Why Hanes Should Be on Your Shopping List

Investors are overlooking the narrow-moat company's mix shift in its business and sustainable free cash flow.

We believe Hanesbrands’ HBI transformation is underappreciated by the market and that the risk/reward of an investment is very favorable, as the shares trade well below our $23 fair value estimate. In our opinion, investors are focused on difficulties in the company’s low-growth innerwear operations and partial dependence on physical retail in the United States and are overlooking the mix shift in its business and its sustainable free cash flow generation. Through a series of acquisitions (at a cost of about $2.7 billion since 2013), Hanes has transformed its brand portfolio into a more diversified and global operation with higher margins and returns. Its Champion brand has grown into a multinational athleisure brand with a significant following and growth opportunities. We think cohesive management of the brand will allow Champion to stand on its own even if the athleisure fashion trend fades.

Moreover, we believe Hanes has margin improvement opportunities stemming from the potential for additional acquisition synergies and supply chain initiatives as we think it can scale its advantaged in-house manufacturing competency. We forecast operating margins above 14% in 2024 and thereafter, something that Hanes has failed to achieve in the past two years. While the COVID-19 crisis has slammed all international apparel companies in 2020, we think Hanes may recover faster than most as its products have limited fashion risk, are purchased regularly regardless of economic conditions, and are available in a large variety of retail outlets, some of which have remained open during the pandemic.

Hanes Creates Value by Going Global and Utilizing Its Supply Chain We think investors underestimate how much Hanes' business has changed over the past seven years. The company closed seven major acquisitions between 2013 and 2018: Maidenform, DBApparel, Knights Apparel, Champion Europe, Pacific Brands, Alternative Apparel, and Bras N Things. Hanes paid for these deals with cash flow and borrowings. When pursuing a deal, Hanes targets an internal rate of return in the low teens or better, which we view as value-enhancing, considering our 8.4% estimated weighted average cost of capital.

One of the benefits of this series of tie-ups is that Hanes has grown from its U.S. roots into a group of brands with international appeal. The company was almost completely dependent on the U.S. market in the first few years after it was spun off from Sara Lee. In 2012, approximately 89% of its sales were to customers in the U.S. and 5% of sales were outside the Americas. By 2019, however, Hanes’ share of revenue from the Americas had dropped to 67% after acquisitions of international businesses and higher growth in some of its foreign markets. Since 2012, Hanes has entered several regions where it previously had zero or minimal presence, including Europe, South Africa, Australia, and New Zealand. Between 2012 and 2019, we estimate Hanes’ share of revenue from the Asia-Pacific region grew to 18% from 3% and its share of revenue from Europe grew to 15% from 0%. In 2019, Hanes’ international segment composed 36% of its total sales and surpassed U.S. innerwear as its largest segment. We foresee continued growth abroad as Hanesbrands adds points of distribution and aligns its business with local consumer trends.

The fruits of this acquisition spree haven’t been limited to the company’s geographic footprint. Hanes reports in three segments: innerwear, activewear, and international. In 2012, U.S. innerwear contributed roughly 55% of Hanes’ total revenue, with activewear about 34% and international about 11%. In 2019, the share of Hanes’ revenue from U.S. innerwear was only 33%. Its U.S. innerwear has declined in importance due to international growth, store closures, and weakness in some of its categories. Its activewear business has grown through acquisitions and organic growth. We forecast negligible growth for Hanes’ innerwear but rosier prospects for the activewear and international segments.

We believe the opportunities afforded by these tie-ups have failed to win over the market, potentially because of the resulting increase in debt. Hanes’ short- and long-term debt grew to nearly $4.0 billion at the end of 2017 from $1.5 billion at the end of 2012, and net debt/adjusted EBITDA increased to 3.4 times from 2.8 times. However, we think the acquisitions were worthwhile to reduce dependence on innerwear in the U.S. Through cash generation, we forecast Hanes will reduce total debt to $2.9 billion at the end of 2024 from $4.3 billion at the end of 2020, resulting in a decline in net debt/adjusted EBITDA over that span to below 2 times from about 5 times.

