How Badly Did Funds Get Hit in the Past 3 Bear Markets?

All the gory details on losses at some of the biggest funds.

A version of this article first appeared in the June 2020 issue of Morningstar FundInvestor. Performance figures have been updated. Download a complimentary copy of FundInvestor by visiting the website.

Nothing about life in the year of the coronavirus is normal. And that's true of the markets.

The economy has shed 39 million jobs in just three months, yet the S&P 500 and the Morningstar US Market Index are down just under 5% for the year to date. Coming off all-time highs with tremendous optimism priced in, there's a big disconnect between the stock market and the economy. The two never move perfectly in sync, nor should they, but they are rarely this far apart.

The Federal Reserve is clearly a big reason why stocks have held up better. If you look back at the prior major bear markets of 2000–02 and 2007–09, they began with a trickle of bad news before a shattering event made everyone more pessimistic. As a result, investors, business leaders, and the Federal Open Market Committee only gradually became worried before the big event. That meant that the Fed gradually responded to economic deterioration and only took extreme measures well into the downturn.

But this time, we had the shocking event right up front. It quickly became apparent that there would be massive unemployment and a brutal economic contraction because of COVID-19. As a result, the Fed pivoted quickly by slashing rates and buying both bonds and exchange-traded bond funds. That cheap money has helped spur a sharp rebound in the stock market and corporate bonds.

I'm not much for market predictions, but it seems a little more likely than usual that we endure another sell-off. That's as far as I'll go with the crystal ball.

With that in mind, I thought I'd look at how markets and funds behaved in those past two bear markets as well as in the most recent one. I pulled returns from peak to trough for funds in the Morningstar 500 to get some idea of what defenses worked in the past. The figures come with two big caveats:

1) Markets never repeat exactly, so we know that losses in future contractions could be even worse or much better. The data give us some insight into relative safety of different asset types and funds, but don't look for a lot of precision here.

2) While the peak-to-trough losses in the next bear market could be worse than stated, the focus on peak to trough overstates the losses that most investors actually incurred. Investors don't have such bad luck that they make all their investments at peak and sell all of them at the bottom. Simply adding a year or two to the start or end of the period in question would have reduced losses significantly, and that's a more realistic scenario, even for people with really bad timing.

The Portfolio-Level View You need to step back and look at your whole portfolio to understand how strong your defenses are. So, let's start with the total market and a 60/40 portfolio using Vanguard Total Stock Market Index VTSAX and Vanguard Balanced Index VBIAX as a starting point.

