Consumer Defensive Stocks Now Heated But Opportunities Remain

Tobacco and alcohol look attractive.

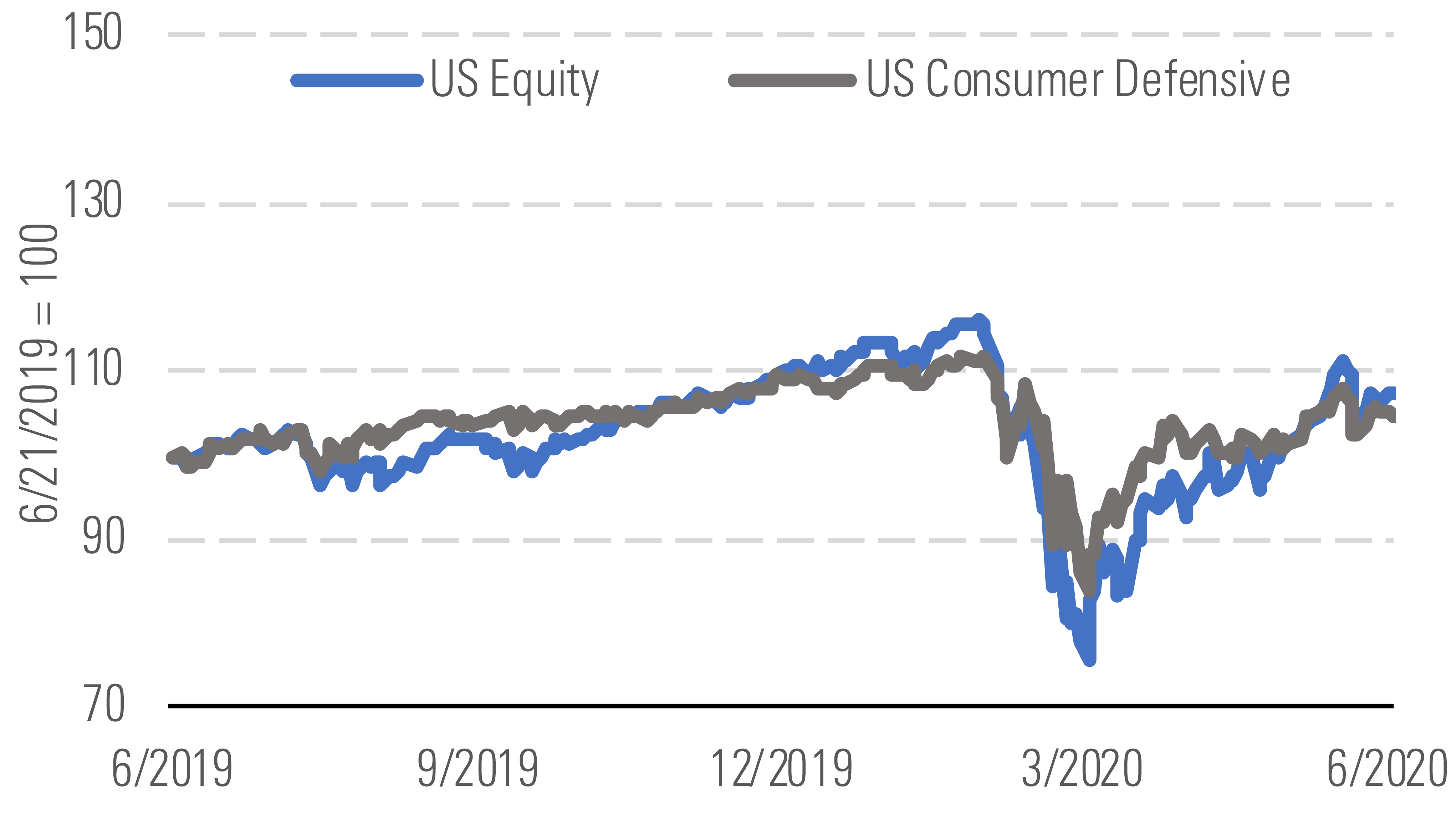

The consumer defensive sector trailed the broader market’s impressive rebound this quarter, generating an 11.8% return compared with the market’s 23.1% gain through June 23.

