State Street Global Advisors Continues to Make Steady Progress

The firm is executing its new strategy and delivering for investors.

State Street Global Advisors, or SSGA, has taken big steps over the past several years to improve its investment offering, its culture, and its operations. These efforts have made the firm more competitive with other large asset managers and have led to better performance for its fund investors. Through this positive trajectory, we're maintaining SSGA's Average Parent rating.

The Parent rating is based on Morningstar's assessment of how well a firm is looking out for its fundholders by focusing on the strength of its investment organization and business practices. It is an input to the Morningstar Analyst Rating assigned to individual funds.

Direction Starts at the Top SSGA began losing market share during the global financial crisis. In 2015, Ron O'Hanley came on board as CEO, having previously served as Fidelity's president of asset management and corporate services. He established a new direction for the firm, and SSGA subsequently implemented a number of changes that have benefited its funds' shareholders. These include revamping its fund lineup, taking a more disciplined approach to product development, improving the tax efficiency of its exchange-traded fund range, and building a top-tier asset stewardship program.

Current CEO Cyrus Taraporevala joined SSGA in 2016 and continues to oversee the internal transformation that was initiated by O'Hanley (who is now the CEO of State Street Corporation STT). Taraporevala and O'Hanley have a long-standing relationship that precedes their time at State Street, which should support alignment and cooperation between SSGA and its parent, State Street Corporation. Taraporevala continues to drive this transformation. More recent initiatives include expanding SSGA's ETF business outside the United States and advancing its asset stewardship initiatives. To date, the firm has shown encouraging progress on both fronts.

SSGA's evolution has been a team effort. Several new faces were brought on board to help steer the firm in the right direction. Notable hires include Noel Archard, head of product development, and Sue Thompson, head of distribution. Both come to their roles with years of industry experience, having previously worked in similar roles at rivals BlackRock and Vanguard.

