How Did Sustainable Fixed-Income Weather First Quarter?

Security selection and investment process helped these strategies navigate markets turmoil.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Equity sustainable funds weathered the first quarter better than conventional funds, helped by a focus on companies with strong environmental, social, and governance profiles and less exposure to energy. So did their fixed-income counterparts.

Like a lot of fixed-income strategies, sustainable fixed-income strategies suffered sudden and large losses during the first quarter of 2020 because of the coronavirus pandemic, but they held up better than conventional funds. Six out of 10 sustainable fixed-income strategies finished in the top halves of their Morningstar Categories.

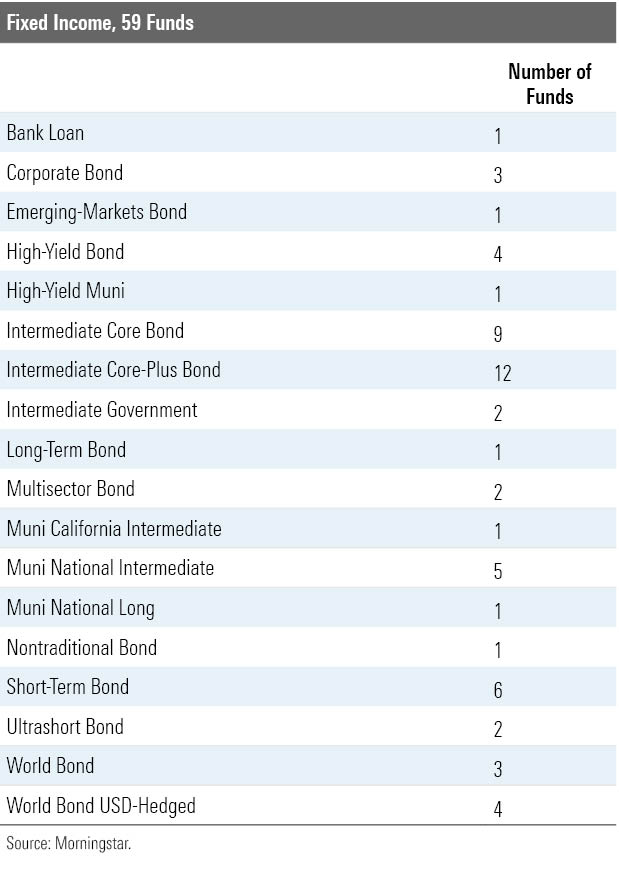

Sustainable Funds Lost Less Than Their Peer Groups Over 2020's First Quarter... Based on a comparison of the first-quarter returns of 59 sustainable fixed-income open-end and exchange-traded funds available in the United States with those of their respective categories, sustainable funds performed better on a relative basis.

Bear in mind that sustainable funds do not constitute an asset class of their own; they invest across capital markets. For purposes of peer grouping, Morningstar therefore places them into our standard categories alongside conventional funds that invest in the same parts of the market, defined for fixed-income funds in terms of region, investment universe, interest-rate sensitivity, and credit risk. The 59 sustainable strategies we took into consideration spread across 18 Morningstar Categories.

