Quarter-End Markets Summary: 6 Charts and Tables on the Q2 Rebound in Risk

What to make of the April to June period.

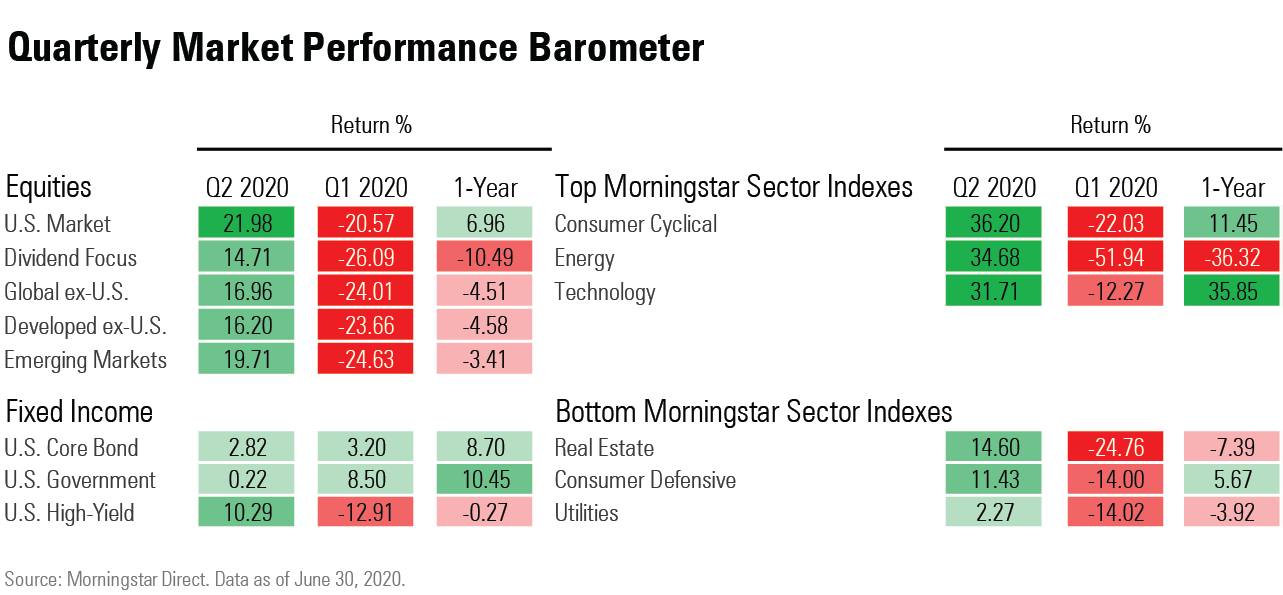

The stock market pendulum swung back strongly in the second quarter of 2020 on hopes that the economic downturn caused by the coronavirus epidemic will be relatively brief with the help of central bank efforts.

But as is often the case, gravity--in the form of a recognition that the epidemic will be wreaking health and economic harm for months to come--trimmed back some of the equity markets' gains by quarter-end.

In the bond market, the riskiest corners also rallied after a tumultuous first quarter, fueled by the Federal Reserve's aggressive efforts to support the U.S. economy, which included purchases of corporate bonds and high-yield exchange-traded funds. Rate-sensitive government bonds were flat as investors turned away from safe havens, but the economic outlook remained weak.

Battered energy stocks saw some relief during the second quarter, as oil prices recovered from a slide where they tumbled to negative territory on supply and storage imbalances.

