We're Forecasting a Strong Long-Run Economic Recovery

We don't think the market's engaging in irrational exuberance.

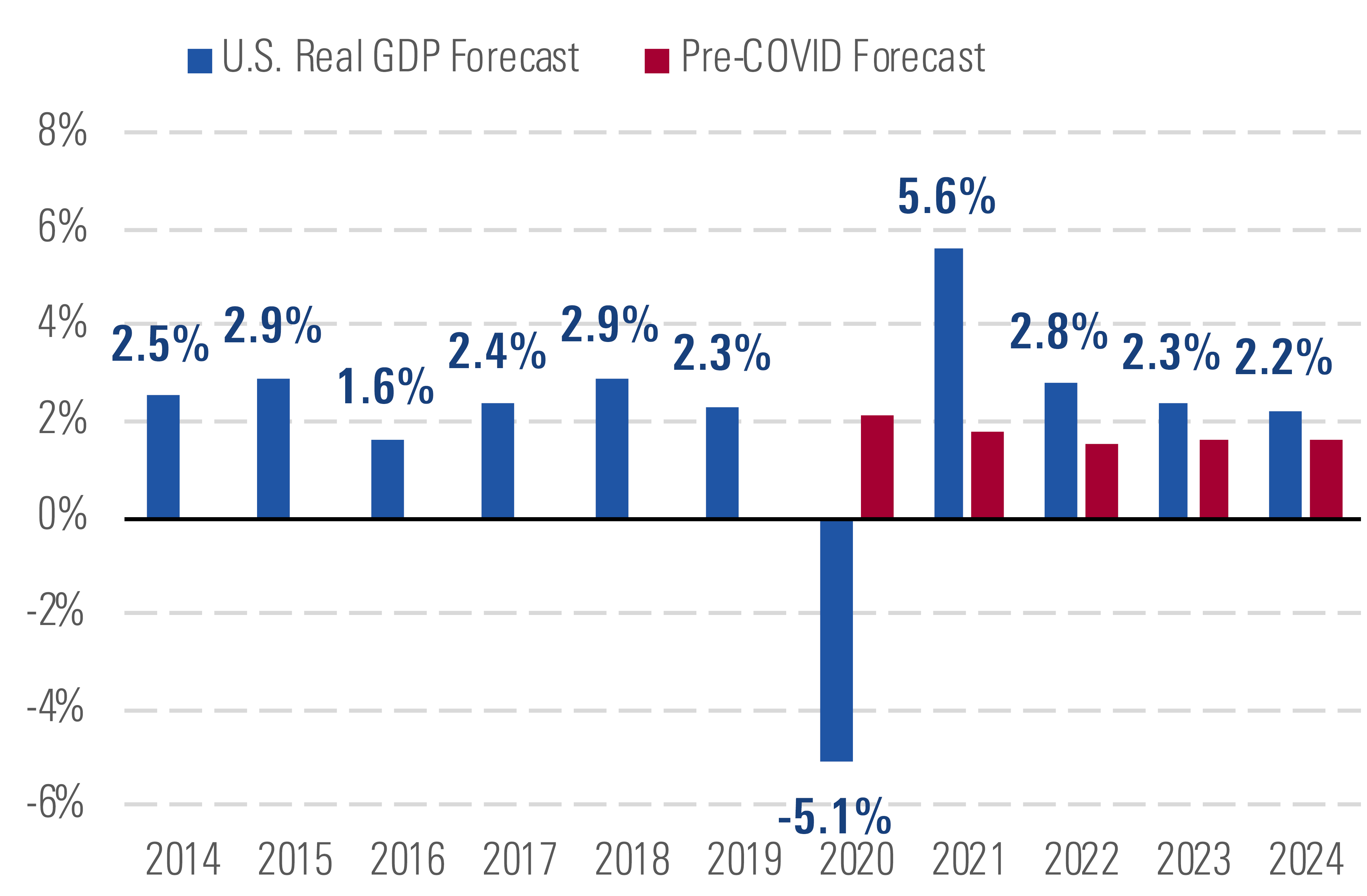

The Morningstar US Market Index has come thundering back since its late March nadir and is now down merely 7% year to date, even as the coronavirus pandemic persists. While many investors are wondering if the market is exhibiting irrational exuberance, we think the rebound has been broadly warranted, as we forecast a strong long-run recovery in the U.S. economy. We expect U.S. GDP to drop 5.1% in 2020 but surge back in 2021 and experience further catch-up growth in following years. By 2024, we think U.S. GDP will recover to just 1% below our expectations before the pandemic.

