Battered TV and Advertising Industries Undervalued

Rebound has been uneven in the sector.

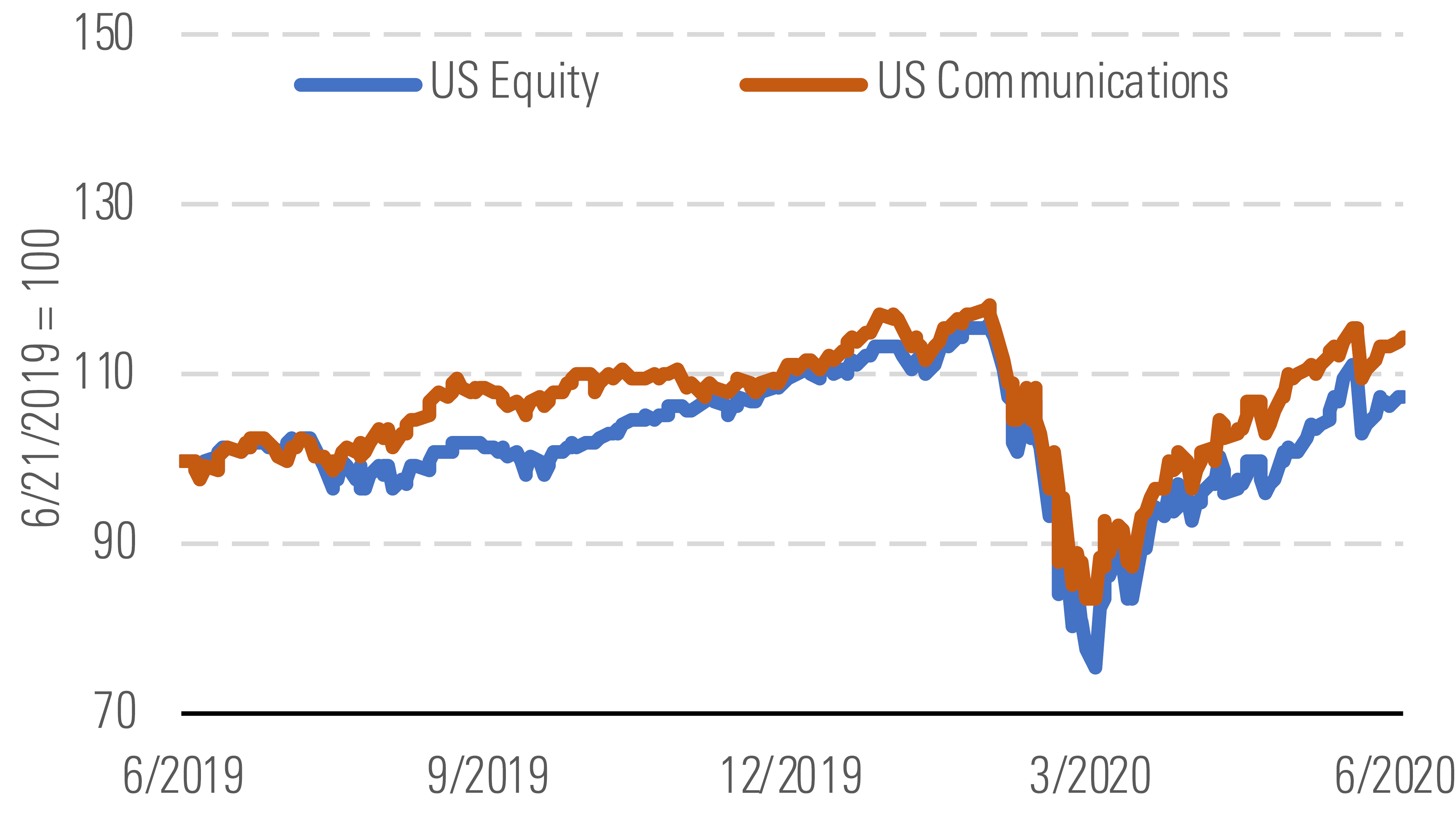

The Morningstar US Communication Services Index has bounced back nicely along with the broader market, gaining 25% since the end of March versus a 23% gain for the Morningstar US Market Index. Facebook, which accounts for about 18% of the sector index, has been the star performer, gaining about 43% over this period and shooting to a 10% premium to our fair value estimate. Traditional telecom stocks, less affected during the market sell-off, have underperformed. AT&T and Verizon, which account for a combined 15% of the index, have gained only about 4% each. Of the two telecom giants, AT&T is more attractive, trading at an 18% discount to our fair value estimate and providing a 7% dividend yield that we believe is sustainable. AT&T has made numerous strategic missteps over the past few years, but we expect it will adhere to a more prudent path under new CEO John Stankey.

The sector has followed the market thanks to winners like Facebook. - source: Morningstar

