Digital Realty Is Our New Favorite Data Center

It's the first one we'd look to in another market sell-off.

March brought a shakeup to the data center industry, and it wasn’t caused by the economic shutdown that resulted from the COVID-19 pandemic. Rather, the new dynamic was brought on by the completion of Digital Realty’s DLR acquisition of Interxion.

We’ve considered the effect that the pandemic will have on data centers, and we’ve determined that the answer is: not much. While data centers won’t be immune to some of the problems and inconveniences that come with the shutdown--such as tenants whose businesses may fall apart in the current economy or delays in bringing additional capacity on line--we expect the impact on our fair value estimates from those factors will be minimal. Additionally, greater data center needs of major tenants that are now accommodating workforces that largely work from home and communicate electronically should ultimately offset these headwinds. Data centers’ biggest customers tend to be cloud providers, other hyperscale customers (such as media and social media companies), and network service providers, and we expect all those customers to see increased activity on their platforms and over their networks in this environment. The expansion of their data center presence thus may need to be accelerated, though we see that as a longer-term move rather than something that will affect 2020 results.

Overlooked in the recent turmoil is the extent to which Digital Realty improved its position by buying Interxion. Interxion had a concentrated portfolio of 54 data centers in 13 European cities, but the entire footprint was extremely network-dense, making its data centers central to the Internet and data connections in Europe. It complements Digital Realty’s existing portfolio extremely well, in our view, and puts Digital Realty and Equinix EQIX at a level clearly above other industry competitors.

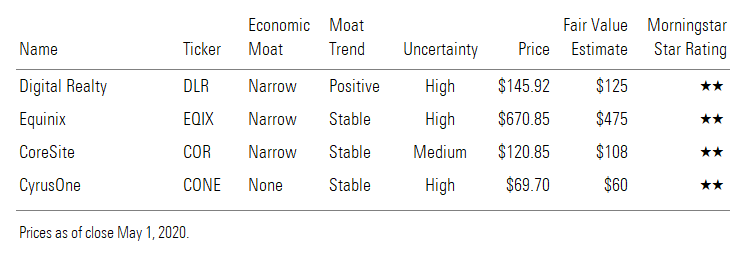

We think Digital Realty has similar prospects as Equinix, but the market continues to value Digital Realty at a discount. Based on our trailing pro forma and forward estimates, we believe Digital Realty trades at a 10%-15% discount to Equinix based on EBITDA and funds from operations multiples. Both stocks have popped about 40% from their lows in March, and Digital Realty has eclipsed our fair value estimate, but it would be the first data center stock we’d look to in another market sell-off.

We’ve long thought highly of data center businesses, but not always the attractiveness of their stocks: We viewed each as significantly overvalued when the calendar turned to 2020. The stock market crash that resulted from the COVID-19 pandemic initially hit the four data center stocks we cover--Digital Realty, Equinix, CoreSite COR, and CyrusOne CONE--hard, bringing three of them below our fair value estimates at the sell-off’s peak. Recent exuberance has brought each of them back to pre-sell-off highs, but market volatility and upcoming earnings reports could cause opportunities to arise again in these solid, long-term businesses.

Data center businesses are not immune to the negative ramifications stemming from what for all intents and purposes has been a shutdown of the global economy. Specific consequences for data centers include delays in expanding their footprints and the loss of customers that might succumb to financial difficulties. However, the long-term thesis underpinning the data center growth story is intact and should resume as the world heals from the pandemic. We see no long-term change to the trends that require increased interconnectivity among people and machines throughout the world, growing use of data and storage, and a shift by companies to the cloud, with hybrid cloud business models. By the same token, because the huge technology and communications companies have been preparing for this growth, we don’t think near-term surges on their platforms will cause a material increase in near-term data center demand.

We’ve previously said that the big differentiator among data centers and what leads to long-term competitive advantages is network density--the number of network providers connecting to a given property. Data centers that have many network providers connecting to the buildings are extremely valuable to tenants, which need to connect with networks to reach the rest of the world, and are extremely costly to replicate. Data centers that currently have dozens or hundreds of networks connecting to them are likely to remain their regions’ leaders because of the unlikelihood of having so many network providers building into new locations when an alternative already exists. These network-dense data centers are most likely to draw the cloud providers’ on-ramps, and the cloud providers then draw their customers to the same properties.

