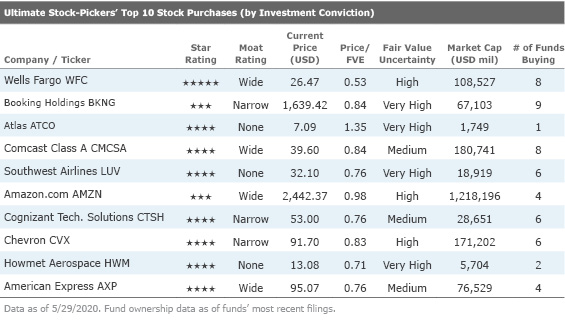

Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Nine of the top 10 conviction purchases are undervalued.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the first quarter of 2020. The piece itself was an early read on individual purchases—focused on high-conviction and new-money buys—that were made during the period, based on the holdings of almost all our top managers. As all our Ultimate Stock-Pickers have reported their holdings for the period, we think that it is appropriate to now examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers chose to purchase or sell the holding, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this trend is likely primarily driven by the shift toward passive products. Despite the net selling, our Ultimate Stock-Pickers still made several high-conviction purchases as well as sales.

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that seven of the top 10 conviction holdings have a wide economic moat. Additionally, seven of the 10 companies composing the top 10 high-conviction purchases and eight of the companies on the top 10 high-conviction sales lists have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the consumer cyclical, energy, real estate, technology, and utilities sectors. There has been a particularly favorable shift toward the communication services sector and away from the consumer sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers remain meaningfully overweight in the industrials and financial services sectors and are now slightly underweight in the consumer cyclical and consumer defensive sectors and are even more underweight in the technology sector compared with the previous quarter.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter, with the only change being the replacement of JPMorgan Chase JPM with Booking Holdings BKNG. We noticed that the relative ordering of the top 10 stock holdings changed somewhat, with Comcast CMCSA moving up the list, while Bank of America BAC and Berkshire Hathaway BRK.B moved down the list. Our Ultimate Stock-Pickers continue to hold companies from the financial services sector with conviction, contributing three stocks to our list. We think that most of the top 10 conviction holdings list is undervalued, with a few notable exceptions. Our research indicates that wide-moat rated Alphabet GOOGL and narrow-moat rated UnitedHealth Group UNH are fairly valued, while wide-moat rated Johnson & Johnson JNJ and narrow-moat rated Apple AAPL are overvalued at the time of writing. As Best Idea Bank of America has maintained its position on the top 10 conviction holdings list for quite some time, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Eric Compton's outlook on the bank.

Wide-moat Bank of America is currently held by 12 funds. This high uncertainty stock currently trades at about a 20% discount to Morningstar analyst Eric Compton's fair value estimate of $30.

Compton argues that Bank of America has built sustainable economic advantages as a result of cost advantages and customer switching costs. Bank of America is the second-largest U.S. bank in terms of assets and is a leader in most of the areas in which it competes with peers. This is evidenced by its position as one of the top deposit gatherers in the U.S., its top two share in small-business lending, home equity lines of credit, and retail mortgages, as well as its presence as one of the top corporate franchises in the country. Due to the acquisition of Merrill Lynch, Bank of America is also one of the largest online retail brokerages and advisor forces. The bank also holds a position as a top five investment bank globally, has one of the largest shares in credit card and debit card issuance, is one of the top fee earners from FICC products, and is a top U.S.-based merchant acquirer. The bank has also invested heavily in technology and grown its fee income lines over time, putting it in a good competitive position for years to come.

Even though Bank of America was hit hard from an underwriting perspective during the financial crisis, the bank has since worked to de-risk its portfolio, reducing exposure to risky subprime loans, second mortgages, and mitigating its consumer exposure so its portfolio is equally balanced between the consumer and commercial side. Compton argues that the bank has set the tone for growing responsibly (as stated by CEO Brian Moynihan) and has been working more conscientiously in loan/risk trade-offs.