U.S. GDP will fall sharply in 2020, but we expect rapid catch-up afterward. - source: Morningstar

Though we agree with consensus forecasts that second-quarter U.S. GDP will be brutal, we're expecting a much quicker recovery. Even while social distancing weighs heavily on some industries, we think the rest of the economy can recover substantially in the second half of 2020. Retail sales, employment, and other data show that this recovery has already begun for the U.S. We expect broad availability of a vaccine to erase the coronavirus' direct impact on the U.S. and global economies by mid-2021.

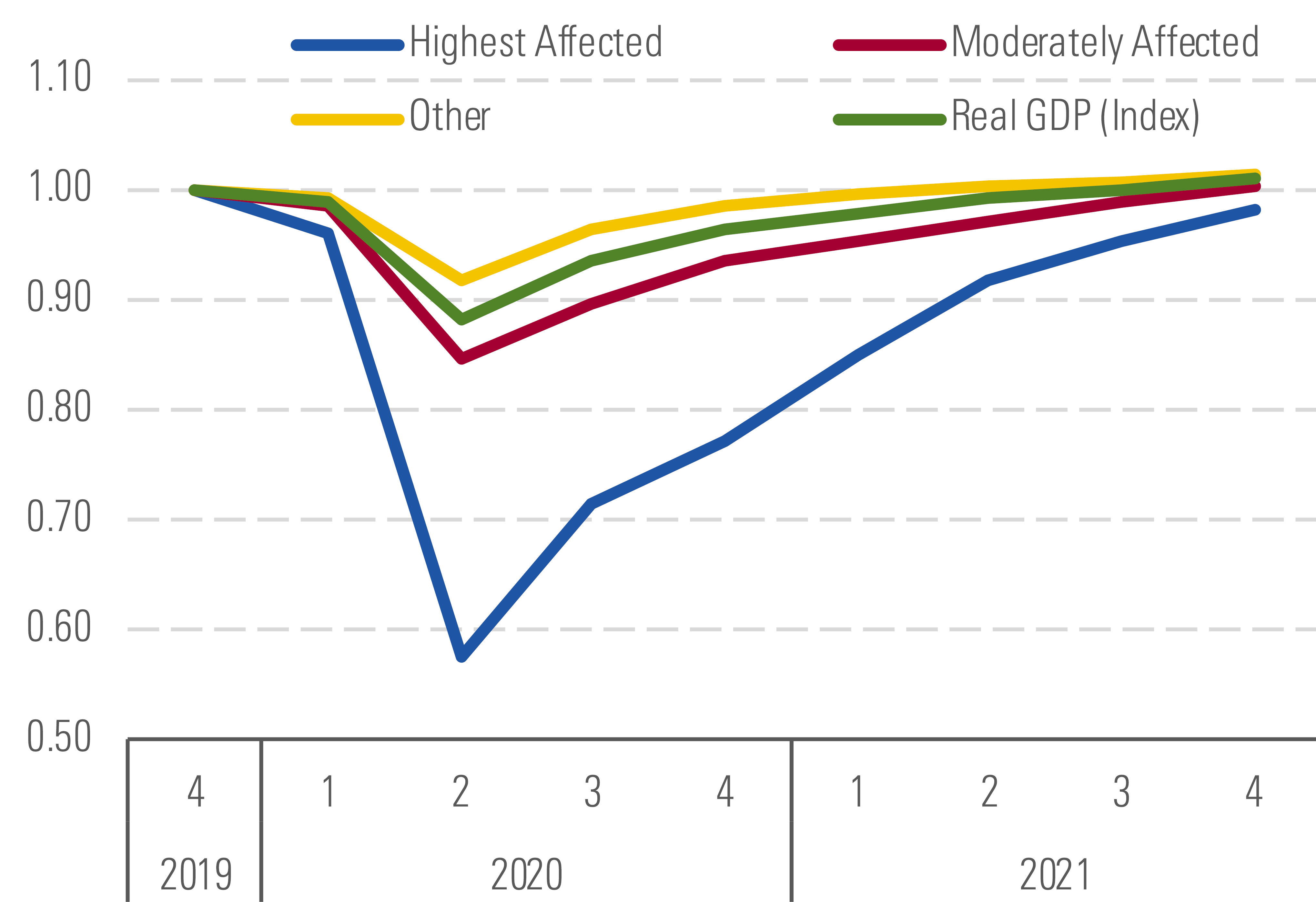

GDP can bounce back substantially, even while some industries lag. - source: Morningstar

