Sustainable Stock Funds Held Their Own in Second-Quarter Rally

They have significantly outperformed for the year to date.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

After showing greater resilience than conventional funds when stocks plummeted in the first quarter, sustainable equity funds available to U.S. investors more than held their own during the second-quarter rebound.

Most sustainable funds finished in the top halves of their Morningstar Categories for the quarter, and 18 of 26 ESG-focused index funds outperformed conventional index funds that cover the same parts of the market.

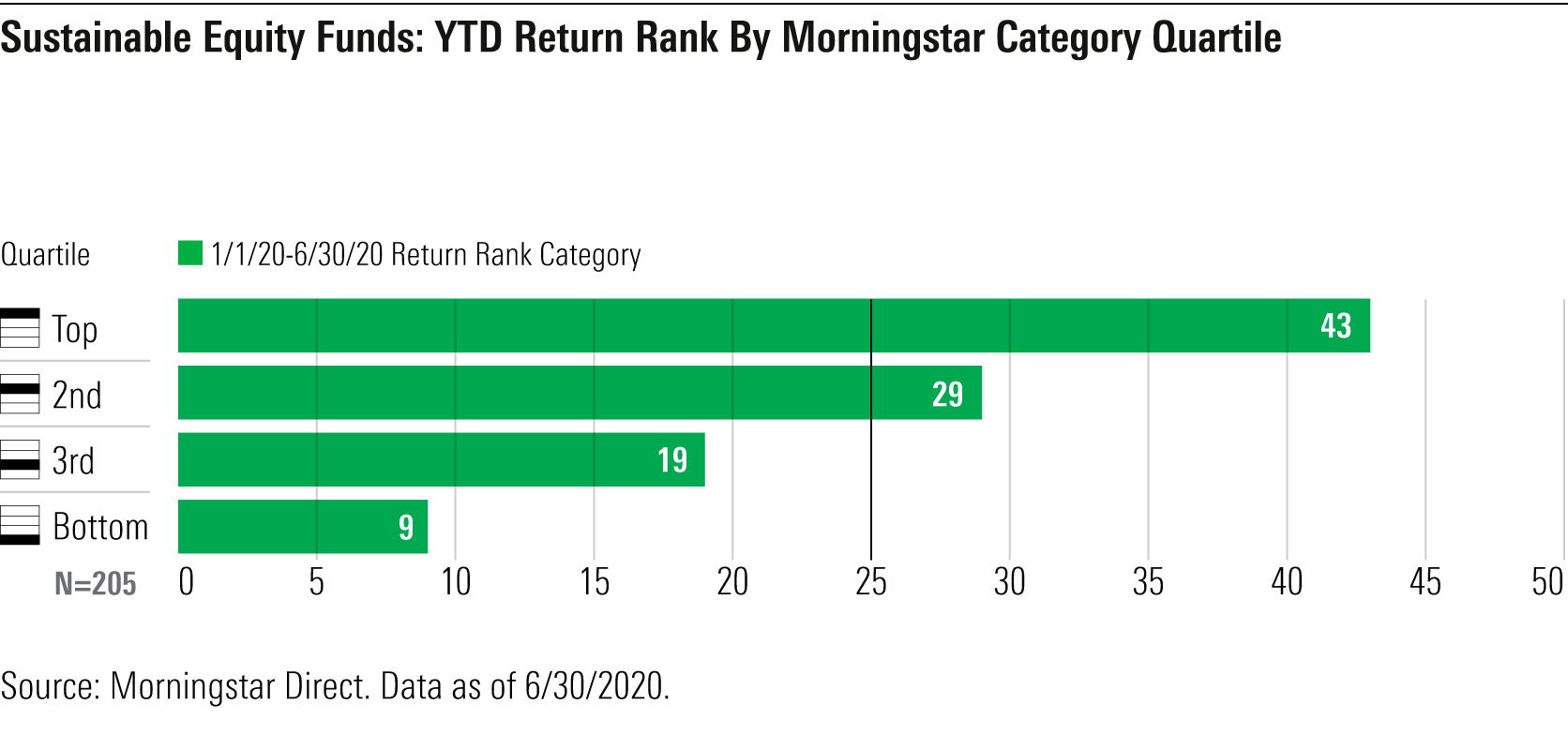

For the year to date, an impressive 72% of sustainable equity funds rank in the top halves of their Morningstar Categories and all 26 ESG (environmental, social, and governance) index funds have outperformed their conventional index-fund counterparts.

