How Vanguard, Fidelity, and Others Embrace ESG Investing

Sustainable investing strategies have gone mainstream; here's how some of the best money managers are doing it.

A version of this article appeared in the May 2020 issue of Morningstar FundInvestor. Download a complimentary copy of Morningstar FundInvestor by visiting the website.

Vanguard has it. Pimco has it. Fidelity has it.

Environmental, social, and governance investing has hit the mainstream. Over the past decade, it has become a much more sophisticated strategy, and many of the best money managers are doing it.

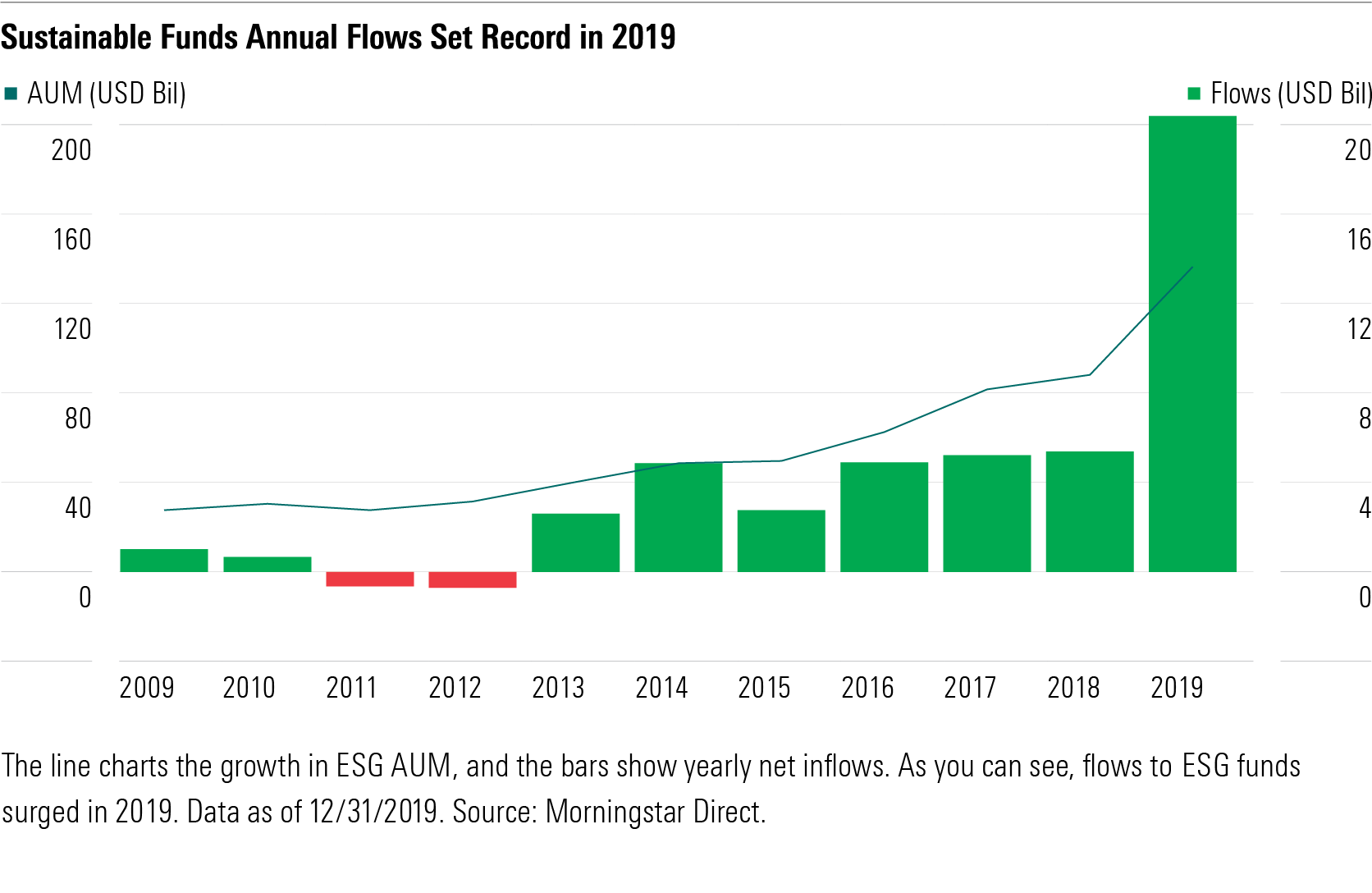

This is a good time to check in on the state of ESG investing. In 2019, net flows to ESG funds in the United States topped $20 billion, compared with a little over $5 billion the prior year.

The central idea of ESG is to support sustainable investing in a way that has a positive impact on the world. It can also be viewed as a risk-management process, as companies that embrace sustainable practices are managing liabilities better than others, perhaps recognizing new opportunities, and may be better positioned to grow in the future. Environmental, social, and governance investing has evolved from funds that simply screened out undesirable companies like polluters or sellers of tobacco to strategies that apply a matrix of sophisticated screens to assess the best and worst players in every industry and actively seek to have a positive impact in many ways.

Likewise, we’ve gone from a few ESG specialist firms to a trend so widespread that nearly every fund company of size has multiple ESG funds. You can see it at Vanguard--its Vanguard FTSE Social Index VFTAX has been around for nearly 20 years, but in the past two years, the firm has added Vanguard Global ESG Select Stock VESGX, an active fund with integrated ESG strategy, as well as two exchange-traded funds with exclusionary indexes. Pimco now offers ESG versions of some of its top strategies as well as a climate-specific fund, and Fidelity offers some passive ESG funds.

T. Rowe Price has gone in a different direction. Rather than launch dedicated ESG funds, it has its own ESG team that assesses companies and provides a risk framework that portfolio managers can apply to their funds. This is fairly common among big asset managers. It is difficult, though, to assess whether ESG is a meaningful factor in these funds’ approaches when the work is happening only in the background and the funds have no stated ESG elements in their strategies.

