Dividend Cuts Build, Hitting Small Caps, but Medalist Dividend Funds Weather the Storm

A look at the U.S. market and some Morningstar Medalists whose payouts have taken a hit.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud. Even as the stock market has recovered from the worst of its coronavirus-driven losses, dividend cuts or suspensions and buyback cancellations continued to mount.

The damage has been heaviest among small companies, especially in the energy and real estate sectors--epicenters of the economic impact of COVID-19. But for Morningstar Medalist funds with dividend strategies, the impact has so far been relatively muted.

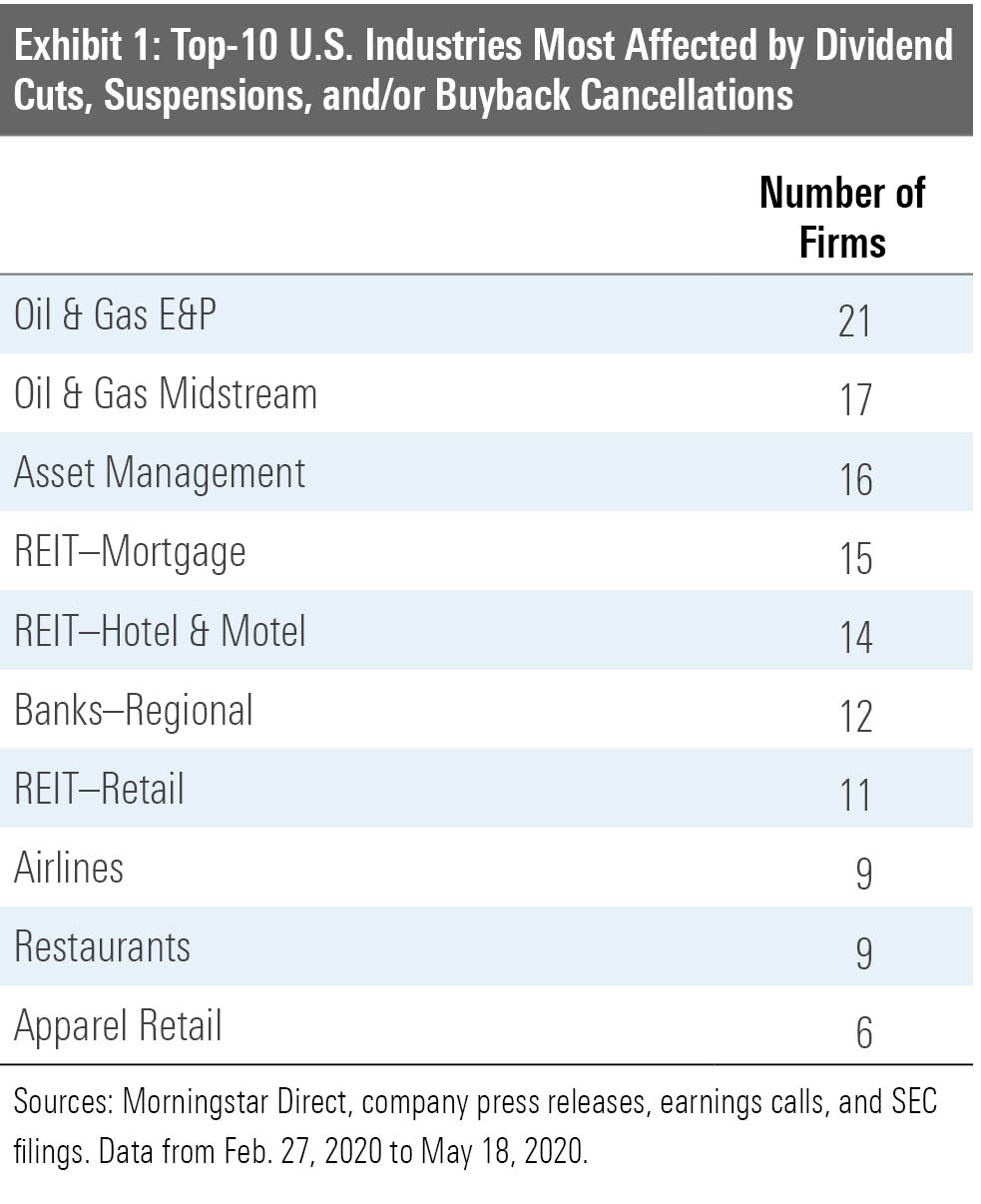

Between late February 2020 and May 18, 2020, no less than 240 U.S. firms across 68 of 142 Morningstar industries announced either a dividend reduction, a pause in dividend payouts, or a cancellation of their buyback programs. Many of those fell into more than one of those categories.

Exhibit 1 depicts the 10 most affected industries. Oil and gas exploration and production stocks lead the way, as these firms have grappled with both oversupply and a sharp drop in demand.

