After a Sharp 2Q Rebound, Fewer Bargains in Stocks

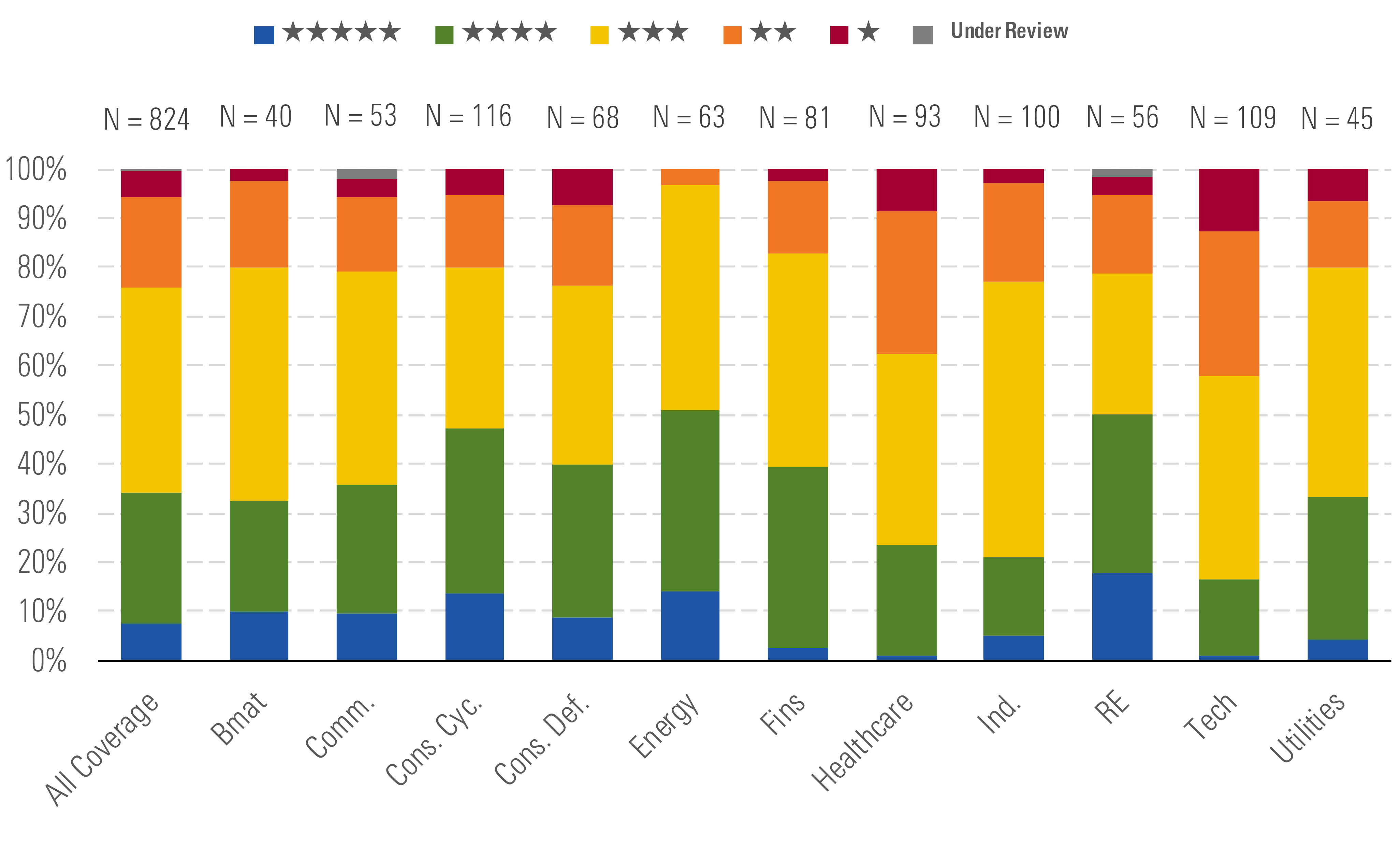

A third of our North American coverage is undervalued compared with two thirds last quarter.

The stock market's swift recovery has us seeing much less value in the North American equity market—although pockets of opportunity remain. As concerns about the coronavirus pandemic began to dissipate and economies reopened, the Morningstar US Market Index surged almost 25% from the end of the first quarter.

The median stock in our North American equity coverage now trades at only a 5% discount to our fair value estimate compared with a 22% discount near the end of March. Of the roughly 800 North American stocks we cover, 34% carry an undervalued rating of 4 or 5 stars. Three months ago, a hefty two thirds of our coverage was undervalued.

Of the 11 sectors we cover, the median stock trades at a more than 10% discount in only three compared with 10 last quarter.

- Tech and healthcare are starting to look expensive. The median stock in each sector trades at a more than 5% premium to our estimate of intrinsic value.

- Plenty of opportunities remain in energy and consumer cyclical stocks. Oil prices are well below our long-term estimate, and in consumer cyclical, nearly 80% of travel and leisure stocks are cheap.

- Three months ago, we had 224 stocks rated 5 stars in our North American coverage. As of June 23, that number had shrunk to 61.

One Third of Our North American Coverage Is Undervalued - Source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)