ESG Funds Setting a Record Pace for Launches in 2020

Here's a look at some intriguing new sustainable funds so far this year.

A lot has been happening in the sustainable funds universe this year. Sustainable funds have performed well relative to conventional funds amid the global pandemic. They have also received record levels of flows. The pandemic and the movement for racial justice in the United States have likely increased investor interest and will prompt even more people to follow through on that interest with actual investments.

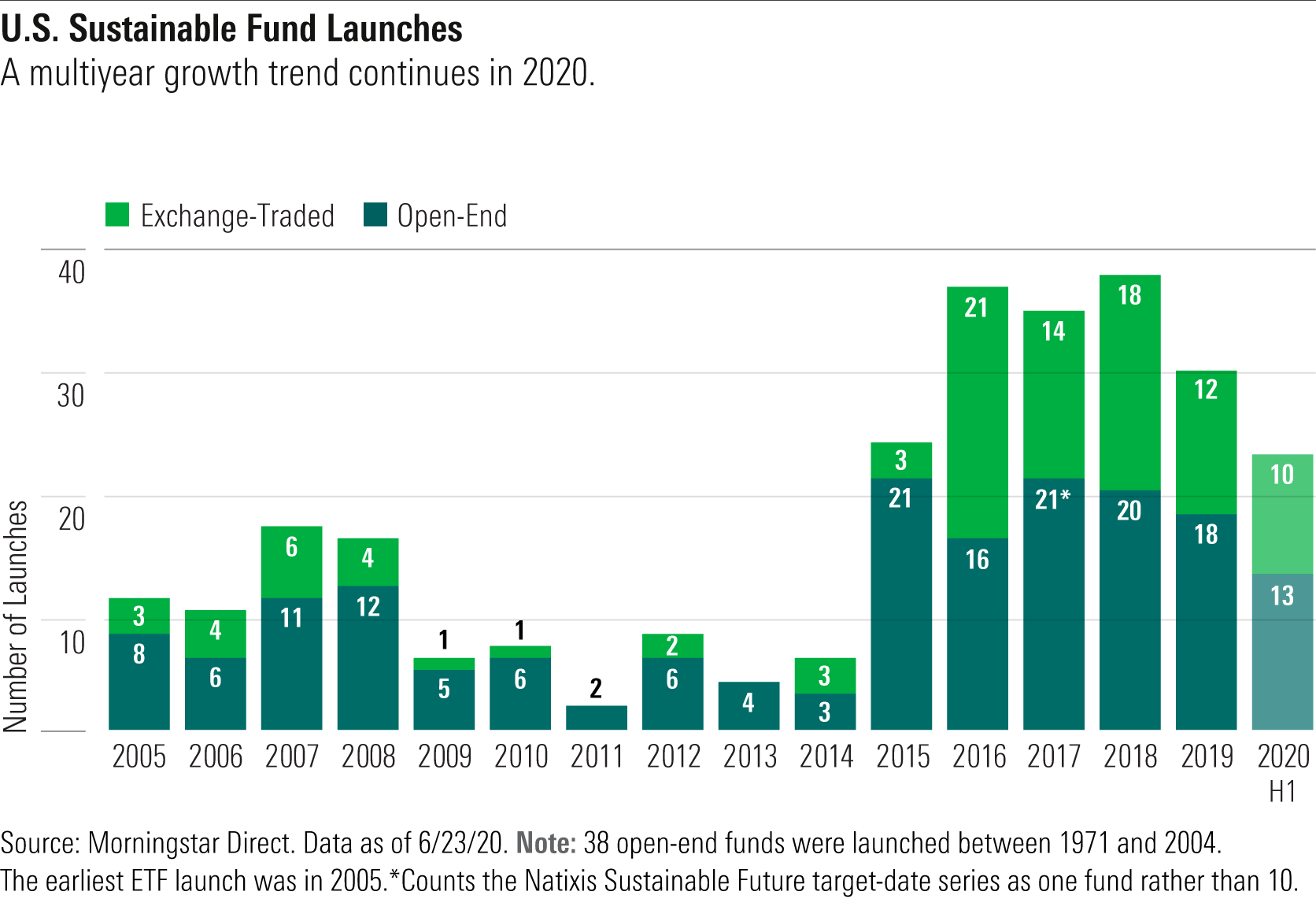

Against that backdrop, the sustainable funds universe continued to grow in the first half of 2020 with 23 new funds launched and three Xtrackers exchange-traded funds repurposed into environmental, social, and governance-focused strategies. With more than 20 new funds currently in registration at the SEC, we will likely see a record number of new sustainable fund launches in the U.S. this year. It would mark the sixth year in a row with more than 20 new launches.