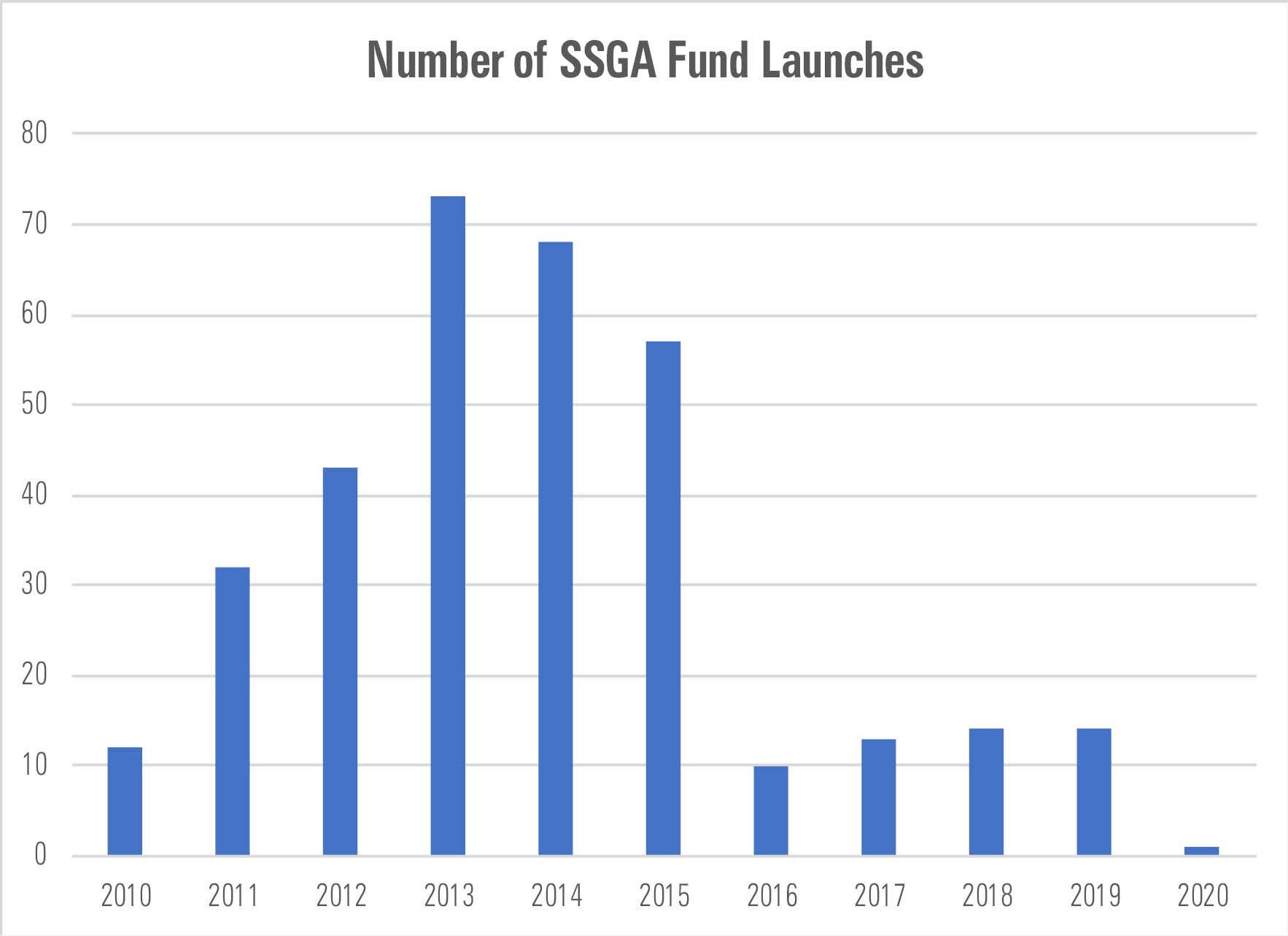

Building Products That Put the Investor First SSGA still has some niche funds in its lineup, but it has shown more discipline in its approach to product development. Starting in 2016, the firm shuttered a number of funds and dramatically slowed the rate at which it launched new strategies. Many of the liquidated funds had failed to resonate with investors.

Source: Morningstar Direct. Data as of March 31, 2020.

Archard's product development team is focused on bringing funds to market that can grow to be large, liquid, and traded in a cost-effective way. Along those lines, SSGA has built out a suite of sensibly constructed, low-cost core ETFs that should have broad appeal. Dubbed the SPDR Portfolio suite, these funds are similar to those previously launched by the firms' closest competitors. While they're hardly first-to-market, offering broadly diversified funds at a low cost is perhaps the clearest demonstration of the new course the firm has plotted and demonstrates its willingness to put investors' interests first.

SSGA has taken similar measures abroad. As in the U.S., fund launches and closures in overseas markets slowed down after 2017. More recently, the firm has made additional investments in its European business, where it has been successfully growing the SPDR ETF franchise. Ten of the 14 funds it launched in 2019 were European-domiciled funds, and there are plans for more.

Investment Management SSGA's investment organization is in great shape. The majority of its assets reside in index-tracking strategies, and the teams responsible for managing these funds have been well-staffed and remarkably stable. Portfolio managers use a combination of industry-standard tools and in-house platforms, placing them on equal footing with other large asset managers.