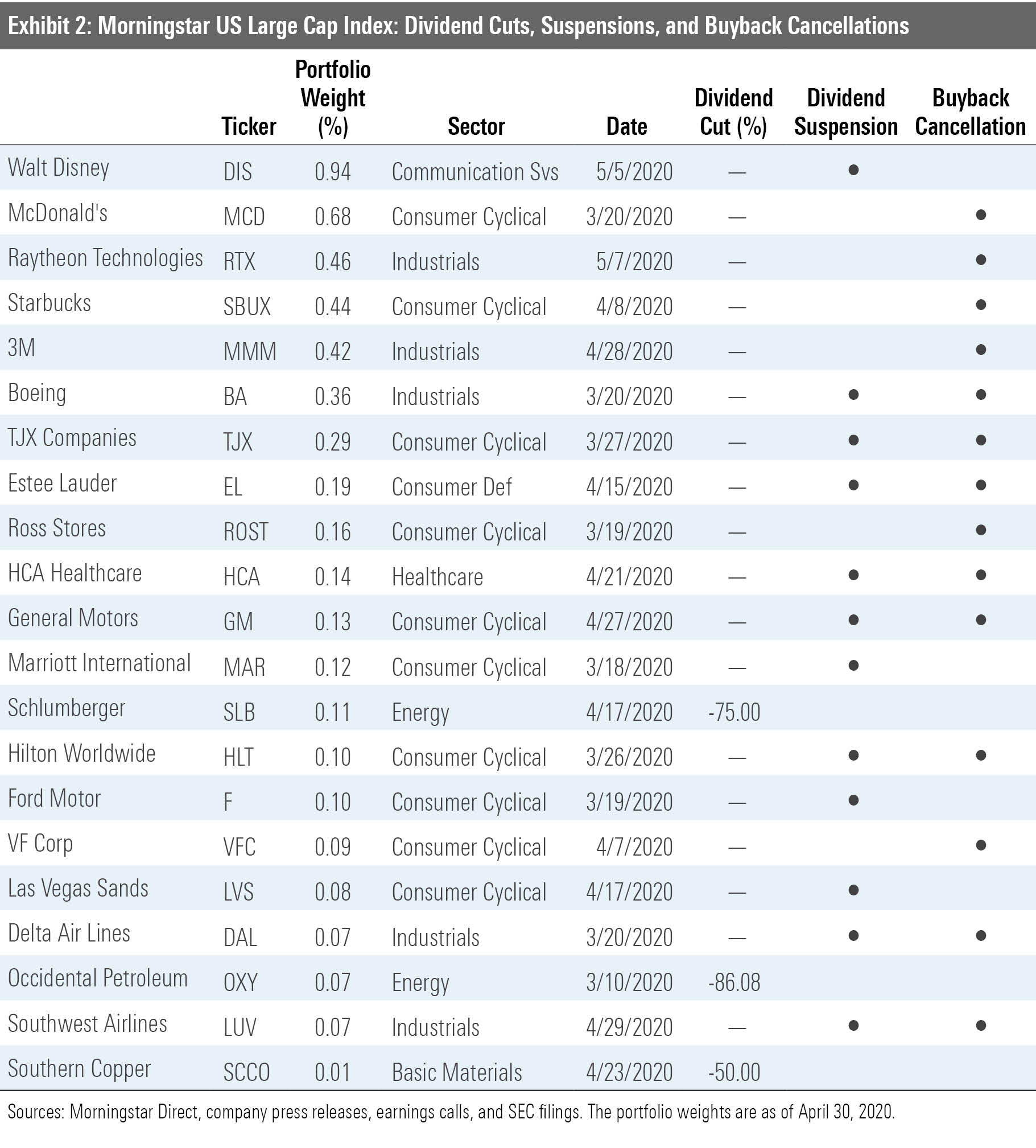

The economic hardship has disproportionately hit small-cap stocks. As of April 30, 2020, the median market cap of those 240 firms was $1.1 billion. Big companies haven't escaped unscathed, however. As Exhibit 2 shows, 21 of the 220 stocks in the Morningstar US Large Cap Index cut or suspended their dividend and/or canceled buyback plans.

Consumer cyclical stocks predominate the list in Exhibit 2, though seven of 11 Morningstar sectors are represented. Three companies cut their dividends by an average of 70%, and another 12 suspended them entirely. The coronavirus' economic havoc has even hit stalwarts like McDonald's (MCD) and 3M (MMM). While both companies have kept their dividends, they've stopped stock buybacks, which suggests they'll be returning less cash to shareholders.

Dividend-growth stocks and high-dividend-yield stocks have both suffered, but the latter have had a harder time proportionately. Of the Morningstar US Dividend Growth Index's 478 constituents, as of April 30, six companies cut their dividends by an average of 63.7%, 18 suspended them entirely, and seven others canceled buybacks. Together, they accounted for 6.7% of that index's weighting.

Meanwhile, the higher-yielding Morningstar Dividend Leaders Index contains only 99 stocks. Nine of its companies cut their dividends by 66% on average, and 10 more suspended them, with one company--Carnival (CCL)--also issuing equity. They accounted for 9.2% of that index's weighting.

Income-oriented U.S. mutual funds with a Morningstar Analyst Rating of Gold or Silver haven't been able to sidestep the cuts, suspensions, and cancellations, but the damage isn't that pronounced. For example, the March 2020 portfolio of American Funds Income Fund of America (AMECX) had just 2.3% of its assets spread across 12 companies on that list. Half had already cut or suspended their dividend by then, while the other half subsequently did.

Strategies with an appetite for deep value have had the most exposure. LSV Small Cap Value (LSVQX) and its subadvised sibling Harbor Mid Cap Value (HAMVX) stand out in this regard. They use the same quantitative model but target that model to the Russell 2000 Value and Russell Midcap Value indexes, respectively. Using inputs like EBITDA forecasts, cash flow data, and earnings/price estimates, the model looks for cheap companies with relatively robust earnings, cash flows, and dividends. As of March 2020, the small-cap strategy had 11.7% of its assets in 36 companies on the list, while the mid-cap version's total was 10.7% across 26 firms.