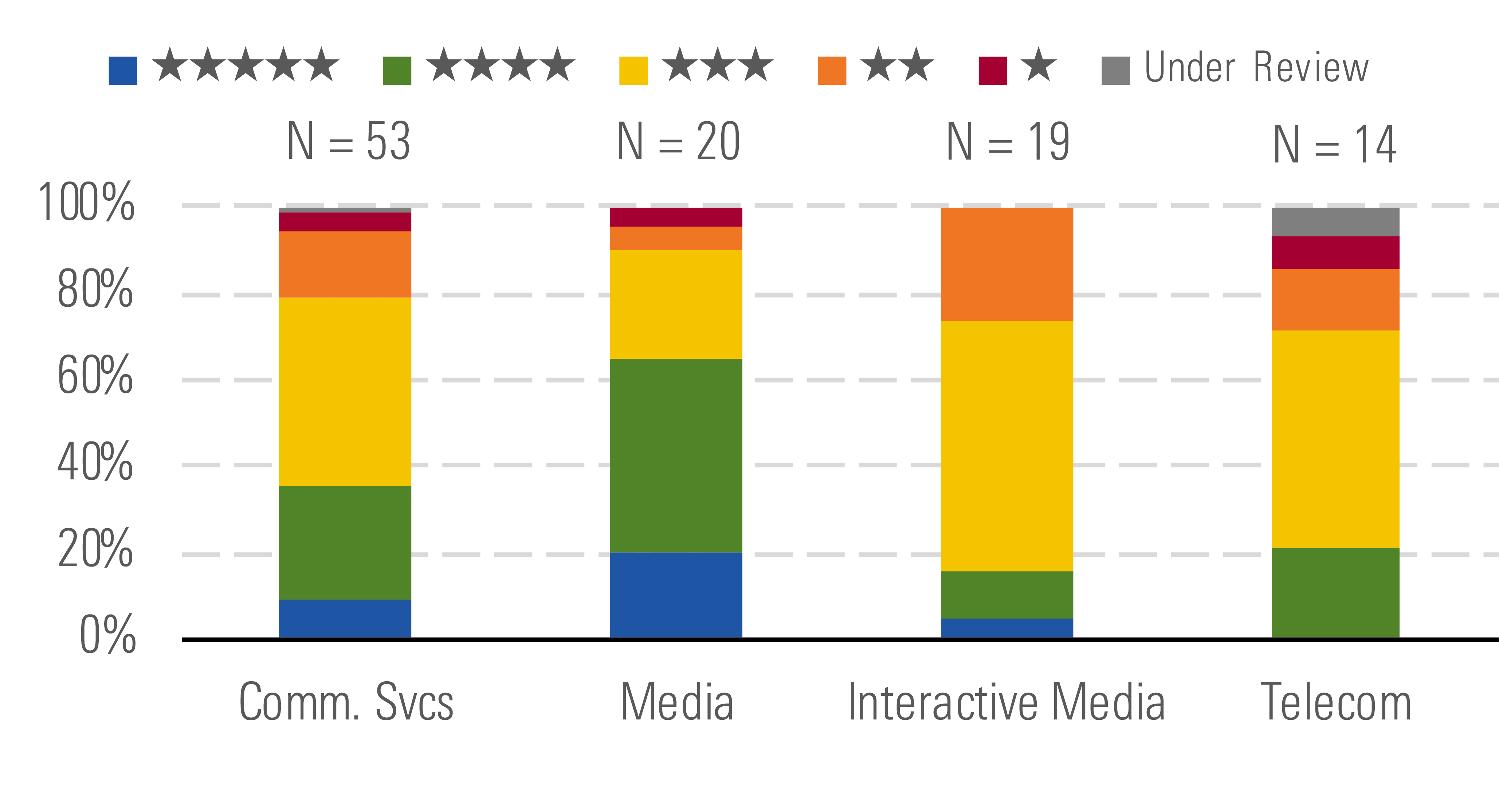

Traditional media looks best, especially television-focused firms. - source: Morningstar

The biggest discrepancy between our outlook and the market sits in the traditional media segment. Smaller firms focused on the traditional television market have rebounded somewhat over the past three months but remain far below our fair value estimates in many cases. ViacomCBS, for example, has gained nearly 70% during the current quarter but remains down about 45% year to date and still sits at less than half our fair value estimate. Stocks like AMC Networks, Fox, and Discovery are in similar positions.

