Following the Rally, Stock Market No Longer Undervalued

Easy returns have been made; the focus now turns to selecting specific undervalued stocks.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Although we recently lowered our forecast for 2020 gross domestic product to a contraction of 3.9% from our previous projection of a 2.9% decline (due to weaker economic activity in the first half of the year than originally expected), recent research has led us to remain confident that the impact of the coronavirus will be minimal to the long-term level of U.S. GDP. We expect only a 1% reduction to the level of GDP over the long term, which translates into only a 2% decrease in the fair value of the overall U.S. equity market.

Following the steady rally across the stock market after its March lows, we now think that equities as an asset class are near fair value--however, we note that many sectors and individual stocks remain undervalued.

Our research revealed that we’re not currently experiencing either of the issues that led to a substantial contraction of long-run GDP in prior recessions: political policy errors or a banking crisis. Rather, in the current situation:

- On the monetary policy front, the Federal Reserve acted quickly and decisively to implement a combination of traditional monetary policy actions, nontraditional programs, and new initiatives.

- On the fiscal policy front, the government launched significant stimulus programs designed to help alleviate the worst of economic impact from the wide scale shut-ins.

Our forecasts incorporate our assumption that a vaccine will be available later this year for high-risk populations based on phase 2 data, broader approval in early 2021, and wide-scale vaccination in the first half of 2021.

Even though there remains significant uncertainty as to how COVID-19 will play out over the near term, it appears that investors are coming around to our long-term point of view.

3 Undervalued Sectors According to the Morningstar Market Fair Value Ratio While there will certainly be winners and losers following pandemic-caused changes in consumer and corporate behavior, our universe of equity coverage suggests that stocks remain undervalued by only 2%.

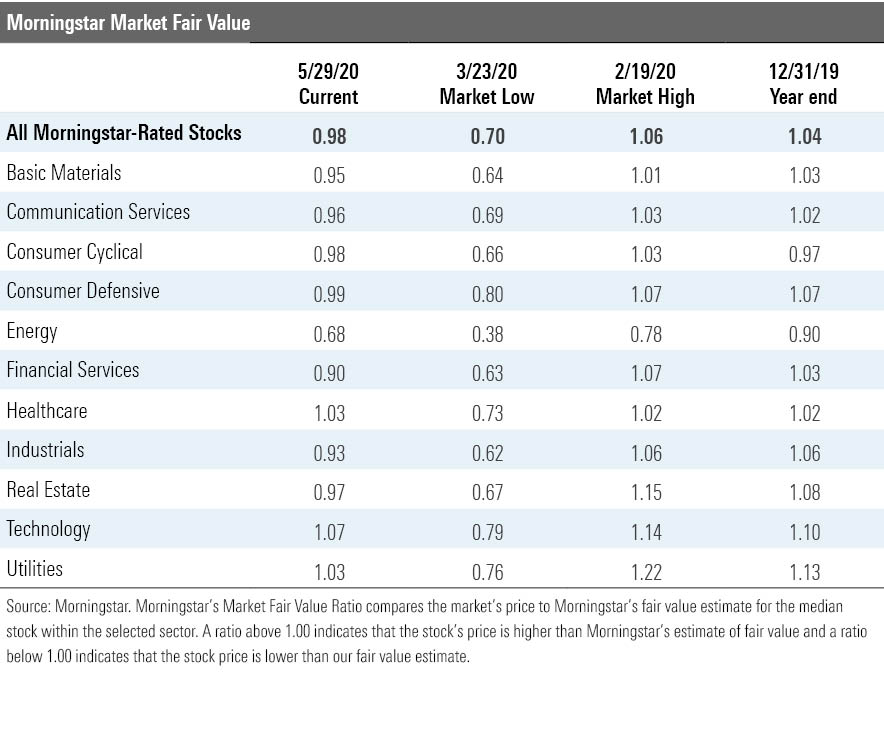

This is indicated by the Morningstar Market Fair Value ratio, which was 0.98 as of last Friday. This ratio compares the current market price to Morningstar's fair value estimate for the median stock under our equity research coverage. A ratio below 1.00 indicates that stock prices are lower than our fair value estimate. Prior to the market rout, the Market Fair Value ratio was 1.06, indicating that stocks were 6% overvalued.

Although there remains some additional upside in the equity market generally, the easy money has already been made. The Market Fair Value ratio dropped as low as 0.70 when the market bottomed on March 23. As we’ve previously noted, a median price/fair value ratio below 0.80 has indicated that the market has likely overreacted to the downside and has represented a good entry point for long-term investors.

However, since then, equity index levels have recaptured more than two thirds of their losses from where they peaked on Feb. 19.

Going forward, investors will need to be more focused on putting their money in those stocks and sectors that remain undervalued rather than only increasing their equity asset class investment allocation. The table below breaks down sectors according to the Market Fair Value ratio.

Here's what our research shows to be sectors with the most undervalued stocks:

- The energy sector has a price/fair value ratio of only 0.68. Although COVID-19-induced shut-ins have drastically lowered the demand for gasoline in the near term (and oil briefly traded at a negative price), oil prices have risen steadily as the imbalance between supply and demand has begun to normalize. Our energy team has maintained its midcycle oil price estimates of $55/barrel for West Texas Intermediate crude and $60/barrel for Brent oil. Among the energy sector, our top picks include Schlumberger SLB, Enterprise Products Partners EPD, and Enbridge ENB.

- The financial-services sector is trading at a price/fair value ratio of 0.90. Stock prices have been under pressure as investors are concerned about the amount of charge-offs that banks will suffer as unemployment hits new highs and corporate bankruptcies rise. Furthermore, the sector's earnings will be hampered by the low interest rate environment and relatively flat yield curve, which will pressure net interest margins. However, even after incorporating those factors into our forecasts, we still see value. Some of our top picks include American Express AXP, U.S. Bancorp USB, and Berkshire Hathaway BRK.A.

- The industrials sector, at 0.93, is the third sector we see value in for investors. Earnings in the industrials sector will have the closest correlation to the rebound in economic growth and our expectation that the reduction to long-term GDP will be minimal. However, investors remain concerned that the current economic recession will impair these businesses from being able to fully recapture their earnings potential. Top picks include 3M MMM, Caterpillar CAT, and Wesco International WCC.

At the same time, the recovery in stock prices has pushed many stocks above our fair value estimates. For example, the technology sector is currently trading at a 7% premium to our valuations. Investors have bid up the price on many technology companies, particularly those that are thriving in the current stay-at-home atmosphere and that they believe will benefit from paradigm changes in consumer and corporate behavior.

While as a whole the sector is overvalued, for investors looking for additional exposure in the technology sector, some of our top picks include VMWare VMW, Microchip Technology MCHP, and Palo Alto Networks PANW.

This article has been written on behalf of Morningstar, Inc. and is not the view of DBRS Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)