Even though Hanes is burdened with significant debt at present, we believe the COVID-19 crisis may create some attractive acquisition opportunities. The company has not completed a major acquisition in more than two years, possibly because valuations have been high. However, the pandemic may cause otherwise viable apparel manufacturers to fall into financial distress. We think Hanes may have the capacity to close a deal or two if it can identify vulnerable manufacturers in its core categories.

Innerwear Is Basic but Also a Defensible and Profitable Business We believe the market also fails to appreciate Hanes' solid brands. Our intangible asset-based narrow economic moat rating is primarily due to the strength of the company's innerwear brands, several of which are more than 50 years old. Hanes is among the share leaders in multiple categories in such countries as the U.S., Canada, Mexico, Australia, New Zealand, France, Spain, Germany, and Italy. Depending on the territory, Hanes has high market share in socks, men's underwear, T-shirts, children's underwear, women's intimates, and women's hosiery. While the price points in most of these categories are relatively low, volume is high as these are replenishment products that people buy on a regular basis. According to Euromonitor, Hanes is the ninth-largest apparel company in the world by retail sales. Its most important markets are the U.S. and Australia, where it is third and second, respectively, in total retail apparel sales. In the U.S., Hanes' apparel sales trail only Gap (including Old Navy and its other brands) and Nike, outpacing such well-known companies as Levi Strauss, Adidas, Target, and Lululemon. Moreover, Hanes, with 2.5% share in 2019, has more than double the U.S. apparel market share of direct competitor Fruit of the Loom (1.1%).

Underwear may be boring, but the margins can be surprisingly good. U.S. innerwear has the best profit margins of any of Hanes’ segments. In 2018 and 2019, Hanes reported operating margins for this segment of 22.6% and 23.0%, respectively. These segment margins are about 10 percentage points higher than those achieved by PVH’s Calvin Klein and Tommy Hilfiger in North America. They are also well above Hanes’ activewear margins (14.9% in 2018, 15.2% in 2019). Hanes’ high margins are partly due to pricing but mainly due to very high volume. Hanes produces vastly more units of innerwear than competing brands like Fruit of the Loom and Jockey and more upscale brands like Calvin Klein. This high volume allows it to negotiate good prices with suppliers and leverage fixed-cost overhead. Also, Hanes has excellent visibility on input costs as it does a lot of manufacturing itself (about 70% of its production), ensuring that it does not overpay third-party suppliers as commodity and labor costs change. Hanes’ innerwear has better margins than activewear because innerwear has a smaller number of stock-keeping units and uses fewer types of fabric.

We believe Hanes is performing well in men’s underwear, while its women’s business is challenged. Hanes is the leader in the $36 billion global men’s underwear market. According to Euromonitor, the company has 7.5% share of the worldwide market, up from 6.2% in 2014 and nearly double that of second-place Fruit of the Loom (4.0%). In North America, Hanes has 36.0% market share of the $6.2 billion men’s underwear market, more than the combined shares of second-place Fruit of the Loom (21.1%) and third-place Jockey (7.7%). Moreover, Hanes has expanded its share by 390 basis points since 2014, largely at the expense of both Fruit of the Loom (down 160 basis points) and Jockey (down 90 basis points). Meanwhile, another longtime competitor, Gildan, has all but abandoned its efforts to establish a brand in men’s underwear. We believe Hanes outperforms others due to its product innovation, marketing, relationships with retailers, and popularity with consumers.

However, we think Hanes has lost share in the $84 billion global women’s underwear market. The company owns many well-known brands in the space, including Playtex, Bali, Maidenform, and Hanes itself. Some of these brands, though, have been stung by store closures and declining customer traffic at retailers that carry them. This has been especially true in the U.S., as Hanes is the largest women’s brand in department stores. While each of its brands is popular in specific niches, they may be perceived as mainstream by consumers and none are strong among all ages and body types. The size and fragmented nature of women’s innerwear has attracted many competitors, putting pressure on market pricing as the market itself has minimal growth. Hanes is the second-largest producer (according to Euromonitor) of women’s intimates in the $13.6 billion North American market with 15.3% share, trailing only Victoria’s Secret (25.3%). However, both Hanes and Victoria’s Secret (which has significant problems of its own) have lost share over the past five years. They have been hurt by the rise of athletic brands like Adidas and Lululemon, cheap imports, and upstarts like ThirdLove, Adore Me, Lively, and American Eagle Outfitters’ Aerie, the last of which increased its annual sales to about $825 million in 2019 from just $310 million in 2015.