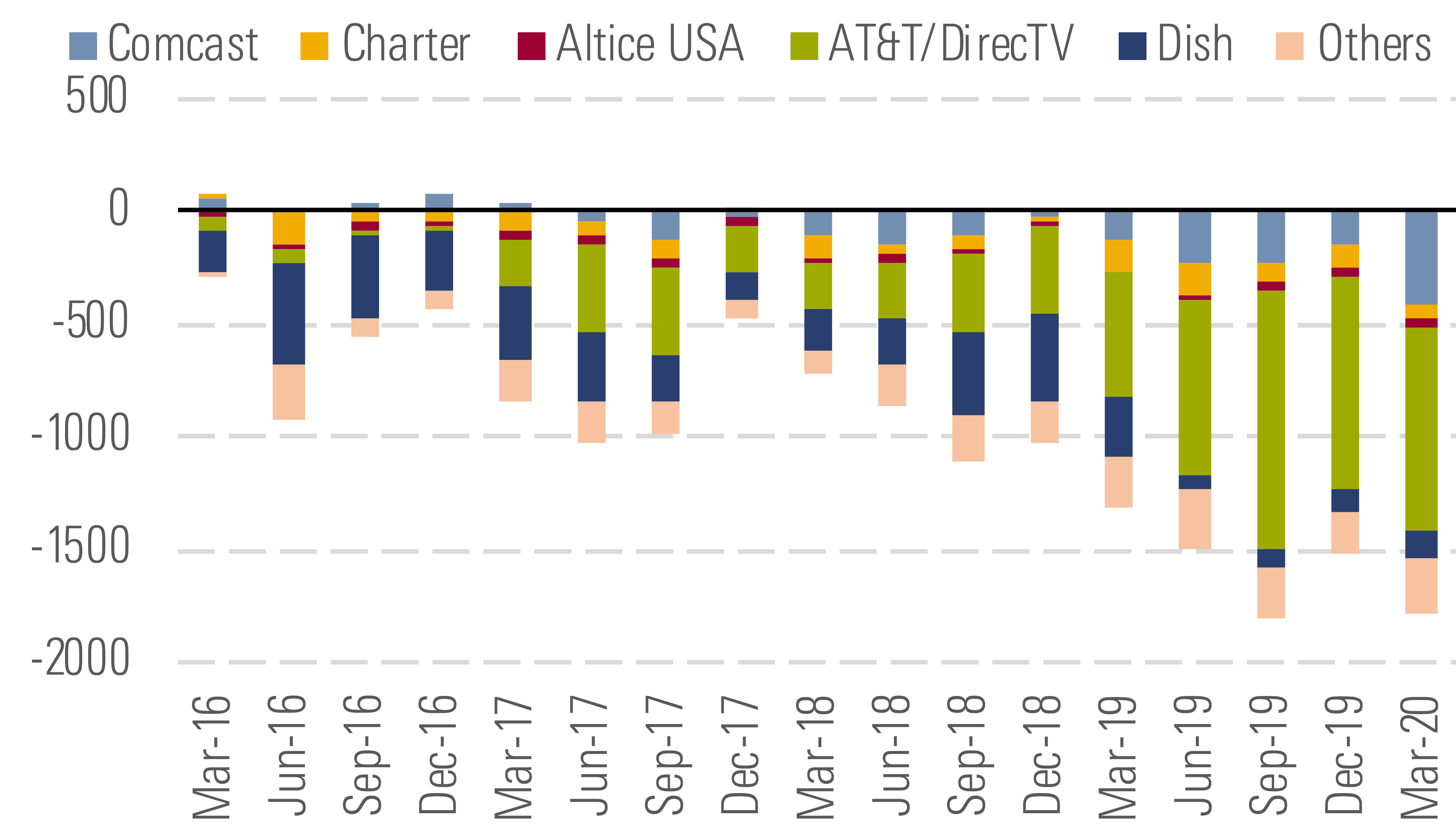

The market appears concerned with two primary factors: the accelerating decline in traditional television customers and the potential for a very sharp drop in advertising revenue during the pandemic. Cable and satellite companies like Comcast and AT&T lost a collective 1.8 million television customers during the first quarter alone, or about 2% of the total. The pay-television market faces several challenges, but we still believe older consumers and dedicated sports fans will lend stability.