We’ve favored the network-dense footprints and focus on connectivity that CoreSite and Equinix offer. We’ve also noted Digital Realty’s ownership of numerous properties that are gems, but those have historically been outweighed by the company’s huge portfolio of non-network-dense data centers. However, after what we think is the outstanding acquisition of Interxion, Digital Realty is no longer an afterthought when considering the companies with the most valuable portfolios. We think it now has to be held in similar regard to Equinix for customers looking for the best, highly connected, global data center footprints. When combining Interxion’s data centers with the advantages that Digital Realty already held, and considering Digital Realty’s valuation discount to Equinix and its ability, unlike CoreSite, to meet customers’ needs globally, Digital Realty is now our top pick among data center companies.

COVID-19 Should Have Only a Modest Near-Term Impact The pandemic affects data centers on both the supply and demand sides of their businesses, but we don't believe the impact will be long-lasting or severe, so we are not reducing our data center fair value estimates on COVID-19 concerns for now. Amid stay-at-home orders in many parts of the world, governments have almost universally exempted a number of essential activities, typically including data centers under a critical telecommunications and digital infrastructure exemption. Although data center companies have taken measures to reduce foot traffic in affected areas, we have not seen any reports or evidence of business disruption.

Data centers are major users of technological, power, and cooling equipment, so supply-chain disruptions that impede or delay a company’s ability to secure the necessary equipment could disrupt operations. We think this is unlikely to cause a problem. Companies tend to have supplies on hand that they intend to use in the near term. For example, at an investor conference in early March, Digital Realty said it has about 12 months’ worth of items such as switches, batteries, and uninterruptible power supply equipment. Unless a COVID-19 supply-chain disruption lingers beyond 2020 and causes sustained shutdowns, we expect the companies can weather any equipment procurement delays without altering their courses. Considering that China reopened for production within three months of shutting down, we don’t expect an inability to buy equipment is likely to have a noticeable impact to operations.

We think what will more likely impede results over the next year are delays in data center expansion efforts. Whereas operational data centers are considered essential, new data center construction may not be in many places. Depending on the length and extent of shutdowns in various states and countries, portfolio expansions are likely to be delayed. Even where construction can continue, it would be slower in an atmosphere where worker absenteeism is likely to rise.

As it affects our valuation models, construction delays would simply push our forecast revenue out by the length of the delay, and this would be slightly offset by a similar delay in some capital spending. While we think it’s quite possible the companies’ development timelines will get pushed back to some extent, that would have only minimal impact on our valuation estimates.

Churn Could Tick Up but With Minimal Impact We don't think data centers will suffer much from a pullback in demand, either. Data center revenue is not usage-based, and most of it is locked into multiyear contracts. Even so, companies that face financial difficulties may be unable to meet their obligations, contracts notwithstanding, and companies that face significant slowdowns to their businesses may not need to expand their data center presences as quickly as they otherwise would have.

Given the significant switching costs that their customers face, data center companies routinely say that one of the most common reasons for churn is that the customer simply no longer needs a data center presence, which can happen when a tenant become financially troubled or is filing for bankruptcy. As the likelihood of companies in many industries running into this situation has increased as a result of the COVID-19 response, churn may tick up in the year ahead.

Still, we expect the impact to be minimal. Most data center revenue comes from huge, global companies. Even if some of these companies--perhaps those in the retail and travel and hospitality industries--must ultimately file for bankruptcy, we think most will probably choose to restructure and continue operating. Although legal maneuvering and negotiations would likely result in modifying data center contracts that technically would need to be accepted or rejected in full in bankruptcy, we’d expect troubled companies to ultimately fulfill the bulk of their contractual obligations, as we don’t think their data networking needs would be significantly reduced after a restructuring.

We think a bigger impact from particularly affected customers with sizable contracts is that they will pull back on adding future commitments, which the data center operators have been counting on, given the rapid expansion still underway. However, we expect a reduction in future spending from those companies hurt by the current situation will be offset by greater demand from others that benefit. Whereas energy, retail, and travel-related companies are likely to face significant pain as a result of COVID-19 and the likely recession that follows, others are seeing more demand for their networks as they meet the needs of people working from home and generally staying in. Data center companies’ biggest customers are overwhelming cloud providers, hyperscalers, and other information technology companies that we think, if anything, will need more data center capacity as a result of a homebound society and habits that change even after lockdown restrictions lift. However, we’re wary of the belief that current stay-at-home conditions will be a boon to data centers in the near term. Data center tenants sign long-term contracts, and the hyperscalers especially tend to make major commitments that they can grow into. They do not come and go depending the needs of a given day. We believe the population’s reliance on hyperscalers may accelerate the timeline of their continued build-outs, but it is part of the story we already forecast to play out over a period of years. We don’t expect it to cause overwhelming incremental demand in 2020. Given the sales contributions of different industries, we don’t believe a downward revision in expected data center demand is necessary.

