There's Ample Room for Sustainable Investing to Grow in the U.S.

Sustainable fund investing is much more robust in Europe. How will the United States catch up?

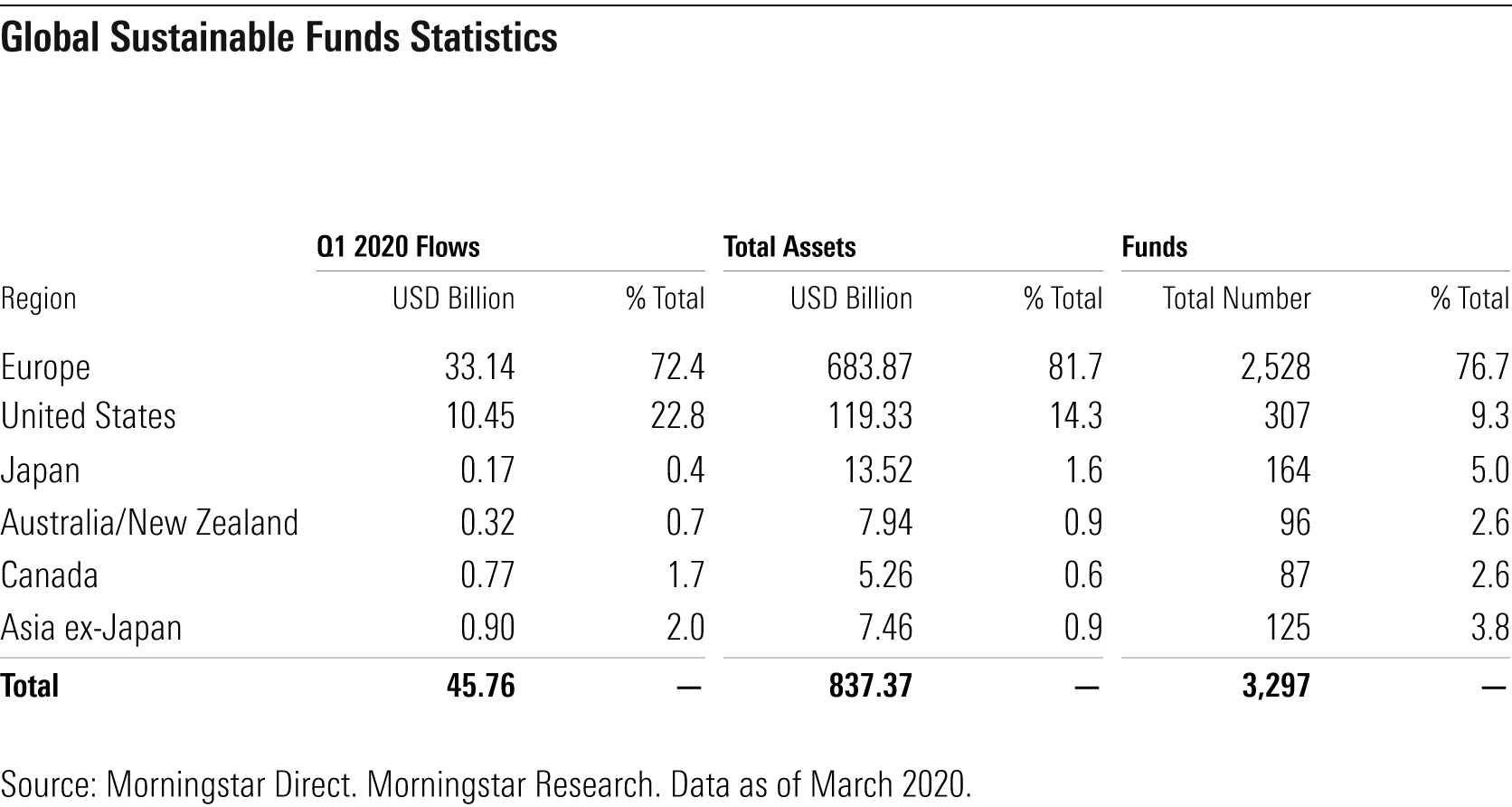

Our first Global Sustainable Fund Flows report, published last week, revealed that sustainable funds globally attracted an estimated $45.7 billion in net flows during the first quarter of 2020 even as the overall fund universe suffered $384.7 billion in outflows. Because of first-quarter investment losses, sustainable fund assets were down 12% at the end of the quarter, but assets for the overall fund universe were down 18%.

