Hands-On Tactical Bond Strategies

Three strategies to consider, and two to avoid.

A version of this article previously appeared in the March 2020 issue of Morningstar ETFInvestor. Click here to download a copy.

Tactical bond investing is hard to do well. For most investors, the best approach is to find broadly diversified, low-cost funds with risks they're comfortable taking and to stick with them. That said, there are some strategies, based on value and momentum, worth considering. Here's a closer look at some moves that might be worth making and some to avoid.

Strategies Worth Considering 1) Yield-Curve Valuation Timing While long-term bonds almost always offer higher yields than short-term bonds, it pays to favor long-term bonds when this yield spread is wider than usual and short-term bonds when it's narrower than usual.

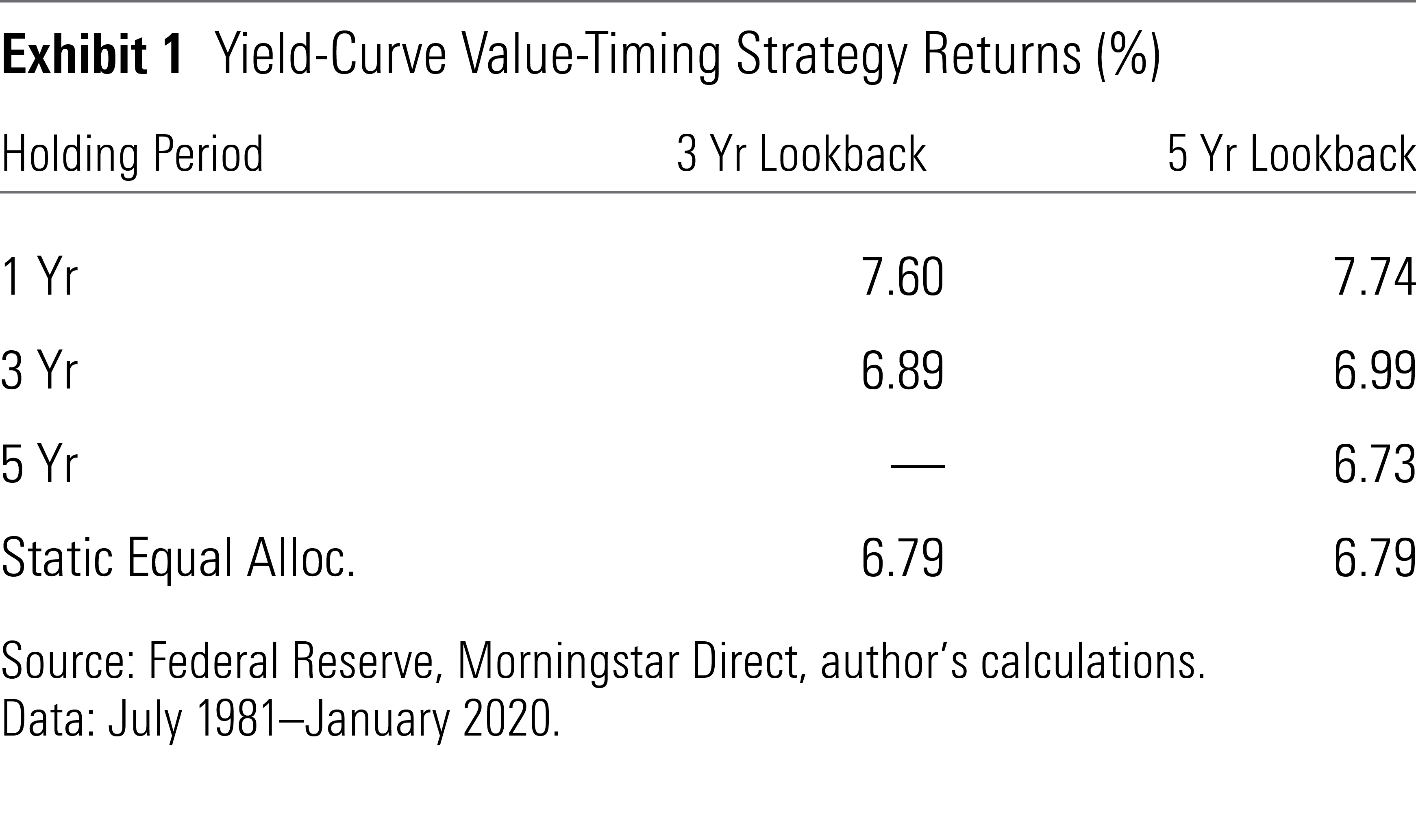

To test this, I created a strategy that held 10-year U.S. Treasuries when the yield spread between the 10- and two-year Treasury equaled or exceeded its average over the past three years. Otherwise, it held two-year Treasuries. I tested this with a one- and three-year holding period. I also tested a version with a five-year lookback. The results are shown in Exhibit 1.

