10 Undervalued Stocks With Momentum

These quality stocks have gained more than 15% in the last three months yet still look undervalued to us.

Market turmoil? What market turmoil?

That's what investors who own shares of Amazon.com AMZN may be asking themselves: The stock has gone up nearly 30% during the past three months. Facebook FB and Apple AAPL are up more than 16% apiece, too. The S&P 500, meanwhile, is still in negative territory for the period, albeit only by about 5% as of this writing.

Indeed, the market has staged a phenomenal comeback after hitting lows in March, and as a result, many once-undervalued stocks now find themselves fairly valued or overvalued.

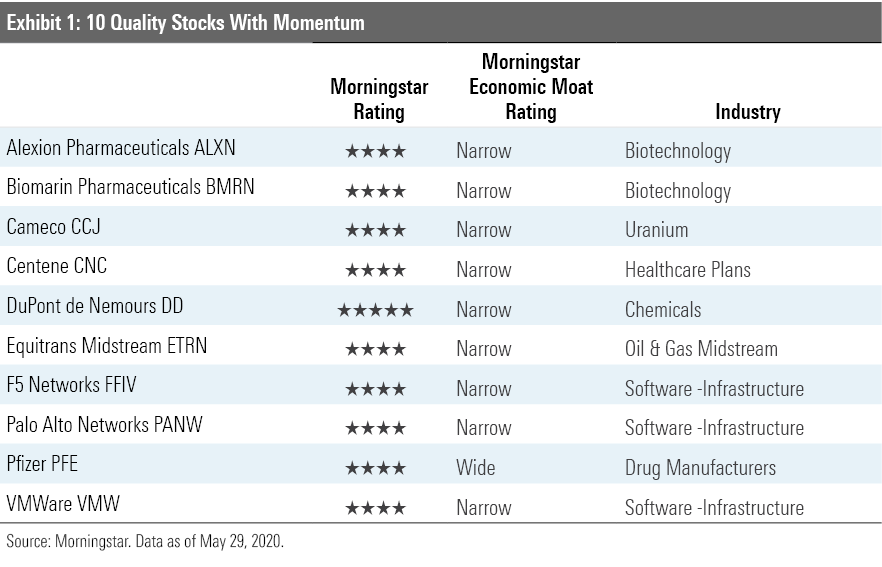

Today, we're looking at quality stocks that have performed well during the past three months that we think still have gas left in the tank. Specifically, we screened for stocks with wide or narrow Morningstar Economic Moat Ratings; these companies have unassailable competitive positions that should allow them to thrive over the long term. And although these names have each returned more than 15% during the past three months as of this writing, they're currently trading at 4- or 5-star levels. Put another way, the prices of these rallying stocks are at a sufficient discount to our fair value estimates to still be considered undervalued today.

Ten stocks made the cut.

Here's what our analysts recently had to say about three of the names on the list.

Centene CNC "We are launching coverage of another top-tier health insurer, Centene. With its focus on government-sponsored plans, Centene offers limited risks surrounding potential U.S. healthcare policy changes and the COVID-19 economic downturn, which makes it unique within the managed-care industry. Like the other managed-care providers, though, we see significant competitive advantages around this organization, and its moat rating (narrow) and trend (stable) remain in line with the other major health insurers on our coverage list. Centene's shares are also trading moderately below our fair value estimate.

"Centene focuses on providing government-sponsored healthcare plans, with a concentration in Medicaid, Medicare, and the individual exchanges. With most of its profits and members coming from the Medicaid program, we think this business is the primary determinant of the company's moat rating and moat sources, which we believe are cost advantage and switching costs. Overall, as a reward for accessing Centene's Medicaid plans that can reduce costs and risks for the states, we think states will continue giving Centene the opportunity to generate adequate returns over capital costs for a relatively long period of time due to its contractually supported and entrenched relationships with each state, which informs our narrow moat rating.

"Also, Centene's concentration in government-based programs differentiates it from the other managed-care companies we cover, which are more focused on the employer-based insurance channel than Centene. Centene may benefit from this different concentration in both the near and long term. In terms of economic sensitivity, Centene's major product lines are at least neutral, as in the case of Medicare (serves older Americans), or countercyclical, as in the case of Medicaid (serves low-income Americans) and the individual exchanges. So Centene may actually benefit somewhat from layoffs in the U.S. economy related to COVID-19."

--Julie Utterback, senior analyst

Cameco CCJ "Cameco was arguably more prepared for the sudden economic shock from COVID-19 given it's been focused on liquidity and free cash flow preservation amid the continuing challenges in the uranium market. COVID-19's near-term impact is somewhat mixed, as lower energy needs from declining economic activity and health prevention practices are likely to slightly weigh on demand. However, the pandemic has also led to even more production curtailments, with Cameco indefinitely placing Cigar Lake on care and maintenance and Kazatomprom cutting its 2020 production forecast by about 8% of global supply. Given the oversupply that's weighed on uranium prices for years, the additional production cuts are a welcome addition. In fact, spot prices have risen from $27 per pound to about $33 per pound in April alone, now reaching levels not seen in years.

"Given the significant uncertainty the COVID-19 pandemic has created, Cameco withdrew its 2020 outlook in mid-April. While the near-term impact is unclear, we think that lower production helps long-term prices by reducing excess supply in the market. We view the rapid price appreciation in the spot market as indicative of this and should help Cameco achieve better contract prices. We've made minor adjustments to our model, leading us to raise our fair value estimate slightly to $16 and CAD 22.50 per share, up from $15.50 and CAD 20.50, respectively, for narrow-moat Cameco.

"The company remains more than adequately liquid, with CAD 1.2 billion in cash and short-term investments, CAD 1 billion in an undrawn credit facility, and no major debt maturities until 2022.

"Shares remain undervalued, as we think the market underestimates the unsustainability of recent prices. However, we reiterate our high uncertainty rating. Although we continue to believe better prices will need to bring both mothballed and new mines into production to meet still-rising demand, the timing of the recovery is uncertain due to the opaqueness of the market."

--Kris Inton, director

VMWare VMW "Narrow-moat VMware's 12% year-over-year revenue growth beat CapIQ consensus estimates due to strength across its portfolio, and non-GAAP EPS of $1.52 solidly exceeded consensus due to lower costs because of the coronavirus pandemic. Subscriptions and SaaS offerings had another profound quarter of growth across various products, and license revenue benefitted from increased demand for end-user compute, or EUC, and virtual desktop infrastructure, or VDI, solutions. In our view, VMware's position as the commonality across hybrid-cloud networks is taking hold with customers and the company's diverse product offerings is allowing entities to consolidate their networking spend toward VMware. Shares rose 9% after VMware reported, and we are maintaining our $202 fair value estimate. We believe investors have an attractive entry point for our best idea within the networking sector.

"Compared with the prior year, license revenue expanded by 2%, subscriptions and SaaS grew by 39%, and services increased by 8%. License sales demand came from organizations requiring EUC and VDI for operational continuity as shelter-in-place orders required individuals to access applications and resources remotely. Subscriptions and SaaS also had strong performance from EUC, as well as robust demand for Carbon Black cybersecurity, VeloCloud software-defined wide-area networking, or SD-WAN, and VMware Cloud on AWS. Management announced triple-digit growth on Amazon AWS as VMware plays the role of accelerating entities' transition to cloud architectures. VMware produced major updates to its core software platforms in the quarter, and we believe its ability to holistically manage containerized and virtualized instances across on-premise and cloud instances, with security capabilities, provides VMware with a unique position as a commonality for its customers' networking requirements."

--Mark Cash, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)