Funds That Buy Like Buffett, 2020

These mutual funds own the same stocks as the Oracle of Omaha.

In a normal year, thousands of people would be converging on Omaha, Nebraska next weekend for the event sometimes known as "Woodstock for Capitalists." That's the annual Berkshire Hathaway BRK.B shareholder meeting, hosted by chairman Warren Buffett and vice chairman Charlie Munger. However, this is anything but a normal year because of the coronavirus pandemic. The in-person portion of the Berkshire meeting and associated festivities have been canceled, though the meeting will still be held at 3:45 p.m. on Saturday, May 2, with only Buffett, Munger, and a few Berkshire employees in attendance. The meeting still will be livestreamed by Yahoo.

That cancellation may be a disappointment for Buffett fans, but his investing principles are more important than ever in this time of uncertainty and market volatility. Thus, it's still a great time for our annual "Funds That Buy Like Buffett"--a look at mutual funds with the highest percentage of stocks in common with Berkshire Hathaway's investment portfolio, as listed in Buffett's annual letter to shareholders and Berkshire's annual report. Morningstar's Susan Dziubinski discussed the letter when it came out in February, and last year's "Funds That Buy Like Buffett" contains links to previous articles.

Berkshire Hathaway's top 15 stock holdings by market value as of Dec. 31, 2019 were Apple AAPL, Bank of America BAC, Coca-Cola KO, American Express AXP, Wells Fargo WFC, U.S. Bancorp USB, JPMorgan Chase JPM, Moody's MCO, Delta Air Lines DAL, Bank of New York Mellon BK, Goldman Sachs GS, Charter Communications CHTR, Southwest Airlines LUV, United Continental Holdings UAL, and Visa V. Nine of the 15 are financial stocks, mainly banks, and another three are airlines. The only three stocks not in those two groups are Apple, Coca-Cola, and Charter Communications.