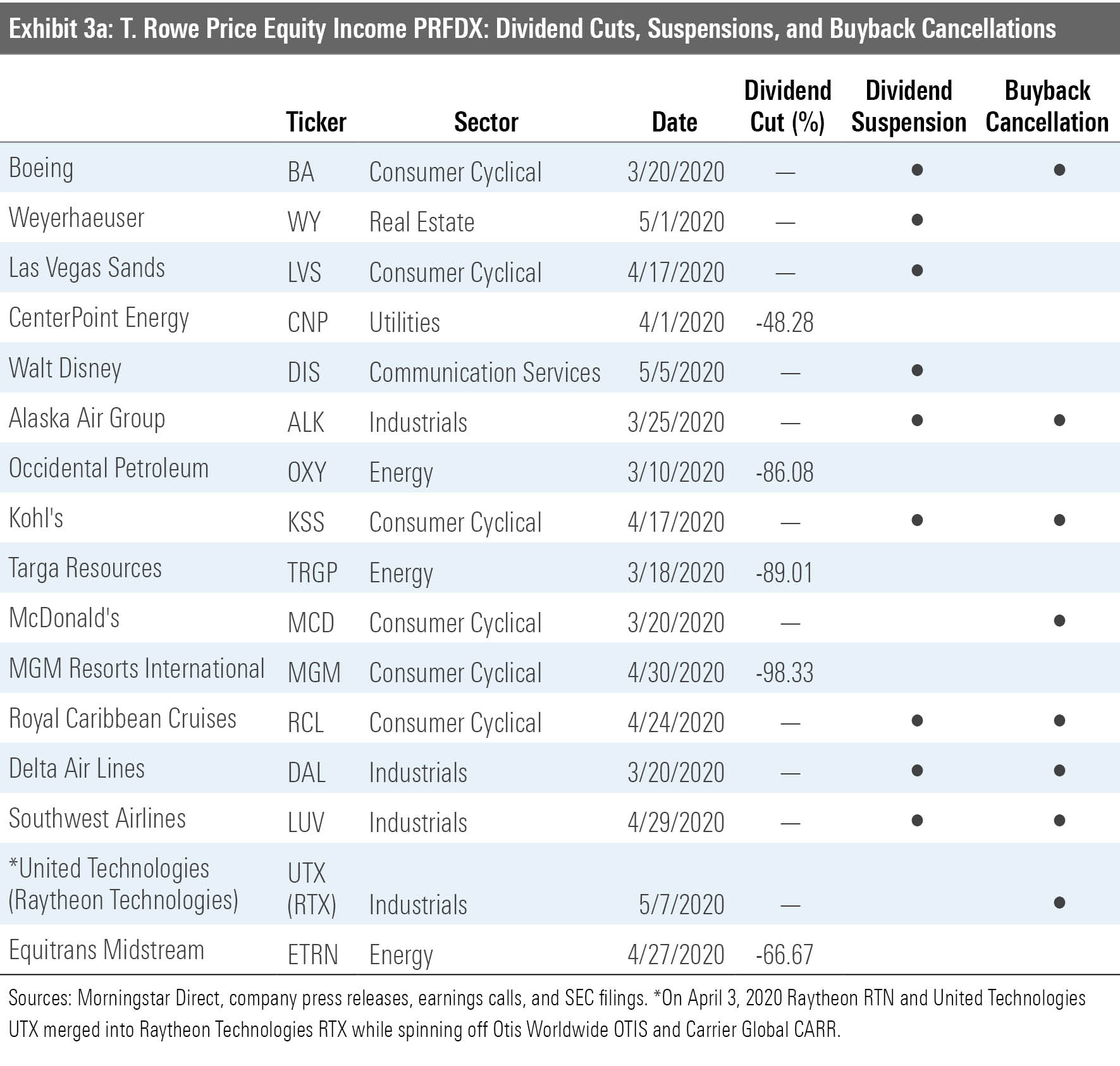

A dividend cut, suspension, or buyback stop may reduce the cash returned to shareholders, especially in the near term, but it doesn't mean an automatic sale. Consider T. Rowe Price Equity Income (PRFDX), whose value-oriented manager John Linehan isn't overly dogmatic about yield. Linehan's recent moves reflect his embrace of companies whose share prices reflect current controversies, as long as he sees a path for improvement and a robust balance sheet.