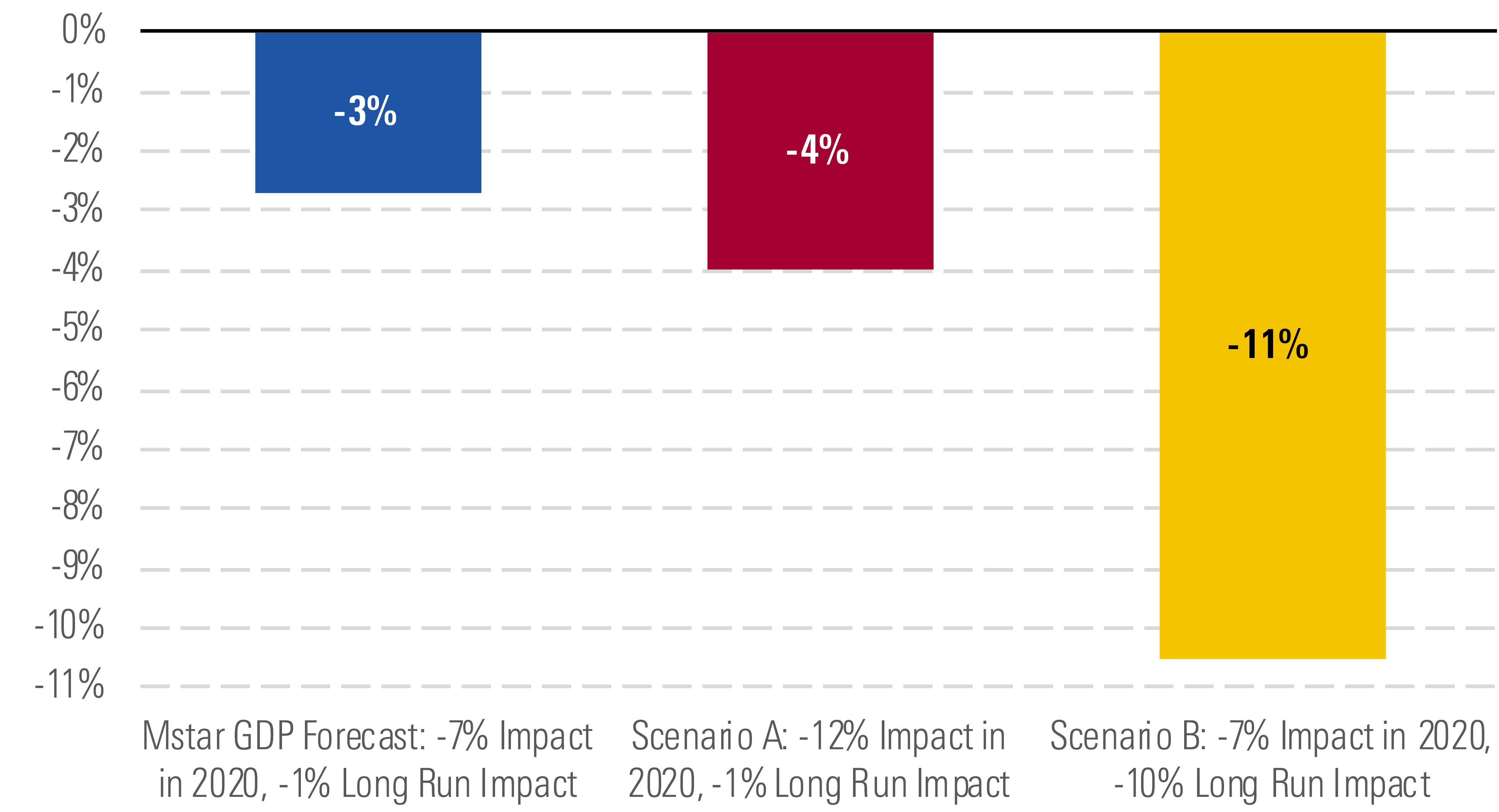

The most important question for investors is what the long-run impact of the pandemic will be on the economy. Our analysis shows the typical stock valuation is drastically more sensitive to the long-run impact on GDP than the short-run impact. We've examined the history of global recessions for clues on the coronavirus recession's impact on long-run economic growth and found that many recessions don't have a long-run impact on the economy. The worst recessions in terms of long-run impact (the Great Depression or the Great Recession) are generally the product of persistent economic policy error.

Long-run GDP impact is the most important question for investors. - source: Morningstar

We've distilled what we learned on what causes recessions to go wrong into a long-run impact scorecard, where we rate the coronavirus' recession. Most important, policy response has been extremely impressive, especially the United States' historically large fiscal stimulus. Likewise, we think risks of a financial crisis are small currently, as central bankers are unconstrained by the moral hazard quandary. Underlying structural issues going into this recession pale compared with the economic distortions before the Great Recession. We forecast a long-run impact on U.S. and global GDP of just negative 1%.

Earlier recessions suggest only a mild long-run hit from the coronavirus. - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)