Rebalancing: A Practical Lesson

Let's take one more look at the "gold shares or bullion" question.

2 Paths Diverged... Last Friday's column compared the performance of two portfolios that diversified by holding gold. One owned precious-metals stocks, the other used bullion. When preparing the numbers, I noticed several interesting features that I could not address at the time because they were not relevant to that article's question of "gold equities or bullion?" Hence, today's installment.

Each portfolio was a variation of a 60/40 balanced fund, investing 60% of its assets into Vanguard 500 Index VFINX, 20% into the Bloomberg Barclays U.S. Aggregate Bond Index, and 20% into its version of gold. The "Gold Shares Portfolio" held Fidelity Select Gold FSAGX, while the "Bullion Portfolio" owned the LMBA Gold Price Index. The time frame was from Jan. 1, 1986, through April 25, 2020.

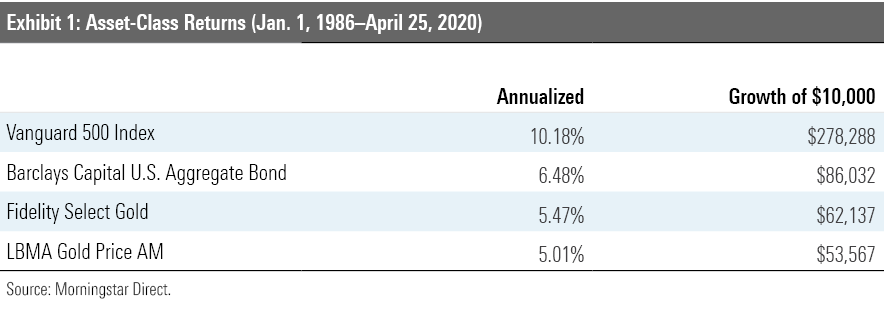

To begin, here are the performances for the four assets, expressed both as annualized returns and growth of $10,000.

No surprises there. Equities easily won the race, with fixed-income investments modestly ahead of gold. The table illustrates the power of compounding, as the cumulative gain for stocks exceeds that of the other three assets combined. Now, 10% versus 6% isn't a huge difference over a year, but it certainly is when that edge is maintained for more than three decades!

The New Math Intuitively, I assumed that if the assets were never rebalanced--the "let it ride" scenario--the Gold Shares Portfolio would have outgained the Bullion Portfolio by 9 basis points per year. My reasoning: The two portfolios were identical except for their 20% gold stakes, and Fidelity Select Gold had beaten the LMBA Gold Price Index by an annualized 46 basis points. That computation, I can do.

Except that I cannot; my intuition failed me. The cumulative performance obeys that math, but not the annualized returns. For the growth of $10,000 calculation, Fidelity Select Gold outgained the gold price index by $8,570. When the two portfolios were not rebalanced, the Gold Shares Portfolio beat the Bullion Portfolio by $1,714, which was indeed one fifth of $8,570.

So far, so good. However, that difference is less than 9 basis points when annualized--2 basis points, in fact. The Gold Shares Portfolio returned 9.06% and the Bullion Portfolio 9.04%. Effectively, huge profits from the two portfolios' equity stakes swamped the finer details of their bond and gold positions. If those lesser assets gained another 50 basis points here or lost 50 basis points there, no matter. Equities drove the results.

The Expense Paradox To an extent, this undermines the argument for cheap funds. Not that reduced costs are ever harmful, mind you. But neither are they particularly meaningful for lower-returning assets, if held over a very long time. Assume a brutally high 2% annual expense ratio on the Gold Shares Portfolio's 20% bond position. Such costs would cut its annualized return to 8.93% from 9.06%, and its growth of $10,000 to $188,431 from $196,607. Mildly painful, but scarcely a catastrophe.

Assume instead that the 2% expense ratio was applied to the Gold Shares Portfolio's equity position, which not only occupies a larger chunk of the portfolio, but also suffers more heavily from an expense headwind because of compounding effects. That decision would slash the portfolio's annualized return to 7.48%, and its growth of $10,000 to $118,854. Now that's what Jack Bogle was talking about.

Conventional thinking is that if one is to pay steeper fund expenses, it should be for higher-returning assets that can "afford" to pay those heavier fees. However, at least when not rebalancing (although I suspect the same holds for rebalanced portfolios--perhaps the topic for another column), the opposite holds. If you are to sin, then sin with government bond funds, not with equities.

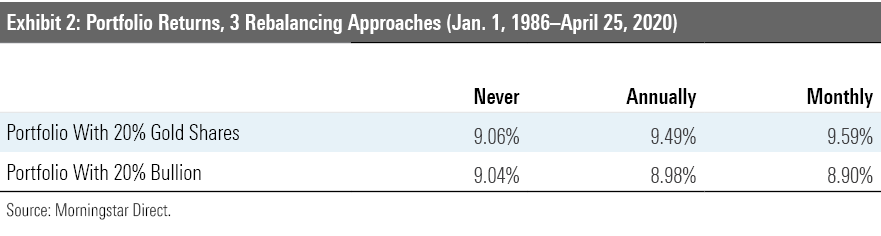

3 Rebalancing Tactics I have mentioned the outcome for the two portfolios when the assets are not rebalanced. I also calculated the results when conducting monthly and annual rebalancings.

