Despite Rally, Energy Stocks Still Look Cheap

It's been rocky, but the worst is probably behind us.

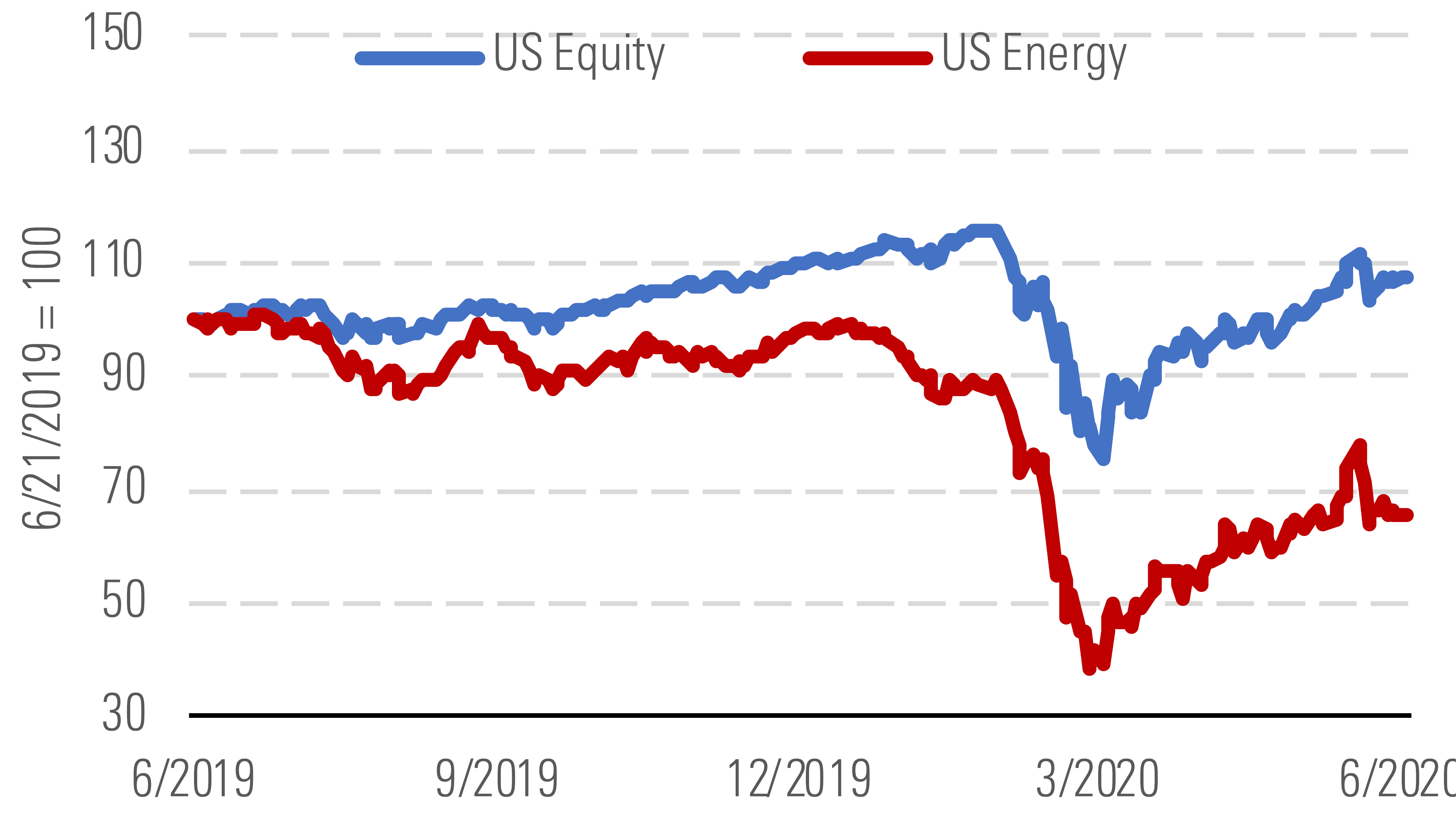

The energy industry still faces a very difficult environment, but the outlook brightened somewhat during the second quarter. The Morningstar US Energy Index mirrored the broader market rebound, gaining 37% in the period. And oil prices rallied sharply, with the West Texas Intermediate benchmark roughly doubling since the end of March. But by and large, the sector remains undervalued and trades at a 23% discount.