Traditional television customer losses have gotten ugly. - source: Morningstar

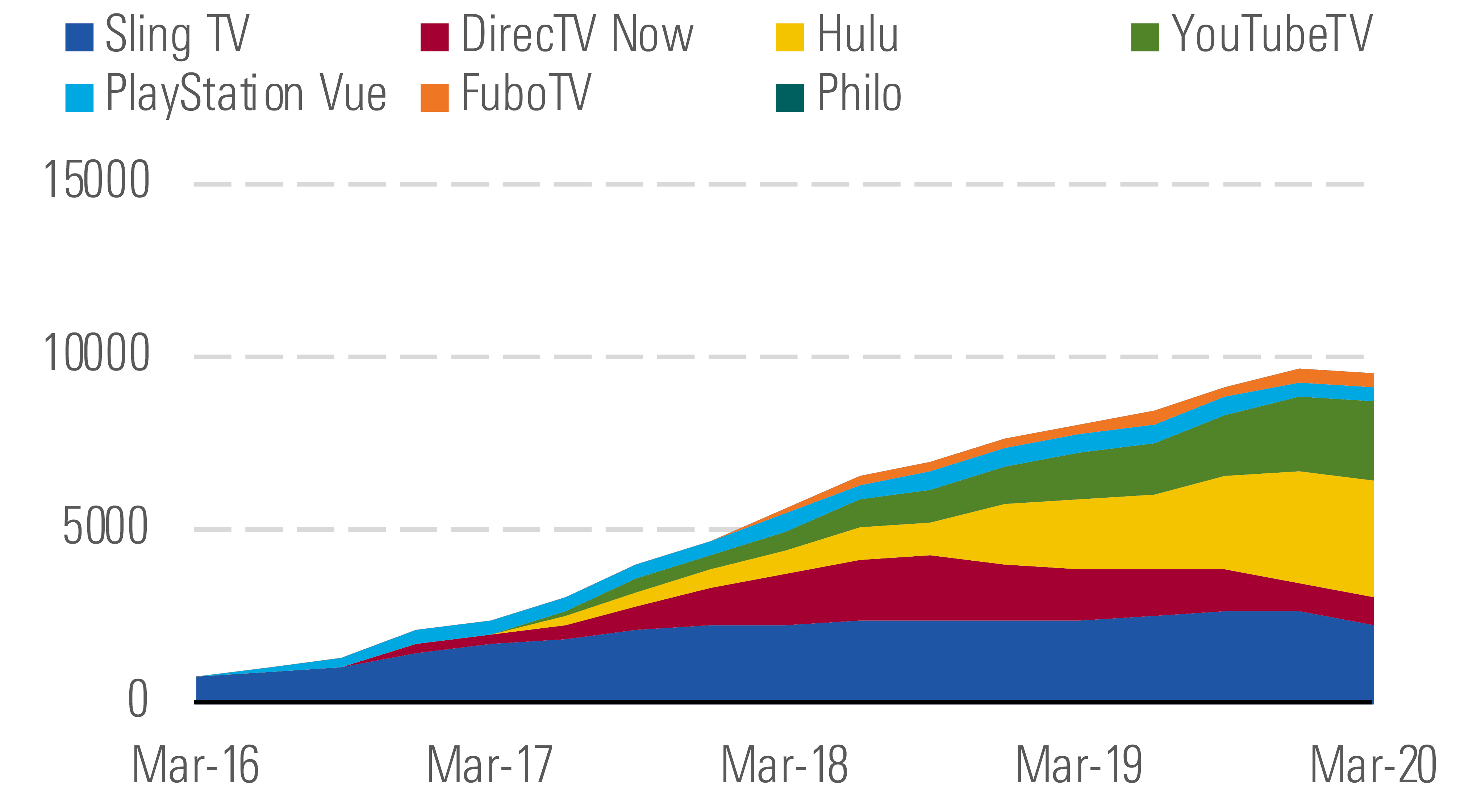

On the advertising front, we don’t expect television to suffer the same fate as newspapers during the financial crisis, where advertisers failed to return to the medium as the economy recovered. Television remains one of the few ways to reach a large audience simultaneously, and firms are getting better at targeting and measuring ad campaigns. In addition to the media firms, we also believe agencies that help direct ad spending, like Omnicom and Interpublic Group, will see business rebound over the next year, as well.

Online television alternatives have only partially picked up the slack. - source: Morningstar

Top Picks

Omnicom Group OMC Economic Moat Rating: Narrow Fair Value Estimate: $79 Fair Value Uncertainty: High

We expect Omnicom, the world’s second-largest ad agency holding company, will return to growth in 2021. As the economy begins to recover over the next year, ad spending should increase, benefiting Omnicom. Plus, as the firm helps clients navigate the pandemic, the handholding could strengthen its client relationships, resulting in fewer account reviews over the long run. In addition, Omnicom’s dividend remains intact, as the firm improved liquidity earlier this year. Given the tight relationship between economic growth and ad spending, any indication of an economic recovery should improve sentiment around this stock.

