4 Pain Points for Liquid Alternatives in 2020's First Quarter

Large losses highlight that these strategies aren't immune to market shocks.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

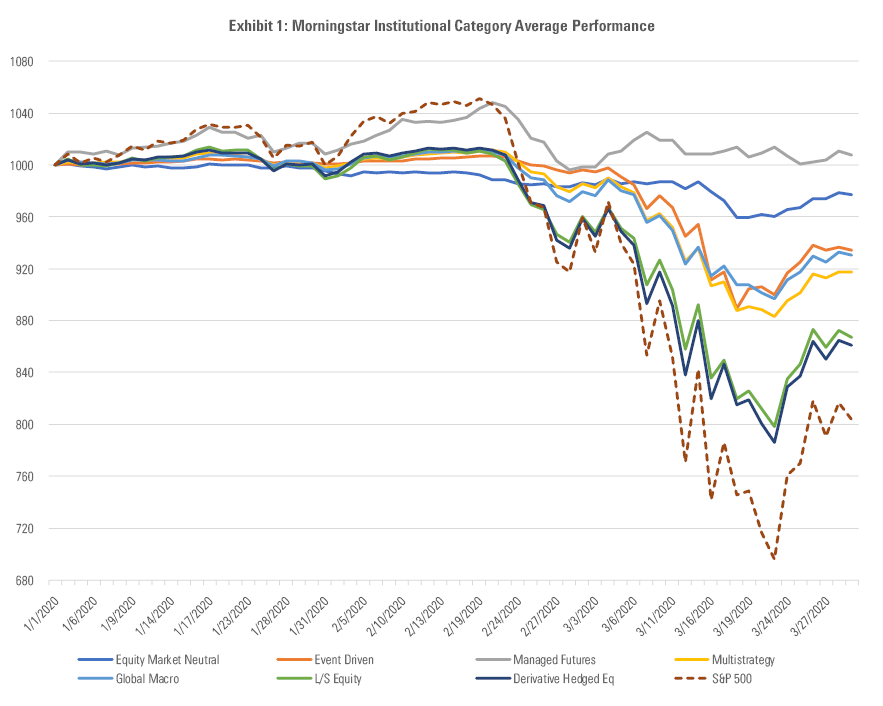

In early March, shortly after the market panic had begun, we noted that a liquid alternative strategy's equity market sensitivity, or beta, was a useful metric for understanding how it weathered the downturn so far. Since then, a sell-off that started in the equity market gave way to a spike in correlations across financial markets, which had a big impact on liquid alternative strategy performance. By the end of the first quarter of 2020, the S&P 500 had lost 20%, credit markets suffered sharp losses, commodity prices cratered, and implied volatility soared to unprecedented highs.

Granted, not all alternative strategies struggled. Managed-futures strategies, which held up well in the global financial crisis, generated positive returns, on average, whereas most other strategies were negative. While many of the themes explored in our previous Fund Spy still held true, pain spread well beyond a strategy’s overall equity-sensitivity in March. Some of the exposures that performed the worst in liquid alternatives portfolios include the value factor within risk premium strategies, event-driven strategies, structured credit, and options strategies. Let’s take a closer look at what went wrong in each of these areas.

- Source: Morningstar Direct.

Merger Madness Event-driven managers try to take advantage of mispricings that occur related to corporate events, such as mergers and acquisitions, reorganizations, spin-offs, and share buybacks, among others. In liquid alternatives, event-driven managers most commonly engage in merger arbitrage, where they buy shares of companies set to be acquired, hoping to capture the spread between the agreed-upon acquisition price and the price that the company is trading at in the open market. Acquisition targets typically trade at a discount to their acquisition price prior to the deal closing primarily to compensate investors for the risk that the deal might fall through. The greater the discount, or spread, the greater the risk that the acquisition won't happen. Some managers may hedge out market exposure by shorting securities that are highly correlated to the stock market, resulting in market-neutral exposure.

In times of economic uncertainty, acquisition deals may be at greater risk of falling apart, and broken deals can result in losses for event-driven strategies. Merger agreements tend to have “material adverse change” clauses built into the contract that allow for the termination of a deal if there is a significant fall in the target’s business value (read: stock price collapse). These clauses are hard to invoke, however, and the uncertainty posed by the coronavirus could make it difficult for either party to make the case in court. Companies can usually still mutually agree to end the merger if they decide it no longer makes sense, which has happened a couple of times in the current drawdown.