U.S. energy recovery mirrors the market. - source: Morningstar

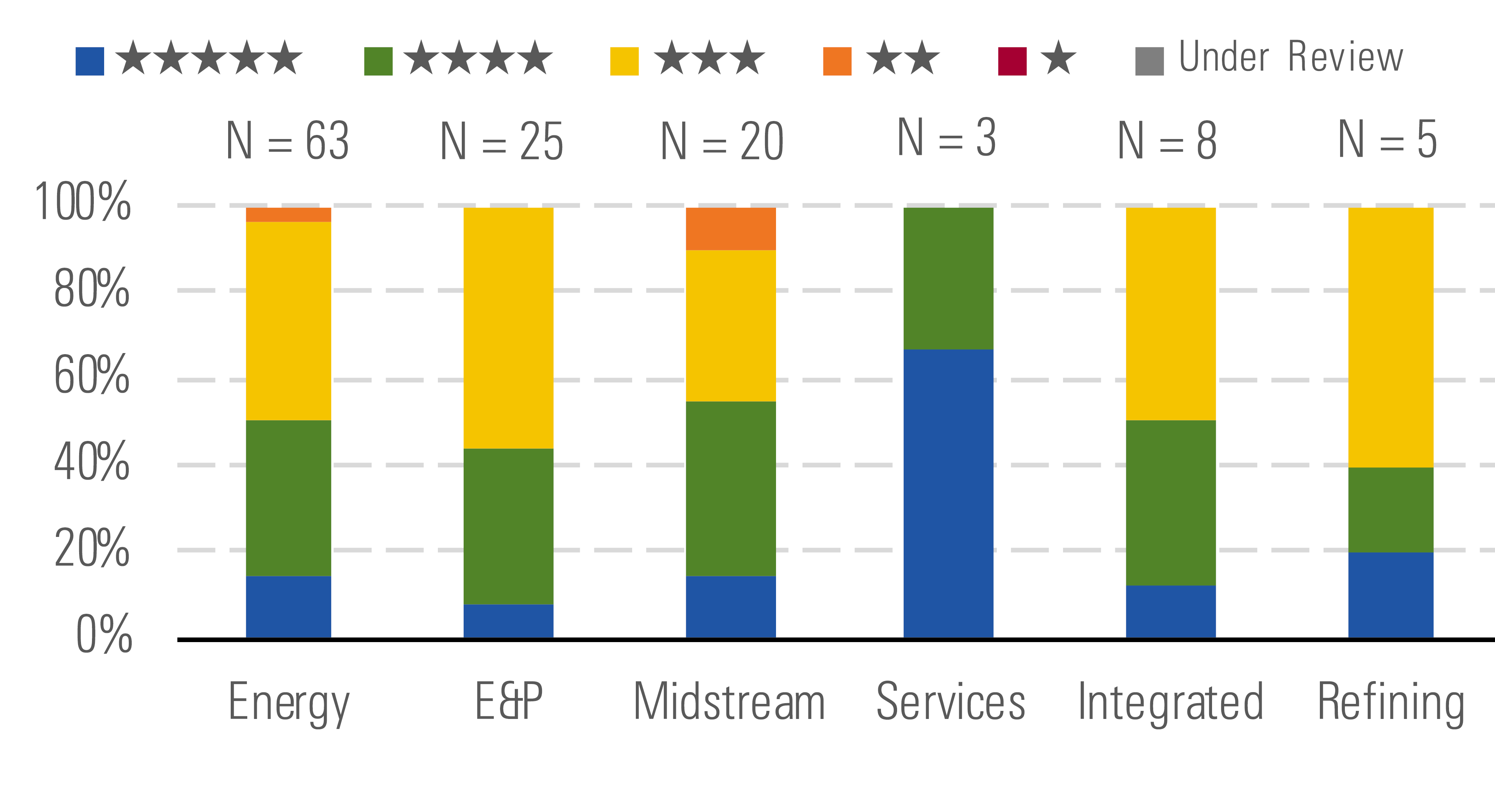

Energy stocks still priced attractively. - source: Morningstar

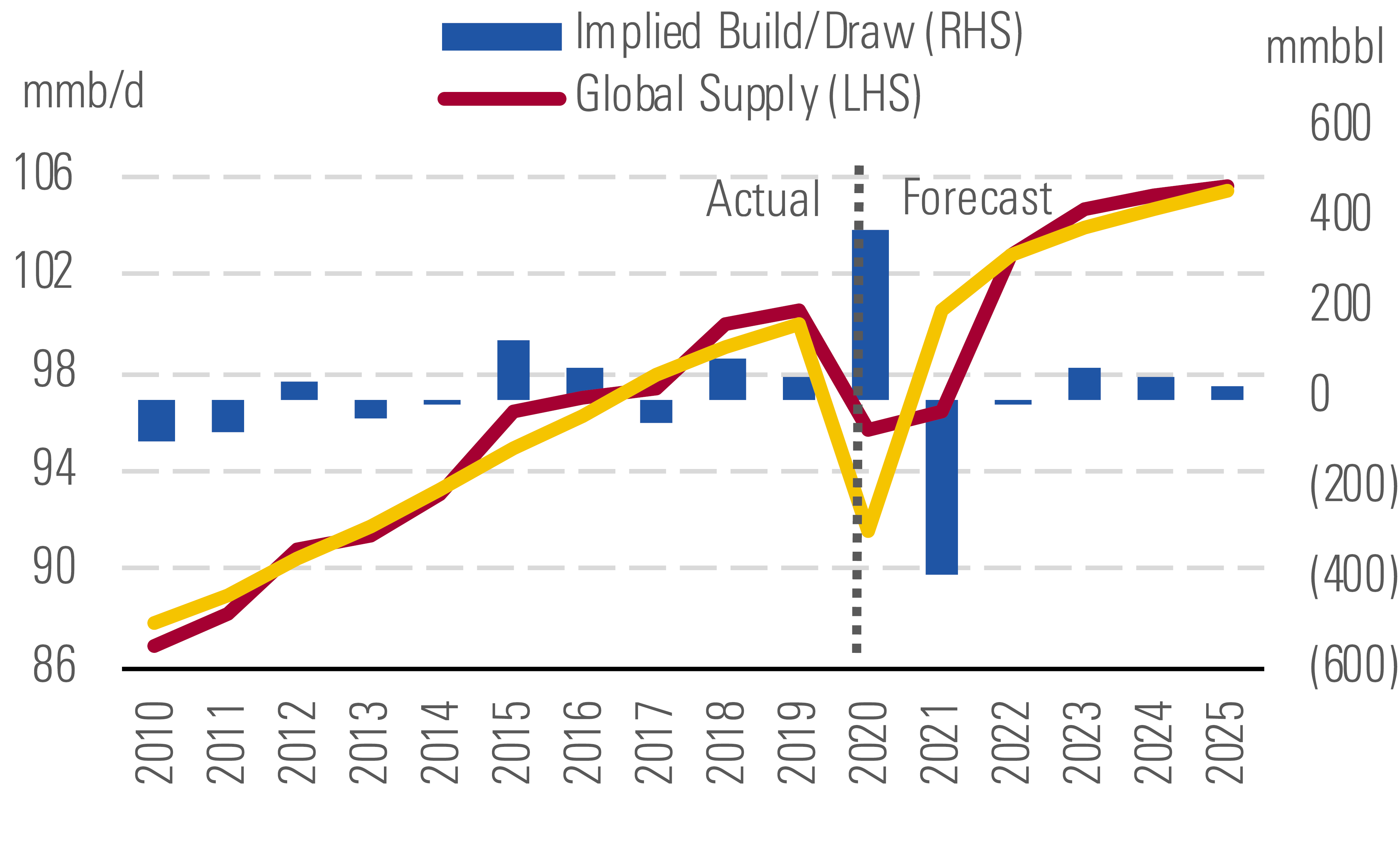

The worst of the pandemic-related collapse in oil and gas consumption is probably behind us, given that most economies around the world are showing signs of reopening. In the U.S., reduced social distancing and unprecedented fiscal stimulus should continue to support the recovery in the second half of 2020. And on the supply side, OPEC and its partners have U-turned after recklessly launching a price war in March and have now pledged substantial production cuts (collectively withholding almost 10 million barrels per day). Producers outside OPEC are also tightening their belts and truncating growth plans. In the U.S., the number of active horizontal drilling rigs has fallen by almost two thirds since the end of March, which means domestic output is likely to decline by 1.5 mmbpd over the course of 2020.

