Ratings Changes for Vanguard, and a New ESG ETF to Consider

Here's a look at some of the funds that earned upgrades and suffered downgrades last month.

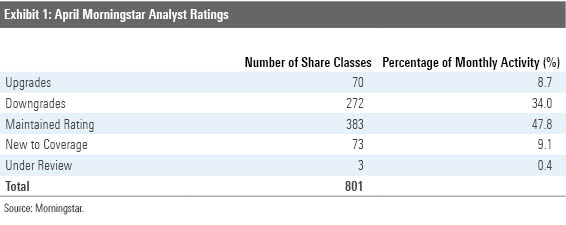

Morningstar updated its Analyst Ratings for 801 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in April 2020. Of these, 383 maintained their previous rating, 272 were downgrades, 70 were upgrades, 73 were new to coverage, and three came Under Review due to material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 181 unique strategies in April 2020. Of these, 12 received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Here are highlights of the upgrades, downgrades, and new coverage for the period.

Upgrades Vanguard High Yield Corporate's VWEAX strong investment team and cautious approach move both share classes to ratings of Gold from Silver under Morningstar's updated Analyst Rating methodology. Michael Hong, a 23-year veteran at subadvisor Wellington Management Company, leads a robust and experienced team using a conservative approach. The investment team focuses on higher-rated high-yield fare resulting in a portfolio that has been more defensive than most peers in the high-yield Morningstar Category. While this fund is the largest in the category, the team manages liquidity carefully, using a mix of cash and Treasuries and focuses on larger names. This approach has helped shield investors in major sell-offs, such as 2015 and so far in 2020.

Morgan Stanley Institutional Growth’s MSEGX established and insightful team underlies its High People Pillar rating and its upgrade to an overall Analyst Rating of Silver from Bronze for its cheapest share classes. Tenured manager Dennis Lynch, a former Morningstar Fund Manager of the Year, leads the 14-person investment team that has a unique and thoughtful investment culture. The team members consider themselves long-term investors in companies rather than stock-pickers, and build a compact portfolio of competitively advantaged businesses reflecting their best ideas. The resulting portfolio is focused and opportunistic, often holding disruptive companies with long growth runways, some of which aren’t yet profitable.

New to Coverage IShares ESG U.S. Aggregate Bond ETF EAGG debuted with a Silver rating. This broad market index strategy focuses on issuers with strong environmental, social, and governance characteristics relative to their sector peers, while keeping tracking error low with the Bloomberg Barclays U.S. Aggregate Bond Index. The fund relies on MSCI's ESG ratings, which assess how exposed each issuer is to ESG risk and opportunities relative to its sector peers. The fund invests in U.S. Treasuries and investment-grade securitized, corporate, and government-related bond issuers, but only corporate and government-related bond issues have ESG ratings, which account for about 30% of the portfolio. To minimize unintended bets, the fund limits sector weightings, duration, and credit quality, which has kept this fund's performance in line with the index during its short history.

Downgrades BlackRock Asian Dragon's MCPCX People rating dropped to Below Average bringing its rating to Neutral for three share classes, and to Negative for its most expensive shares, from Bronze. Lead manager Andrew Swan's unexpected departure in April 2020 was the latest in a string of experienced manager departures in recent years, eroding confidence in the overall group. Stephen Andrews serves as lead manager now, but he is inexperienced as a money manager. Alethea Leung supports Andrews and they will continue to employ a style-agnostic approach, blending top-down and bottom-up research to navigate market inflection points. While the approach is reasonable, it relies on manager intuition and experience, and given Andrews' limited experience it's not clear he can replicate Swan's success.

The Analyst Ratings of Vanguard Dividend Appreciation VIG moved to Silver from Gold after its first run through Morningstar’s enhanced Analyst Rating methodology. This fund tracks the Nasdaq U.S. Dividend Achievers Select Index, which targets dividend-paying U.S. stocks that have increased their dividend for at least 10 years. The fund favors firms with durable competitive advantages and shareholder-friendly management teams, giving it a quality bent. While this stringent approach helps the fund weather downturns better than its large-blend peers, it eliminates the possibility of the fund owning high-quality emerging dividend stocks, limiting its Process rating to Above Average.

Hotchkis & Wiley Mid-Cap Value’s HWMIX high-conviction, contrarian process’ vulnerability to value traps led to a downgrade of its Process rating to Average. That dragged its Morningstar Analyst Rating to Bronze for its cheaper share classes and to Neutral for its most expensive shares. This deep and experienced team tries to capitalize on short-term mispricing of companies by focusing on long-term earnings potential. However, mean reversion in industry or company profitability can take years and, if there are major secular shifts, can be pushed out further. Since 2018, lead manager Stan Majcher has increased the fund’s exposure to cyclical and economically sensitive fare, such as energy, industrials, and financials. That has marred the fund’s recent and long-term performance.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)