This strategy posted higher returns than a static equal allocation to 10- and two-year Treasuries with both the one- and three-year holding periods. This success is remarkable because the strategy tended to favor short-term bonds more than half of the time, and these usually offer lower yields than long-term bonds.

The strategy works because term spreads tend to mean-revert. The opportunity cost of holding short-term bonds is lower when the yield curve is flatter. When the yield curve mean-reverts, it steepens, causing short-term rates to fall relative to long-term rates, which helps short-term bond prices. Conversely, a steeper-than-average yield curve helps long-term bonds, not only by giving them a larger advantage off the bat, but also because they appreciate more when long-term rates fall relative to short-term rates when the curve subsequently flattens.

This mean-reversion signal indicated that long-term Treasuries were more attractive than short-term Treasuries at the end of April 2020, despite their low absolute yields.

2) Substitute Cash for High-Quality Short-Term Bonds Online high-yield savings accounts often pay interest rates that are competitive with short-term, high-quality bonds. So, they're worth a look. Ally Bank ALLY and American Express AXP currently offer high-yield savings accounts with annual percentage yields of 1.25% and 1.50%, respectively. That's higher than the average yield to maturity of the holdings in Vanguard Short-Term Treasury ETF VGSH (0.30%) and Vanguard Short-Term Bond ETF BSV (1.00%), which includes both Treasuries and investment-grade corporate debt.

High-yield savings accounts at U.S. banks are FDIC-insured, so there’s no credit risk on deposits under $250,000. And, unlike most short-term bond funds, these accounts don't charge expense ratios and they aren't subject to daily price fluctuations, which can make them more attractive when their yields are comparable, as they are now.

3) Credit Momentum Cash and high-quality bonds are great for mitigating risk, but they also limit returns. A momentum strategy may be worth considering for timing exposure to credit risk, though it requires frequent trading.

This strategy is based on the premise that recent changes in corporate bonds' option-adjusted spreads, or OAS, will likely continue in the short term. The OAS is the difference in yield to maturity between a bond with credit risk and a duration-matched Treasury after adjusting for prepayment options. If credit spreads have recently narrowed, they should continue to narrow, which should help lower-rated bonds. If they have recently widened, they should continue to widen, hurting lower-rated bonds.