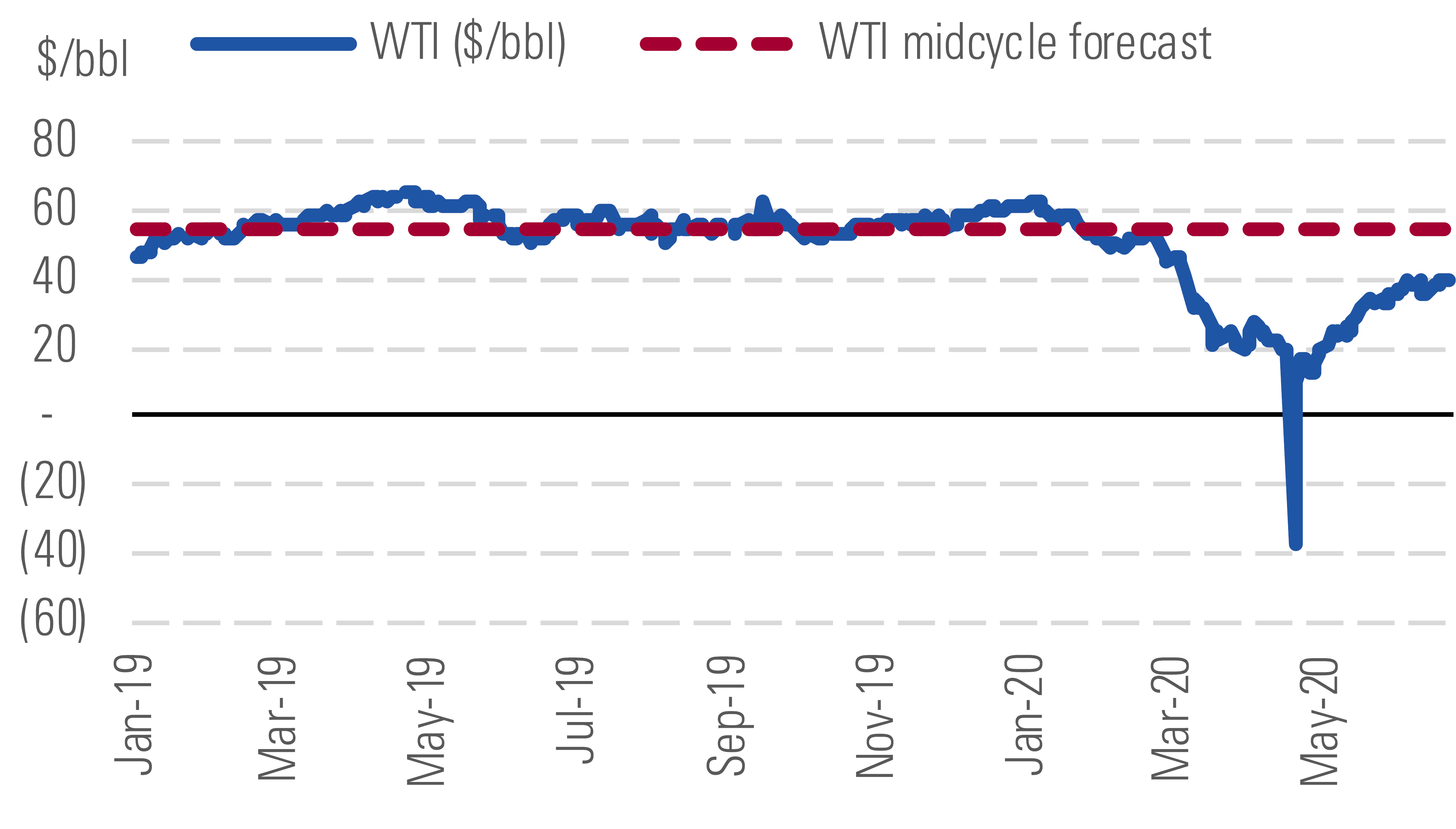

Current oil prices are well below our long-term estimate. - source: Morningstar

These cutbacks won’t stop crude stockpiles from ballooning temporarily, but we still expect inventories to drift back to normal levels during 2021. Accordingly, we see no reason to change our midcycle price estimates of $55/bbl WTI and $60/bbl Brent. U.S. shale is still the marginal producer in our global framework, and the shale business model does not work in the current price environment. Without a rebound in oil prices, producers will have no incentive to grow their production or even replace declines, resulting in a downward spiral for supply that could eventually turn the current glut into a shortage. But prices cannot sustainably exceed our midcycle forecasts, either. Shale wells today are much cheaper on a per barrel basis than the large, complex megaprojects that would have set prices in a world without U.S. shale. Over the long run, we think U.S. shale well cost inflation will remain subdued, due to the no-moat nature of many shale services, and that wider adoption of current technologies coupled with decades of attractive drilling opportunities will cap unit costs.

Long-term demand will be nearly unscathed by COVID-19. - source: Morningstar

Top Picks

Enterprise Products Partners EPD Economic Moat Rating: Wide Fair Value Estimate: $25.50 Fair Value Uncertainty: Medium

Enterprise Products Partners is well positioned to deal with the industry downturn over the next one to two years. The partnership has liquidity of $8 billion compared with $2.3 billion in maturities through the end of 2021, and 78% of its customer base is investment-grade. Fee-based earnings make up 80%-90% of earnings. Take-or-pay commitments make up 45%-55%, more resilient areas such as storage and demand-driven pipeline exposure make up about 20%-30%, and volume-exposed fees make up the balance.

