Be Careful with Financial Services Stocks Today

Banks are the most undervalued subsector.

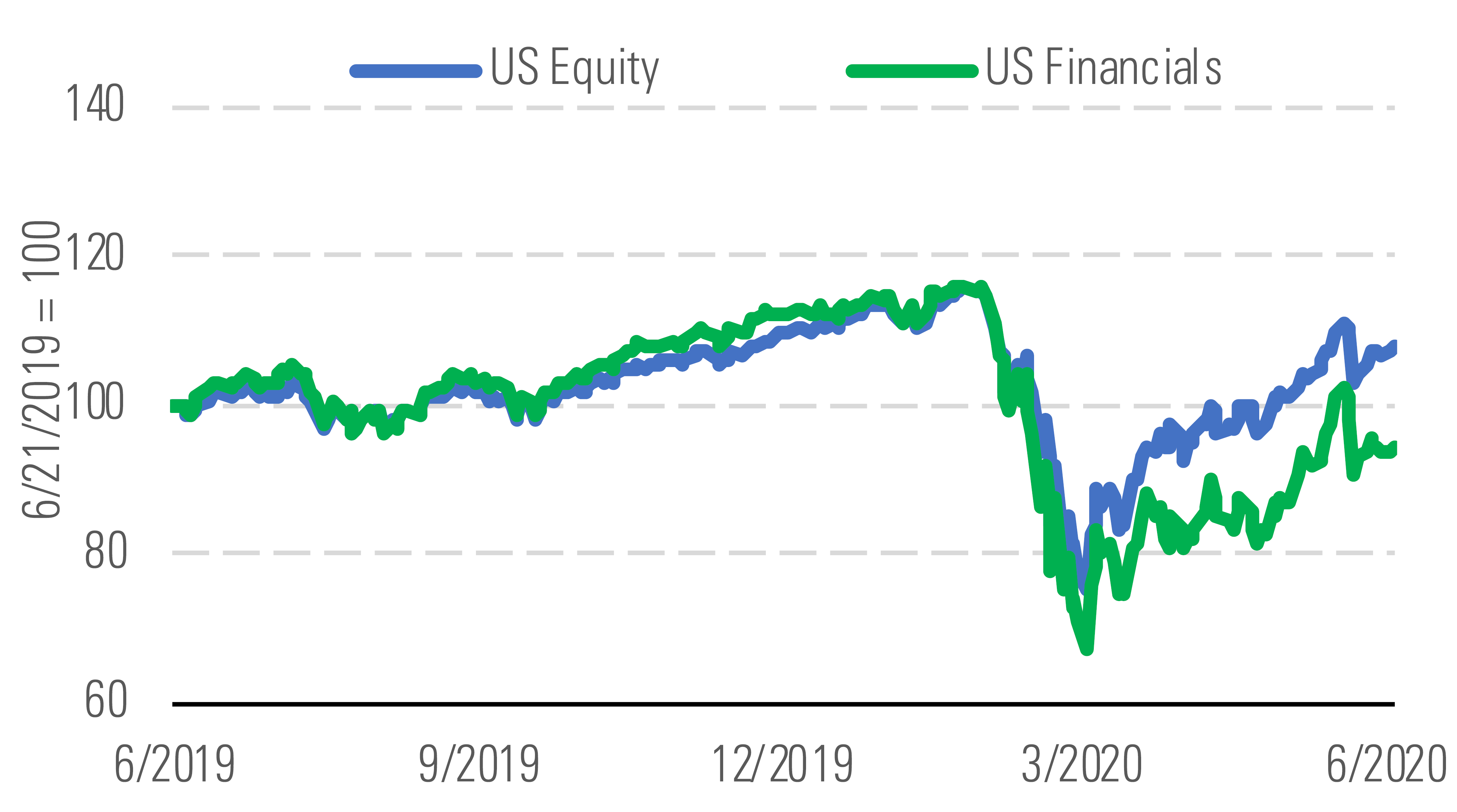

The Morningstar US Financial Services Index has significantly underperformed the Morningstar US Market Index over the previous year, down 5.7% compared with an increase of 7.7%. However, the U.S. financial sector has had a strong recovery over the previous quarter, up 19% compared with the market's 23%. Even with the recent increase in stock prices, the median North American financial sector stock still trades at an 11% discount to its fair value estimate but below a 30% discount a quarter ago. With our assessment that many financial sector stocks are less undervalued than they were a quarter ago, investors should be much more discerning of which stocks they choose and cognizant of the risks they’re taking.