Bank of America has historically had poorer operating efficiency than peers, largely as a result of post-crisis fines (highest out of the Big Four) and the prolonged costs of several large acquisitions before the Great Recession. However, the bank has made strides since then, reducing headcount by over 30% and consolidating 30% of its branches. Bank of America is now able to operate as efficiently as peers. While it may not perform better than peers on an absolute basis, it is still able to match peers while also maintaining a $10 billion technology budget. The fact that the bank should be able to match other banks' efficiency while investing at a greater rate is indicative of a competitive edge that other banks do not necessarily have. The bank also has a better fee income mix than many competitors, making it better insulated during uncertain times.

Bank of America is also advantaged as it has developed economies of scale and scope in fixed-cost, fixed-platform businesses that generate switching costs. According to Compton, the bank's ability to provide a diverse range of services in payments, wealth management, investment banking, and securities makes it a one-stop shop for clients and helps it generate outsized returns. The same is also true from a commercial perspective, as it can offer a wide range of services to business clients while continually investing in technology.

While Bank of America has not been immune to the impacts of the COVID-19 pandemic, it has performed better than some of its other competitors so far, has a low exposure to COVID-19-related industries, and maintains a solid capital and liquidity position to weather the downturn. Even though many investors' eyes have been turned toward metrics like earnings per share and other short-term results, Compton emphasizes that the story about the banks is not one about current results; it is more about maintaining a solid position in terms of capital and liquidity to survive the downturn. Bank of America is a much better operator and a much more conservative underwriter now compared with the last crisis, and he believes the bank has adequate capital reserves and will come out of this downturn intact.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is almost entirely composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers had three purchases in the financial services sector, followed by two in the consumer cyclical and industrials sectors. We covered several of the undervalued names on the conviction purchases list in the previous editions of Ultimate Stock-Pickers. From a valuation and quality perspective, the cheapest wide-moat stocks are Wells Fargo WFC and American Express AXP, which received purchases from eight and four funds, respectively. Since Booking Holdings is one of the top names on this list and is part of the travel industry, which is receiving much scrutiny, we believe it is essential to discuss this company.

Narrow-moat rated Booking Holdings currently trades at around a 15% discount to Morningstar analyst Dan Wasiolek's fair value estimate of $1,950. The travel industry has recently garnered much attention, given that it has been one of the industries most highly impacted by the rapid and prolonged economic shutdown caused by the coronavirus pandemic.

Wasiolek argues that in spite of the significant near-term impact of COVID-19 on demand for travel, Booking's solid financial position will help the company weather the downturn. Booking's position as a leader in the global online travel agency space will only grow over the next decade, as the company maintains a strong foothold in Asia-Pacific (accounting for bookings in the high-teens), maintains a solid market share in Europe with almost 50% of total bookings, and continues to grow its presence in the attractions, vacation rentals, and restaurant reservation space. This is all supported by its position as a leader from a market and technology perspective, as well.

Booking Holdings' narrow moat is mainly a result of its strong network effect, with its variety of hotel properties and other services continuing to increase the scale of its user base. Wasiolek sees this growing in both developed and emerging markets as well as expanding in verticals from rental properties to different holiday attractions, helping the company create an integrated trip offering.

It would be difficult to replicate Booking's network in the developed world such as Europe both from the perspective of time investment and costs, as 65% of hotels remain boutique establishments. In Asia-Pacific, the company is focused on expanding its Booking.com and Agoda.com platforms, alongside growing its foothold in China via its partnerships with CTrip and Meituan-Dianping. Wasiolek sees Asia-Pacific as constituting one third of online booking growth over the next five years and sees it as a key market for the company.

Given an increasingly modernizing world, Booking has seen a shift to planning and reservations via the use of mobile applications. According to pre-COVID-19 data, Booking.com maintained its position as a top 10 travel application in over 100 markets, compared with Expedia's EXPE top position in 24 markets.

However, giants in the technology world and other industries such as Amazon AMZN, Google GOOGL, Facebook FB, and Alibaba BABA have started paying more attention to this area, and their entry can meaningfully impact profitability. Even so, Wasiolek argues that it would still require a significant time investment and significant expenses for them to replicate Booking Holdings' network. Moreover, Booking's model is an OTA model under which it directly controls relationships with hotels, while these companies are more likely to operate a metasearch model instead of directly competing with Booking's approach.