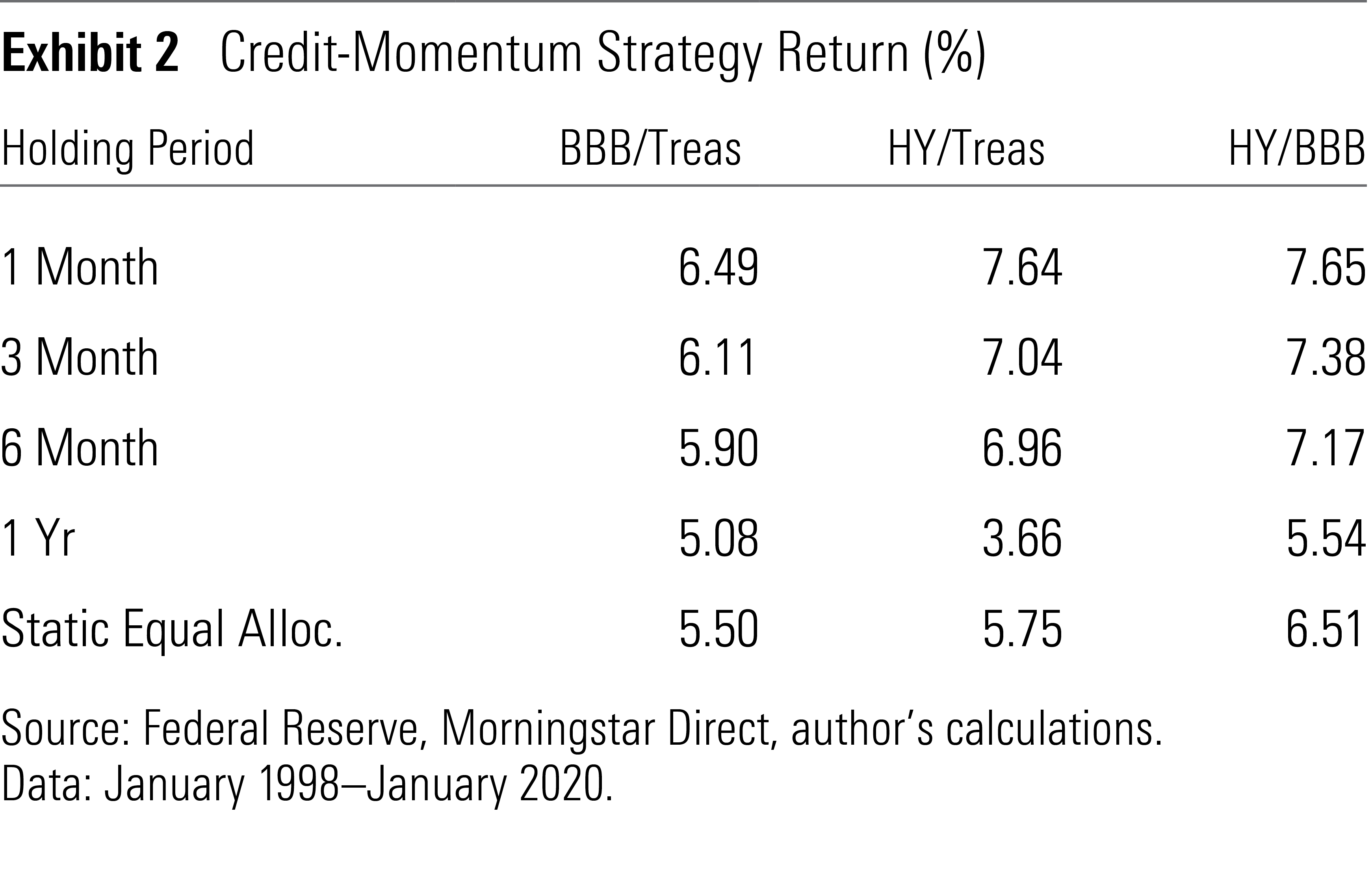

The credit-momentum strategy held Treasuries if the OAS of BBB rated corporate debt at the end of each month was less than its average over the past 12 months, otherwise it held BBB corporate bonds. I repeated this exercise with high-yield corporate bonds and Treasuries, high-yield bonds and BBB corporate bonds (using the difference in their OAS), and different holding periods. Exhibit 2 shows the results.

As with most momentum strategies, these worked the best over the shortest holding period, though they posted better returns than a static equal allocation between the two groups of bonds underlying each strategy with up to a six-month holding period.

Why does this work? Investors may be slow to detect changing credit quality, causing prices to adjust more slowly than they should. Comfort with risk may also lag changing fundamentals, creating a knock-on effect where investors demand less compensation for credit risk after macroeconomic conditions improve and greater compensation after they deteriorate. At the end of April, the BBB/Treasury and high-yield/Treasury strategies pointed to Treasuries, while the high-yield/BBB strategy favored BBB bonds.

Strategies to Avoid 1) Yield-Curve Momentum Given the success of the credit-momentum strategy, it was worth testing whether this approach could also work for timing the yield curve. It turns out it doesn't work very well here.