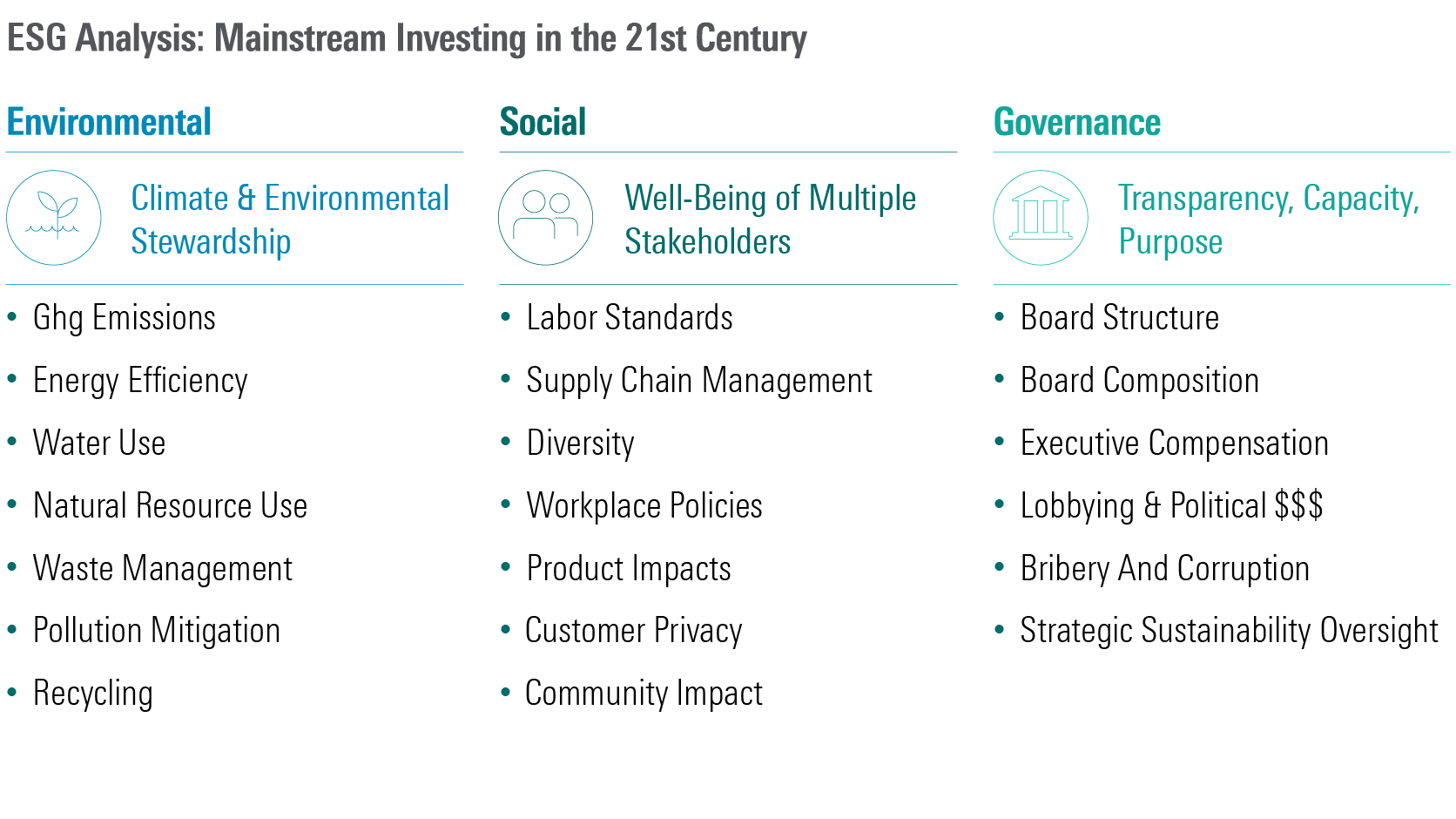

What Is ESG? Let's look at the focus of each aspect of ESG investing. Environmental covers greenhouse-gas emissions, energy use, land use, waste management, water quality, and hazardous materials. Social encompasses labor standards, worker safety, equal employment, community impact, and healthcare. Governance looks at business ethics, board independence and diversity, shareholder voting rights, executive pay and employee pay, lobbying and political expenditures, and accounting transparency.

I mentioned that the earlier ESG strategies focused on excluding bad actors. But over time the concept has grown toward embracing the good actors, directly funding promising ESG ventures, engaging with companies on ESG issues, and voting proxies to advance ESG goals. Each fund has a different approach, and different fund types can be quite different.

Is There Agreement on ESG? We all have different perspectives on values as well as each company's ethics, and some of that has to do with what part of a company you look at. For example, some see Apple AAPL as a progressive company that embraces diversity and supports employee rights, while others look at the controversies around Apple contractors in China and see a company that treats employees harshly in order to squeeze pennies out of their costs.

You should definitely review a fund’s ESG criteria and its portfolio before investing. The rest of the selection process is like that of any fund. Find a fund that aligns with your goals and the needed role in your portfolio, then choose one with strong fundamentals such as strategy, manager, parent, and fees.

Will ESG Investing Improve My Performance? The answer is to be determined. When I've looked at the data, it always shows that ESG funds collectively have average performance. Or, to put it another way, an ESG focus doesn't help as much as its biggest cheerleaders say, nor does it hurt as much as its critics say.

To me, that makes sense. A sustainable focus ought to be a positive, but on the other hand, many low-ESG companies like tobacco or oil trade at very low valuations because of those liabilities. Perhaps that cheapness will be sufficient to compensate investors for taking on those risks.