Despite Hanes’ struggles in women’s underwear in the U.S., the innerwear segment remains highly profitable. Moreover, Hanes’ problems appear to be more manageable than those of Victoria’s Secret, which is a mall-based retailer with limited flexibility and an arguably broken brand (Morningstar recently downgraded parent L Brands’ moat rating to none from narrow). We do not believe that Hanes’ brands have fallen out of favor, but the company does need to make changes as the market evolves. As a wholesaler to all types of stores, it should be able to shift sales to stronger channels. Our expectations for Hanes’ innerwear business are modest, as we assume long-term growth of just 2%.

Hanes’ struggles in the women’s innerwear market in North America contrast with its success in Australia. According to Euromonitor, Hanes has more than 4 times the market share of anyone else in the AUD 960 million (2019) women’s underwear market in the country. Across all its brands, Hanes’ total share of the women’s underwear market grew to 28.4% in 2019 from 0% in 2015. Hanes owns three of the four largest brands in Australia: Bonds, Bras N Things, and Berlei. These three brands compose 21.6% of the market and have been gaining share under Hanes’ ownership. Bonds and Berlei have increased their shares to 13.1% and 4.1% from 10.6% and 3.7%, respectively, since Hanes acquired them as part of its Pacific Brands acquisition in 2016. Bras N Things, acquired in 2018, experienced a 50-basis-point share increase between 2017 and 2019, to 8.4% from 7.9%.

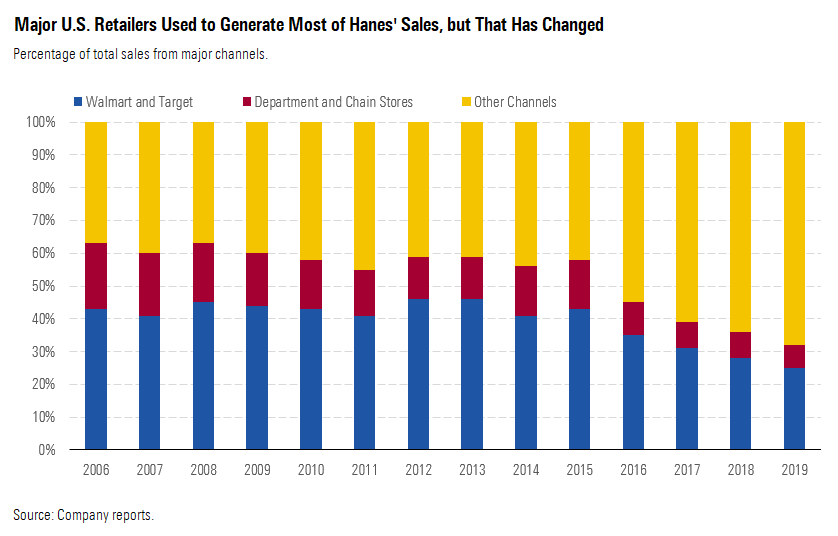

No Longer at the Mercy of the U.S. Mass Channel Thanks to the deals that have been completed since 2013, Hanes has lowered its exposure to the U.S. wholesale market. We believe this has effectively reduced its reliance on a channel that has been challenged by store closures, sales lost to e-commerce, and inventory reductions. Hanes has broad distribution across U.S. retail, as its products are available at most apparel retailers, including department stores, mass-market stores, dollar stores, warehouse clubs, and even drugstores and supermarkets. However, Hanes has reduced its exposure to American physical retail. Domestic wholesale accounted for 77% of Hanes' 2012 total sales, but only 52% in 2019. We expect the importance of Hanes' domestic wholesale will continue to decline as we forecast its international segment will grow twice as fast as U.S. innerwear over the next decade, with assumed long-term growth of 4% for international and 2% for U.S. innerwear. In our opinion, Hanes had little choice but to change its sales model, as the shift to online channels and discount stores has resulted in store closures by many retailers that carry or have carried its products, including Sears/Kmart, Macy's, and J.C. Penney, and we expect this trend to accelerate in the wake of COVID-19. Between 2006 and 2019, the percentage of Hanes' sales to U.S. department stores and national chains dropped to 7% from 20% through diversification, international growth, and customer attrition at these stores. Hanes has responded by diversifying its distribution by channel and geography, a factor that we believe the market has been slow to grasp but stands to improve its prospects. In 2019, for example, 18% of its U.S. sales were "consumer-directed" through its own stores and e-commerce or third-party e-commerce, up from 15% in 2017.