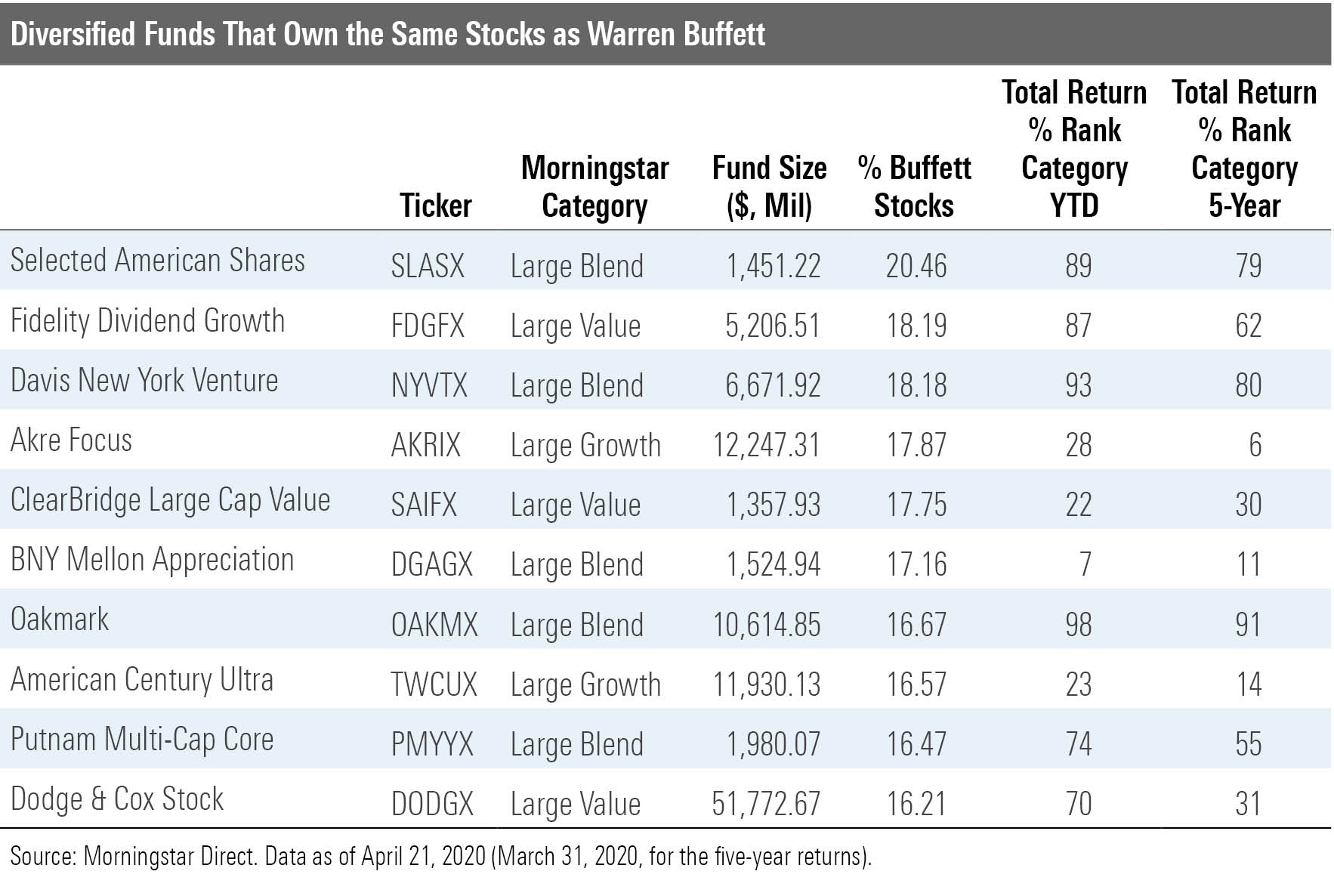

The table below shows the open-end mutual funds with the largest combined weightings in those 15 "Buffett stocks" as of their most recent portfolio. We left out funds with under $1 billion in assets, those not covered by Morningstar analysts, and sector funds such as banking and financial-services funds, which would otherwise dominate the top 10 because of the presence of so many banks on the list. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks. We show each fund's Morningstar Category, size, and percentile rank in its category for the year to date (through April 21, 2020) and for the trailing five years (through March 31, 2020):

The first- and third-ranked funds on the list, Selected American Shares SLASX and Davis New York Venture NYVTX, are both run by Chris Davis and Danton Goei of Davis Selected Advisors. Davis is a longtime Buffett fan whose value-investing approach often favors financial stocks, so it's no surprise to see these funds here. Both funds had Berkshire Hathaway as their top holding as of Jan. 31, 2020, with Wells Fargo and JPMorgan Chase also among the top 10, and Bank of New York Mellon, American Express, and U.S. Bancorp in the top 20. Both funds struggled in this year's market crash, largely because of their big financial stakes, and they also got hit hard in 2018. Both funds have put up great results at times in the past, but the managers' willingness to take big risks hasn't always paid off recently, leading to Morningstar Analyst Ratings of Neutral for all but their cheapest share classes.

Oakmark OAKMX is another fund on this list that has fallen on hard times recently. It was among the hardest-hit large-cap funds in the coronavirus-driven bear market, and it still ranks near the large-blend category's bottom for the year to date. The biggest culprit was its big holdings in financials, which make up 35% of the latest portfolio, though industrial and consumer stocks, such as online travel firm Booking Holdings BKNG, also took major hits. Bank of America was the only "Buffett stock" among its top 10 holdings in the March 31, 2020, portfolio, but the fund held smaller positions in eight others. Despite its recent troubles, the fund earns an Analyst Rating of Gold thanks to the solid and disciplined strategy of managers Bill Nygren and Kevin Grant and the patient way they've executed it over the past 20 years.

In contrast to the Davis funds and Oakmark, Akre Focus AKRIX has held up relatively well in 2020 and ranks near the top of the large-growth category over the past five years. It has a highly concentrated portfolio of fewer than 25 stocks, which the managers choose using very Buffett-like criteria and then hang on to for the long term. The fund does hold a small position in Berkshire Hathaway, but it makes this list thanks to its position in two stocks: Moody's, which took up 10.33% of the Jan. 31, 2020, portfolio, and Visa, which took up 7.55%. The concentrated nature of such funds tends to make them more volatile than their peers, but it also makes it possible for such funds to distinguish themselves and to outperform over the long term if they're managed skillfully. Akre Focus has done that, helping it earn a Silver rating.

Finally there's Dodge & Cox Stock DODGX, by far the largest fund on this list and the other Gold-rated fund besides Oakmark. Like Oakmark, it has struggled so far in 2020, but its longer-term record is stellar. The committee that manages it has a Buffett-like approach to choosing stocks, emphasizing cheap stocks with good management, competitive advantages, and strong growth potential. It had three "Buffett stocks" in its top 10 holdings as of March 31, 2020 (Bank of America, Wells Fargo, and Charter Communications), and it also had substantial positions in four others (Goldman Sachs, Bank of New York Mellon, JPMorgan Chase, and American Express). The fund has been a steady performer that ranks in the large-value category's top quartile over the past decade, illustrating the success that can come from skilled application of a strategy emphasizing quality and valuation.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)