Consumer defensive has underperformed the broader market. - source: Morningstar

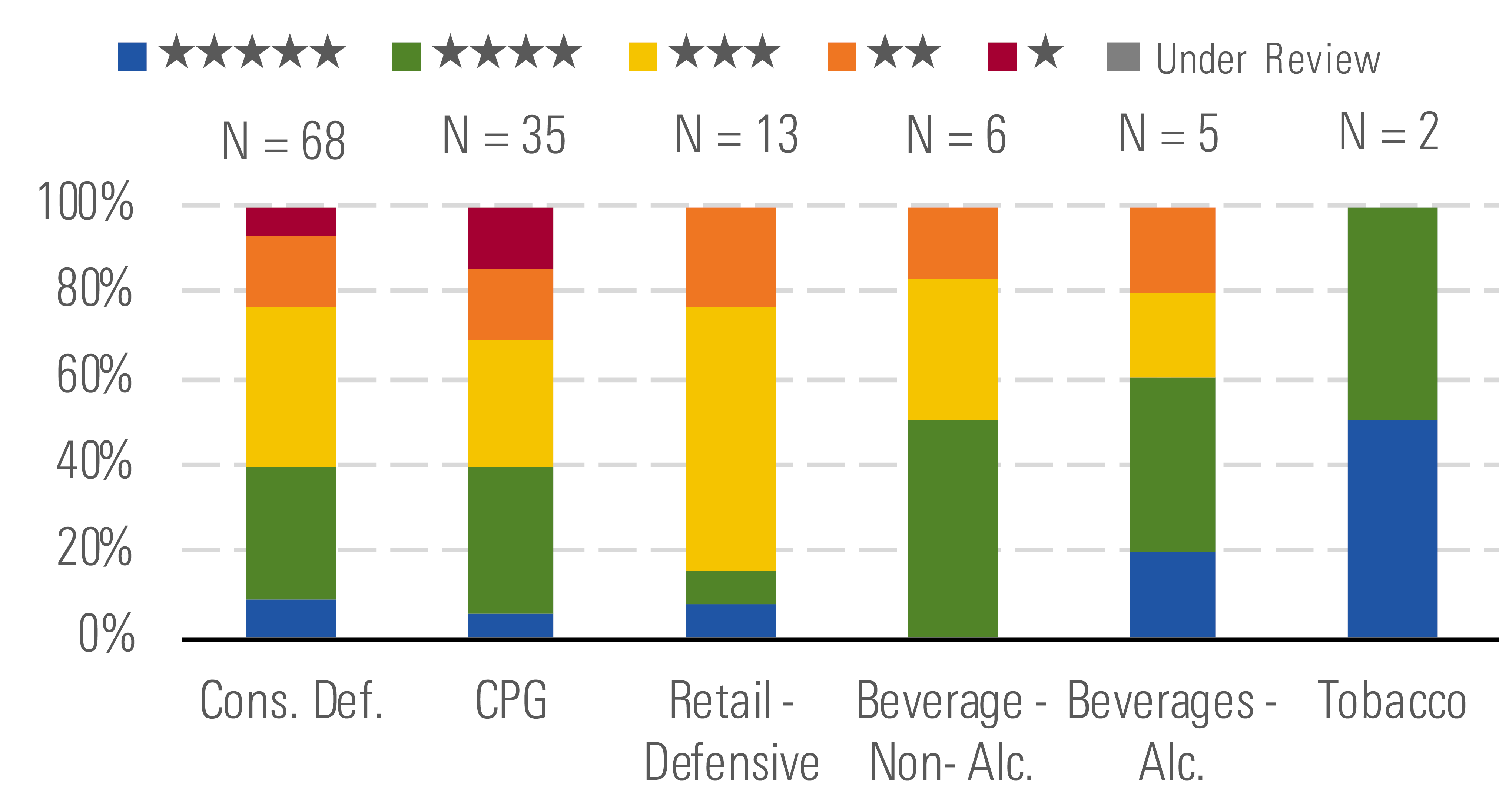

Despite this, we think the space has become more heated, such that the median stock in our coverage now trades at just a 1% discount to our fair value estimates. This runs in contrast to the 14% discount the aggregated space boasted three months ago. Consumer packaged goods and nonalcoholic beverages offered bargains at the onset of the pandemic in the U.S., but shares have since bounced. However, we still believe there are values in the sector. Specifically, tobacco and alcoholic beverages provide opportunities, trading at 26% and 16% discounts to our valuations, respectively.