Booking Holdings is able to maintain a competitive edge via its network effect. After acquiring Booking.com in 2005, it was able to spend on promotions to both travelers and hoteliers. Booking.com allowed travelers to make the payment after visiting a hotel instead of requiring an up-front payment. This increased customer traffic to the website, which attracted more hoteliers, thus driving up hotel inventory as well. As per Wasiolek, this positive virtuous cycle began before any competitor had developed enough scale in Europe and allowed Booking Holdings to become a leader in the industry over time.

Wasiolek also believes the company will be able to maintain its network effect—35% of the OTA market is controlled by Booking and another 35% is controlled by Expedia. The remainder remains extremely fragmented, and this creates difficulty for small new entrants to gain scale from a demand or supply side. As previously mentioned, the large amount of time and money required to do this would make it very difficult for new entrants to carve a place for themselves in this market. Moreover, Booking has strong and sustainable cash flows, which enable the company to continue to offer new, attractive products, spend on advertising, and bring in new customers.

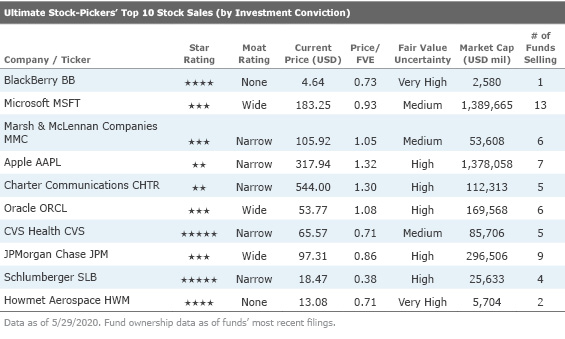

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Two of the conviction sales are also conviction holdings—wide-moat Microsoft MSFT and narrow-moat Apple appear on both lists. Much of the selling activity came from the technology sector, which contributed four names to the conviction sales list. Four of the 10 names on this list are overvalued according to Morningstar estimates, with only two of them being meaningfully overvalued. It is interesting to note the large number of undervalued names on this list, though that is not entirely surprising given the recent market sell-off. One such name is wide-moat rated Microsoft, which trades at about a 7% discount to Morningstar analyst Dan Romanoff's fair value estimate of $196.

According to Romanoff, Microsoft remains well positioned to drive IT advancement for the next five years and shares would provide an increasingly attractive opportunity if the COVID-19-related sell-off continues. Hybrid cloud environments are expected to persist over time, and Azure, Microsoft's cloud-computing service, will lead growth along the way. Microsoft continues to use its dominant position of on-premises architecture to allow customers to move to the cloud easily and at their own pace, which we believe will continue over the next five years.

Microsoft's enterprise salesforce is an underappreciated asset that helps customers make an easy and painless move toward adopting the cloud by offering hybrid cloud environments. IaaS, PaaS, and SaaS cloud services have continued to outperform Romanoff's expectations from both a revenue and margin perspective. Moreover, the company has made immense progress toward revamping its business to develop a recurring revenue model, as seen in recent times via its Microsoft 365 initiative. As per Romanoff, Office remains a crown jewel as it has a near total monopoly in the type of software it offers and still has some runway left with regard to the transition to a recurring revenue model.

Microsoft also continues to innovate, especially in the gaming arena via offerings such as XCloud, Game Pass, Xbox Live, etc. While LinkedIn is often overlooked within the overall story of the company, decent growth has been seen on this front as well. With robust revenue growth, high and increasing margins, a strong, well-positioned balance sheet, and the company's position as a key strategic partner for businesses, Romanoff sees Microsoft as a company well poised for growth.

The sell-off of undervalued stocks is not a surprise given the current economic and social climate. As the COVID-19-linked economic shutdown is prolonged and stock markets exhibit high volatility, there has been a broad sell-off trend in the markets overall. Even though Microsoft has faced a slowing momentum in the shift toward subscriptions such as Office, has a limited mobile presence, and is still not a leader in key growth areas such as Azure and Dynamics, the company remains in a good competitive position with its wide moat and is expected to grow over the next few years.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain has an ownership interest in Bank of America. Eric Compton has no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)