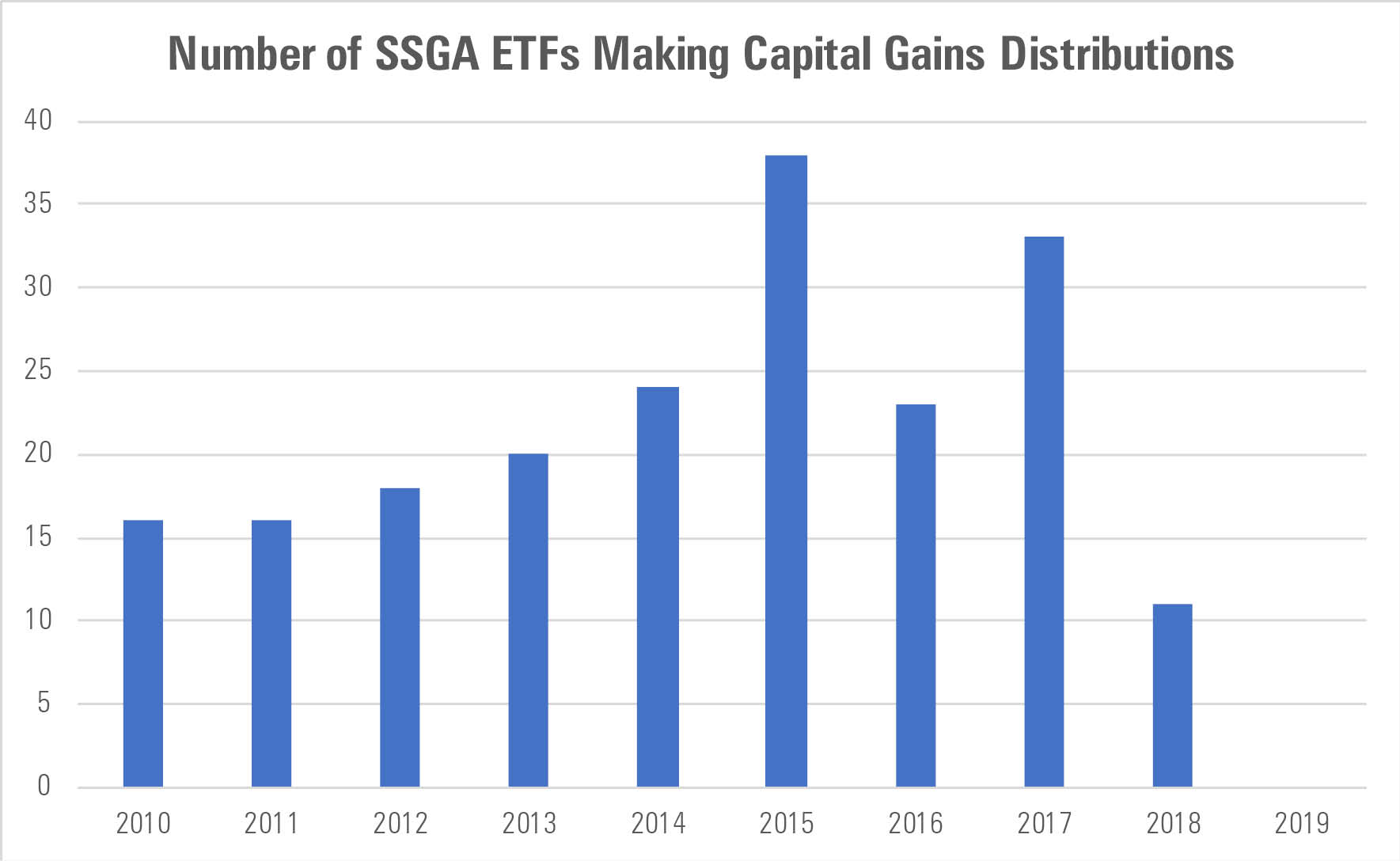

The tax efficiency of SSGA's ETFs was once a sore spot, but this too has turned for the better. Recent enhancements to the portfolio management process have reduced the number of ETFs making capital gains distributions, translating to lower tax bills for investors. Before the changes were adopted in 2017, SSGA stood out from the competition--in a bad way. It regularly had 20 or more of its ETFs distribute taxable capital gains in a given year. The changes have proved effective. The number of the firm's U.S. ETFs that made capital gains distributions declined to 11 in 2018 and zero in 2019.

Source: Morningstar Direct. Data as of Dec. 31, 2019.

Looking Out for Investors SSGA has been ahead of many rivals when it comes to asset stewardship. The firm has a well-thought-out structure for scoring portfolio companies on financially material issues related to environmental, social, and governance practices. Those scores help inform the direction SSGA moves when engaging portfolio companies, whether through proxy voting or direct discussions with senior management. The system was designed to be transparent, allowing companies to improve their score by changing their practices.

Rakhi Kumar spearheaded SSGA's stewardship effort for years but announced she was leaving the firm in May 2020 to pursue other opportunities. Kumar's colleagues, Ben Colton and Rob Walker, will take over her responsibilities as co-heads of asset stewardship. While all investors benefit from these efforts, prioritizing them demonstrates SSGA's commitment to doing best by its fundholders.

More to Come Looking forward, SSGA plans to complement its index fund lineup with actively managed funds, particularly in fixed income. But that effort is just beginning. What's clear is the firm has a strong structure and team in place to improve its business practices and build on the stability of its investment management team. Its top-tier stewardship program also demonstrates that it recognizes the importance of prioritizing fundholders' interests. All told, we're encouraged by SSGA's continued progress down the path it has charted.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)