The Best Target-Date Series

A surprise retirement and our updated methodology lead to a shake-up of series with Morningstar Analyst Ratings of Gold.

Target-date strategies play a central role in many Americans' retirement success by often serving as the default investment option in their defined-contribution retirement plans. At the end of March, assets in target-date mutual funds and collective investment trusts totaled approximately $1.9 trillion, up from $1.7 trillion at the end of 2018 but down from its peak of $2.2 trillion before the coronavirus-driven bear market in the first quarter.

The recently published 2020 Target-Date Strategy Landscape covers trends shaping target-date strategies and reviews their performance during the onset of the most recent bear market. (Morningstar Direct and Office clients can find the full report here.)

In this article, we’ll take a closer look at how the recent enhancements to our Morningstar Analyst Rating for funds impacted our target-date ratings and highlight our top-rated target-date series.

Morningstar Analyst Ratings: Methodology Recap In November 2019, we enhanced the methodology that underpins our qualitative, forward-looking Morningstar Analyst Rating for funds. The updated methodology applies to equity, fixed-income, and multi-asset strategies and should improve our ratings' effectiveness and usefulness to investors. More information can be found here, but the high level changes are:

- We moved from a five-pillar framework to three pillars--People, Process, and Parent--and moved to a more granular, five-point pillar rating scale (High, Above Average, Average, Below Average, Low) from a three-point scale (Positive, Neutral, Negative).

- The Performance Pillar was absorbed into the People and Process Pillars. We removed the Price Pillar. Now, we simply subtract a fund's expenses from our estimate of how much value it can add before fees. As a result, each share class of a fund receives a tailored rating, with costlier share classes often receiving lower ratings than cheaper share classes. Previously, we assigned the same rating to all of a fund's share classes.

- For target-date series, each vintage of a series will have the same ratings across share classes. For example, BlackRock LifePath Index 2050 K LIPKX and BlackRock LifePath 2020 K LINKX both earn Morningstar Analysts Ratings of Gold, but BlackRock LifePath Index 2050 A LIPAX and BlackRock LifePath Index 2020 A LIJAX, which have higher expense ratios, both earn Morningstar Analyst Ratings of Silver.

- Our updated methodology sets a higher bar for target-date series. Formerly, we might have assigned ratings of Gold, Silver, or Bronze to a series that could beat its average peer across vintages but not its costless category index. Now, we only recommend series expected to beat both bogies after fees, adjusted for risk.

