A Star From the Previous Bear Market Is Struggling in This One

Market history doesn't repeat itself, but it rhymes.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Every bear market is different, but some commonalities emerge. They typically hit a few industries hardest while others may emerge relatively unscathed. The huge growth rally of the 1990s was corrected by a severe sell-off in technology and healthcare stocks that pummeled aggressive growth funds while leaving some value industries alone.

The 2007-09 bear market followed a nice value run with a brutal financial meltdown, which hit value funds right where they live.

If the market had kindly stuck to the pattern of reversal, growth funds would be destroyed and value managers finally vindicated. But no such luck: Once again value is bearing the brunt, though financials haven't been hit the hardest.

The previous bear markets dragged on for a couple of years, whereas we've already had a nice rebound in this one. If we don't have a second leg down, then the damage to stock investors will look awfully mild compared with the massive damage to our health and the economy.

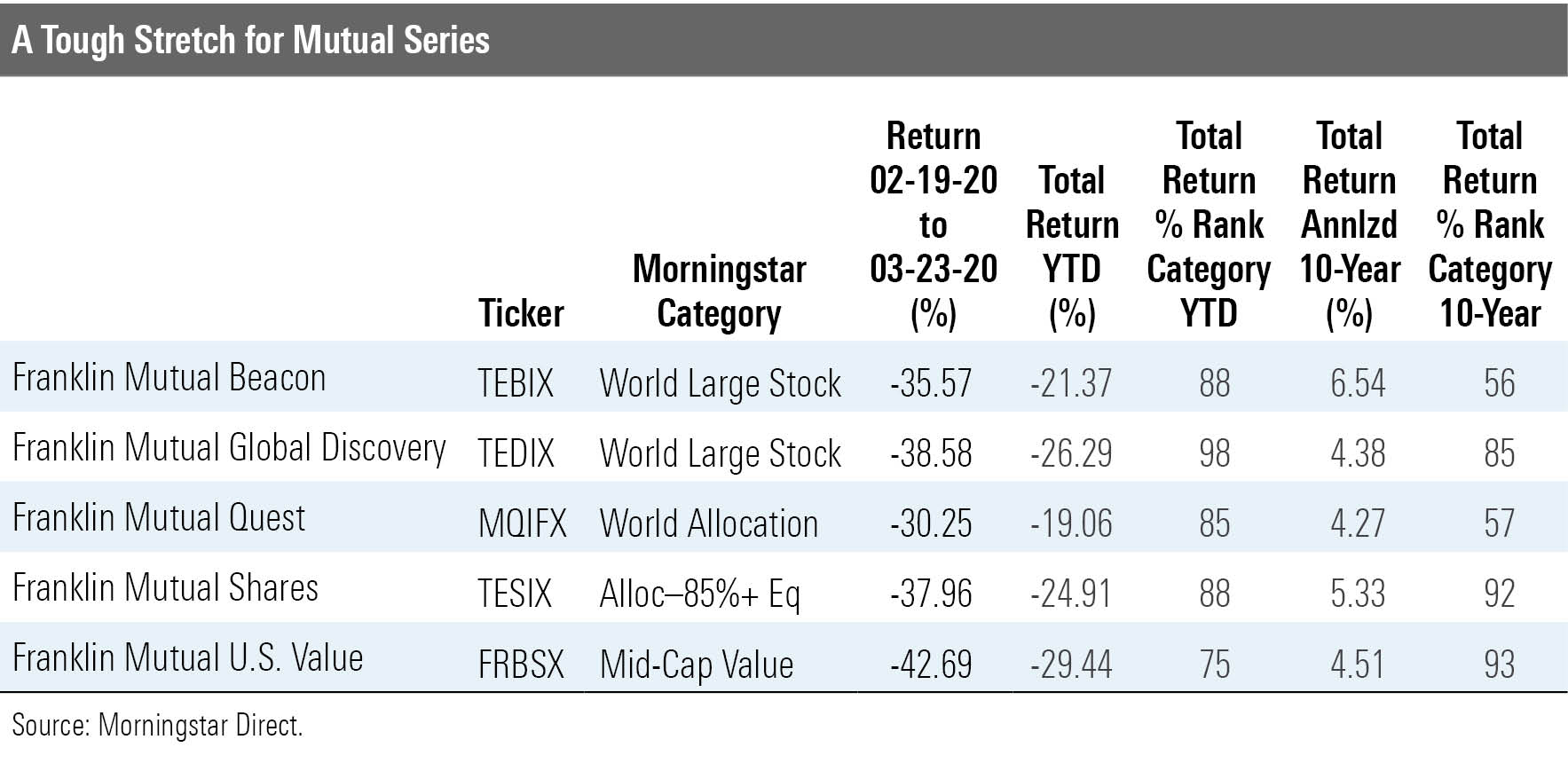

Even so, this bear market has been much tougher on Mutual Series funds than the previous one was. A big part of that story is cash. The firm, part of Franklin Templeton, has long taken a conservative approach. Mutual Series manages price risk by insisting on a sizable discount to its fair value estimate, and it also historically has let cash build from time to time. At the end of 2007, Franklin Mutual Beacon TEBIX, Franklin Mutual Global Discovery TEDIX, Franklin Mutual Quest MQIFX, Franklin Mutual Shares TESIX, and Franklin Mutual U.S. Value FRBSX had single-digit cash stakes. But as warning signs grew, Global Discovery and Quest raised cash to more than 15% in March 2008 and to 21% or 22% in June. The other funds followed the same direction but on a smaller scale. In June 2008, all five were at double-digit levels between 10% and 15%.

In March 2009 when the market hit bottom, Franklin Mutual Global Discovery and Franklin Mutual Quest had raised cash to 48% and 49%, respectively. The other three were between 13% and 15%. For Global Discovery and Quest, it was a big win. Global Discovery's peak-to-trough loss was 32% compared with 56% for the world stock Morningstar Category and 57% for the MSCI ACWI Index. Quest lost 33% compared with 41% for its typical world-allocation peer.

The others were less impressive. Franklin Mutual Beacon's 54% loss was pretty close to its peers', and Franklin Mutual Shares shed 52%.