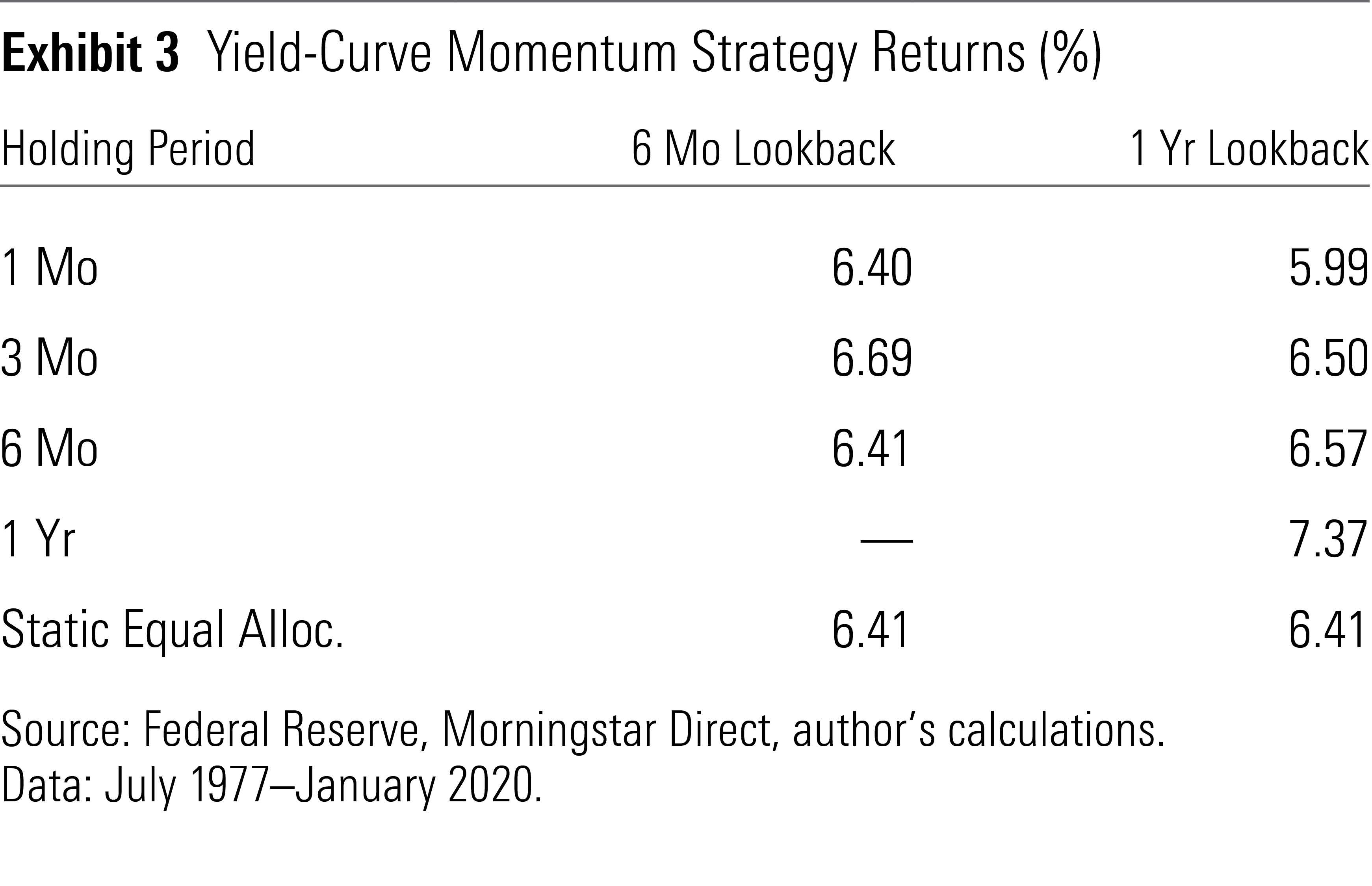

The yield-curve momentum strategy held two-year Treasuries if the yield spread between 10- and two-year Treasuries at the end of each month was less than its average over the past 12 months, otherwise it held 10-year Treasuries. I repeated this with different holding periods and a six-month lookback. Exhibit 3 shows the results.

Performance wasn't great. The only instance where this strategy posted significantly higher returns than a static equal allocation to 10- and two-year Treasuries was the one-year lookback with a one-year holding period. This could be a fluke. If momentum were at work here, the results should be strongest with the shortest holding periods, as momentum is a short-term effect. These results suggest momentum isn't a great strategy to apply in the Treasury market.

Treasuries are one of the most efficiently priced areas of the bond market, with stiff competition and little uncertainty about future cash flows. So, prices adjust quickly, making it difficult to profit from past trends.

