charges more than the typical no-load large-cap fund. Still, it takes it into more reasonable territory.

Carillon Eagle Mid Cap Growth HRAYX This fund's success has led to a surge in assets, and that in turn has led to a reduction in the Y shares' fee to 1.01% from 1.13%. That's a good sign. A little more worrisome, though, is that lead manager Bert Boksen is starting to hand off duties as he nears retirement. No date has been set, but we have the People and Process Pillars rated Average and give the fund a Morningstar Analyst Rating of Neutral in part because of that pending hand-off.

Artisan Global Discovery APFDX This fund put in a fee waiver, bringing its expense ratio down to 1.41% from 1.50%. The fund has less than $200 million in assets and is just coming up on its three-year anniversary. We don't cover it, but it's on my radar because it is run by the same managers who run Artisan Small Cap ARTSX, among others. That fund is rated Silver, and this fund is off to a fine start. Admittedly, the new expense ratio is still not cheap, but it is at least a little more understandable for a small asset base.

Matthews Emerging Asia MEASX Matthews put in a fee cap that took this fund's adjusted prospectus expense ratio to 1.42% from 1.48%. The story is similar to Artisan's. This is a small, new fund where management doesn't want the fee to be too high. We rate the fund Bronze with Positive People and Process ratings. However, that was before the enhanced methodology, so we'll have to see how that works out when we next rate it.

Really, industry best practice is to start a fund off with competitive fees, even if that means eating some losses. Vanguard and Dodge & Cox are the best at starting funds off with cheap fees right away.

Vanguard International Dividend Appreciation Index VIAAX Vanguard cut this fund's fee 5 basis points to 0.20%. That's pretty cheap for a foreign equity index fund. That fee cut, plus the enhancement to our ratings methodology, led to an upgrade of its Analyst Rating to Silver from Bronze in June. The fund is about four years old and has the promise to make a solid core holding, similar to its U.S. version. That fund has had an appealing risk/reward profile as dividend appreciation screens lead to a high-quality portfolio with defensive characteristics. You don't get as high a yield as an equity-income fund, but screens for rising dividends, financial strength, and growth add up to greater return potential and better defense. Will it work that way for a foreign dividend-appreciation fund? We'll have to see.

Vanguard Energy VGENX Vanguard Energy's fee has come down to 0.32% from 0.37%. That would be cheap even for an index fund, and you get solid active management here for that price. We actually lowered the fund's rating to Bronze from Silver in February because of a management change at subadvisor Wellington Management. If you're such a value investor that the beaten-down energy portfolio and super cheap fees are enough to overcome the awful returns in energy, I tip my cap to you.

Columbia Large Cap Enhanced Core NMIAX This fund's fees came down 4 basis points to 0.84%. When you run an enhanced-index fund, you ought to be sensitive to index fees. This quantitative fund runs a bunch of models to pick stocks but within very tight constraints for sectors and tracking error. The goal is to outperform with a tracking error of just 100 to 200 basis points. Thus, if you are going to hug an index, you ought to price the fund so it has shot at outperformance. The fees are a good sign, but we rate the fund Neutral.

DFA International Small Cap Value DISVX Although just 4 basis points, this is probably the most significant cut I'm writing about today. DFA has long taken ground somewhere between index funds and active funds. The firm runs value-tilting strategies that are largely passive in nature and holds hundreds or thousands of names that fit value and earnings tests. They aren't index funds because they don't track an index and give managers flexibility to make trades when bid-ask spreads are attractive.

Because DFA funds are positioned in the middle ground, they are priced between active and passive. But the firm has chosen to sit out all the fee-cutting going on, arguing that its process is superior and its funds don't need fee cuts to compete. Finally, DFA has relented with cuts across the board. A welcome move for funds that were falling further behind the passive competition. As it happens, DFA is in a tough spot because it generally tilts smaller and more value than the broad market, and that's been a brutal spot this year.

We rate this fund Silver.

Principal LargeCap Growth PLGAX Tremendous asset growth has allowed this $11 billion fund to pass along some economies of scale in the form of a 4-basis-point fee reduction. The fund has enjoyed strong performance under subadvisors T. Rowe Price and Brown Advisory. We rate it Bronze because we are impressed with management and the process. Now that the fund's expense ratio is down to 1.00%, it's better priced but not really a bargain given its large asset base.

DFA Emerging Markets Value DFEVX Although this Bronze-rated fund is in outflows, it is another beneficiary of DFA's fee cuts. At its new price of 0.51%, it is one of the cheaper emerging-markets funds.

Conclusion Fund fees change slowly, so it would be easy to miss the changes, but they can have a big impact on long-term returns. Over time, those differences compound in your favor when you pick low-cost funds.

Correction: An earlier version of this mistakenly included two FPA funds. FPA Crescent's FPACX fee actually declined just 2 basis points, and FPA International Value's FPIVX was flat at 1.29%. We have removed them from the text and table. We regret the error.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)