As of March 2020, sustainable funds in Europe dominated the global picture. They constituted 76% of sustainable funds by count, 81% of assets, and 72% of first-quarter flows. U.S. funds, by contrast, made up less than 10% of sustainable funds and 14% of assets, but they garnered 23% of global flows in the first quarter.

What does this say about sustainable funds in the United States? That there is ample room for U.S. sustainable fund assets to grow. Using Europe as a benchmark, U.S.-based sustainable fund assets could grow to 6 times their current size just to reach today's level of European sustainable fund assets. And for U.S. sustainable funds to constitute the same percentage of overall fund assets as sustainable funds do in Europe, U.S. funds would need to grow to about 11 times their current size. While interest in sustainable investing has been higher in Europe for some time, especially among institutional investors, interest in the U.S. certainly seems to be catching up.

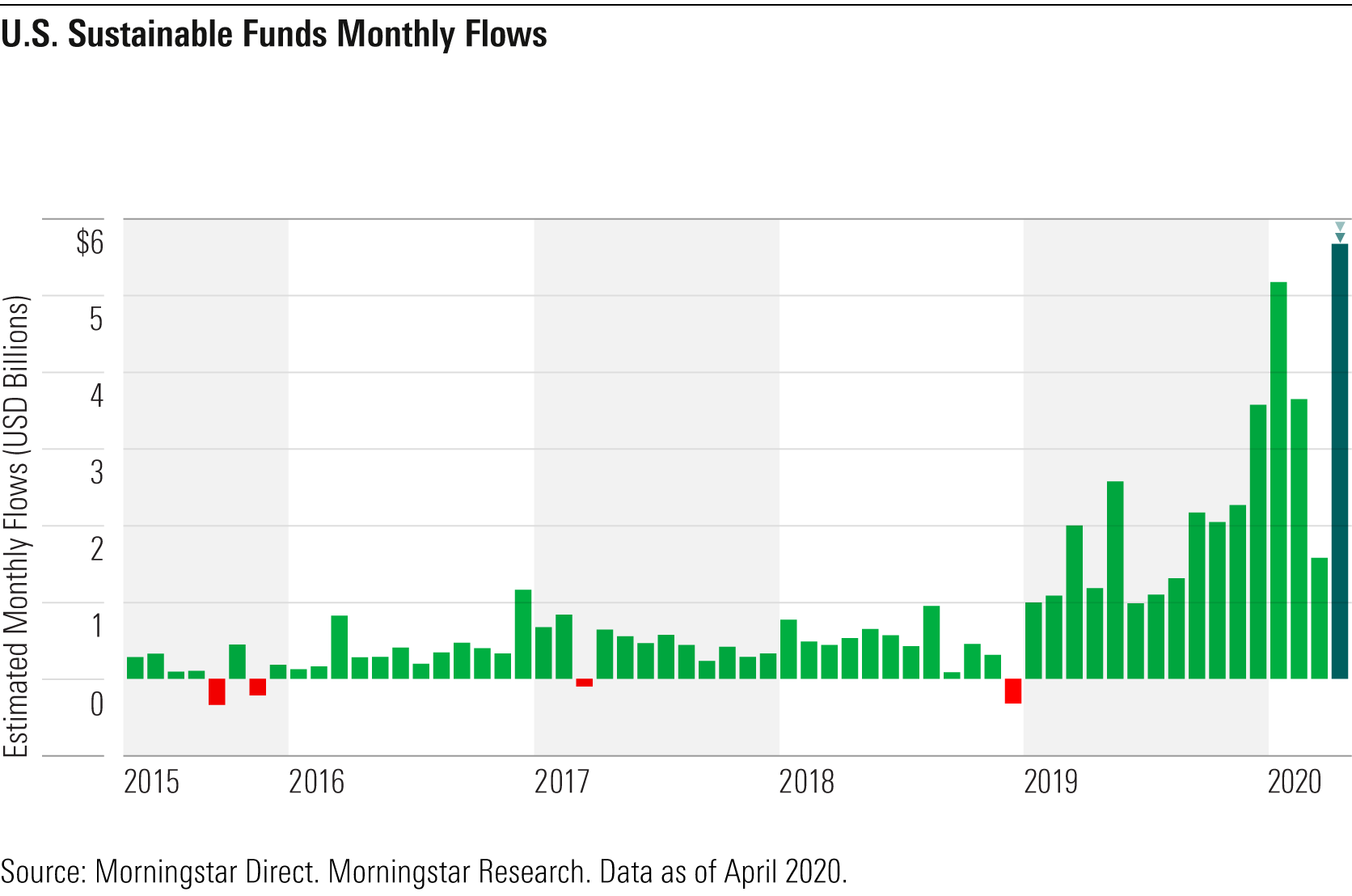

And in fact, recent sustainable fund flows in the U.S. suggest that the wave is already building. In 2019's fourth quarter, sustainable funds set a record for flows, which, in turn, led to a calendar-year record. Despite the onset of a global pandemic, U.S. sustainable funds set another quarterly record for flows in 2020's first quarter. And in April, while the country was on lockdown, sustainable funds attracted more flows than in any month ever.