Hanes has also reduced its dependence on the U.S. mass channel. The ongoing shift to e-commerce is just the latest change in how Americans shop for clothes. Hanes adapted to a previous shift when, beginning in the 1980s, mass-market stores replaced department stores as the primary retailers of basic apparel. For many years, Hanes depended on Walmart, Target, and to a lesser extent Kohl’s for as much as half of its sales. In 2012, for example, Walmart and Target combined accounted for 46% of Hanes’ total sales. By 2019, however, the two retailers had dropped to 25% of Hanes’ worldwide sales. For the most part, we do not think Hanes’ innerwear has lost innerwear shelf space at these retailers. Rather, we believe other parts of Hanes’ business have grown through diversification. For example, Hanes has greatly increased sales from Europe and Asia-Pacific (mainly Australia).

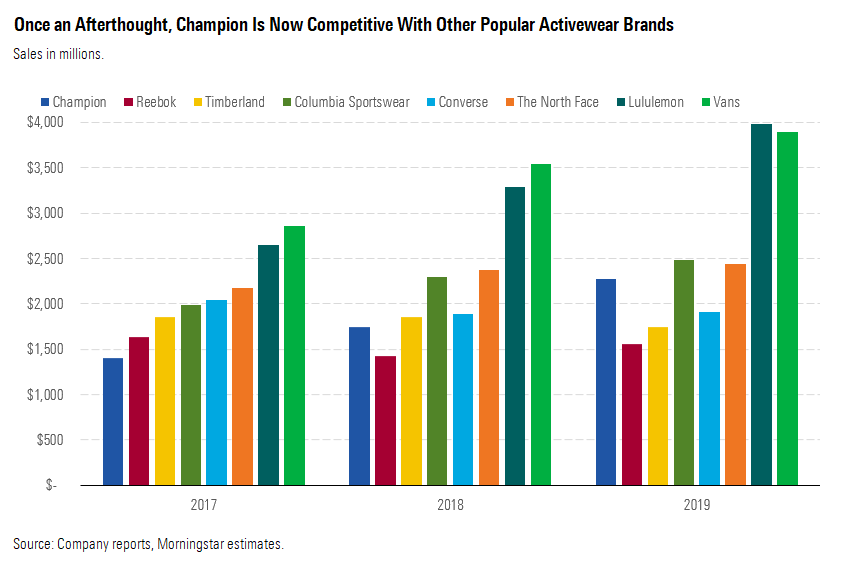

Champion Is an Athleisure Winner The growth of Champion since Hanes unified the brand worldwide in mid-2016 is another success story that investors have overlooked. Global sales of Champion, which is included in all three of Hanes' reporting segments, jumped to about $2.3 billion in 2019 from approximately $1.2 billion in 2016, a compound average annual growth rate of about 23%. Champion, which contributed about 33% of Hanes' 2019 revenue, has benefited from the athleisure fashion trend, sports-inspired clothing worn daily. Champion is now in a class that includes such brands as VF's Vans and The North Face, Gap's Athleta, Patagonia, Fila, and Lululemon.

It is only recently that Champion has been managed as a single, worldwide brand. The label celebrated its 100th anniversary in 2019. For much of its history, it was best known as a supplier of college sports uniforms and fan apparel. In the 1990s, Champion supplied uniforms for all NBA and NFL teams and the 1992 U.S. Olympic basketball “Dream Team.” By the early 2000s, however, Champion had lost many of its professional and college uniform deals as Nike and other footwear brands gained prominence and pushed traditional uniform makers aside. In 2001, under pressure from investors to simplify, former owner Sara Lee carved up Champion by geography. Later, an independent Hanes spent about $500 million to reassemble it. Thus, Champion has only had consistent worldwide product and marketing under Hanes’ control for a few years, and we think this could prove a lucrative advantage that is only now beginning to be tapped.