Sustainable Funds Outranked Their Conventional Peers in Second Quarter After clearly outperforming their peers on a relative basis in the first-quarter downturn, the opposite might have been expected in the second, as stocks posted their best quarter since 1998. This expectation was bolstered by sustainable funds' tendency to underweight energy, or to avoid the sector altogether, which helped first-quarter returns to some degree because energy stocks were among the worst performers. But with energy the top-performing U.S. sector in the second quarter, sustainable funds faced headwinds in their effort to outperform their peers. Moreover, stocks with attractive ESG profiles that proved more resilient in the first quarter might have been expected to generate more modest returns in the rally than stocks that had experienced greater first-quarter losses.

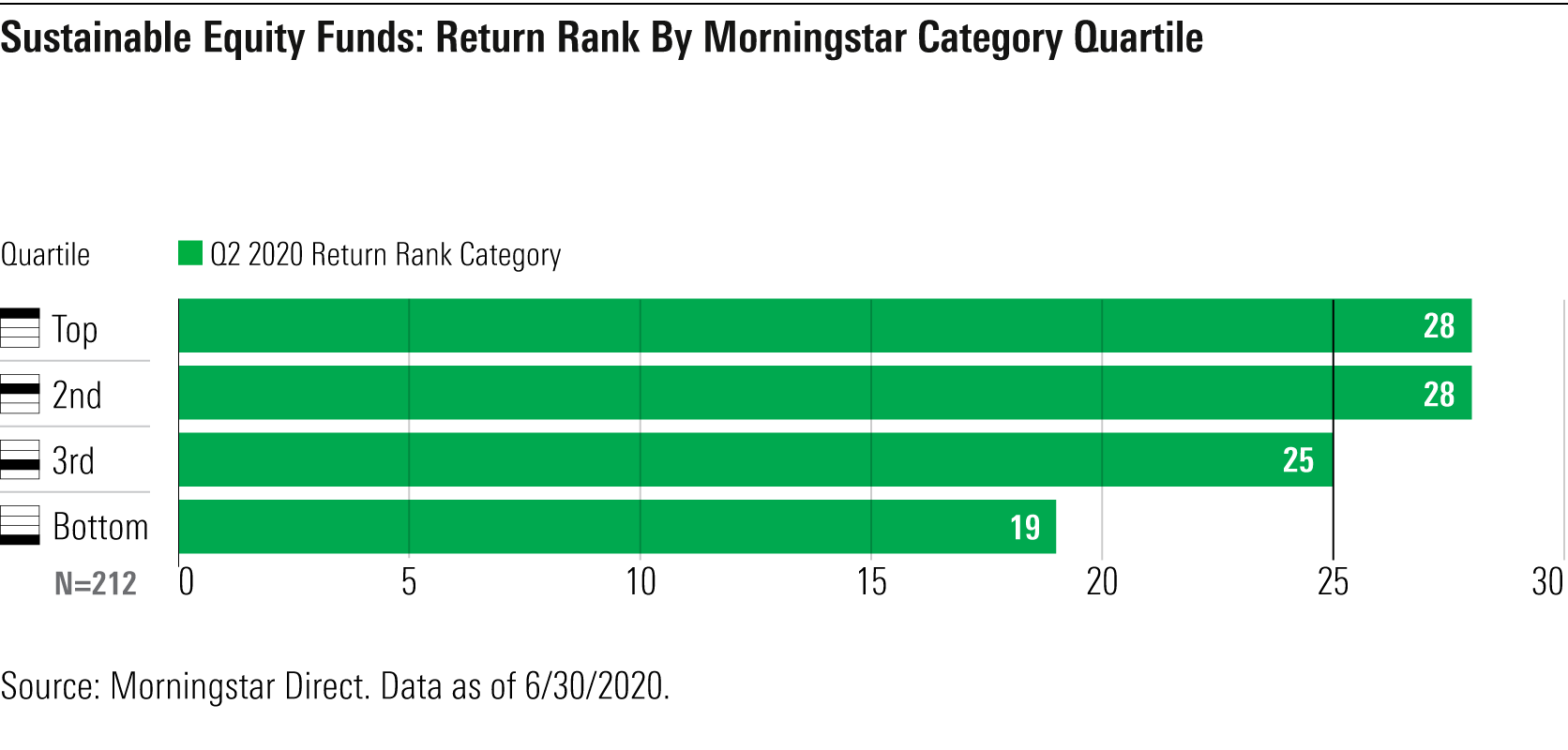

Nevertheless, 56% of sustainable equity funds managed to rank in their category’s top half for the second quarter. Breaking it down by quartiles, 28% ranked in the top quartile of their categories while only 19% finished in the bottom quartile. Thus, sustainable equity funds were once again overrepresented in the top quartiles and top halves of their categories (in which, by definition, 25% of all funds place in each of four quartiles).

While the distribution of sustainable funds by quartiles is clearly not as skewed toward the top as it was in the first quarter, the second quarter was a solid one for sustainable funds, contributing to what is shaping up to be a very good year for them relative to peers.