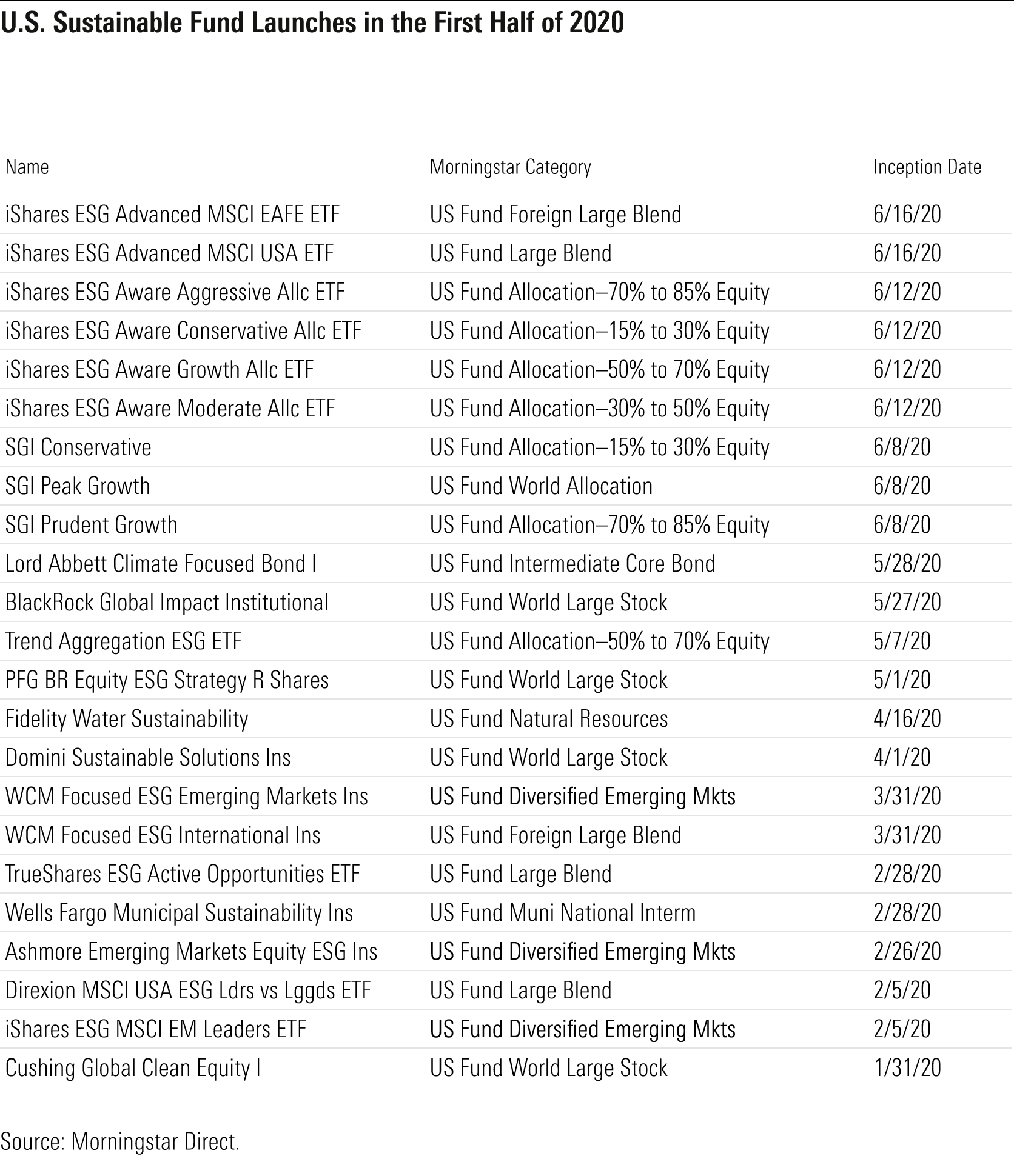

So far in 2020, new open-end sustainable funds have a 13-10 edge on ETFs, but the three repurposed Xtrackers ETFs even up that tally. The new sustainable fund entries this year include seven allocation funds, three sustainable sector funds, three emerging-markets equity funds, two equity impact funds, and two bond funds.

Here's a closer look at a few intriguing sustainable funds that were launched in the first half of 2020:

iShares ESG Aware Asset Allocation ETFs BlackRock CEO Larry Fink announced in January that sustainability would be BlackRock's "new standard" for investing. The firm has followed up on that by launching seven additional iShares ESG ETFs and one BlackRock mutual fund so far this year. Others are in registration for launch in the second half, including a target-date series. The new ETFs already up-and-running bring to 21 the number of ESG and impact-oriented iShares ETFs available to U.S. investors.

