Top 10 Holdings of Our Ultimate Stock-Pickers' Index

Large-cap strategies disappoint on the back of stock market volatility at the end of 2019.

Overall, 2019 was a difficult year for stocks, and 2020 has shaped up to be even harsher given the COVID-19 pandemic. After a volatile December 2018, the market attempted to rally during the first quarter of 2019. There was a brief period of respite in July with performance ticking up, though that soon sharply reversed toward the end of August. Since then, stocks continued to struggle until the end of October. There was a rally in November through the end of the year as some uncertainty with regard to economic policies such as those governed by the Fed abated and investors became less cautious. After COVID-19 spread across the world, the markets responded strongly and dipped into bear territory, ending a long bull run. 2020 has been characterized by high levels of uncertainty and volatility. With the recent recovery in markets, stocks now trade on par with our analysts’ fair value estimates after a period of undervaluation after the COVID-19 pandemic began to set in.

Taking a look at the cyclically adjusted price/earnings, or CAPE, ratio, which divides the current market price by the average of 10 years of earnings (adjusted for inflation), it currently stands at around 28.02, below where it was when we wrote the last article (30.62). This is compared with a historical mean of 16.72 and median of 15.79, with Shiller relying on market data from both estimated (1881-1956) and actual (1957 onward) earnings reports from companies represented in the S&P 500 Index. Today's levels are relatively in line with levels seen around events such as Black Tuesday and higher than levels seen before the Great Financial Crisis. The CAPE ratio is generally used to assess potential returns from equities over longer time frames, with higher-than-average CAPE values implying lower-than-average long-term annual returns going forward, which is what we're gleaning from the current ratio. While not intended to be an indicator of impending market crashes, it has provided warning signs for investors in the past.

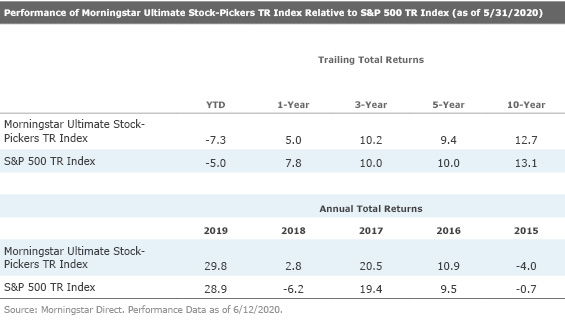

Our own Morningstar Ultimate Stock-Pickers index has not been immune to the trend of underperformance of active management, as it still trails the S&P 500 index year to date, though three-year returns are still outperforming the S&P 500.

Aside from tracking the holdings, purchases, and sales as well as the ongoing investment performance of our Ultimate Stock-Pickers, we also follow the makeup and results of the Morningstar Ultimate Stock-Pickers TR Index. For those who may not recall, the Ultimate Stock-Pickers index was set up to track the highest-conviction holdings of 25 different managers, a list that includes our 21 top fund managers as well as the investment managers of four insurance companies—Berkshire Hathaway BRK.A/BRK.B, Markel MKL, Alleghany Y, and Fairfax Financial FRFHF. It is constructed by taking all the stock holdings of our Ultimate Stock-Pickers that are not only covered by Morningstar stock analysts but have either a low or medium uncertainty rating and ranking them by their Morningstar Conviction Score. The Morningstar Conviction Score is made up of three factors: 1) the overall conviction (number and weighting of holdings), 2) the relative current optimism (holdings being purchased), and 3) the relative current pessimism (holdings being sold).

The index itself is composed of three subportfolios—each one containing 20 securities—that are reconstituted quarterly on a staggered schedule. As such, one third of the index is reset every month, with the 20 securities with the highest conviction scores making up each subportfolio when they are reconstituted. This means that the overall index can hold anywhere between 20 and 60 stocks at any given time (because some stocks may remain as the highest-conviction score holders in any given period, meaning there can be overlaps in the holdings, reducing the total number of different stocks held). In reality, the index is usually composed of 35 to 45 securities, holding 39 stocks in all at the end of May. These stocks should represent some of the best investment opportunities that have been identified by our Ultimate Stock-Pickers in any given period. It can also have more concentrated positions than one might find in a typical mutual fund, with the top 10 (25) holdings in the index accounting for 48.2% (85.8%) of the total invested portfolio at the end of last month. The size and concentration of the portfolio does change, though, as this is an actively managed index that tries to tap into the movements and conviction levels of our top managers over time.