Keep in mind that sustainable equity funds are distributed across a variety of Morningstar Categories, based on their regional, market-cap, and stylistic emphases. Not all sustainable funds are alike in those respects. The 212 such funds (open-end and exchange-traded) available in the United States are found in 26 Morningstar Categories.

For the year to date, 72% of sustainable equity funds rank in the top halves of their categories. And the ratio of top-to-bottom quartile ranks is 43% to 9%.

Most Sustainable Index Funds Beat Conventional Index Funds Index funds can provide useful marketwide comparisons between sustainable and conventional strategies. While passive sustainable funds are not all structured the same way nor do they follow the same indexes, they generally provide broadly diversified exposure to areas of the market comparable to those of conventional market-cap-weighted index funds. The difference is that the sustainable indexes use company ESG ratings and screens to determine which stocks make it into the index and their weightings.

In the second quarter, 18 of 26 sustainable index funds covering U.S. stocks, non-U.S. developed-markets stocks, and emerging-markets stocks outperformed a comparable conventional index fund, net of fees. While fees for most sustainable index funds have come down and are low compared with actively managed funds, they tend not to be quite as low as the rock-bottom fees charged by conventional market-cap-weighted index funds. This year, sustainable index funds have more than made up for that with their strong performance.

For the year to date, every one of the 26 sustainable index funds is outperforming its respective conventional index-fund peer, net of fees.