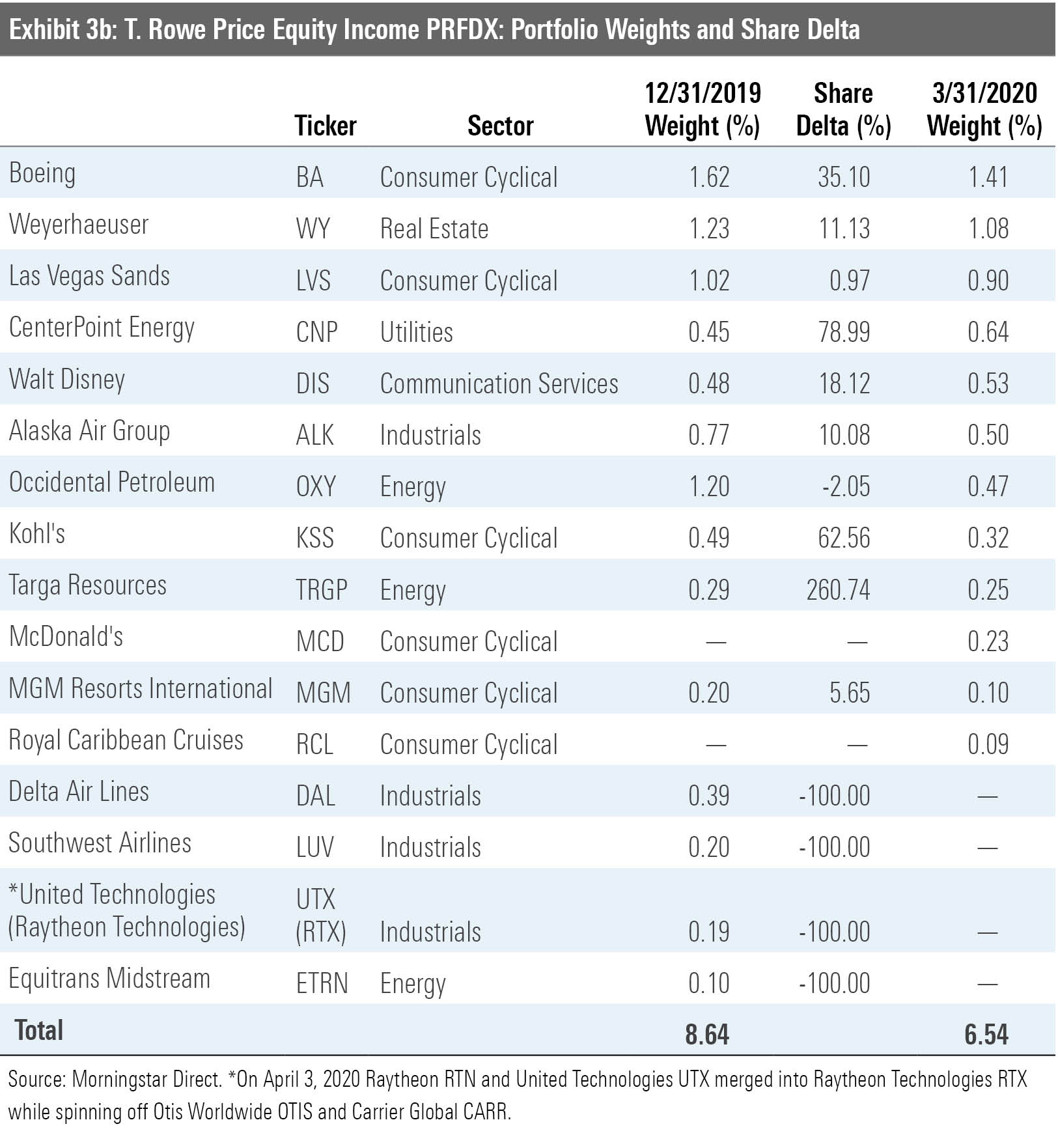

As Exhibits 3a and 3b show that while T. Rowe Price Equity Income's exposure to companies on the list fell from 8.6% at year-end 2019 to 6.5% on March 31, 2020, Linehan largely stuck with his picks despite their fall-off in total yield (dividends plus share buybacks) and declining share prices. For example, while he sold Delta Airlines (DAL) and Southwest (LUV), he held on to Alaska Air Group (ALK) and even increased the fund's share count in that stock by 10%.

More hits to company payouts are likely, especially if the country's economic slump becomes prolonged. While that could spell an end to the stock market's recent recovery, it shouldn't cause dividend-oriented investors to lose their heads. Rather, as T. Rowe Price manager John Linehan's moves suggest, they should keep total return in mind and take what the market gives rather than reaching for yield that might soon disappear.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)