Technical pressures can drive deal spreads wider as well and, in times of panic, often beget more selling. Although event-driven strategies are less correlated to equity markets much of the time, they’re vulnerable to experiencing losses in severe market dislocations. Investors flock to safe assets in these periods and may have to reduce their exposures to riskier assets to raise cash. Event-driven trades are a common hedge fund investment strategy, where managers often use leverage to squeeze extra returns from otherwise modest deal spreads in the low- to mid-single digits. In periods of extreme market stress, some funds are forced to deleverage their portfolios, both to reduce risk and meet margin calls, which leads to a cascade of selling. Because these merger holdings trade relatively less frequently than the broader market, spikes in volume can have an outsize impact on prices.

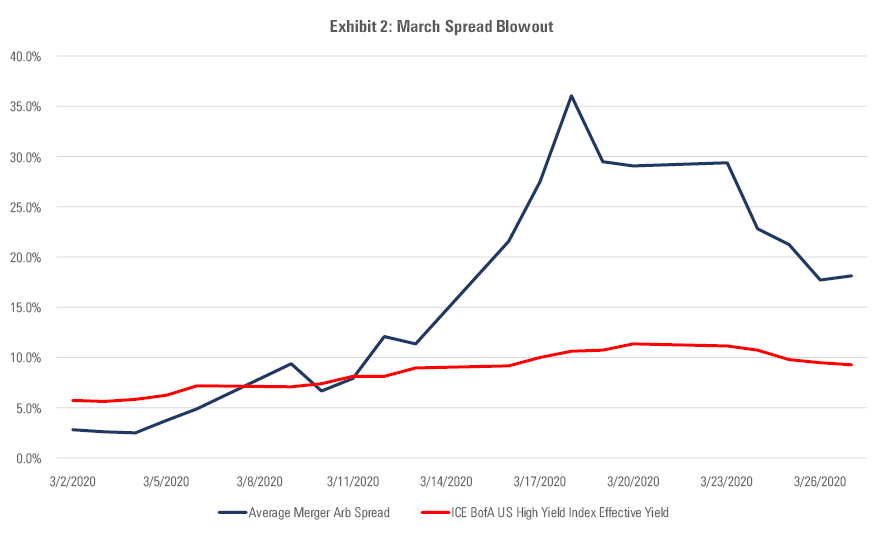

Both of these fundamental and technical pressures hurt merger arbitrage strategies in March. The month started out innocuously enough, with the average stock set to be acquired in an all-cash deal trading around 3% cheaper than its acquisition price. But as uncertainty and selling pressure mounted, spreads widened significantly to more than 35%, on average, around the middle of the month. Even safe deals such as LVMH’s acquisition of Tiffany, which entered the month trading at a spread of less than 2%, reached discounts of nearly 17% in the worst of the sell-off, a spread normally associated with riskier deals that haven’t received regulatory approval. By comparison, spreads on riskier leveraged buyouts faced colossal blowouts as investors grew concerned they would lose access to funding. A prime example of this was Blackstone’s buyout of Tallgrass Energy, which went from an 8.9% spread on March 9 to 75.9% on March 16.

- Source: Morningstar Direct.