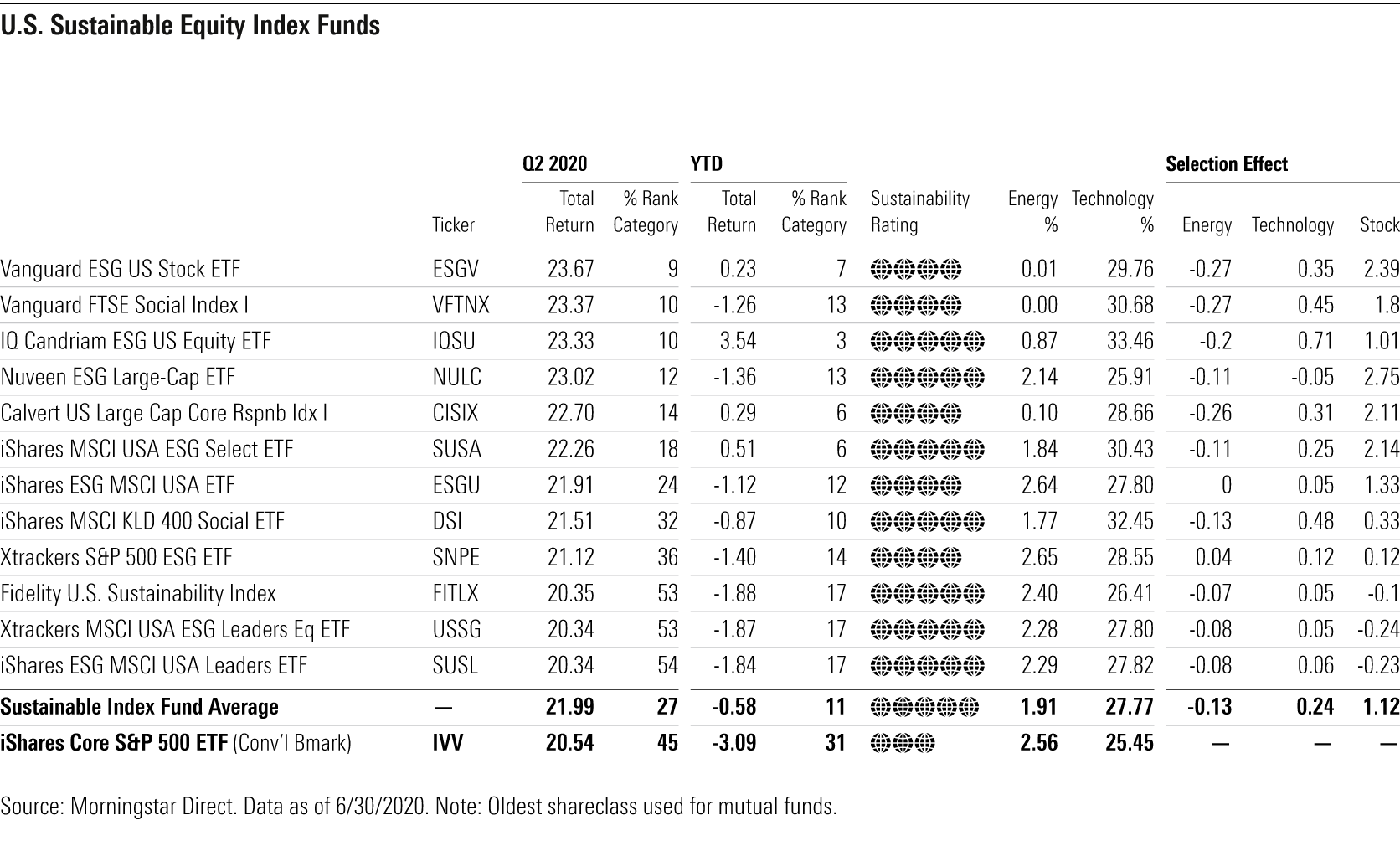

U.S.: Among U.S. stock index funds, nine of the 12 sustainable funds found in the large-blend category outperformed the iShares Core S&P 500 ETF IVV for the quarter. While IVV gained 20.54%, the average ESG passive fund's return was 21.99%.

The top-performing U.S. sustainable index funds for the quarter were Vanguard ESG US Stock ETF ESGV, based on the FTSE US All Cap Choice Index; Vanguard FTSE Social Index I VFTNX, based on the FTSE4Good US Select Index; and IQ Candriam ESG U.S. Equity ETF IQSU, based on a proprietary index developed for IndexIQ by European sustainable asset manager Candriam.