Champion has enjoyed a resurgence in popularity. The brand has benefited from strength in the U.S. athletic apparel category, as it has moved into specialty and more upscale retail, grown internationally, and expanded its assortment. Its lifestyle apparel assortment has brought new distribution and driven incremental shelf space in existing wholesale accounts. Hanes has pursued three major goals for Champion: greater distribution in existing markets, increased consumer-directed sales, and geographic expansion. In the last few years, Champion has added retailers, such as Urban Outfitters and Foot Locker, that had not previously carried the brand. The label’s growth has been fueled by the athleisure trend and a renaissance of 1990s fashion. For example, Fila, which also had its athletics heyday in the 1990s, tripled its worldwide sales between 2016 and 2018. Champion and many others, including Nike, Adidas, Vans, and Off-White, have benefited from the rise of apparel known as streetwear, casual clothing worn by urban subgroups. PwC estimates the global retail streetwear market at $185 billion and reports that 60% of streetwear consumers are under the age of 25, Champion’s primary demographic. Champion is now as large as some activewear brands that are household names.

We expect Champion will continue to be a main driver of Hanes’ growth for years to come. Although this projection is partially dependent on the longevity of athleisure, we feel confident that this style is a change in how people dress rather than a mere fashion trend. In 2019, excluding its C9 subbrand, Champion generated $1.92 billion in (wholesale) sales, putting it on track to easily surpass Hanes’ prior goal of $2 billion in 2022 sales. Champion’s 2019 sales were evenly split between the U.S. and international. While most of the brand’s sales are in activewear (sweatshirts, hoodies, jackets), Hanes uses it for basics (underwear, socks) as well. Activewear composed about 90% of Champion’s U.S. sales, with innerwear accounting for the rest. Hanes’ U.S. activewear margins have benefited greatly from the growth of Champion, rising from the midsingle digits to the midteens over the past few years.

We think Hanes has an opportunity to open many Champion-branded stores in the U.S., Europe, and Asia-Pacific, which we think will enhance the value and staying power of the brand. As with its other product lines, we think Hanes must reduce Champion’s dependence on traditional physical retail as shopping patterns change. While there were already a handful of Champion outlet stores in the U.S., Hanes opened its first-ever U.S. full-line, stand-alone Champion store in Los Angeles in 2018 and has since opened additional stores in New York, Chicago, Boston, Philadelphia, and Las Vegas. These stores are designed to do more than just generate sales. They promote the brand in key cities and produce useful data that enhances wholesale and e-commerce. Moreover, as the Champion stores allow consumers to customize their clothing, the stores serve as barometers of fashion trends.

Champion has experienced increased popularity on social media. As of early June, the number of Champion’s Instagram followers stood at 5.9 million, up from 2.0 million in January 2018 and just 200,000 in January 2017. Champion now has more Instagram followers than many notable activewear and fashion brands. Further, according to Google Trends, searches for Champion in the 2019 holiday season were more than 5 times greater than in the 2016 holiday season. Google released its top searches for 2019 and “Champion outfit” placed ninth in the category of “outfit ideas.” Amazon, too, has provided evidence of Champion’s increased popularity. In a press release on its 2019 holiday sales, it cited Champion as one of the most popular brands bought with Prime Wardrobe. It also singled out athleisure as a top gift trend and mentioned Champion and a few others (including Nike and Adidas) as “customer-loved brands.”