Curious. The more frequently that the Gold Shares Portfolio was rebalanced, the better its performance. And the increases were meaningful. As we previously saw, purchasing a bond index fund with a 2% annual expense ratio penalized the portfolio by 13 basis points of annual return. In contrast, rebalancing annually brought it 50 additional basis points, and moving to monthly added another 10.

In contrast, rebalancing slightly lowered the Bullion Portfolio's returns. I can't explain why it declined when rebalanced without conducting a tedious examination of the underlying monthly (and annual) data, but I do know why the effect was slight rather than substantial: gold bullion is less volatile than gold equities. That greater stability makes bullion easier to own, psychologically, but less likely to benefit from rebalancing.

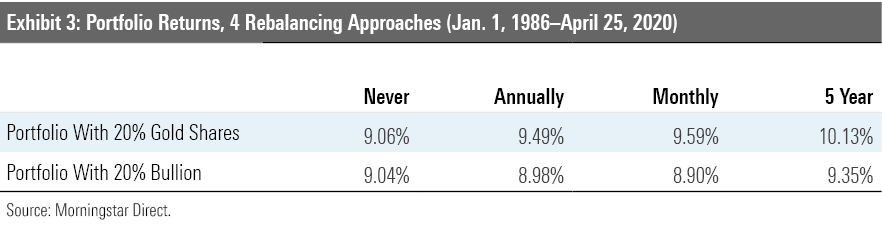

The 5-Year Fluke Let's see what happens if the portfolios are rebalanced every five years--in January 1991, January 1996, and so forth.

Curiouser yet. Both portfolios perform their best when rebalanced every five years. Why would that be better than doing so either less or more often? Goldilocks may prefer the middle chair, but optimal investment tactics rarely do. They almost always are end-point solutions.

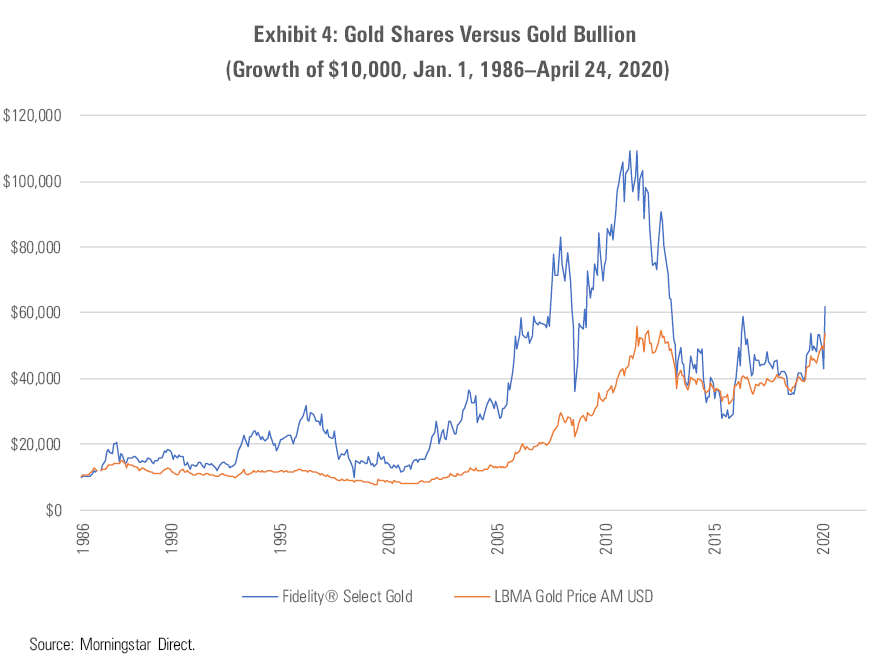

The answer lies below, in the chart that depicts the performance of Fidelity Select Gold and the LBMA Gold Price Index.

The five-year rebalancing plan, executed in years that end in "1" or "6," almost perfectly timed gold's rise and fall. Both gold equities and bullion--the equities even more spectacularly--soared from 2006 through 2011 and then plummeted. Portfolios that were rebalanced each five years held those assets all the way up, without sacrificing gains by shifting those monies elsewhere, then pocketed their profits as gold peaked.

Blind, dumb luck. Shuffle that data series, so that the same monthly returns occur over the same period (meaning that the cumulative gains for each of the four assets remain constant), and the rebalancing lessons will likely change. It just so happened that gold strung together a long winning streak, followed by big losses, and that those events aligned with the five-year rebalancing schedule.

Wrapping Up In conclusion:

- It's better to overpay for low-returning assets than for high performers.

- Volatile assets benefit most from frequent rebalancing.

- It's difficult to generalize about "best" rebalancing strategies, because the results depend so heavily on marketplace specifics.

Different Drums As I write these words, the Dow Jones Industrial Average is up 365 points, on a day when the Department of Labor announced that unemployment rose by another 3.2 million over the past week. Tuesday's column described my struggles to explain why that is to friends who are not investors. My task has not become any easier.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)