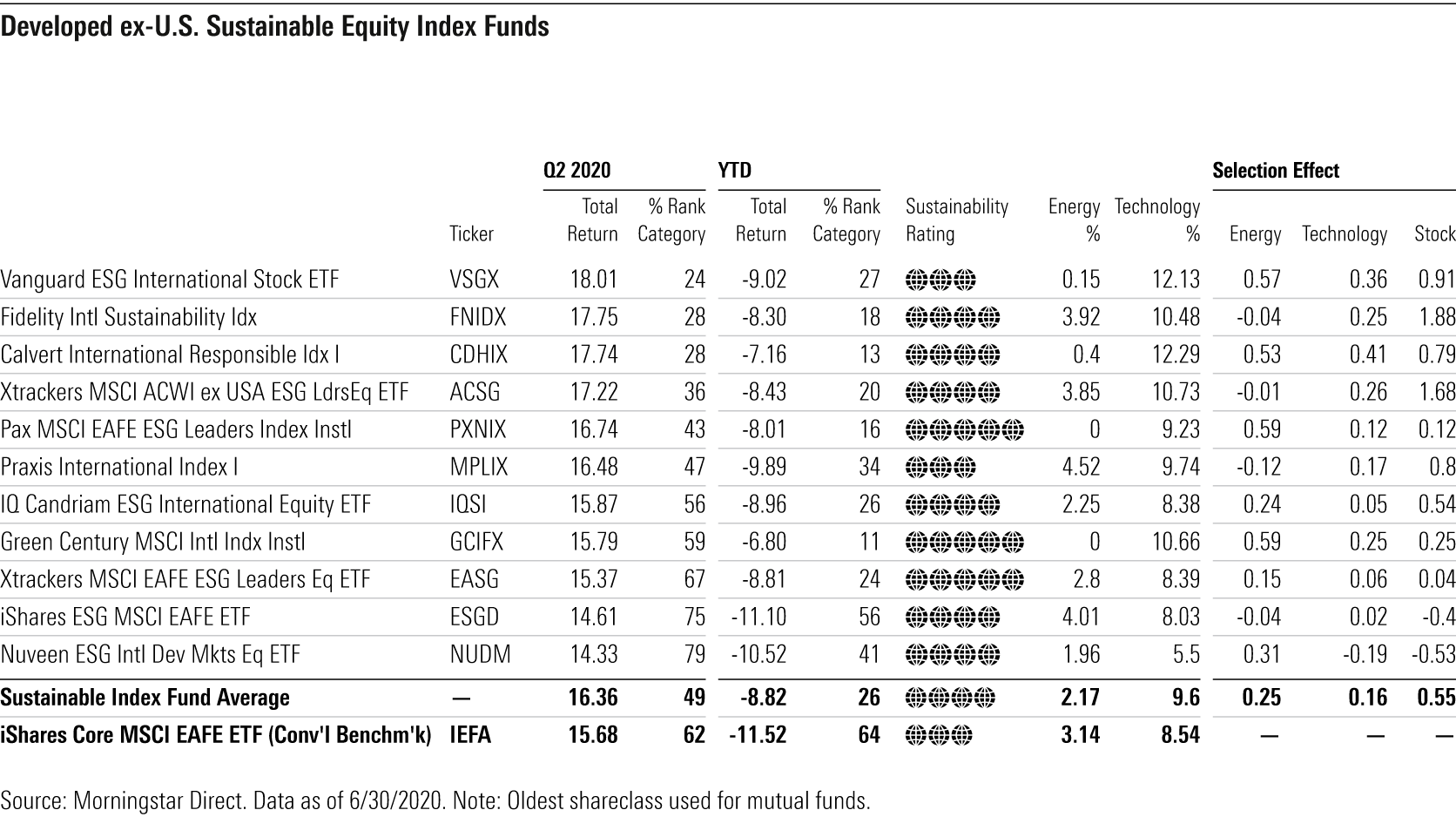

Non-U.S. Developed Markets: Among sustainable index funds found in the foreign large-blend category, eight of 11 outperformed iShares Core MSCI EAFE ETF IEFA for the quarter. The average ESG index fund return was 16.36% while IEFA gained 15.68%.