Digital Realty’s and Equinix’s customers most hurt by the pandemic generally reside in the enterprise category, which accounted for 8% and 18% of revenue in 2019, respectively. Of course, not every customer in this very broad category will be affected. CoreSite and CyrusOne don’t provide as much granularity, but we know that each company gets more than half its revenue from network, cloud, and information technology companies. CoreSite is the only company that shows one of its biggest customers coming from a particularly hard-hit industry (Equinix’s fourth-biggest customer is an enterprise company in an undisclosed industry, so it is the only other data center company that could have top-10 customer exposure).

CoreSite and Equinix, with their focus on retail colocation and therefore enterprise customers, would probably have greater exposure to companies in troubled industries, but with future growth largely predicated on riding the wave toward cloud usage, we don’t expect it will have a major impact on the revenue growth outlook for either.

After taking into account the various ways that COVID-19 could affect data centers, we think a delay in getting space currently under construction into operation would be the most likely to have a significant impact. At this point, we expect these projects to be finished just a few months behind schedule. In general, the data centers may see some moderation in 2020 revenue, but there is little effect on our growth forecasts beyond that, leading to minimal impact to our fair value estimates. While our near-term estimates may ultimately need to come down, we are not reducing any fair value estimates. The effect would be small enough that it wouldn’t materially offset the time value of money or various other puts and takes that generally cause small variances in our fair value estimates, so we don’t think tiny downward revisions amid this extreme uncertainty are warranted. A change in revenue growth trajectory beyond 2020 would have a more material impact, but we don’t currently forecast that.

Apart from how the current pandemic directly affects the data center business, the recent market crash and seizing up of credit markets likely played a role in the violent stock downturns. Data center companies tend to be highly leveraged, but we think each of the ones we cover is in satisfactory financial shape. Only Equinix has a significant amount of debt maturing in the next two years (a total of about $1 billion), and it had more than that much cash on hand at the end of 2019. Additionally, with the pandemic unlikely to cause major disruptions to data center businesses, we don’t foresee any being in danger of breaching debt covenants, and we think it’s likely all would still be able to access the credit markets if necessary.

With COVID-19 not materially changing our outlook for data center companies, we’re focused on other major developments that inform our thinking about this industry, namely Digital Realty’s acquisition of Interxion and how it positions the company to compete with Equinix, the only other provider that has a truly global offering of highly connected data centers, two qualities that are paramount for industry leaders.

Digital Realty Struck Gold With Interxion We think Digital Realty hit a home run in acquiring Interxion, which adds 54 data centers in 13 European cities. While a more robust global offering will certainly be a benefit, the key feature that makes Interxion special is how unique its data centers are, due to their attributes as interconnection hubs. Interxion's data centers are central enablers of transcontinental communication between Europe and the rest of the world in addition to the intracontinental connectivity they provide.

We believe the best attribute a data center can have is network density. In our view, high network density provides a huge competitive advantage because it is extremely costly and difficult to replicate. It also leads to a network effect moat source, as other network service providers and cloud providers typically need to connect with many other networks, so they are drawn to locations where many partners are present. Cloud providers in turn draw their customers, which use cloud on ramps to connect with them.

We’ve cited Equinix and CoreSite for their network density and the advantages that flow from it. Digital Realty already had several network-dense data centers, but they were overshadowed by the rest of its portfolio, which historically was not focused on interconnection but rather on wholesale space. Interxion fits squarely with CoreSite and Equinix as a company built around interconnection, with virtually its entire footprint benefiting from network density. On a relative basis, Interxion’s 13-city footprint had greater network density (based on the number of network providers connecting to its data centers in each city) than both Equinix and CoreSite, although Equinix’s impressive footprint is 4 times as large. Interxion had more than 40 network service providers connecting in every one of its cities, and it had over 100 network providers in nearly 40% of them. Interxion’s biggest market is Frankfurt, Germany, where more than 700 network carriers connect to its campus and it houses the core infrastructure for the Deutscher Commercial Internet Exchange, or DE-CIX, the biggest Internet exchange in Europe. The addition of Interxion makes Digital Realty’s connectivity options competitive with Equinix, the only other company with such a large, global footprint.