Financials made a comeback in the previous quarter. - source: Morningstar

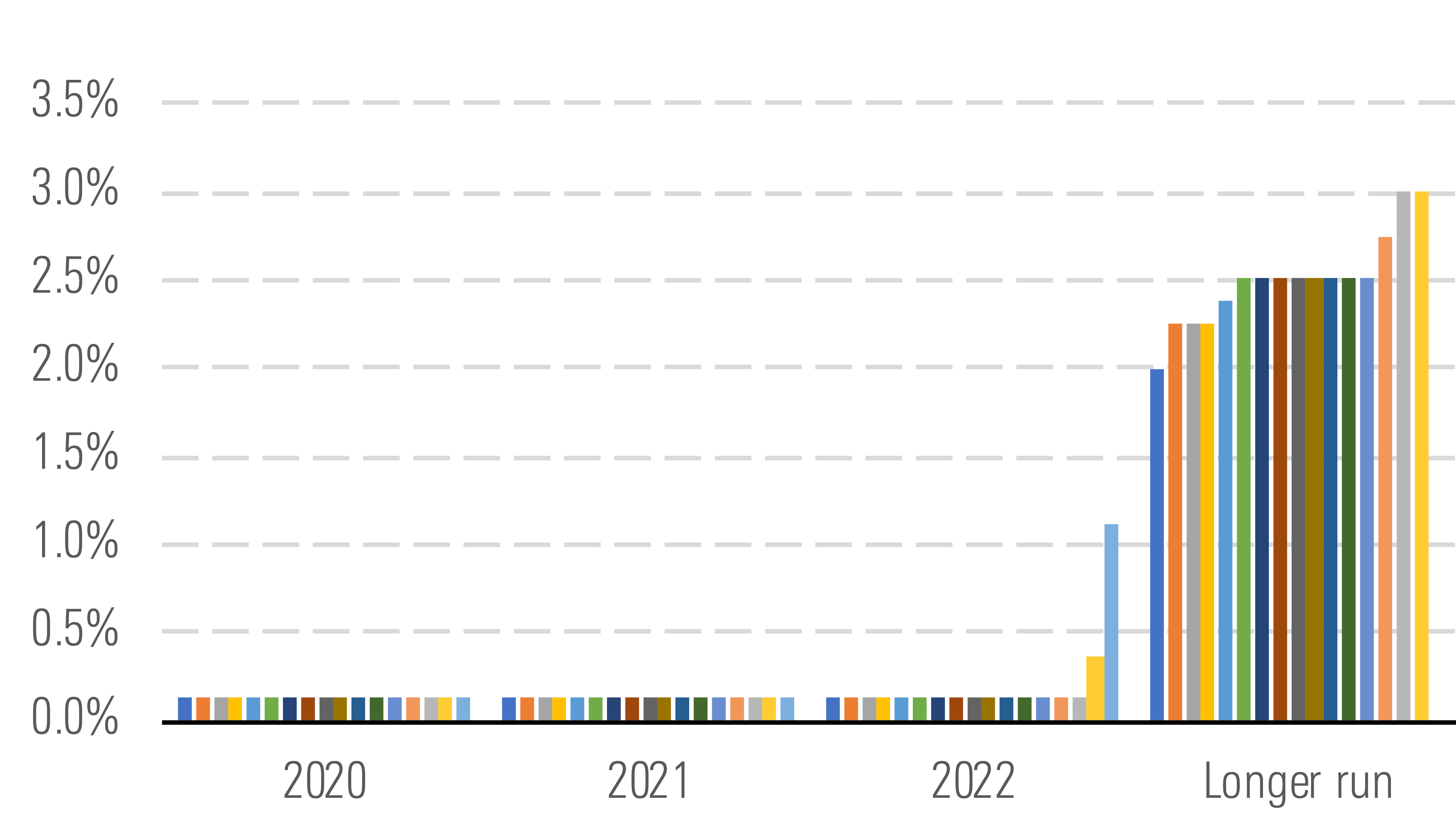

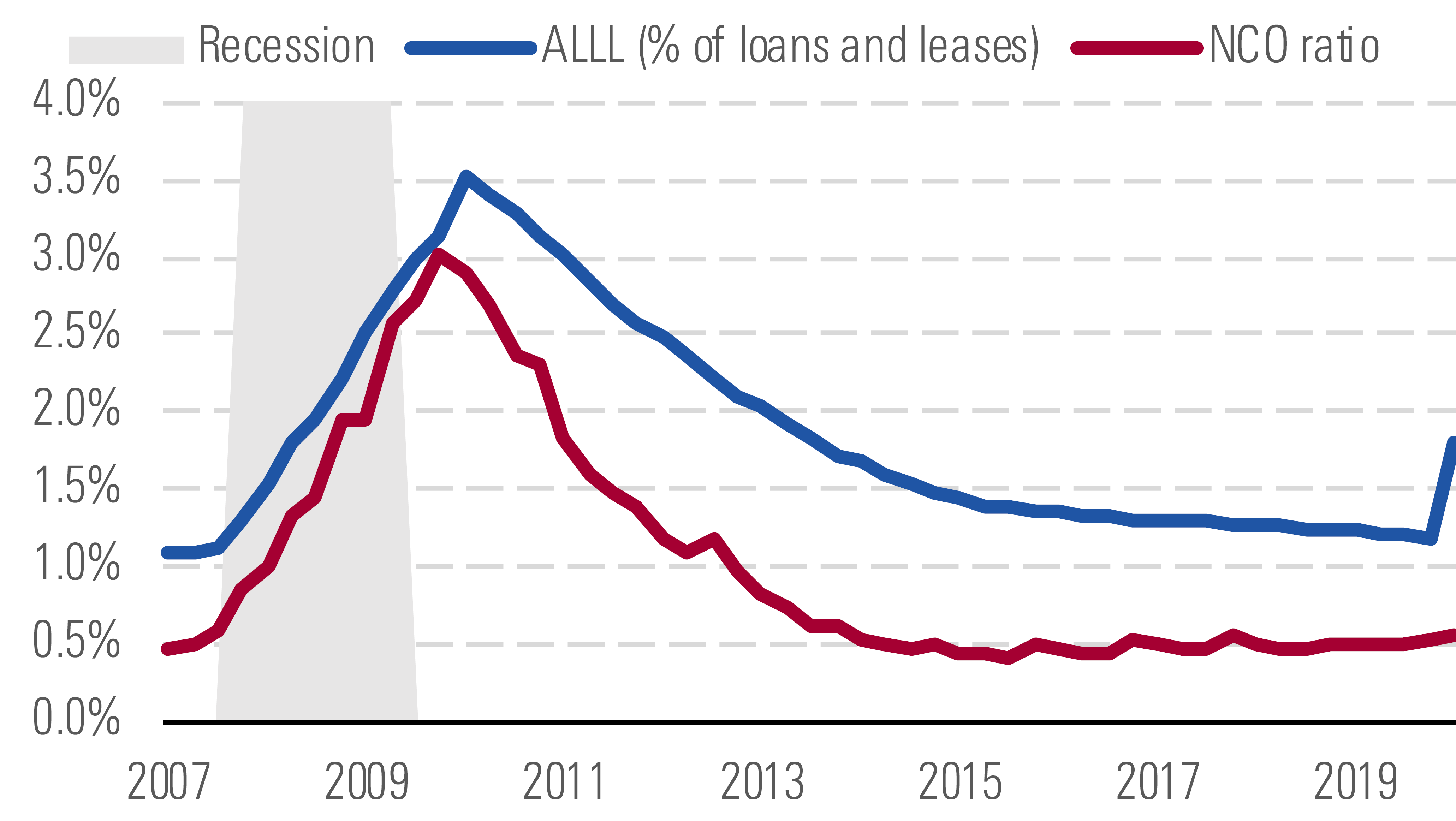

We continue to believe that the most undervalued industry in the North American financial sector is banks. For banks, two of the primary drivers of their valuation are interest rates and loan losses. Interest rates will likely stay low for an extended period. According to the U.S. Federal Open Market Committee’s dot plot from June 2020, members believe the federal-funds rate should stay in the 0% to 0.25% range through 2022. While banks increased their allowance for loan losses in the first quarter of 2020 and we expect them to continue provisioning for pandemic-related loan losses in the second quarter, loan charge-offs have remained muted. We believe that the up to $1,200 stimulus checks, $600 of additional unemployment benefits, and loan- and rent-payment forbearance have delayed banks from charging off loans. If further government stimulus isn’t passed, such as an extension of enhanced unemployment benefits past July, charge-offs could spike in the second half of 2020. We believe that banks have enough capital to survive these near-term negatives and that they can be suitable for long-term investors.