The top-performing foreign large-blend ESG index funds for the quarter were Vanguard ESG International Stock ETF VSGX, based on the FTSE Global All Cap ex US Choice index; Fidelity International Sustainability Index FNIDX, based on the MSCI ACWI ex USA ESG Leaders Index; and Calvert International Responsible Index CDHIX, based on Calvert's own proprietary index.

Emerging Markets: Xtrackers MSCI EMs ESG Leaders Equity ETF EMSG outperformed iShares Core MSCI Emerging Markets ETF IEMG for the quarter. Based on the MSCI Emerging Markets ESG Leaders Index, the Xtrackers ETF posted a 19.83% return, besting IEMG by 0.93%. Nuveen ESG Emerging Markets Equity ETF NUEM lagged IEMG by just 1 basis point, while iShares ESG MSCI EM ETF ESGE lagged by 0.85%. The latter two ETFs are based on different MSCI ESG indexes.

ESG Stock Selection Once Again Key to Strong Performance Sustainable funds, on average, were helped in the first quarter by having less exposure to energy stocks than market indexes and more exposure to technology stocks, but their greatest advantage resulted from ESG stock selection. While energy underweights proved to be a hindrance in the second quarter, and technology overweights were a positive, overall ESG stock selection was, once again, positive, with much bigger attribution effects than either sector. (See the last three columns of Exhibits 1-3.)

For the second quarter, sustainable index fund underweights, on average, cost U.S. funds 0.13% and emerging-markets funds 0.08% relative to their comparison indexes (S&P 500 and MSCI Emerging Markets), but developed-markets ex US funds benefited from their underweights by 0.25%, on average, because Royal Dutch Shell RDS.A and Total TOT, which dominate the energy holdings in the MSCI EAFE Index, both underperformed.

Sustainable index funds’ average overweights to technology added 0.24% to U.S. funds relative to the S&P 500, 0.16% to developed-markets ex U.S. funds relative to the MSCI EAFE Index, and were a wash in emerging markets.

By comparison, ESG stock selection had a much bigger positive impact across all three areas. Among the sustainable index funds considered here, all but two have Morningstar Sustainability Ratings of 4 or 5 globes, indicating they hold companies with stronger ESG profiles and lower ESG risk.

First-quarter attribution analysis demonstrated that the average overall stock-selection effect for sustainable index funds was not only positive but also larger than the energy or tech sector-selection effects for U.S. and non-U.S. funds.

For the second quarter, attribution analysis shows that stock selection was once again strongly positive. For U.S. sustainable index funds, stock selection added 1.12% to returns relative to the S&P 500. For developed-markets ex U.S. funds, stock selection added 0.55% to returns relative to the MSCI EAFE Index, and for emerging-markets funds, stock selection added 0.91% to returns relative to the MSCI Emerging Markets Index.

ESG Insights Lead to Long-Term Stakeholder-Centric Focus The better relative performance of sustainable funds so far this year derives mainly from their focus on companies that have stronger ESG profiles and face lower levels of ESG risk. It helps make the case that investing with an eye toward how a company addresses material ESG risks and more broadly, how it manages all its stakeholders, can produce better returns than those of conventional funds, especially during periods of market and economic turmoil.

This, of course, doesn’t mean that sustainable funds are going to outperform every quarter, but I think they are onto something important. And that’s the idea that basing investment decisions only on the financial health of a business no longer captures the essence of the 21st-century corporation, if it ever did. Investors that use ESG insights are able to construct a more holistic view of a company. This helps them understand how sustainable its long-term business model is, how it treats its stakeholders, and gives them an early warning on environmental and social risks before they affect company value.

For companies, the growth of sustainable investing encourages a move away from short-term decision-making designed to maximize profits for shareholders toward a more long-term-focused stakeholder-centric approach that adds value in a sustainable way over time. That’s a better outcome for stakeholders--including shareholders--society and the planet.

Companies that are already moving in that direction are helping get us through this terrible coronavirus pandemic and, in the aftermath, the demand seems sure to grow for others to follow.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)