Are Small-Cap Indexers Hurting the Performance of Active Funds?

An investigation into a common complaint of active managers.

Some active small-cap managers bemoan the industry’s secular shift toward passive products as a direct cause of their performance struggles. They often claim that heavy flows into indexlike or smart-beta products can distort the prices of small-cap companies due to their illiquidity; the impact of the flows to passive products theoretically outweighs the market movements resulting from the price discovery of other transactions. In turn, less-attractive index constituents rally undeservedly, the active portfolios’ stocks struggle to outperform the index amidst the overwhelming force of the passive flows, and managers don’t get rewarded for discovering sound fundamental companies that may be less prominent in or excluded from the benchmark. This phenomenon contributes to the fund underperforming its benchmark net-of-fees.

While this assertion flows logically, research has not found a relation between flows to passive small-cap products and active small-cap fund performance, and a look into small-cap managers’ performance compared with small-cap asset flows suggests no causal relationship. If this theory were correct, one would expect to see that periods of high passive inflows would correlate with weaker active performance over time.

Methodology For the purposes of this article, the flow data only considers flows to open-end index funds and exchange-traded funds categorized as small-cap. It excludes flows toward total market funds (which invest in small-cap companies as well) because they benchmark to different indexes, making their flows less relevant for small-cap managers who only try to outperform the constituents of their own respective benchmarks. The potential relation stems from flows to passive vehicles tied to the active managers' benchmarks, making small-cap passive products a more reasonable focus.

Since the Russell 2000 Index has tripled in size since the December 2000 start of this study, flows into passive vehicles were scaled based on the Russell 2000’s (the most commonly used, style-neutral small-cap index) market cap at that time; for example, $1 billion of inflows into passive products in 2000 represents a larger influx than $1 billion of inflows in 2020.

Furthermore, since flows into passive small-cap strategies deviate widely on a month-to-month basis, this study makes use of a 12-month rolling sum and compares returns of the oldest share class of actively managed strategies to the Russell 2000 over the preceding 12 months to proxy the success of active managers.

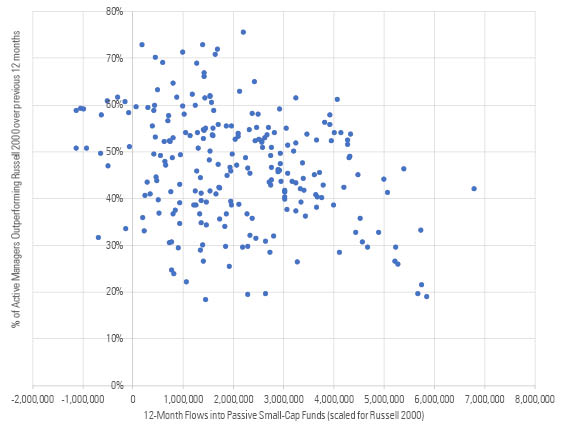

Exhibit 1: Percentage of Active Small-Cap Managers Outperforming versus Passive Small-Cap Flows

Source: Morningstar Direct, author's calculations.

Upon comparing flows into small-cap passives to the percentage of active small-cap funds outperforming the Russell 2000 over the preceding 12 months, no immediate connection seems apparent. Active managers have historically thrived and struggled in various environments regardless of passive vehicle flows, and the shift toward passive strategies hasn’t been consistent, leaving active managers plenty of opportunities to outperform were passive flows their biggest problem.

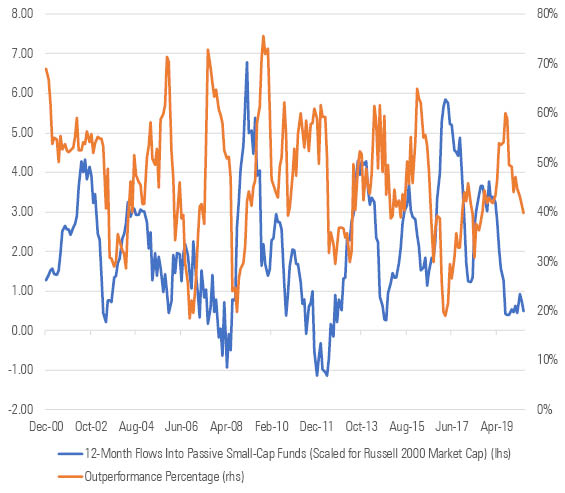

Exhibit 2: The Evolution of Flows into Passives versus Active Manager Performance

Source: Morningstar Direct, author's calculations.

When looking at a time series of the same data, a few periods do support the idea that passive flows adversely affect active manager performance. In the year preceding December 2005, more than 70% of active strategies outperformed the Russell 2000 over the preceding 12 months amidst weaker flows into passives. Over that time, the Russell 2000 rose only 2.5%, perhaps an indication that managers were able to skillfully select the best stocks in an otherwise sleepy market. August 2019 saw 60% of managers outperform over the trailing 12 months while ETF flows fell to several-year lows and the Russell 2000 dropped 15%. Many examples can be found by checking through the data month by month.

However, several periods also saw poor active manager performance even with weak flows into passive products, or vice versa. The year preceding July 2008 also saw low flows into passive products and poor active manager performance, even in the type of volatile equity environment that many managers claim helps them. The year preceding August 2012 saw only 34% of active managers outperform the Russell 2000 while 12-month passive flows were negative.

Meanwhile, heavy inflows into passive products haven’t always been a death knell for active managers by any means. For example, the year prior to August 2009 saw 61% of active managers outperform despite strong flows to passive products, and the year prior to January 2016 saw more than 65% of active managers outperform the Russell 2000 over the preceding 12 months amidst sizable passive inflows.

No Clear Connection It's difficult to conclude that active managers meaningfully suffer from flows to passive products based on this data. While a few periods might lend credence to the idea, just as many exist that would contradict it, indicating that passive flows don't have a direct impact on active manager performance. Stock-picking is a gargantuan task, but flows into passives don't seem to directly make it more challenging.

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)