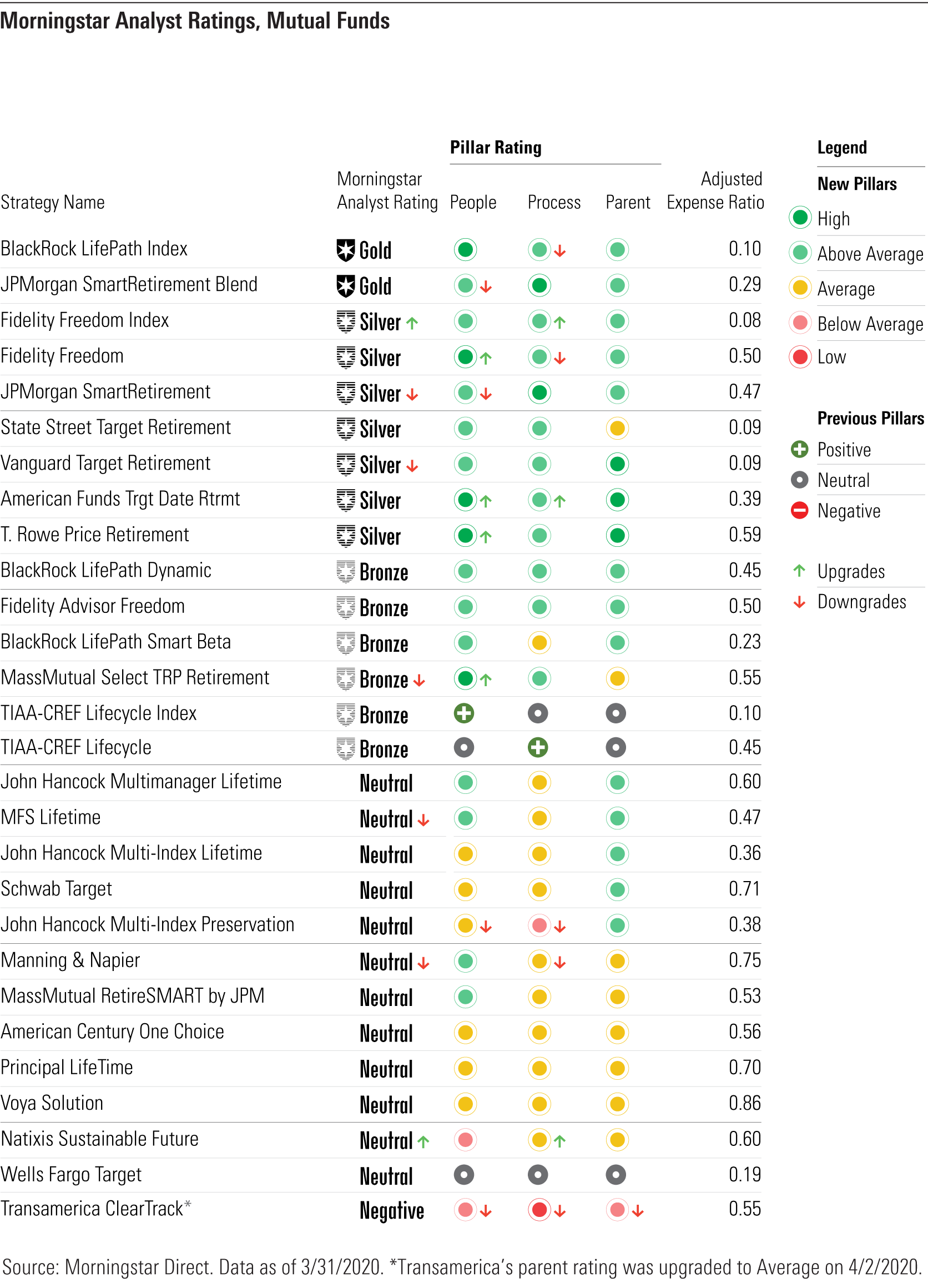

Target-Date Series Ratings The table below shows ratings assigned to the cheapest share class of target-date fund series we cover, as of March 2020, along with the average expense ratio across its vintages. It also highlights how the Analyst Rating, People Pillar, Process Pillar, and Parent Pillar changed between October 2019 and March 2020. Overall, two series' cheapest share class received an upgrade to the Analyst Rating, while five received a downgrade. The combined effect of the change in our methodology along with changes to pillar ratings drove the upgrades and downgrades. Only three series--TIAA-CREF Lifecycle, TIAA-CREF Lifecycle Index, and Wells Fargo Target--have yet to be rated under the new methodology. Investors can still feel confident using their ratings. If we had reason to believe they weren't reliable, we'd expedite the process of updating them under the enhanced methodology.

Series That Earn Gold BlackRock LifePath Index and JPMorgan SmartRetirement Blend are the only two series that earn Morningstar Analyst Ratings of Gold for their cheapest share class.

BlackRock LifePath Index stands out versus peers thanks to its management team’s dedication to progressive research, topnotch building blocks, and low costs. Lead manager Matt O’Hara and team have continually pushed the series forward. In 2014, for example, O’Hara led a research effort that resulted in a steeper glide path that held more equities when investors were further from retirement and sharply decreased as investors neared retirement. This leads to a glide path that seeks to maximize growth when investors’ time horizons are longest and minimize the downside risk at retirement, when time is no longer on investors’ side. More recently, in 2019, the team lowered its early overweight to REITs in the glide path to emphasize the growth potential of broader equity markets when investors are furthest from retirement. Continuing to revisit prior assumptions and make proactive changes that are backed by rigorous research gives us confidence that the team will continue to evolve the series over the long term to investors' benefit.

In March 2020, Anne Lester, former Morningstar Allocation Fund Manager of the Year and matriarch of JPMorgan’s target-date strategies, unexpectedly announced her retirement. This led to a downgrade of the People rating for both JPMorgan target-date strategies we cover to Above Average from High, but JPMorgan SmartRetirement Blend continues to have our highest conviction for its cheapest share class.

Target-date series that combine passive equity funds and actively managed bond funds are common today, but that wasn’t the case in 2012 when JPMorgan launched its Blend series. It’s a testament to Lester and her team’s innovative approach to constructing portfolios. The series uses cheap index funds for exposure to asset classes where active management has struggled to add value, like U.S. large-cap equities, and uses active management in asset classes where they have conviction in the active manager to outperform the index alternative, like U.S. core bonds. It is a sound approach to building portfolios that leverages the best of both passive and active options, rather than dogmatically prescribing exclusively to one or the other. The process also stands out for the team’s thoughtful and proactive approach to strategic asset allocation and its ability to add value through its established tactical-allocation process over the long term, a feat few other series have been able to achieve. Although Lester’s departure raises some long-term questions, this series is built to endure.

Target-Date Strategies Upgraded to Silver The Fidelity Freedom Index target-date series launched in 2009 as a simplified, cheaper alternative to Fidelity's legacy Freedom series. Andrew Dierdorf, Brett Sumsion, and relative newcomer Finola McGuire Foley (June 2018) lead the index-based offering, while receiving support from Fidelity's robustly resourced asset-allocation team. This series maintains a strict focus on index-based building blocks, limiting the team's ability to tap into certain niche asset classes where index offerings are less suitable. However, the managers implement a sound, research-driven approach that informs the strategic asset allocation within this series and across the firm's other target-date offerings. The series' index-based construction, which drives its low cost, also provides it a meaningful advantage and further supports our confidence in its prospects. As a result, the series' Morningstar Analyst Rating was upgraded to Silver from Bronze across both of its share classes.

Target-Date Strategies Downgraded to Silver JPMorgan SmartRetirement shares many similar traits with its sibling Blend series that earns a Morningstar Analyst Rating of Gold, but Lester's departure and its higher fees (due to its exclusive use of actively managed equity funds instead of index funds) lowers our conviction on this series, leading to a downgrade to Silver from Gold. The series also takes more risk with its tactical bets than the blend series, which means that when it does occasionally miss, as it did in 2018, it has a deeper hole to climb out of. Still, investors who can stomach rare periods of underperformance should be rewarded over the long run.

Vanguard Target Retirement, the more than $700 billion behemoth of target-date strategies, was downgraded to Silver from Gold. Our conviction in the series’ management team and process hasn’t changed, but under the new methodology it is tougher to earn our highest Analyst Rating given the low dispersion of returns among target-date funds and higher degrees of confidence in the team and approach at other series. Still, its straightforward and simple design remain perfectly suitable for anyone saving for retirement. It is a particularly attractive option for investors who aren’t able to access other series’ cheapest share classes. Its Investor share classes have a low minimum investment of $1,000 and charge between 0.15% and 0.13%.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)