Tobacco and alcoholic beverages look most attractive. - source: Morningstar

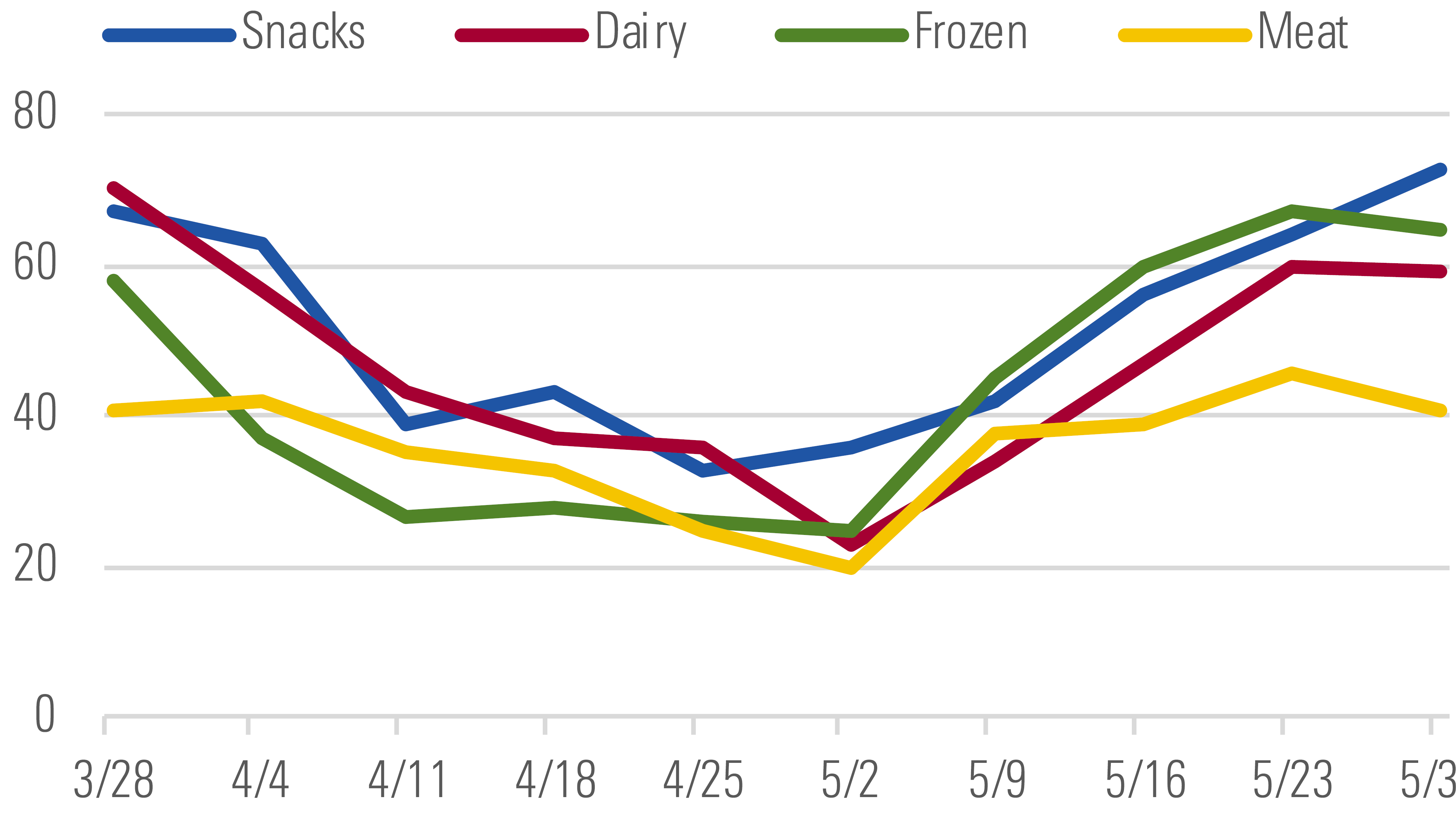

When shelter-in-place mandates were announced, consumers rushed to stock their pantries with essential fare. Because of the rapid rise in purchases, which prompted out-of-stocks or limited supplies of certain items, manufacturers halted previously slated promotions. This is shown in an index by Numerator, a market research firm, of top promoted grocery products. Compared with the same week in 2019, products sold on promotion across a number of categories since March 2020 are tracking lower, with a reading of under 100 signifying fewer items sold on promotion than the period last year. The initial buying surge has waned and lockdowns have lifted, so items sold on sale have begun to edge higher. We think promotions may persist if a prolonged recession ensues. However, given a lack of switching costs, we think firms across the sector will need to invest in R&D and marketing to ensure their brands and retail relationships aren’t impaired.

Items sold on promotion have started to rebound as lockdowns ease. - source: Morningstar