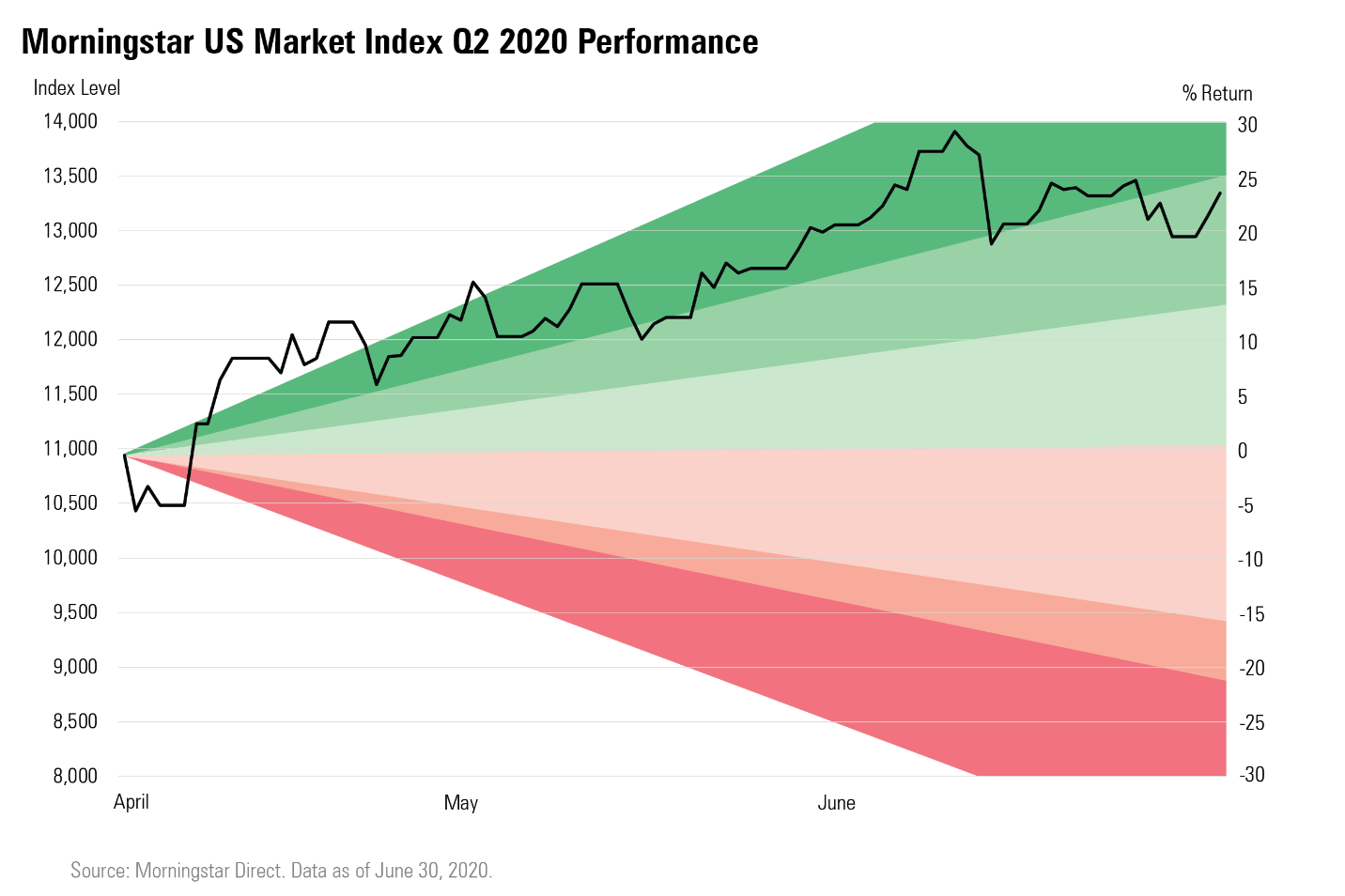

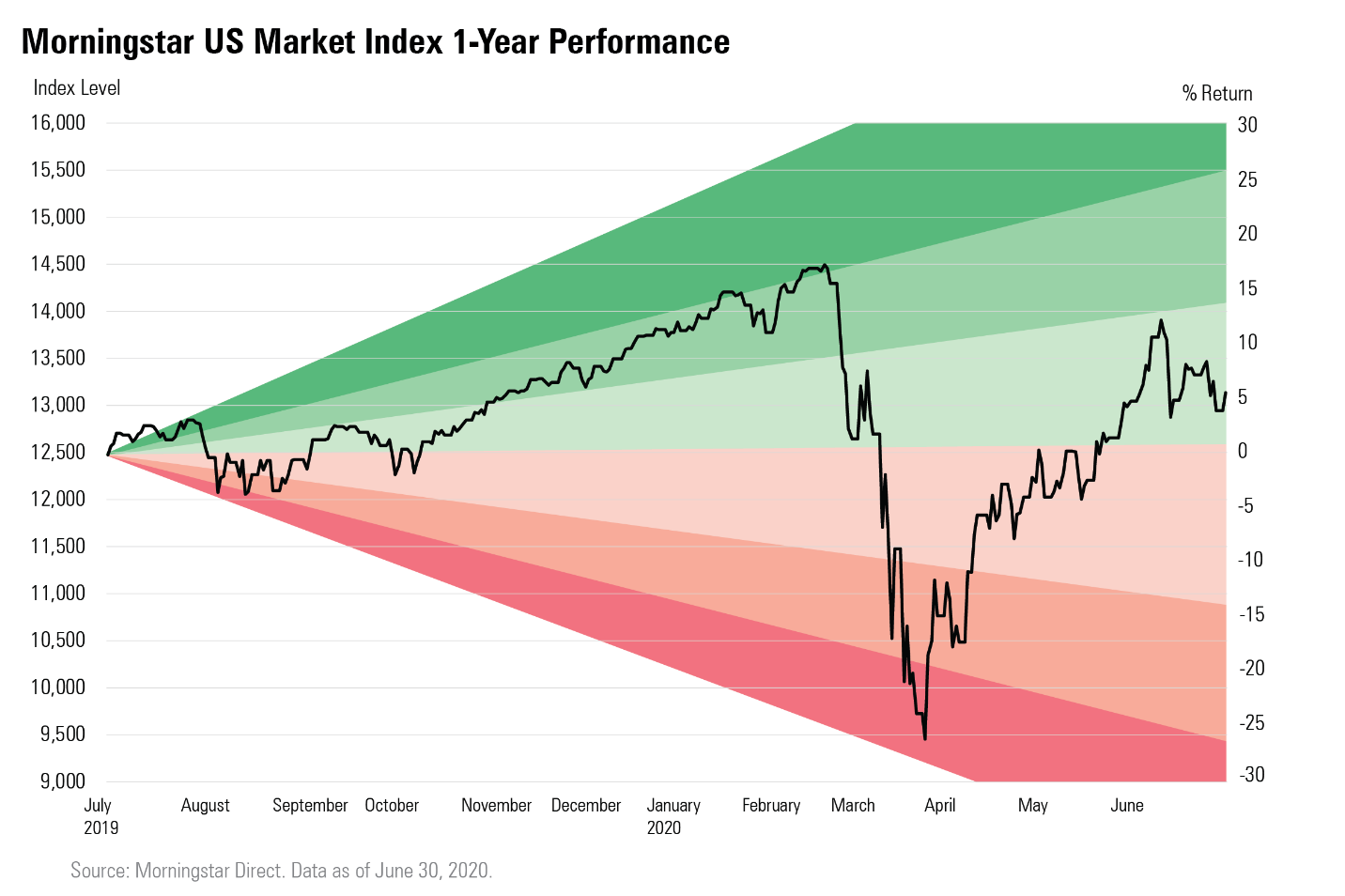

More broadly, the second quarter began where the first quarter left off, with equity markets extending their climb out of the hole dug by the coronavirus-driven economic collapse. Encouraged by central bank actions to support economies, as well as evidence at the time that progress was being made in the fight against COVID-19, stocks jumped higher in April before plateauing. Equities added to their gains in June, even as the spread of COVID-19 extended in the United States.

Even with the second-quarter rebound, the broad stock market is still well below its early 2020 highs. Still, equities are not far from year-ago levels, even with the damage done to the economy by COVID-19.