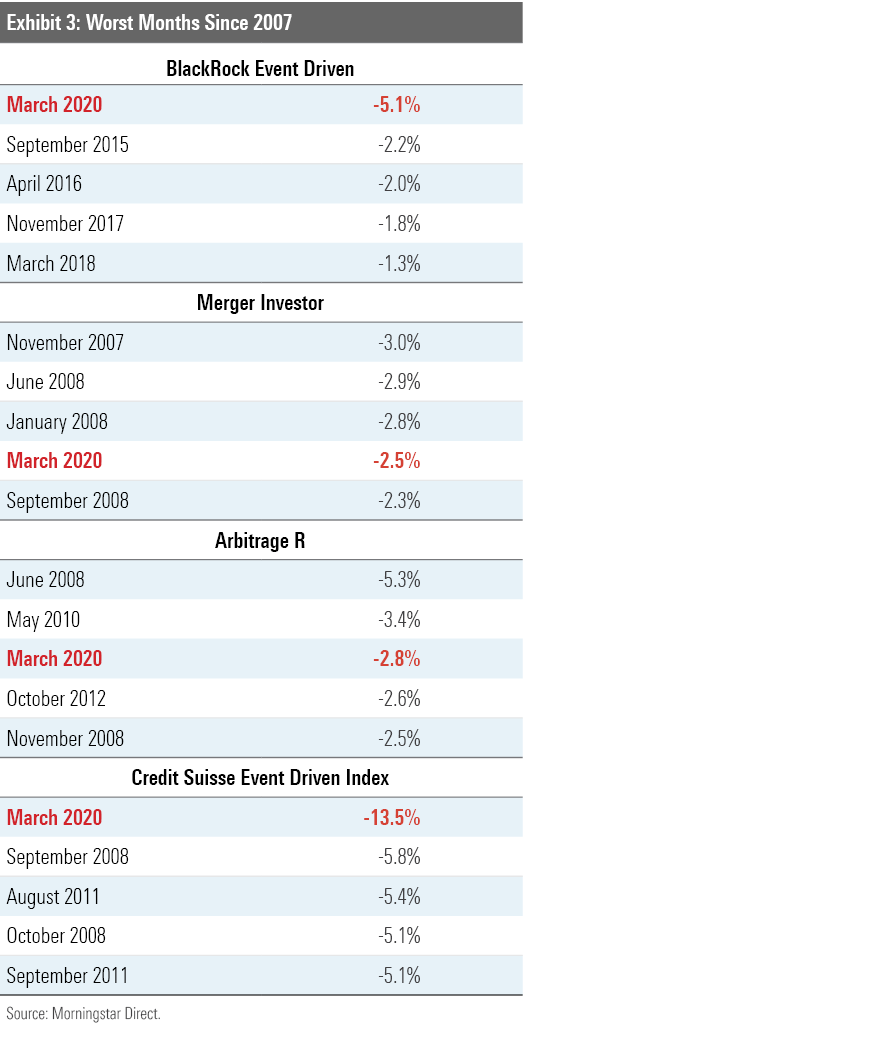

Spreads have narrowed since their peak but remain far above historical levels. So far, despite the heightened volatility, deals have progressed as announced. Blackstone acquired Tallgrass Energy at the agreed-upon price, meaning investors that bought in at the spread peak would have realized a 75% return in just about three weeks’ time. Indeed, many of the funds we cover that bottomed in the middle of the month bounced back, though they still experienced one of the worst months on record.

There will be struggles ahead as uncertainty remains, but March’s deeply discounted deal spreads likely drastically overstated the risk of deal breaks, especially given the prevalence of relatively ironclad merger agreements.

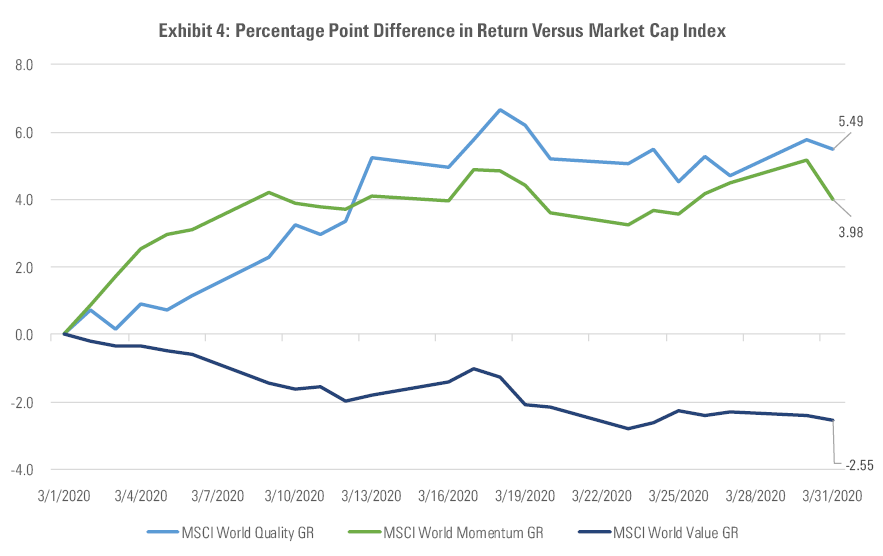

Style Premiums The value factor is a common risk premium held across different liquid alternative strategies, but it is probably most commonly accessed in alternative risk premium strategies. These funds offer exposure to a diversified portfolio of assets, often in a format designed to be market-neutral. Rather than bet on specific asset classes, sectors, or individual securities, these strategies aim to capture the premiums of well-known factors that drive returns across asset classes, such as value and momentum, usually with a modicum of leverage.