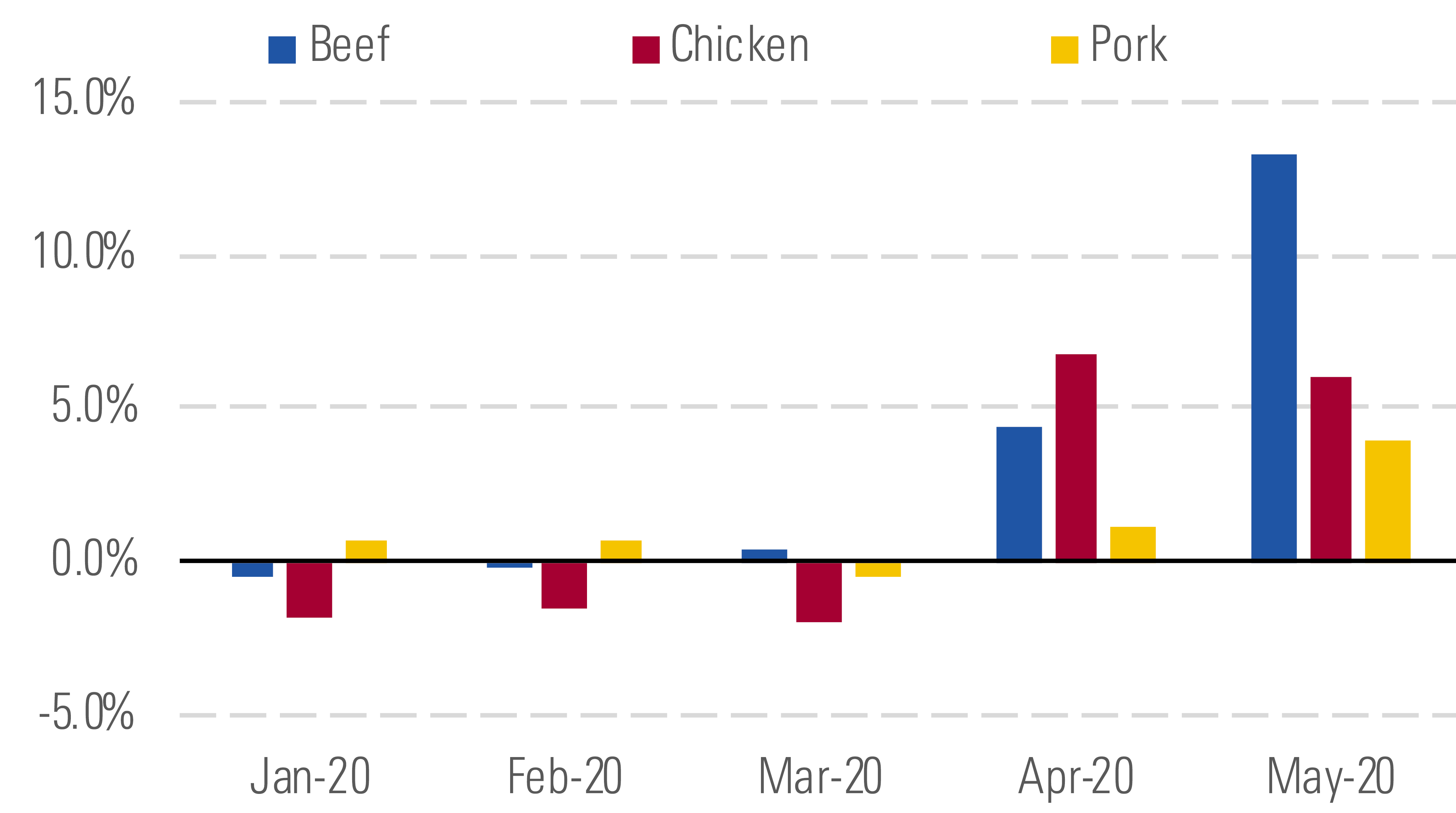

Protein price increases have been more pronounced since April, which we attribute partially to disrupted production at several meat processing plants due to the spread of COVID-19. These jobs are labor-intensive, with workers in proximity, impeding social distancing efforts. Beef and pork producers have been disproportionately affected (30%-35% industrywide) compared with poultry (4%-5%), as beef and pork plants tend to be larger, with more employees. While increased safety and sanitation costs are likely to persist, beef and pork profit margins should hold up because of lower livestock costs and higher selling prices.

Beef, chicken, and pork chalked up hearty price increases since April. - source: Morningstar

Top Picks

Anheuser-Busch InBev BUD Economic Moat Rating: Wide Fair Value Estimate: $96 Fair Value Uncertainty: Medium

We think investors should consider wide-moat Anheuser-Busch InBev, trading about 50% below our assessment of intrinsic value. Although sales have taken a hit from coronavirus disruptions, we expect revenue to pick up when social distancing guidelines are relaxed (about 33% of 2019 sales were on-premises) and to grow high single digits in 2021. AB InBev is the most leveraged among the brewing group, but we think the firm has enough liquidity to operate through the pandemic. We believe the firm is well positioned for the long term, with monopolylike positions and cost advantages in developing markets that continue to generate value.