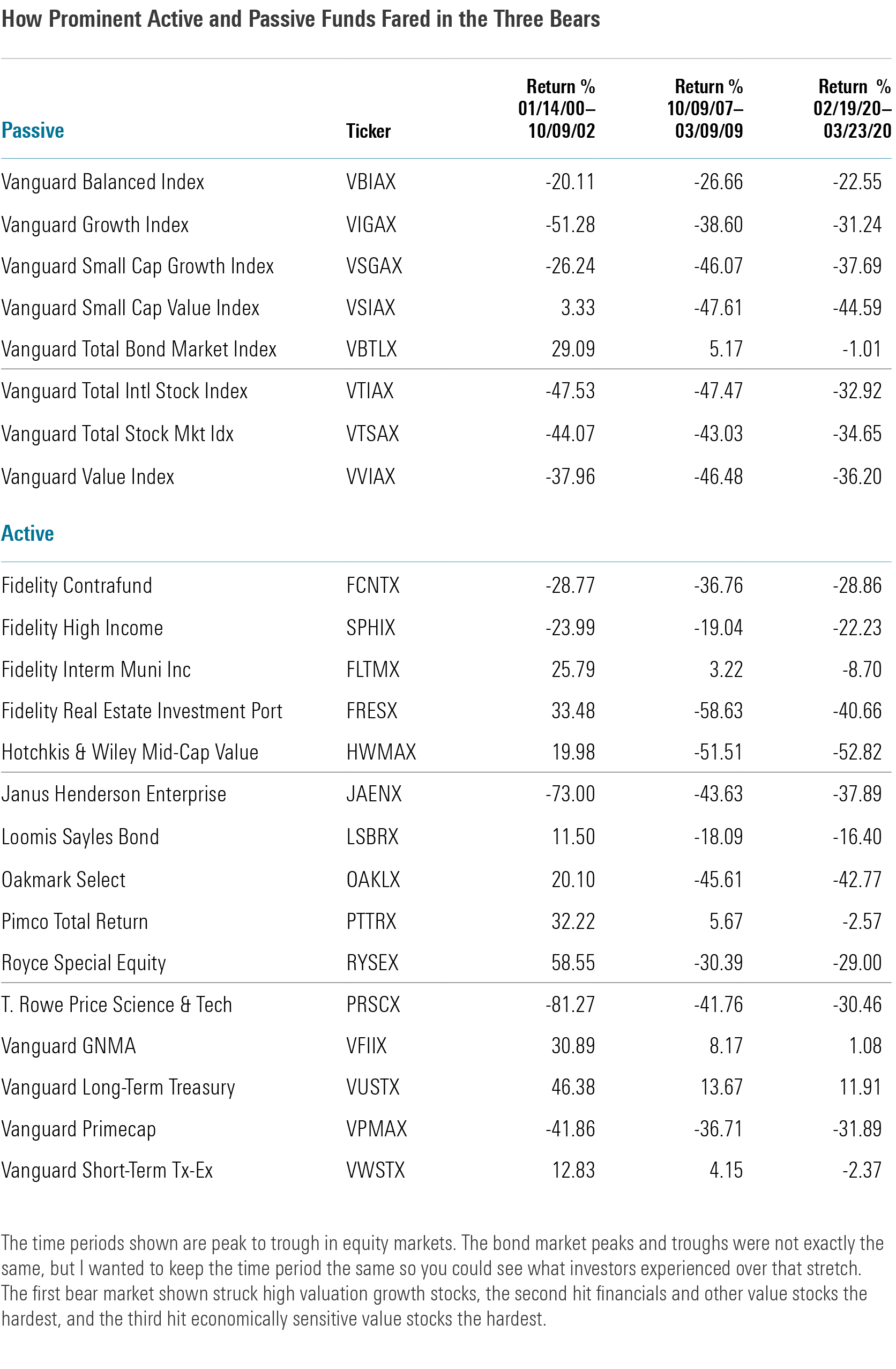

The total market lost 44%, 43%, and 35% from peak to trough in the past three bear markets. (You can see all the passive funds' returns in the table below.) That's pretty harsh. But Vanguard Balanced Index's losses were much more modest. It lost 20%, 27%, and 23%. Simply having a 60/40 portfolio turned a bear market into a rather manageable setback. It also helps to look at your portfolio in those terms even if you own 20 funds. If you focus on your worst performers that lost, say, 55%, then you might sell or make wholesale changes, but if you instead look at the big picture, you may be more inclined to ride it out.

It's worth noting that Vanguard Balanced Index uses a bond index with a heavy tilt to government debt. If you have a fair amount of high-yield or other riskier bonds in your portfolio, your 60/40 portfolio probably won't hold up as well as Vanguard Balanced Index. You can see that from the other allocation--50%-70% equity Morningstar Category funds in the Morningstar 500. The 15 funds that were around for all three bear markets (excluding Vanguard Balanced Index) on average produced returns of 0.6% in the first one, negative 28% in the second, and negative 26% in the third. The reason is many in that group have a value strategy for equities and thus held up quite nicely in the first bear market and worse in the second two. One further caveat for active fund histories is that they have survivorship bias because many of the funds that fared worst in the earlier two bear markets were likely to be liquidated. Thus, the surviving fund records look a little better without them.

We only have four allocation--30%-50% equity funds that were around for all three bears, and they had average returns of 7%, negative 23%, and negative 21%. It's telling that the latter two bear markets punished them almost as much as Vanguard Balanced Index because they had more value exposure and more high-yield debt.

Market Comparisons Did foreign-equity diversification help in our past three bear markets? Not really. Vanguard Total International Stock Index VTIAX lost 48%, 47%, and 33% in the three bears. That's a little worse than the losses of the U.S. market (with Vanguard Total Stock Market Index as the proxy) in the first two and a little better in the recent one. Two lessons here are that, in a panic, equities tend to get unloaded wholesale without much attention to the details. Second, it also shows how the global economy is so closely linked that problems in any of the top economies are a problem for the rest of them.

But foreign diversification does have value, just not in terms of limiting downside in a bear market. Rather, the diversification benefit comes in rallies. Market leadership has tended to rotate on a 10-year basis. There are decades when the U.S. outperforms most of the major foreign markets and times when it lags most of them. Given how long that run can last, it's not wise to gamble that the next 10 years will be a repeat of the past 10 years.

Investment style has mattered more than domicile in the bear markets. Vanguard Value Index VVIAX lost 38% in the first bear market, 47% in the second, and 36% in the third. That's much better than Vanguard Growth Index's VIGAX 51% loss in the first one but worse than its 39% and 31% losses in the following two.

Fixed-income categories likewise have shown a wide variety of results. Only government-bond funds had positive returns in all three bear markets. In a recession, the chance of default hurts most other kinds of bonds because they have credit risk, while at the same time investors seek the safety of U.S. government bonds.

Short-term municipal bonds performed respectably in the first two downturns but lost money in this year's bear market. Vanguard Short-Term Tax-Exempt VWSTX gained 13.0% in the first bear market and 4.0% in the second but lost 2.4% in this one. (That fund isn't technically an index fund, but it is close and therefore a decent proxy for short-term munis.)