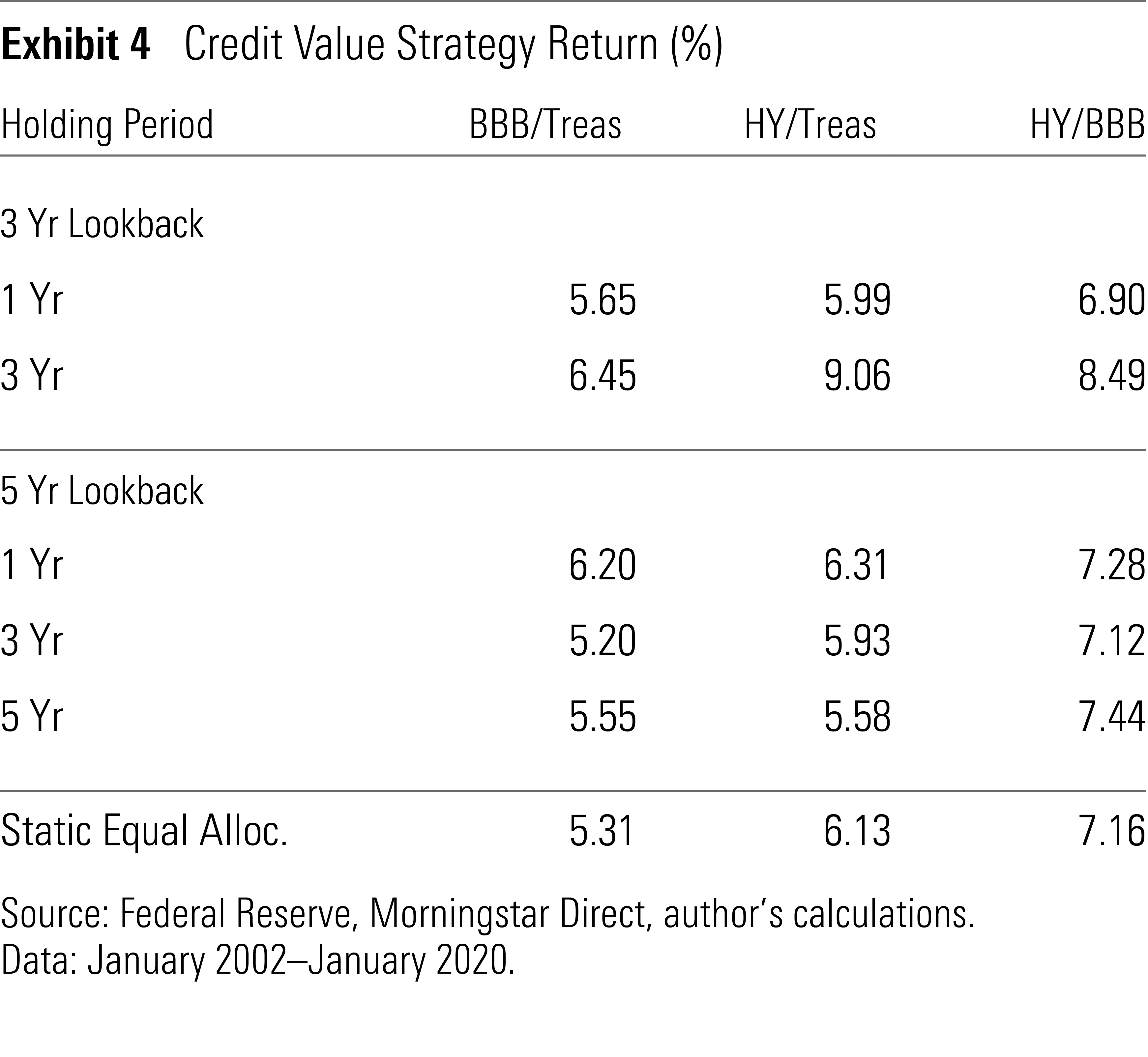

2) Credit Value There isn't clear evidence that valuations are effective for timing exposure to credit risk. The value strategy I created used the same bond index pairs as the credit-momentum strategy, but it held the lower-rated bonds for a year when the relevant OAS was greater than or equal to its average over the past five years, otherwise it held the higher-rated bonds. I repeated this with a three-year lookback period and longer holding periods.

This is an intuitive strategy that waits until the market offers attractive compensation for credit risk before diving in. It uses longer lookback and holding periods than the momentum strategies because value is a slower-moving effect. Exhibit 4 shows the results.

The results are mixed. The valuation-timing strategy posted better returns than the static equal allocations to the relevant bond index pairs with the three-year lookback and holding period. However, there wasn't a clear advantage with the other periods. This suggests OAS valuations are not very helpful for timing exposure to credit risk. This may be because widening credit spreads often widen further in the future, reflecting deteriorating fundamentals.