Even though Hanes suffered a setback with the loss of the C9 contract at Target, it quickly found another quality partner. In 2004, Hanes created an exclusive subbrand for Target called C9 by Champion. According to the 2015 book Fixing Fashion by former Hanes supply chain manager Michael Lavergne, Target demanded short production times for C9, hastening Hanes' move to offshore production. The brand was a consistent performer for Target for years and its products received strong ratings on its e-commerce site. The brand generated retail sales of as much as $1 billion for Target in some years. In January 2020, though, Target replaced C9 with a new internally created activewear brand called All in Motion, part of the retailer's broader strategy to build its own brands. The news seemed to indicate that the C9 label would disappear. However, in March 2020, Hanes announced an exclusive, multiyear agreement with Amazon Fashion for C9 apparel and accessories. This storefront is separate from the longstanding Champion storefront on Amazon as C9 is positioned as a value activewear brand. While we do not expect C9 will reach the sales levels it achieved at Target in the foreseeable future, the new partnership will put C9 in front of Amazon's enormous customer base and, for the first time, make it available worldwide.

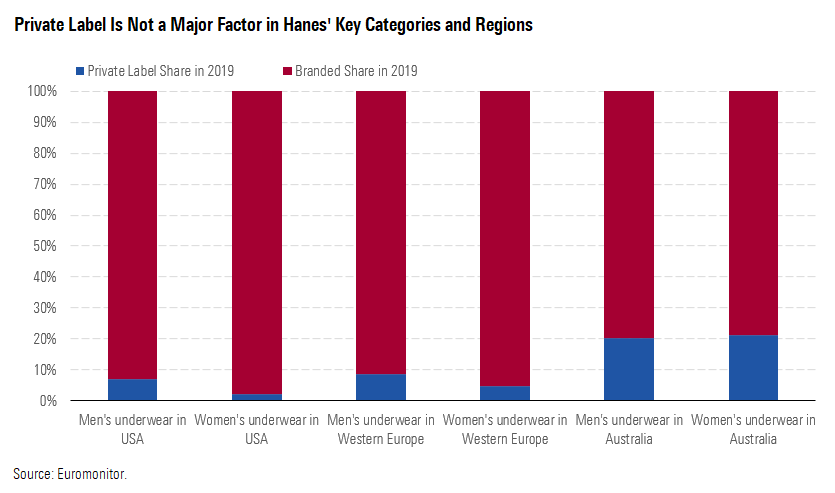

Private Label Shouldn't Hurt Hanes' Trajectory The threat of private-label apparel is often cited as a major risk to Hanes. To improve margins, many retailers have replaced brand-name clothing with their own brands. Walmart and Target, for example, have been looking to offset investments in grocery and e-commerce by finding margin opportunities in other parts of their stores. According to a 2018 NPD report, private-label clothing now accounts for just over one third of apparel unit share and nearly one third of apparel dollar share. Moreover, as the unit and dollar growth of private apparel brands continue to outpace the growth of national brands, captive brands could constitute 40% of the market within a few years. As Hanes owns and operates manufacturing and distribution, it could participate in this market if chose to do so. The company has, in fact, manufactured private-label products in the past but largely quit the business in 2012. Hanes has avoided private-label deals in recent years because of the significant investment required, depressed profitability, and short contract lengths (typically rebid on an annual basis), providing little visibility on their long-term value and the return on investment. Gildan, for example, has a large private-label business and its gross margins (in the mid-20s) are consistently lower than those of Hanes (close to 40%).

Hanes does not see private brands as competitive threats in many of its major categories and sales territories, a sentiment that we share. Branded underwear outsells private-label offerings by large margins. The relatively low shares of store brands in innerwear make sense given the low prices of the products. At Walmart.com, for example, a six-pack of George (store brand) men’s boxer briefs sells for $14.98 versus $16.98 for a five-pack of Hanes’ Comfort Flex men’s boxer briefs, a difference in price of 36% per unit in percentage terms but only $0.90 per unit in dollar terms (prices as of June 2020). Most consumers, mostly likely, will not buy generic underwear to save $0.90 when they believe that the name-brand underwear is of superior quality. Indeed, as of June 2020, nearly all the 25 best-selling men’s boxers on such large U.S. e-commerce sites as Amazon, Macys.com, and Walmart.com are branded products, mostly from Hanes and Fruit of the Loom. Hanes has a large store on Amazon, which it says has grown to be a top-five customer from practically nothing in the early part of the 2010s.