However, as I mentioned, ESG has evolved significantly in approach and in terms of the firms managing those strategies. So, even if the past data showed a more meaningful performance pattern, I’d be wary of projecting that into the future. One positive impact of the spread to larger firms is that there are more low-priced ESG funds, and that means the bar to beating an index has gotten lower for ESG. Vanguard and TIAA-CREF, for example, have very cheap ESG funds in both active and passive strategies.

ESG Strategy Types Let's examine a few funds that demonstrate different types of ESG equity strategies.

Passive exclusionary: Silver-rated Vanguard FTSE Social Index VFTAX is one of the cheapest ESG funds because it is passive and because it is run by Vanguard. The fund takes the whole universe of U.S. large- and mid-cap stocks, then screens out businesses involved in fossil fuels, tobacco, alcohol, nuclear power, adult entertainment, and gambling. (Technically, you could say this is an ES fund because it doesn't have governance screens.) Then, it weights the filtered holdings on a market-cap basis. Because fossil-fuel companies are mostly on the value side, this screening gives the fund a bit of a growth tilt relative to the Russell 1000 and the typical large-blend fund. Over the past 10 years, it has beaten most peers because of that growth tilt but lagged in the prior decade, which had a value tilt.

There Is a newer form of passive that goes beyond exclusionary to overweight firms that rate highly on ESG criteria. Bronze-rated Fidelity US Sustainability Index FITLX is one of this new breed.

Focused active: Silver-rated Parnassus Mid-Cap PARMX weeds out companies in the alcohol, tobacco, weapons, nuclear power, gaming, and fossil-fuel industries. But it also has positive criteria that focus on exemplary management and high ethical standards. In addition, management seeks strong growth prospects like other growth managers would. It wants companies with sustainable competitive advantages and products with strong growth potential. The fund holds just 45 or so names, so you get a very different portfolio from Vanguard FTSE Social Index.

Integrated active: Vanguard Global ESG Select Stock VESGX doesn't exclude any business. (We don't have an analyst rating on the fund.) Rather, it chooses companies it thinks are standouts in their industries. So, this fund could buy a company it views as a wise steward even in industries like fossil fuels or alcohol. For example, the fund owns mining giant BHP BHP and energy company Total TOT. Run by Wellington, the fund has a focused portfolio that lands in the large-blend spot in the Morningstar Style Box. Management seeks companies that follow leading ESG practices and have proven track records of capital allocation. It also emphasizes corporate culture, employee engagement, and adaptability. In ESG-land, the difference between outright avoidance of certain industries and the purchase of the best ESG leaders in those industries is a key one.

Now, let’s take a look at fixed income. The bond side of ESG has been slower to come around. It presents some challenges. First, some investors were slow to embrace ESG because they were quite happy simply investing in government-bond funds, which allowed them to not worry about investing in companies they didn’t like. A second reason is that bondholders don’t have the say in proxy votes that equity fundholders do. Finally, most bond funds are very diversified in order to minimize default risk, and it’s hard to achieve that level of diversification in a fund meant to promote ESG practices.

That last challenge is still a tricky one, but ESG fixed income has some appealing options.

Hybrid of exclusionary screening and impact investing: TIAA-CREF Core Impact Bond TSBIX, which has a Morningstar Analyst Rating of Silver, shows that ESG investing can work for a core bond holding. Combining the two strategies is key. About 60% to 70% goes into a screened bond portfolio, while the rest goes to an impact bond portfolio, where finding sufficient supply would make it hard to use as 100% of a core fund. The portfolio's duration and credit risk are typical of a core bond fund as is its performance. Thus, you have corporate bonds and government bonds like you'd see elsewhere. However, it also has 9% in taxable municipal bonds, which serve the impact goals of the portfolio.

I haven’t added any pure impact bond portfolios to the Morningstar 500 because they are more niche in character, but I’m keeping an eye out for some good ones.

Conclusion Do you need to own ESG funds? The answer is still no, but even if you prioritize performance first, you may find that an ESG fund suits your needs or that it reduces risk in a way that will benefit your portfolio. As these strategies grow, you'll likely encounter more of them in your research, so it's wise to understand how they work.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)