Comcast CMCSA Economic Moat Rating: Wide Fair Value Estimate: $47 Fair Value Uncertainty: Medium

Comcast’s core cable business (about 70% of consolidated EBITDA) is in great shape and should see minimal impact from the coronavirus. While television customer losses have worsened, the firm now earns far more profit providing Internet access, where it continues to gain market share. The theme parks and movie businesses will struggle in 2020, but they are relatively small. Longer term, the parks business and movie studio are key assets behind Comcast’s media efforts. The Sky acquisition added to Comcast’s debt, but the balance sheet remains solid. Net debt is at about 3 times EBITDA versus around 5 times at cable peers Charter and Altice USA.

Fox FOX Economic Moat Rating: Narrow Fair Value Estimate: $39 Fair Value Uncertainty: High

By selling Twenty First Century Fox’s entertainment assets to Disney in 2019, Rupert Murdoch created a unique media firm, heavily focused on live events, primarily via Fox News, the Fox broadcast network, and FS1. Murdoch has effectively turned Fox into a large-scale bet on his own long-held belief on the value of live sports and news in the U.S. Given their importance to the pay-television bundle, Fox is well-positioned to capitalize on those trends. The recent market sell-off across media has made valuation more attractive, with the shares trading at more than 25% below our fair value estimate.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)