So what will it take for assets in U.S. sustainable funds to reach the levels seen in Europe today?

Continued good performance. Sustainable funds invest in all parts of equity and fixed-income markets, and managers can adapt environmental, social, and governance analysis to a range of investment styles. That means there will nearly always be some sustainable funds outperforming and some underperforming, especially as their overall numbers grow. At the same time, these funds, as a group, have demonstrated they can perform competitively in a variety of markets. Sustainable equity funds outperformed when markets plummeted in the first quarter. Many sustainable equity funds use investment approaches that emphasize quality and tend to work well in a variety of markets, including volatile ones. Understanding ESG attributes across industries and using ESG to compare companies is emerging as a way to help identify great businesses poised for sustainable long-term growth.

Growing acceptance among asset managers and advisors. Most asset managers, large and small, are somewhere along the curve of ESG adoption. Many are developing the capacity to integrate ESG throughout their fund lineups, either as an element of existing strategies or in stand-alone sustainable funds. Some, like BlackRock and Neuberger Berman, are ramping up their active-ownership activities, recognizing engagement and proxy voting as ways to urge companies to adopt more long-term stakeholder-value-oriented approaches to management. More advisors are embracing ESG as a way to reduce risk in client portfolios and to better align their practices with the desire of many clients to achieve competitive return and positive impact with their investments. As mainstream asset managers and advisors continue to embrace sustainable investing, more assets will flow into it.

Demographic shifts. Much has been made about the greater affinity among younger generations and women toward sustainable investing. As more millennials and women become investment decision-makers, more assets will flow into sustainable investments. This applies to both individual investors and investment decision-makers for institutions.

Facts on the ground. What we now call sustainable investing or ESG has been around in some form for a long time, but the facts on the ground have changed, making the idea more relevant for more investors. The growing immediacy of the climate crisis is causing investors to be more concerned about climate risk in their portfolios and to recognize the importance of corporate responses in mitigating the worst effects of global warming. Increases in inequality are adding to the widening debate about the purpose of the corporation, adding urgency to shareholder engagements. Investors increasingly see diversity and gender pay equity as keys to better decision-making and a more committed and productive work force. And the coronavirus is highlighting the need for companies to focus on keeping their employees and customers safe and healthy.

What could derail the growth of sustainable investing?

Greenwashing. For all the ESG initiatives being undertaken by asset managers, many conventional investment strategies remain untouched by ESG analysis. While many asset managers are still getting up to speed on ESG, if their efforts are ultimately seen as greenwashing--simply as a way to portray the firm as a sustainable investor for marketing purposes--then momentum could stall.

More than 2,000 asset managers have become signatories to the Principles for Responsible Investment over the past decade. The PRI is a global organization that provides valuable resources about sustainable investing and networking opportunities for signatories. It also provides them with a way to signal to investors a commitment to sustainable investing with relatively little expected in return.

Soohun Kim and Aaron Yoon's recent academic study of asset-manager PRI signatories found that only a small number of funds improved their ESG performance after becoming signatories but many attracted new assets, suggesting that asset managers may be using their PRI status "to attract capital without making notable changes to ESG."

Product mismatch. A related concern is that funds labeled as ESG could disappoint investors, not because of investment returns but because they fall short on demonstrating their social and environmental impacts. Some examples: A passive ESG fund that simply underweights poorer ESG performers and overweights better performers relative to a conventional index. An active fund that considers ESG risk but is willing to buy high ESG-risk stocks if they are undervalued. Or funds that do little to nothing on shareholder engagement or broader policy fronts. Beyond that, it's easy to find ESG funds with a focus on companies that have exemplary ESG policies and practices in their operations, marketing, and governance. It's not as easy to find funds with a focus on companies creating sustainable products and services.

Too much greenwashing and too many products that fall short of expectations could put a dent in sustainable investing's momentum. As investors become more sophisticated about the field, many will demand a degree of authenticity from sustainable funds along with evidence of impact. But for now, interest is strong and growing, backed by demographic trends, and the issues animating that interest are not going away. For problems like global warming and inequality to be mitigated anytime soon requires capital markets to be part of the answer.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)