Then came the rebound and the funds gradually pared cash but not in a dramatic way. Franklin Mutual Global Discovery and Franklin Mutual Quest were both around 35% in June 2009, and they finished the year at 28% and 22%, respectively. The funds gained about 21% in 2009, but that landed them in the bottom decile of their peer groups and was about 1,200 basis points behind the world-stock benchmark. In short, they timed the cash raise nicely but timed their re-entry so poorly that they squandered much of their earlier outperformance.

That led the firm to swear off the massive 30%-or-greater cash stakes, but managers still had discretion to hold more than their typical peers. Also, in December 2009, Franklin Mutual Global Discovery managers Anne Gudefin and Charles Lahr left for Pimco to run a fund that has since been liquidated.

At the end of 2010, the highest cash stake among the five was 13% and the lowest was 6%. For most of 2014 and 2015, the funds' cash stakes were in the single digits. At the end of January 2020, three funds held 5% or less in cash, and the largest stake was Franklin Mutual Quest's 11%. The funds didn't flinch for the most part, and four left their cash stakes in the single digits during the bear market, but Quest cranked cash up to 30% by the end of March.

From Feb. 19 to March 23, 2020, Franklin Mutual Quest lost 30%, while the others lost 36% to 43%. The year-to-date rankings aren't pretty. All are bottom-quartile. Funds that held up nicely in 2008 are hurting today.

Of course, you'd hope their conservative stock selection would have taken some of the sting out of the sell-off even without a cash buffer, but it hasn't. And now the funds' long-term records are less impressive as a down market didn't help them make up the ground lost in the up market.

You don't see a lot of equity or allocation funds with big cash stakes. You could make the case that Mutual Series shouldn't have reined in its managers, but it's not that simple. As that missed rebound indicates, timing is really difficult. And if your timing is off, then you've just got a big opportunity cost in that cash stake.

But the biggest reason you don't see many funds with big cash stakes is that planners and individual investors want greater control over their asset allocation. If stock fund managers stick to stocks, bond fund managers stick to bonds, and money market funds stick to cash, you can precisely dial in the amount of exposure you want to each asset class.

If they don't, then you are handing over some of the allocation duties to the fund manager. I think that's fine, but planners and investors do at least have an information edge over the manager when it comes to knowing the investor's needs and goals, even if they lack the ability to make timing calls.

I don't mind funds that hold cash. Focused funds can use cash to dial down volatility a bit and buy when the opportunity presents itself. Using cash tactically is trickier. Even if you time it well once, you can hurt your record if you don't get the next move right.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)