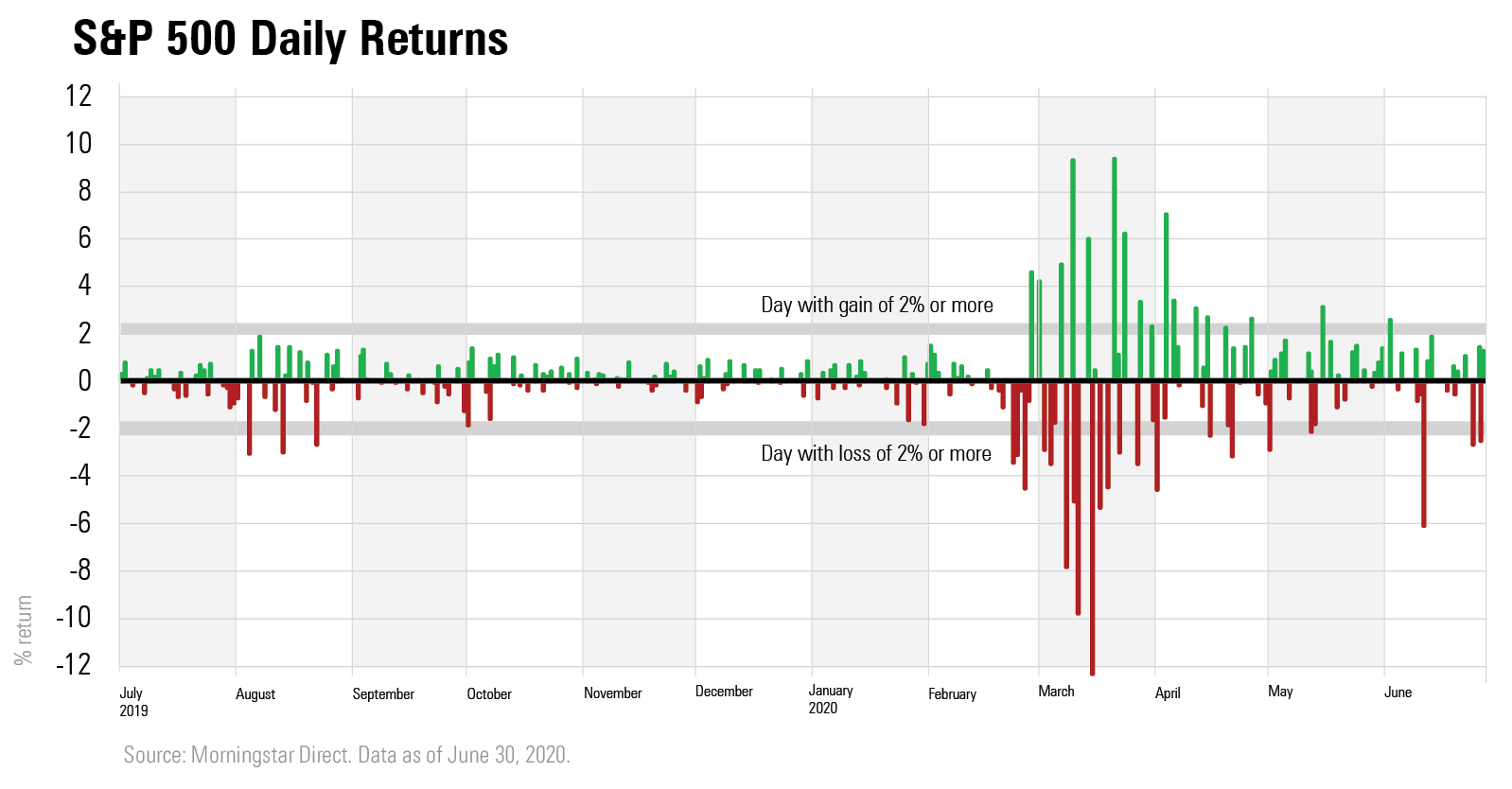

The S&P 500 posted its best quarter since 1998 with a 20.5% gain. Along the way, volatility retreated somewhat from first-quarter extremes. However, as shown in the following chart, the S&P 500 continued to post outsize daily swings at a much more frequent rate than is usually the case.

