Morningstar's Take on the Second Quarter

Our analysis of the second quarter in stocks and funds.

As the second quarter of 2020 comes to a close, Morningstar's analysts have provided in-depth reviews and outlooks across equity sectors and fund categories.

Equities

Here are our analysts' top ideas in each sector this quarter.

A third of our North American coverage mis undervalued compared with two thirds last quarter.

We're Forecasting a Strong Long-Run Economic Recovery

We don't think the market's engaging in irrational exuberance.

What to make of the April to June period.

After the first-quarter market volatility, the time is right to see if any adjustments are in order, writes Christine Benz.

Finding undervalue stocks among challenged dividend-payers.

Here are two stocks that catch our eye.

And what we expect to see moving forward.

But first-quarter wallop still stings.

Q2 Saw Tech Turbulence as Workers Sheltered at Home

What we expect from July.

Communication Services: Battered TV and Advertising Industries Undervalued

Funds

U.S. stocks have pulled off an astounding recovery.

Sustainability Matters: Sustainable Stock Funds Held Their Own in Second-Quarter Rally

They have significantly outperformed for the year to date.

Here's a recap of performance, flows, and fund launches during the tumultuous first six months of 2020.

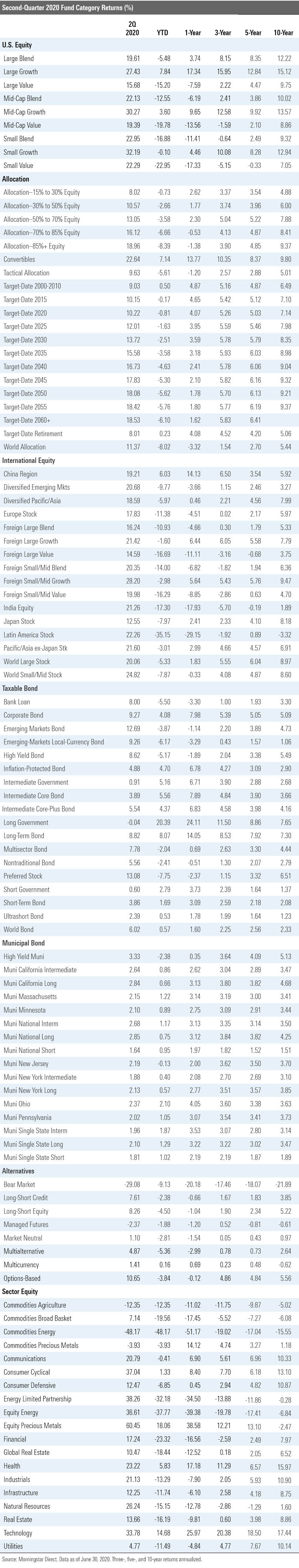

Large growth maintains its supremacy in the Morningstar Style Box during a volatile first half for mutual funds.

Why these funds are struggling and what to do about it.

The comeback was uneven, however.

Riskier Fixed-Income Sectors Bounce Back in the Second Quarter

Decisive central bank action and investor optimism for a swift economic recovery spurred a titanic rally for riskier sectors in fixed-income markets.

As the fears that drove credit spreads to their widest levels in 20 years failed to materialize, corporate credit spreads tightened meaningfully throughout the second quarter.

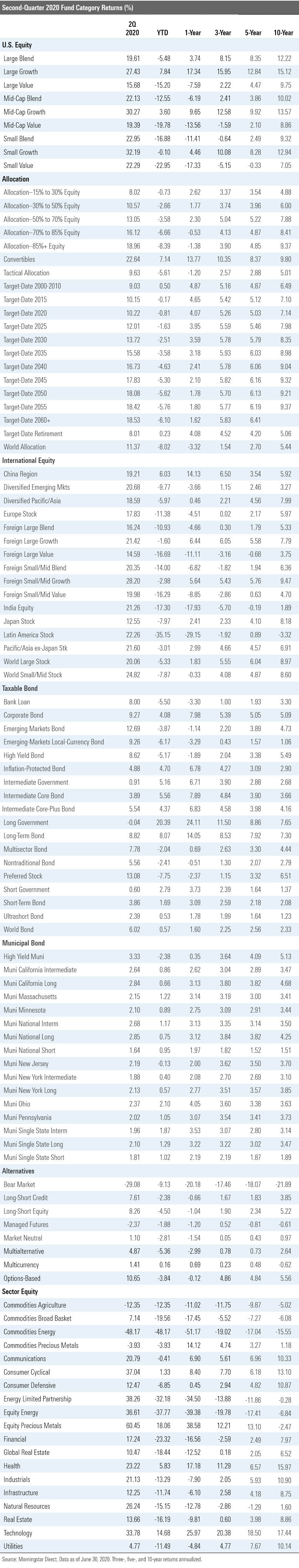

Download the quarter-end data.