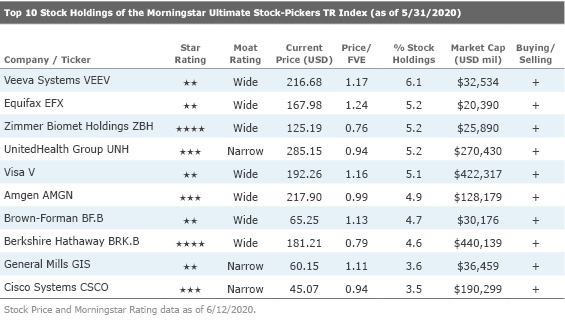

Looking at the top 10 stock holdings of the Morningstar Ultimate Stock-Pickers index at the end of May, there are currently only two names trading at approximately a 10% or more discount to our analysts' fair value estimates. These include wide-moat rated Zimmer Biomet ZBH and Berkshire Hathaway. Another notable name on this list is wide-moat Veeva Systems VEEV, which is first on our top 10 stock holdings list. It currently trades at approximately a 15% premium to Morningstar analyst Soo Romanoff's fair value estimate of $185 per share.

Veeva Systems is a leading supplier of vertical software solutions for the life sciences industry. The company addresses largely unmet technology needs of customers ranging from small, emerging biotechnology companies to departments of global pharmaceutical manufacturers. Morningstar analyst Soo Romanoff maintains the view that Veeva Systems’ best of breed technology and entrenchment into its client’s mission critical operations supports high switching costs that drive the company's wide moat rating.

Veeva has over 860 customers in 130 countries, which includes 19 out of the top 20 life science firms. The robustness of its products and expanding portfolio create cross-selling opportunities to assist clients improve efficiencies and compliance and driving retention trends over 100%. As with software subscriptions supporting mission critical activities, the key elements that generate switching costs are the lost time and expenses that would arise in addition to lost productivity as customers have to re-learn a new system, potential operational risks as a result of data losses, and other operational disruptions. The greater the level of integration of the software system within an organization and the higher its level of importance, the more switching costs the offering can generate and position the company in a better competitive standing.

Romanoff points out that Veeva’s innovative products provide real-time client solutions, improve efficiency, and keep track of milestones all while adhering to strict regulations such as the HIPPA concerns. Pharmaceutical companies heavily rely on inflexible legacy systems to support rigorous workflows from the development to the marketing phase of their offerings, lacking functionality to remain compliant and operate efficiency in an evolving and increasingly competitive market. Veeva offers a wide variety of clean technology solutions, ranging from accurate documentation and regulation on the commercial side to protocols for rapid drug commercialization on the development side. According to Romanoff, such seamless and integrated solutions continue to further differentiate the company from its competition and help generate switching costs for clients.

Veeva's business remains strong and stands to benefit from the faster-than-expected technology adoption with the recent COVID-19 pandemic. As in-person physician meetings were impacted by shelter-in-place orders, Veeva's platform supported a 30 times increase in physician interactions between February and April. Even though the company's shares have appreciated like most quality software peers, Veeva's best-in-class technology supports efficiency in mission critical functions (in underserved markets).

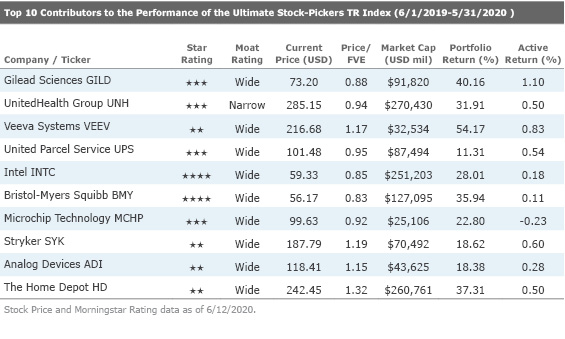

Looking at the year-over-year performance of the Morningstar Ultimate Stock-Pickers index, many of the highest-performing standouts came from the healthcare sector, which supplied five names to the Top 10 Contributors list, and the technology sector, which contributed three names to the list. We note that Veeva Systems and UnitedHealth Group UNH appeared on both the top 10 holdings and top 10 contributors list this quarter. Six of the names on the list are trading at a discount to our Morningstar fair value estimates. These include wide-moat rated Gilead Sciences GILD, United Parcel Service UPS, Intel INTC, Bristol-Myers Squibb BMY, and Microchip Technology MCHP, and narrow-moat rated UnitedHealth Group. Intel is a key player in the technology sector and is trading at a 15% discount to fair value, so we believe it is essential to discuss the company.