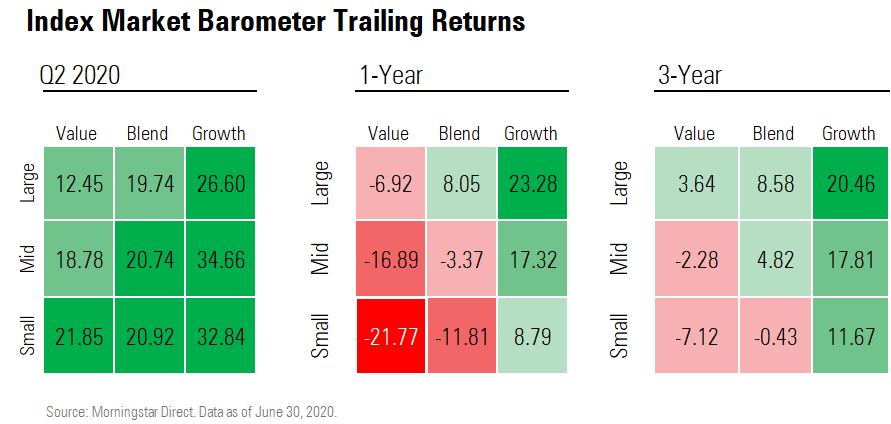

For a change, the second quarter wasn't all bad news for value stocks. The group has lagged significantly behind growth stocks in recent years, and this was once again the case for the most recent three-month period. Across all three market-capitalization segments, growth was in the lead. However, small-value stocks did manage to top small-blend stocks, and mid-value stocks were just a shade behind mid-blend. But large-value stocks were left in the dust.

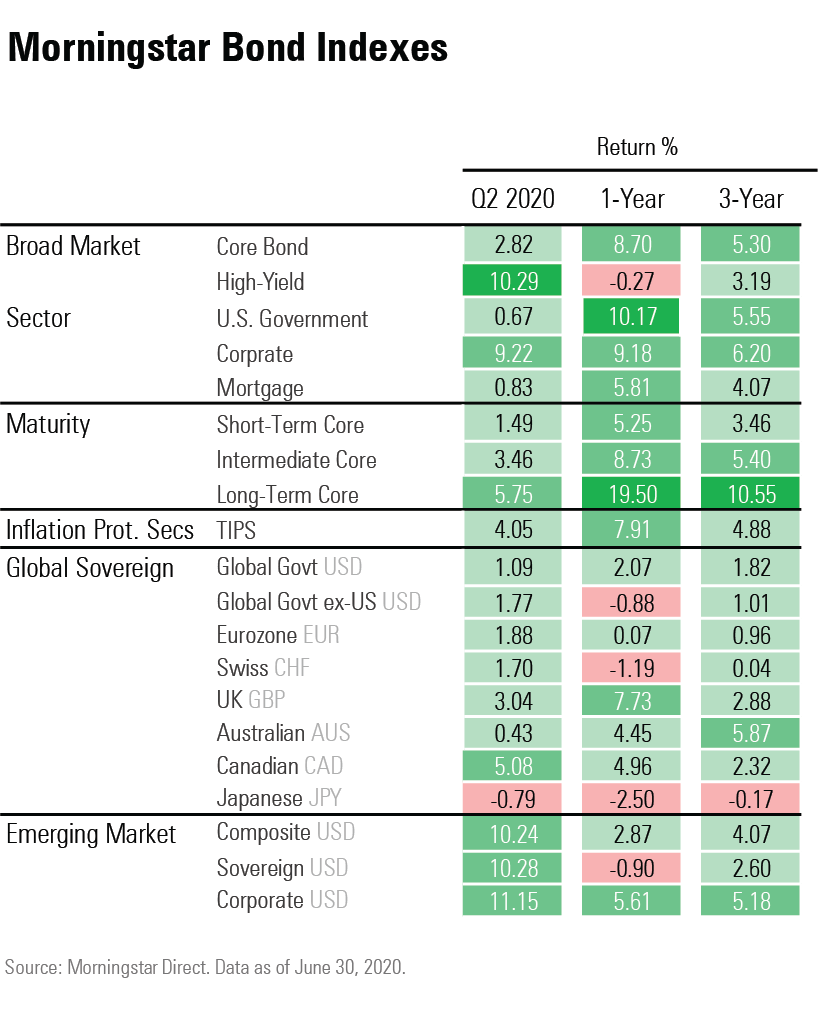

In the bond markets, the second quarter was a mirror image of the flight-to-quality trend that dominated the first quarter. During the April-June period, riskier corners of the bond market fared the best, led by high-yield bonds and emerging-markets debt.

Magnifying interest in corporate bonds was the Fed's new securities-buying program, where the central bank began purchasing high-yield bond ETFs and individual investment-grade corporate debt. That, plus the Fed's commitment to easy money and warnings about the outlook for the economy, helped keep a floor under interest-rate-sensitive portions of the bond market.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)