While their market-neutral orientation helped stem major losses, many alternative risk premium funds were hurt by underperforming factor exposures. Chief among them was value, which sold off more than market-cap-weighted indexes as investors considered potentially higher bankruptcy risk for some value stocks and the likelihood of lower dividend yields. This continued a stretch of poor performance for value, though managers have argued that this factor tends to perform well coming out of drawdowns and is historically cheap relative to the growth factor. The quality factor provided the biggest boost, as investors flocked to profitable companies that have the balance sheets to weather economic downturns. Bronze-rated AQR Alternative Risk Premia QRPRX fell about 10% during the equity sell-off from Feb. 20 through March 23, 2020, as the firm’s noted exposure to value was a detractor, while its exposure to a stand-alone trend-following strategy helped offset some of the losses. AQR Multi-Strategy Alternative ASAIX was even worse off, as the fund was hurt not only by the value factor in its stock-selection models, but also the aforementioned spread-widening in event-driven trades, leading to a negative 22% return in the first quarter.

- Source: Morningstar Direct.

Structured Credit While high-yield corporate was the first bond sector to get swept up in the pandemic crisis, structured credit came under pressure as the crisis unfolded. While many alternative strategies still take long and short positions in high-yield corporate bonds and indexes, it's become more common since the global financial crisis for hedge funds and other alternative credit managers to invest in structured credit, particularly subordinated tranches with elevated default and liquidity risk. Examples include collateralized loan obligations, nonagency residential and commercial mortgage-backed securities, and other asset-backed debt. Liquid alternatives, like their hedge fund counterparts, may invest across the ratings spectrum and capital structure of these sectors, usually as a sleeve of a diversified multistrategy program.

As with merger arbitrage trades, both fundamental and technical factors contributed to steep price declines for structured credit. Leveraged investors, such as hedge funds and mortgage REITs, as well as some mutual funds, were forced to sell these holdings to meet margin calls or redemption requests, sending the additional yield spreads these securities offer over government bonds to record or near-record highs. Meanwhile, the economic slowdown caused by the policy response to the pandemic raised concerns that some sectors would suffer capital impairment, particularly in the subordinated tranches. For example, agency credit risk transfer securities, a sector created in 2013 to transfer mortgage credit risk from Fannie Mae and Freddie Mac’s balance sheets to private investors, have been an increasingly popular source of additional yield for liquid alternative and traditional bond strategies alike. But as investors dumped the bonds and concerns percolated about the impact of loan forbearance programs and increased default risk, CRT yields spiked to unprecedented levels, resulting in losses as high as 50% for the riskiest tranches, while even bonds with better protections sank around 15%, causing pain for strategies with concentrated exposures.

Private vehicles with infrequent redemption periods and lock-up provisions are better positioned to take advantage of these less-liquid markets, and managers of open-end vehicles that provide daily liquidity to their investors must be extra mindful of the risk they hold while investing in these complex instruments.

Options Strategies The managers that make up the options-based Morningstar Category are a heterogenous mixture of long and short volatility funds, but they all treat market volatility as an investable asset to varying degrees. It should be no surprise that short volatility managers struggled in the first quarter. Similar to insurance companies, these strategies collect premiums in exchange for agreeing to protect against market losses. Over longer time frames, they tend to exhibit low volatility and can provide an uncorrelated source of return in many market environments. Unfortunately, they are also crash-prone by design, as they can rapidly give back their gains from collecting premiums when stocks quickly sell off; this is analogous to the insurer compensating the insured. The first quarter was no exception, as losses on the CBOE S&P 500 PutWrite Index, which is designed to capture the performance of put option-writing strategies, matched those of the S&P 500.