In high-risk bond categories, the loss potential isn't so far from that of 60/40 funds. You can see that with two actively managed funds I've chosen to illustrate: Fidelity High Income SPHIX lost 24%, 19%, and 22% in the three bears; Loomis Sayles Bond LSBRX, a multisector fund that has high-yield along with foreign bonds and currency exposure, did a little better. It gained 11.5% the first time out and lost 18% and 16% in the next bear markets.

The central lesson is that Treasuries have low returns in most markets but serve nicely as an insurance policy in the worst markets. You should definitely know what your portfolio's Treasury exposure is, including cash, to estimate how much of your portfolio will be well protected in drawdowns.

Investment-grade bond funds, which generally contain some Treasuries, held up pretty nicely, though not quite as well as pure Treasury funds. Pimco Total Return PTTRX returned 32% (Bill Gross wasn't the Bond King for nothing), 6%, and negative 3% in the three bear markets. But as it is a wide-ranging sometimes aggressive fund, you can't be certain it will have defenses up as well as it did in the past three bear markets.

Moving further down in quality to high yield presents challenges in portfolio building. Yes, it's great for income, but it is dependent upon leveraged companies and therefore quite vulnerable to a recession. So, it is not so great at diversification from equity risk but often produces good returns over a full cycle. Interestingly, high yield had a big swoon this year but has recovered in a big way. I mentioned Fidelity High Income's 22% loss, but it has recovered and is only down 6.1% for the year to date. Thus, high yield at this writing doesn't look like the sort of bargain it often is in a recession.

In summary, if you want to avoid losses as large as Vanguard Balanced Index's, you'll likely need more than 40% of your portfolio in investment-grade bonds and cash. One simple place to start is on the cash side. Planners recommend you have six to 12 months of living expenses in cash. If you don't have that much, you can begin by building that cash stake.

Looking at Actively Managed Funds The actively managed funds in the Morningstar 500 provide some more color on how far funds can vary from the market, but it's less likely they will repeat their bear-market performances. Two things seem to endure for reducing risk in equity funds. One is a big cash stake. The other is quality. Quality means companies with steady earnings and high barriers to entry. For example, Jensen Quality Growth JENSX lost just 6% in the 2000-02 bear market--that's remarkable for a large-growth fund in a growth-led bear market. But it lost 35% and 30% in the subsequent ones. Those are much better than the overall market but obviously still painful.

Let's look at four excellent actively managed equity funds that have risk levels at or slightly higher than the markets. Value fund Dodge & Cox Stock DODGX lost a mere 5% in our first bear market but got slammed when value was hit. It lost 50% and 40% in the following two bear markets. Oakmark Select OAKLX is in the large-blend category. It put up an amazing 20% gain in our first bear market, shed 47% in the second (a little worse than the broad market), and lost a disappointing 43% in the third.

Growth standout Fidelity Contrafund FCNTX did much worse than the above two funds in the 2000–02 bear market with a 29% loss, but that was still better than the broad market and most growth funds. The fund lost 37% and 29% in the following two. All three were better than the market, but Fidelity Contrafund was certainly not impervious to the sell-off. Vanguard Primecap VPMAX took substantial losses in all three bears. It fell 42%, 37%, and 32%, respectively.

Although better than the market, all of Primecap's losses show that even the best stock-pickers are vulnerable to bear markets. What we're seeing is that great stock-pickers can help modestly in down markets, but even they get caught flat-footed by shocking events, and we shouldn't look to them for much help in severe downdrafts. Rather, we should look to them to build value over a long cycle.

The Edge Cases Let's look at some of the extreme results from each bear to better understand just how widely dispersed returns can be. But I should add another caveat here that I'm looking at funds that survived all three bear markets, and thus, there's some upward bias in this information. In the first bear market, Royce Special Equity RYSEX, led by value maven Charlie Dreifus, gained 59% cumulatively. On the flip side, Janus Enterprise JAENX (now named Janus Henderson Enterprise), a true believer in dot-com and other tech stocks, shed 73%, and T. Rowe Price Science & Technology PRSCX lost 81%.

In the 2007-09 bear market, it was virtually impossible for an equity portfolio to be in the black, so bonds were the stars. Vanguard Long-Term Treasury VUSTX gained 14%, but Ariel Fund ARGFX shed 57%, and Fidelity Real Estate FRESX lost 59%.

In our brief but severe 2020 bear market, Vanguard Long-Term Treasury once again claimed the crown with a 12% gain. Alas, deep-value and energy stock fan Hotchkis & Wiley Mid-Cap Value HWMAX fell 53%.

What I'm Doing The short answer would be not much. I don't like to veer off plan or overreact. I'm slightly increasing exposure to money markets and government bonds. To me, defense is valuable thing. In moderation.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)