We think few competitors can deliver decent products at a lower cost than Hanes. Although private-label apparel is usually touted as the low-cost choice, we think Hanes has competitive advantages that allow it to price competitively while achieving decent profit margins. Retailers are looking for suppliers with responsive supply chains, and Hanes views the ability to manufacture at scale in the Western Hemisphere as a competitive advantage that insulates against private-label competition. Moreover, as many private-label producers are based in China, the trade war, associated tariffs, and possibly the coronavirus crisis have created uncertainty and made many private-label providers less competitive. As evidence of Hanes’ cost-competitiveness, it is the primary supplier of underwear and socks at Dollar General, a dollar store chain that caters to low-income customers and only carries inexpensive goods (on an absolute basis).

Cash Is King, and Hanes Will Return Much of It to Shareholders We think investors also fail to appreciate the strong free cash flow characteristics of Hanes' business. Through efficiency improvements as it has integrated acquisitions, Hanes has expanded its operating margins. These enhanced levels of profit have resulted in improved operating cash flow, even though organic growth has been limited, because its capital expenditure needs are low after building out its supply chain during 2005-10. Hanes' capital expenditures have been less than 1.5% of sales, or about $100 million per year on a revenue base of about $7 billion, and we do not think any significant increase will be necessary. The combination of improved margins and lower capital expenditures has translated into a business with strong cash generation. Hanes' free cash flow to equity jumped to 10.0% of sales in 2019 from 8.2% of sales in 2018 (to $702 million from $557 million). Due to the pandemic, we forecast Hanes' free cash flow to equity will drop about 50% this year but will rise steadily after the virus has been contained. We forecast yearly free cash flow to equity will average about $800 million (11.3% of sales) in 2022-29.

We expect Hanes will return significant cash to shareholders after the COVID-19 crisis. After paying down considerable debt, Hanes instituted an annual dividend in 2013 of $0.10 per share (split-adjusted). By 2017, the dividend had increased to $0.60 per share. The company has not raised its dividend since 2017, though, as it has prioritized debt reduction. Hanes’ prudent use of capital has allowed it to maintain its dividend during the pandemic, and its dividend yield of about 5% is one of the highest among U.S. apparel manufacturers. We expect Hanes will hold its current dividend through 2022, but we model yearly dividend increases of 12.5% thereafter. We forecast an average dividend payout ratio of about 39% in 2021-29, close to the ratios of the last two years.

We also expect Hanes will return significant capital to shareholders in the form of share repurchases. In 2015-17, Hanes spent a total of $1.1 billion to repurchase 46 million shares, reducing its total share count by about 10%. The company did not repurchase any shares in 2018 or 2019 but resumed buybacks in the first quarter of 2020 with $200 million in repurchases at an average price of $13.83. The pandemic hit soon after, and the company immediately suspended repurchases to conserve cash. We forecast buybacks will resume on a small scale in 2021 and slowly build from there. We forecast Hanes will return most of its free cash flow to equity to shareholders as dividends and buybacks over the next decade. We forecast a 27% decline in its shares outstanding between the end of 2019 and the end of 2029, providing value to shareholders. We believe buybacks would be highly accretive if completed at prices below our fair value estimate.

Investors Who Love Bargains Should Add Hanes to Their Shopping List All of the aforementioned factors have led to Hanes trading at an attractive valuation based on its relative and historical free cash flow multiples. At the end of 2019, Hanes had a free cash flow yield of 13.0%. This was about double the median of a peer group of apparel manufacturers and well above normal levels for Hanes. Between 2009 and 2018, the company's average free cash flow yield was around 7%, even though its free cash flows were inconsistent. While we anticipate a decline in free cash flow in 2020, we forecast that it will eclipse the 2019 level in 2022.

Given the huge transformation of its business, its strong market share in key categories in multiple countries, and the potential for Champion, we are comfortable with our fair value estimate of $23 per share for Hanes. The market views the company as stagnant, but we see potential. The COVID-19 pandemic is a huge challenge for all apparel manufacturers this year, but we forecast Hanes will remain profitable and that earnings and cash flow will begin to rise again in 2021 after the pandemic has been contained. Hanes trades at less than 10 times our 2021 earnings per share forecast of $1.22, which is not an aggressive valuation based on historical norms. We think this is an excellent time for investors to stock up on this value stock.

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)