Of note are the new iShares ESG Aware Asset Allocation ETFs. These are ready-made asset-allocated portfolios that invest in iShares ESG ETFs covering U.S. large caps and small caps, international developed and emerging markets, and investment-grade intermediate- and short-term aggregate bonds. The seven underlying ETFs are packaged into Aggressive EAOA (80% stock/20% bond), Growth EAOR (60%/40%), Moderate EAOM (40%/60%), and Conservative EAOK (30%/70%) allocation portfolios. All-in fees are 0.18%.

These ETFs certainly make it easy to build a diversified ESG portfolio by investing in a single fund. The underlying ETFs tilt toward companies with strong ESG traits relative to their sector peers. This is done via an optimization process that aims to maximize a fund's exposure to companies with high ESG ratings while keeping tracking error and security and sector weightings close to their respective MSCI conventional indexes.

Their drawback is that, while there are some product-involvement exclusions and one for severe ESG controversies, these ETFs do hold a number of firms that sustainable investors may not be comfortable with, and they are not fossil-fuel-free by any means. In fact, the main U.S. large-cap ETF used, iShares ESG MSCI USA ETF ESGU, holds Exxon Mobil XOM, Chevron CVX, and ConocoPhillips COP, albeit at lower levels than the baseline MSCI USA Index.

The iShares stable of sustainable ETFs does include funds with a greater focus on leading ESG companies (iShares ESG MSCI USA Leaders SUSL, for example) and impact (iShares MSCI Global Impact SDG).You just can't get them packaged together in a ready-made allocation portfolio. The new iShares ESG Advanced MSCI USA ETF USXF and iShares ESG Advanced MSCI EAFE ETF DMXF offer the most comprehensive takes on ESG in the iShares lineup. They are fossil-fuel-free and avoid companies that produce harmful products and services and those with poor overall ESG ratings.

Domini Sustainable Solutions Many sustainable funds focus on using material ESG metrics to evaluate companies, with an eye toward identifying those that have lower ESG risks or that embed sustainability into a successful business model. Their focus is squarely on investment performance, but most sustainable investors are interested in achieving positive societal and environmental impact as well. The 17 UN Sustainable Development Goals, or SDGs, provide a useful framework to guide impact investing in public equities and fixed income. More sustainable funds are now adopting the view that ESG metrics can help them identify good investments from a risk/return perspective, while the SDG framework can help them assess the broader impact of their portfolios.

The new Domini Sustainable Solutions CAREX is an example. It is a globally diversified equity portfolio that plans to keep its holdings to fewer than 50 and limit turnover. It will look for companies with strong ESG credentials that are developing products and services that are helping address the SDGs. Examples include renewable energy, electric vehicles, new medical technologies, healthy food, and financials that support underserved communities. The Domini team, led by founder Amy Domini and CEO Carole Laible, will source the names, and SSGA's Global Equity Beta Solutions group will structure the portfolio weightings. The expense ratio is 1.40% for the investor shares and 1.15% for the institutional shares.

Wells Fargo Municipal Sustainability Speaking of impact, municipal bonds are an asset class well-suited for investing with impact. Why focus on general-obligation bonds issued by wealthy municipalities and states when you can focus on less well-off issuers that have good sustainability credentials and help them finance projects that create social good? That's what an increasing number of sustainable impact muni-bond funds are doing. The most recent addition is Wells Fargo Municipal Sustainability WMSAX. Its expense ratio is 0.45%.

The fund looks for positive environmental or social impact at both the issuer level and the bond's use of proceeds, using these four criteria:

- A bond's proceeds are to be used on a project or activity that offers tangible environmental or social benefits.

- The issuer, through its services or operations, increases or provides new benefits to the environment or society.

- The issuer or the bond's proceeds address an underserved population group.

- The issuer or bond attains a positive third-party ESG rating.

The beauty of this approach is that your muni portfolio can still be managed like a conventional muni fund because the credit profiles and interest-rate risk of impactful muni credits aren't much different from those of the overall universe. This allows impact muni managers to use the same techniques they would in a conventional fund--such as duration management, yield-curve positioning, and credit-quality allocation--to generate federally tax-free income.

Lord Abbett Climate Focused Bond In a similar vein, Lord Abbett Climate Focused Bond CFBAX offers investors exposure to taxable intermediate-term investment-grade bonds along with a positive impact on the climate. The fund invests in issuers (companies or governments) that are involved in the provision of clean energy, energy efficiency, sustainable transportation, clean water, resource management, or low-carbon solutions. It avoids issuers with poor ESG ratings and those involved in fossil fuel, unless the actual bond being purchased is a green or climate-aligned bond with the use of proceeds going to finance positive climate-related projects. Fees are 0.65% for A shares and 0.45% for I shares.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)