Schlumberger SLB Economic Moat Rating: Narrow Fair Value Estimate: $48 Fair Value Uncertainty: High

Schlumberger remains our top oilfield-services pick. Thanks to its strong balance sheet and focus on less-volatile international markets, we expect it to weather the storm facing oil markets over the next two years. Investors shouldn’t be discouraged by the temporary dividend cut, which is a wise precautionary move given the severe near-term industry environment. In the long run, we think Schlumberger will benefit from secular growth in international capital expenditures. Also, we think the company is poised to gain market share and improve margins via its efficiency-boosting integrated and performance-linked project initiatives.

Enbridge ENB Economic Moat Rating: Wide Fair Value Estimate: $40 Fair Value Uncertainty: Medium

We see over 30% upside in wide-moat Enbridge’s stock. We think uncertainty surrounding long-term Mainline utilization has made investors tentative. In our view, the market underappreciates the long-term cash flows from the Mainline. We anticipate that all three major Canadian pipeline expansion projects will be built by the end of 2023. This naturally creates concerns about the utilization of Enbridge's Mainline system. Even though producers look to cut capital spending, we still expect growth when crude prices reach our forecast midcycle levels. We think advancements associated with solvent-assisted technology will lower oil sands break-evens, leading to long-term Canadian production that will surprise to the upside and add 1.3 million barrels of oil per day over the next decade. Investors shouldn't expect Mainline underutilization to last long, as we expect it to operate near full capacity as supply ramps up to our forecast levels by 2026. Enbridge offers an attractive dividend, which is yielding around 7% at current levels.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)