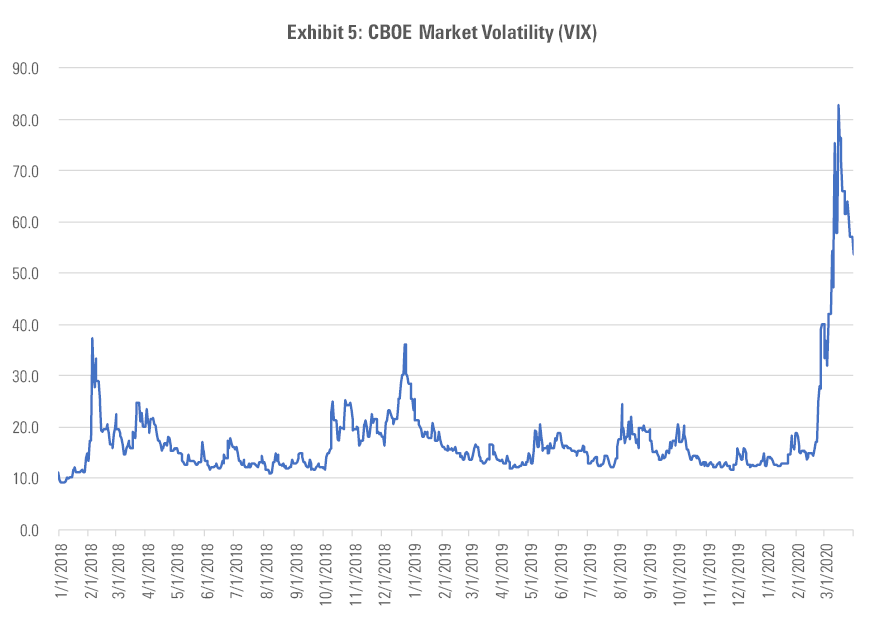

Some strategies were burned more than others by the unprecedented moves in implied and realized volatility. Volatility levels soared at extraordinary speed to historical highs surpassing levels seen during the global financial crisis. The CBOE Volatility Index, or VIX, a measure of the S&P 500’s expected volatility, jumped from the midteens to the upper 40s in a matter of days at the end February. The spike didn’t stop there, though, as the index hit a record high of 82.7 in the following weeks, exceeding the prior high of 79.1 set in October 2008. In addition to the magnitude of the increase, its speed played an important role in options pricing. Options contracts closer to expiration were more severely affected by the market’s decline as longer-dated options contracts did not see the same increase in implied volatility. This is common during shock periods, but the spread between the implied volatility of short-dated contracts versus long-dated contracts reached levels well beyond previously recorded highs. To make things worse, bid-ask spreads (the difference between the prices quoted for an immediate sale and an immediate purchase of a security) widened to levels that made trading more difficult than usual for some strategies seeking to actively manage risk and reduce exposure.

- Source: Morningstar Direct.

While these funds may not be suitable for everyone because of their significant risks, they may offer attractive properties for some sophisticated investors. High implied volatility translates into more attractive premium collection, and thus higher prospective returns, which enables these funds to make up losses as volatility reverses back toward its long-term average. However, their inherent complexity, coupled with the nonlinearity of option prices, make prudent implementation paramount.

Know What You Own Far from being a monolithic group, liquid alternatives apply vastly different strategies, some of them better positioned to weather turbulent markets than others. Investors who suffered steep losses in their liquid alternative funds may understandably be disappointed. But with few places to hide during the recent turmoil, some compelling strategies have gotten bruised but still hold plenty of potential for patient investors. It is therefore worth remembering that most alternative strategies are designed to provide diversification by gaining access to different forms of market risk premiums, or active management of those risks as the market environment evolves. In other words, investors should not expect these to offer full protection from losses but to provide differentiated sources of long-term returns.

Markets are quickly recovering from their lows in March, but uncertainty about the lasting effects of the global pandemic remains. The COVID-19 shock can serve as an instructive stress test for this universe of funds, where most players have yet to show track records spanning a full market cycle. Did a strategy perform as expected given its exposure levels and risk profile? Were any losses it experienced consistent with your risk tolerance? Is it still capable of fulfilling its purpose in your portfolio over the long term? Given the wide dispersion of results across various liquid alternative strategies, careful manager selection is important. While no two market downturns are identical, examining liquid alternative strategies’ performance during the latest sell-off can help you better understand a strategy’s drawbacks and make better long-term decisions about adding alternatives to your portfolio.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)