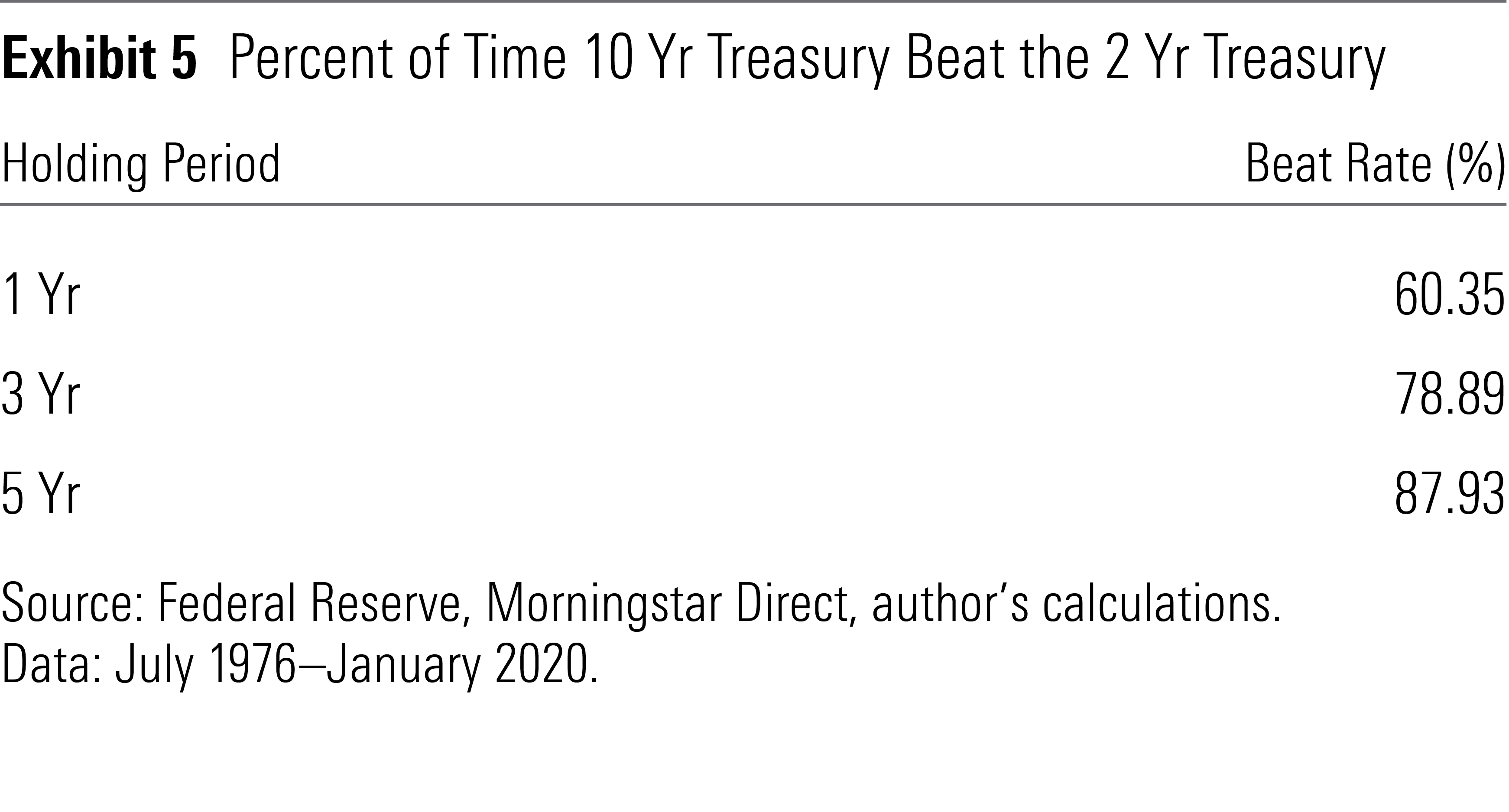

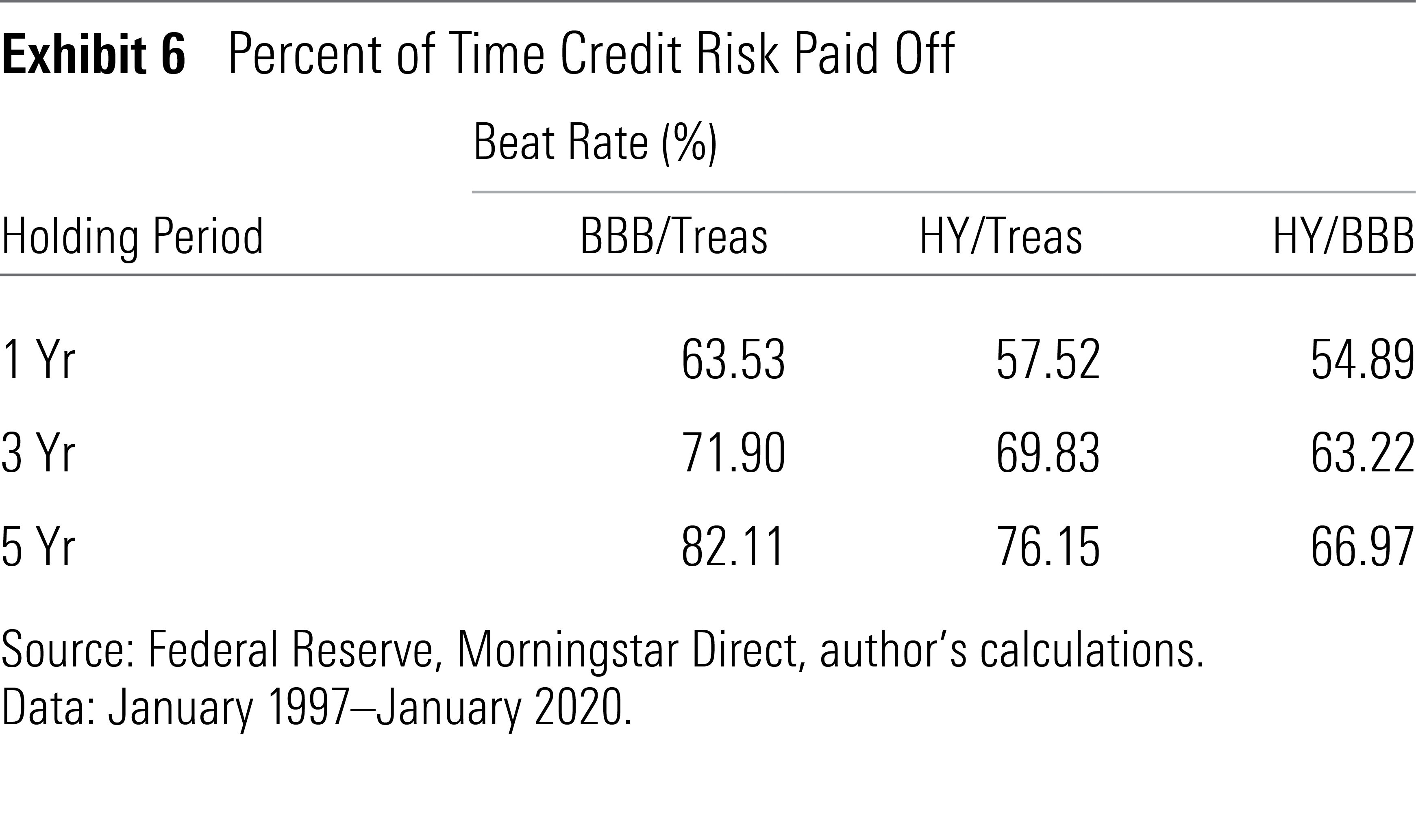

Hold It While some tactical strategies may work, choosing the appropriate level of risk to take is far more important. There are times when risk-taking pays off and times when it doesn't. But the longer the holding period is, the more likely credit and interest-rate risk will be rewarded, as Exhibits 5 and 6 show.

That said, avoid taking more risk than you're comfortable with, because there's a good chance you may not stick with riskier positions through the inevitable rough patches. Lower-quality bonds also tend to be more highly correlated with stocks. Taking a lot of credit risk can hurt portfolio-level diversification.

Good Long-Term Holdings With an appropriate risk target in mind, you can often reach it with low-cost index funds and ignore what's going on in the market. A broad fund, like iShares Core Total USD Bond Market ETF IUSB (0.06% expense ratio) is a good place to start. This market-value-weighted fund replicates the composition of the broad U.S. bond market, including both investment-grade and high-yield debt with a least one year until maturity. Despite its inclusion of high-yield debt, this fund doesn't take much credit risk. Those comfortable with greater credit risk could pair this fund with iShares Broad USD Investment Grade Corporate Bond ETF USIG or iShares Broad USD High Yield Corporate Bond ETF USHY. Similarly, BSV and Vanguard Long-Term Bond ETF BLV are effective complements for adjusting the level of interest-rate risk in a portfolio.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)