Data center companies with highly connected properties are able to charge a premium and monetize cross-connects to a greater extent than less connected properties, leading to much more productivity over their footprints. Interxion was no exception.

In addition to its wisdom in nabbing the Interxion portfolio, we immediately commended Digital Realty upon the announcement for making this merger an all-stock transaction. We thought stocks throughout the entire industry, including Digital Realty’s, had risen too much, so if one company was going to buy another when valuations might be peaking, it was best to use one’s own stock as currency. The decision looked even better when the deal was completed in March, as prices for all stocks came down, and companies with too much debt in the current environment may face distress. On a relative basis, we think Digital Realty paid a fair price.

The fair price leads us to believe that Interxion brings incremental value to Digital Realty owners. After taking a closer look at Digital Realty and reassessing what the integrated portfolio means for future opportunities, we raised our fair value estimate to $125 per share from $112. When combining the more complete geographic presence and additional network-dense properties with the other advantages Digital Realty has that already buoy its margins (due in large part to its ownership of nearly all its data center space, in contrast to Equinix, which leases about half its space, including much from Digital Realty), we think Digital Realty now has a portfolio that positions it as well as any competitor and is poised to capitalize financially. In our view, its revenue growth prospects are second to none, and it should be able to accomplish that growth more profitably. Considering the combination of business positioning and valuation, Digital Realty is now the most attractive data center company we see.

Our view that densely connected data centers provide the truest long-term advantage (since they are nearly inimitable and continually gain importance as global interconnection and data use grow) previously led us to CoreSite as our favorite data center company. It has a concentrated, network-dense U.S. portfolio and has historically provided the best data center returns on invested capital. However, as communication evolves, enterprises move their businesses to the cloud, and the global cloud providers that underpin data center revenue demand a global presence, we now think a valuable portfolio is not sufficient to keep up with industry growth. We see CoreSite as in a very similar position to Interxion: a company with treasured assets that need to be part of a bigger portfolio. (We actually think CoreSite would be a good acquisition target for Digital Realty, but we don’t expect such a move to happen as Digital Realty focuses on integrating Interxion and building its portfolio on other continents.) Instead, we think Equinix and Digital Realty, companies that can offer data center space in most major cities throughout the world, are poised to pace the industry’s next phase of growth. As we view Digital Realty and Equinix as having clear advantages, we are raised our fair value estimate for Equinix as well, to $475 per share from $430. Our new fair value estimates are based on forecasts that imply similar levels of revenue growth and margin expansion and result in similar fair value EBITDA multiples--around 20 times our 2020 estimates. However, Digital Realty is the only one of the two that is in the vicinity of fairly valued.

Investors already see Equinix in such a favorable light, and in our view, this has led to the stock getting ahead of itself. Based on Equinix’s 2019 results and our pro forma estimate for the combined Digital Realty and Interxion (based on disclosed pro forma financial statements through three quarters of 2019), Equinix’s trailing EV/EBITDA is currently 3 turns higher than Digital Realty’s, and Digital Realty’s multiple ignores its significant stakes in unconsolidated joint ventures, which we value at over $2 billion. Current prices applied to our 2020 projections tell a similar story.

Even at the depths of the recent market-wide sell-off, Equinix’s shares did not get down to our new fair value estimate. Digital Realty, on the other hand, was well below it and was not being valued commensurately with the opportunity it has thanks to the portfolio it now controls. Although the recent market bounce has put Digital Realty back above our fair value estimate, it is closer to fairly valued and may present an opportunity on another market correction. In our view, the addition of Interxion’s assets places Digital Realty on solid footing to compete with Equinix on a global scale and should result in the companies being valued similarly.

Digital Realty in Position to Take On Equinix as Global Data Center King Interxion helps Digital Realty on two fronts. In addition to the very network-dense property portfolio the company acquired, which includes campuses with hundreds of networks connecting in Frankfurt, Amsterdam, and London--three cities critical to Internet connectivity in Europe--the European location has advantages. Europe has been slower to adopt cloud services en masse, but it has been closing ground relative to the U.S. While U.S. hyperscale demand lulled in 2019, Europe gained steam. With a European addressable market nearly as large as that of the U.S., there is room for the European catch-up to continue. The combination of a deeper presence in a hot market and the addition of network-dense European data centers that complement the rest of its portfolio allows Digital Realty to offer customers a more full-service, integrated global solution.