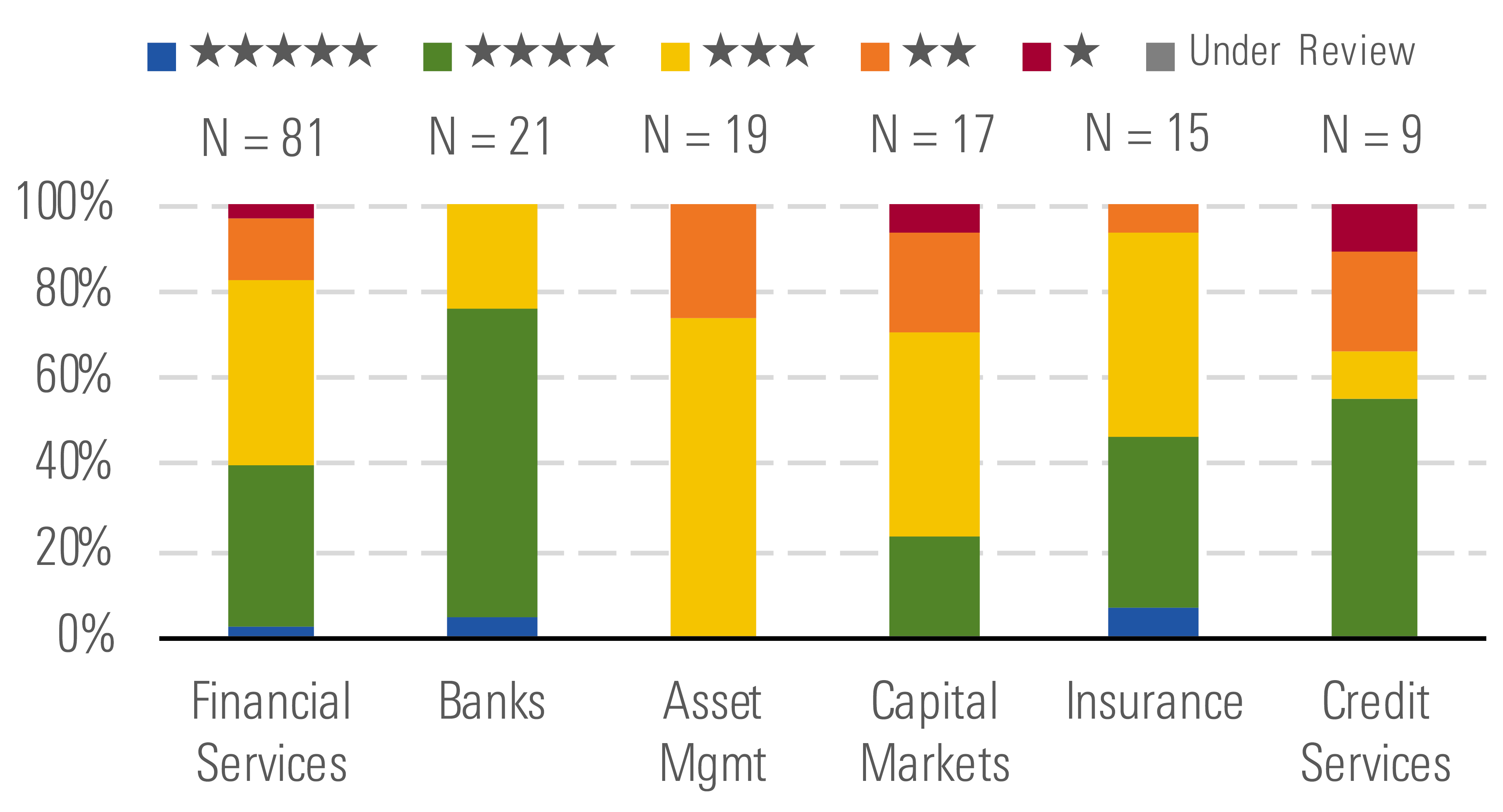

After run in the market, most financials are fairly valued. - source: Morningstar

Interest rates likely to be lower for longer. - source: Morningstar

Outside of banks, we see fewer bargains in the financial sector. The investment-management firms we considered undervalued at the end of the first quarter are mostly fairly valued after the run in the stock market. The median North American insurer we cover also trades at around an only 8% discount to its fair value estimate, which is a relatively small margin of safety, given the insurance industry’s exposure to interest rates, asset prices, and tail risk of large insurance claims from the pandemic.

Loan charge-offs may soon follow provisions and spike. - source: Morningstar

Top Picks

American International Group AIG Economic Moat Rating: None Fair Value Estimate: $59 Fair Value Uncertainty: High

AIG CEO Brian Duperreault was a primary architect behind peer Chubb's strong franchise that has generated industry-leading underwriting margins. He pledged that AIG would generate an underwriting profit in 2019, and the company achieved that goal. With steady improvement in underwriting results in recent quarters and recently unveiling a plan to take out $1 billion in costs by 2022, we believe AIG is gradually trending toward peer results. However, in the near term, progress will likely be obscured by coronavirus-related claims on the property and casualty side of the business and capital markets pressure on AIG’s life insurance operations.

Berkshire Hathaway BRK.B Economic Moat Rating: Wide Fair Value Estimate: $228 Fair Value Uncertainty: Medium

We remain impressed with Berkshire Hathaway's ability to generate high-single- to double-digit growth in book value per share. Believing it will take some time before the firm succumbs to the impediments created by its size, and that the ultimate departure of CEO Warren Buffett and Vice Chairman Charlie Munger will have less of an impact than many may believe, we're always looking for opportunities to put money to work in the name. Berkshire has a ton of cash on hand, with the potential to repurchase a ton of stock, making it an ideal defensive name in a slowing economy or down market.

Truist Financial TFC Economic Moat Rating: Narrow Fair Value Estimate: $54 Fair Value Uncertainty: High

We believe Truist is in a unique situation. The bank recently underwent a major merger of equals before the COVID-19 downturn started, which may explain why the name trades at a larger discount. However, recent commentary from management about its ability to keep cost synergies on pace, BB&T's historically strong credit underwriting, and the combined bank's strong overall banking franchise lead us to have confidence that the bank can withstand the upcoming downturn and that it will emerge stronger once it's over. As such, we see an attractive risk/reward for Truist's shares at today's prices.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)