Pilgrim's Pride PPC Economic Moat Rating: None Fair Value Estimate: $34.50 Fair Value Uncertainty: High

We consider Pilgrim's Pride an attractive investment, with shares trading almost 50% below our fair value estimate. Pilgrim's CEO has temporarily stepped aside after being indicted on criminal charges of price fixing, with the trial set for August, but we think the business remains attractive. We believe Pilgrim's is poised to benefit from China removing its ban on imports of U.S. chicken and from the global protein shortage caused by African swine fever. And even amid the coronavirus pandemic and its 50% food-service exposure (which skews toward quick-service restaurants), we expect strength in retail to largely offset weak restaurant sales.

US Foods Holding USFD Economic Moat Rating: None Fair Value Estimate: $31 Fair Value Uncertainty: Medium

Shares of no-moat US Foods trade around a 40% discount to our intrinsic value. Consumers avoided away-from-home food consumption during the pandemic, and as such, the food-service industry slowed, which hasn’t spared any operator. Despite the hit to sales, we expect US Food’s growth to gradually improve in the second half of 2020 as customers revert to prior habits. And we don’t believe this slowdown has hampered its liquidity profile. Although we’ve ratcheted back our fair value estimate for US Foods by 17% since the start of the pandemic, shares are down 54% year to date, creating an attractive opportunity.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)