Over the last decade, the data center dichotomy has changed. Rather than simply having wholesale data centers, which house just a few huge tenants that need massive amounts of space, and retail colocation centers, which house many tenants that need smaller amounts of space or just need a presence for interconnection, companies are looking to meet all needs that their customers might have. We believe the shift has been driven by the importance of cloud providers and other hyperscale platforms, which need both large amounts of space throughout the world and the ability to connect with many other companies. To the extent possible, these customers prefer to work with fewer data center providers, because it is easier for them to coordinate and reliably get the service they need. Equinix provides a clear example of this shift. Built on colocation and interconnectivity, Equinix is now investing in large, hyperscale facilities to meet its customers’ requests. Its ability to accommodate customers through its sizable presence on nearly every continent has also been crucial. The combination of extensive interconnection options and global breadth has made Equinix the biggest winner in this environment.

Equinix has a major presence in the Americas, Europe, the Middle East, and Africa, and Asia-Pacific and dwarfs the rest of the industry in terms of total cloud on-ramps, cross-connects, network-dense properties, and geographic breadth. Digital Realty had already been the only other data center company that could match the total size of Equinix’s footprint, but it was much more heavily skewed to North America and couldn’t come close to matching Equinix’s connectivity offerings. Digital Realty’s diversity throughout Europe and the Americas now leads to a revenue mix that more closely resembles Equinix’s, and while Digital Realty has a lower revenue contribution from the Asia-Pacific region, joint ventures in Hong Kong and Japan and current construction in Japan, Singapore, and Australia give it a greater presence and opportunity in the region than appears at first glance.

Equinix has parlayed its global, network-dense footprint into the leading platform for global cloud on-ramps and Internet exchange connections. By a wide margin, Equinix is the predominant cloud on-ramp provider into AWS, Azure, and Google Cloud. Adding Interxion’s data centers more than quadruples Digital Realty’s on-ramps, but more significantly, we think it puts Digital Realty in a stronger position to continue building that business as providers add more on-ramps. We now think Digital Realty is on much better footing to be a legitimate competitor to Equinix on a global scale, not just because of the location of its assets but the quality of its position. After adding Interxion’s data centers, Digital Realty’s network density is much more alluring, making it a better option than it had been for customers with global needs.

Digital Realty can now sell its clients on a portfolio that has a much greater presence at the heart of the Internet--through which all the exploding data traffic flows--and can better compete on a global level with Equinix. According to Packet Clearing House’s Internet Exchange Directory, the cities with Europe’s biggest Internet exchange points are Frankfurt, Amsterdam, London, Moscow, Katowice, Paris, Warsaw, St. Petersburg, Milan, and Zurich. Digital Realty previously had a material network-dense presence only in London and Amsterdam. Interxion’s data centers were major connection points in half of those 10 cities, including all the Western European cities in the top 10 except Milan. Interxion was also present in the cities with the biggest Internet exchanges in Belgium, Denmark, Ireland, Spain (where Madrid is a key gateway to Northern Africa and Latin America), Sweden, and Austria and has the most network-dense campus in Marseille, France, where Interxion has 14 subsea cables that result in Marseille being a key hub connecting the EMEA region with Asia-Pacific.

Companies will now be more able to turn to Digital Realty as an alternative when striving for a one-stop destination to meet their data center and interconnection needs throughout the world. With Interxion in the fold, Digital Realty has an extremely attractive property offering, in our view, and we expect it to close the gap with Equinix, both in competing for customers and in terms of data center productivity. Equinix is the king of global connectivity, but with Interxion in the mix, Digital Realty’s portfolio is now competitive.

In our view, the combination of Digital Realty and Interxion is greater than the sum of the two companies individually. Integrating Interxion’s valuable portfolio with the worldwide presence that Digital Realty already had gives the combined company a footprint that can largely match Equinix’s in terms of network connectivity and global breadth, leaving it in a much stronger position to win business and charge more attractive rates as the data center industry grows and evolves. Digital Realty’s stock hasn’t been immune to the recent market swings caused by COVID-19, and on varying days in the last two months its stock has looked materially undervalued or overvalued relative to our fair value estimate. We think Digital Realty’s future is very bright, and we don’t think it will be severely hurt by a coronavirus-induced recession. When the market presents an opportunity, we’d look to invest in Digital Realty before any other data center company.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)