Morningstar analyst Abhinav Davuluri sees value in wide-moat Intel, one of the world's largest chipmakers, which develops microprocessors for the global data and personal computer markets. Davuluri argues that Intel's competitive edge stems from its cost advantage in the design and manufacturing of its microprocessors, which grants it a wide moat. Intel has considerable scale, with the company's x86 dominating in PC and server CPU markets, and it is also focused on new chip opportunities such as AI and 5G.

Since semiconductor manufacturing is highly capital-intensive, Intel garners its advantage via investing in process technologies, as well as in high levels of research and development. While the company had some delays in the 10-nanometer process development, it started shipping some 10-nm products in 2019 and aims to use EUV lithography to ramp up its 7-nm process by 2021. With this, Davuluri believes Intel will be able to fend off competitors such as Advanced Micro Devices AMD and transition from a PC-centric firm to a data-centric one.

Intel has weathered the COVID-19-induced economic shutdown well so far. Due to the increase in working-from-home and learning-from-home activities, the company has seen strong cloud and mobile PC demand. Intel's factories are still running, and over 90% of products have seen on-time deliveries. The company is also releasing a whole host of 10-nm products this year, including Ice Lake Server CPUs, Tiger Lake CPUs, and 5G Snow Ridge base station system-on-chip. Overall, even though there might be slower PC demand in the latter half of the year, the increase in cloud computing and shift toward AI should provide some tailwinds for the data center group, and Intel should be able to weather the downturn.

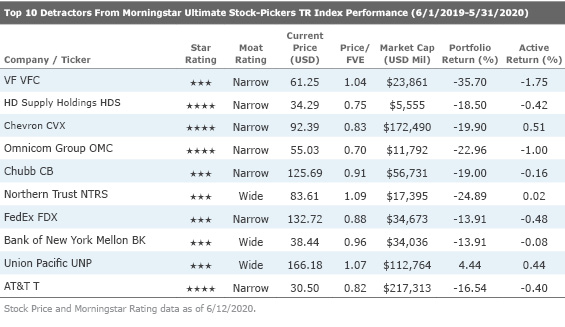

While lists of top-performing stocks are often composed of stocks that have already run up, our top detractors list can sometimes be a good area to pick through the wreckage. Even though these names might not be performing well at the moment, it is possible that there could be some value plays in the long run. From our current list, we will highlight narrow-moat rated AT&T T, which is trading at approximately a 20% discount to Morningstar analyst Michael Hodel's fair value estimate of $37.

AT&T is the second-largest U.S. wireless carrier, connecting over 100 million devices. Hodel believes that AT&T's foray into being a diversified media and telecommunications company will not garner it any special strategic advantages due to the lack of complementary factors between them. Hodel also views the acquisition of Time Warner as an ill-advised capital allocation decision, as companies in the media business must have a wide range of audiences to develop relationships with content creators and defend against rivals. For AT&T, this necessity will be limiting in creating unique experiences for the company's telecom customers. Other wireless providers have also sought to mimic this move, partnering with firms like Netflix and Disney DIS to provide media offerings of their own. While Hodel believes AT&T can benefit from its access to customer data from an advertising perspective, the evolving nature of television viewing presents limitations.

AT&T does benefit from its scale on the wireless side. The company still remains larger than T-Mobile TMUS (post-Sprint acquisition) and benefits from its deep network infrastructure across the United States. It also provides a broad range of services in telecom, particularly to enterprise customers. The T-Mobile-Sprint merger improved the structure of the industry and reduced the incentive for irrational pricing. WarnerMedia also remains a powerhouse in media, with a wide audience-reach and a vast content library, thus providing diversified content offerings. Even though Hodel remains wary of some of this segment's foray into direct-to-consumer, it will help the company's studios and networks remain competitive in the eyes of content creators in the future.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain and Eric Compton have no ownership interests in any of the securities mentioned. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)