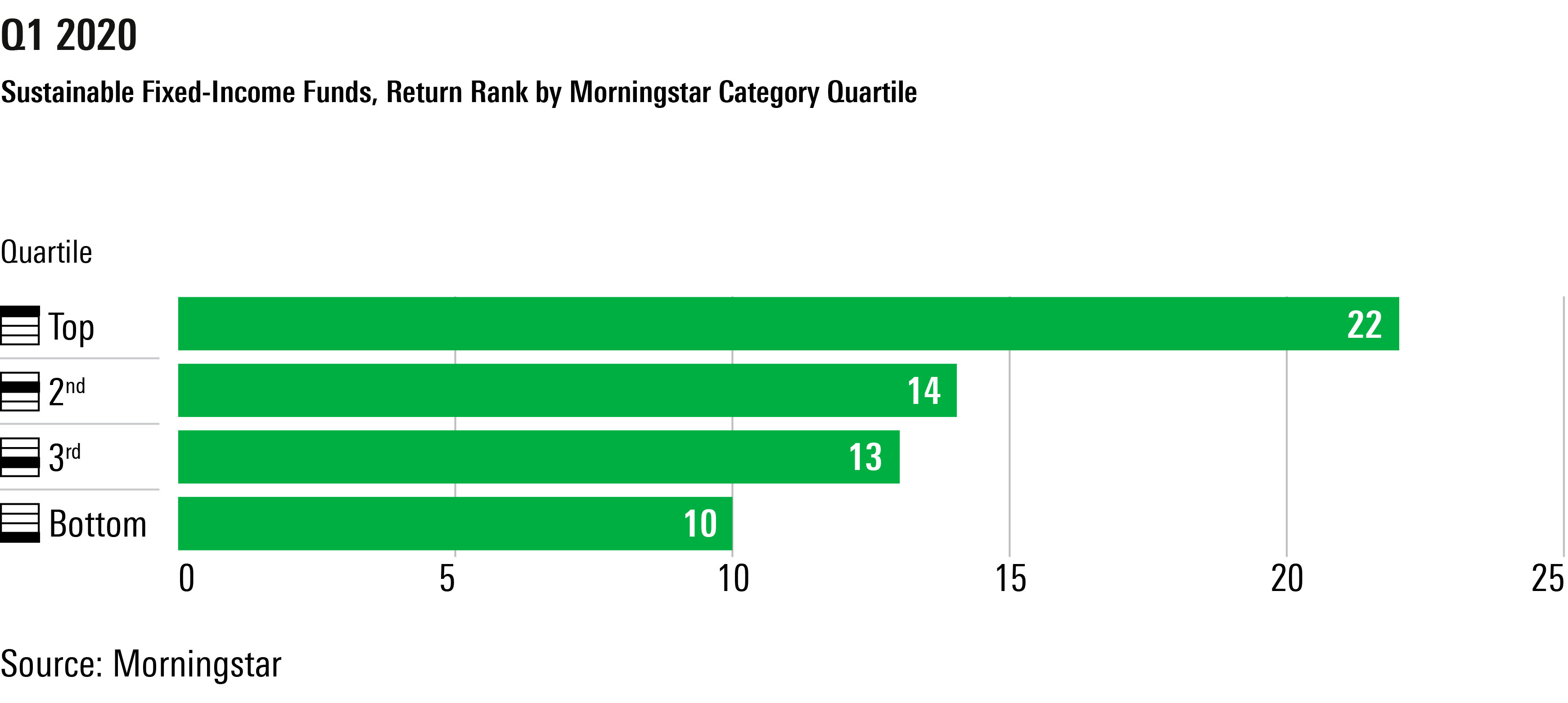

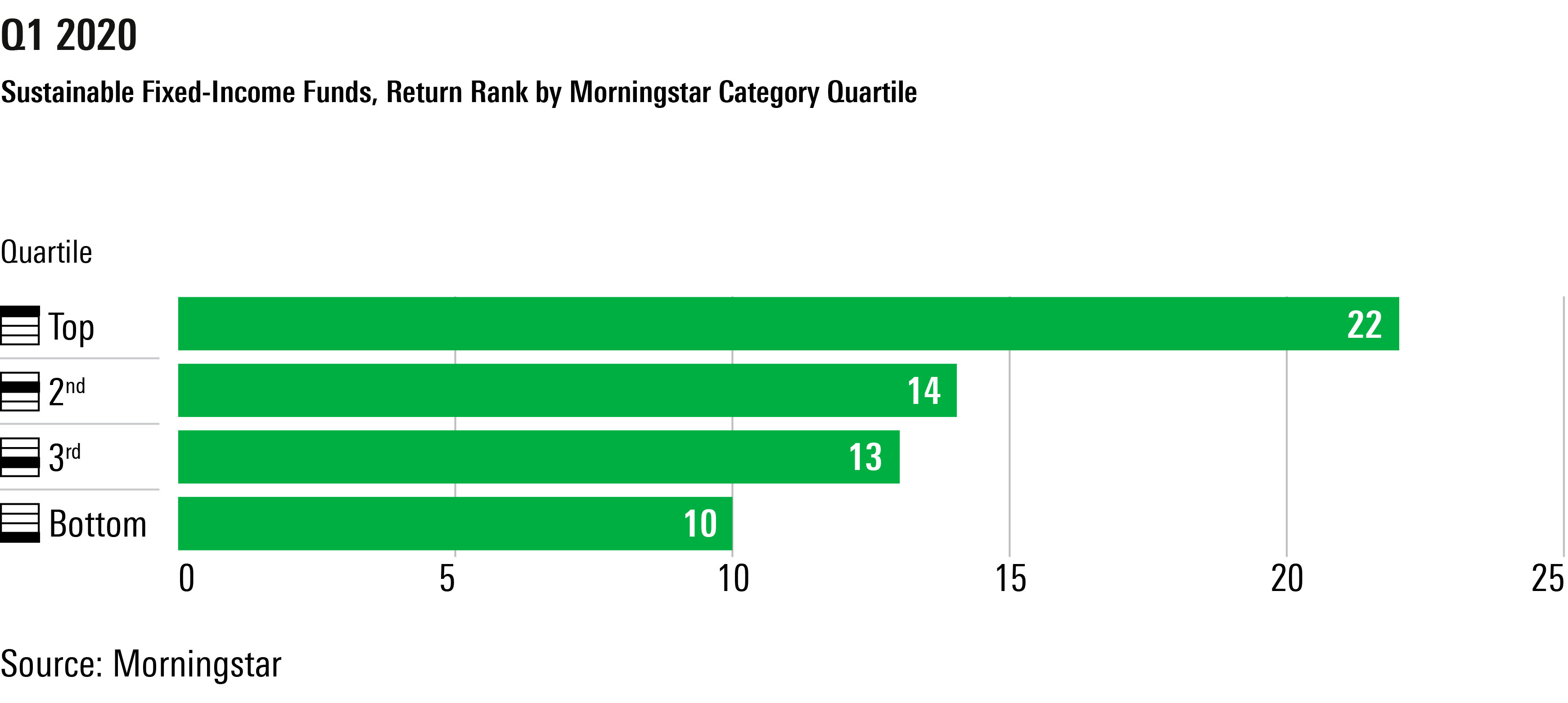

During the first quarter, the returns of sustainable fixed-income strategies were clustered in the top halves of their respective categories, and more sustainable strategies’ returns ranked in their category's best quartile than in any other quartile. The returns of 61% of sustainable fixed-income funds ranked in the top halves of their categories and 37% ranked in their category's best quartile. By contrast, only 17% of sustainable equity funds finished in their category's worst quartile. That's 2.2 times more sustainable funds finishing in the best quartile than in the worst quartile of their categories.

Based on first-quarter returns, sustainable funds were substantially overrepresented in the top quartiles and top halves of their peer groups (by definition, 25% of all funds in a category place in each of four quartiles).

2020's First Quarter Is a Tale of Two Stories That End the Same Until markets started selling off on Feb. 20, most major fixed-income indexes were posting positive year-to-date performance.

A common assumption about sustainable fixed-income strategies is that they tend to have higher credit quality and lower overall risk profiles than their respective category peers. Bond funds with lower risk profiles would seem likely to hold up better during stressed markets but lag during rallies.

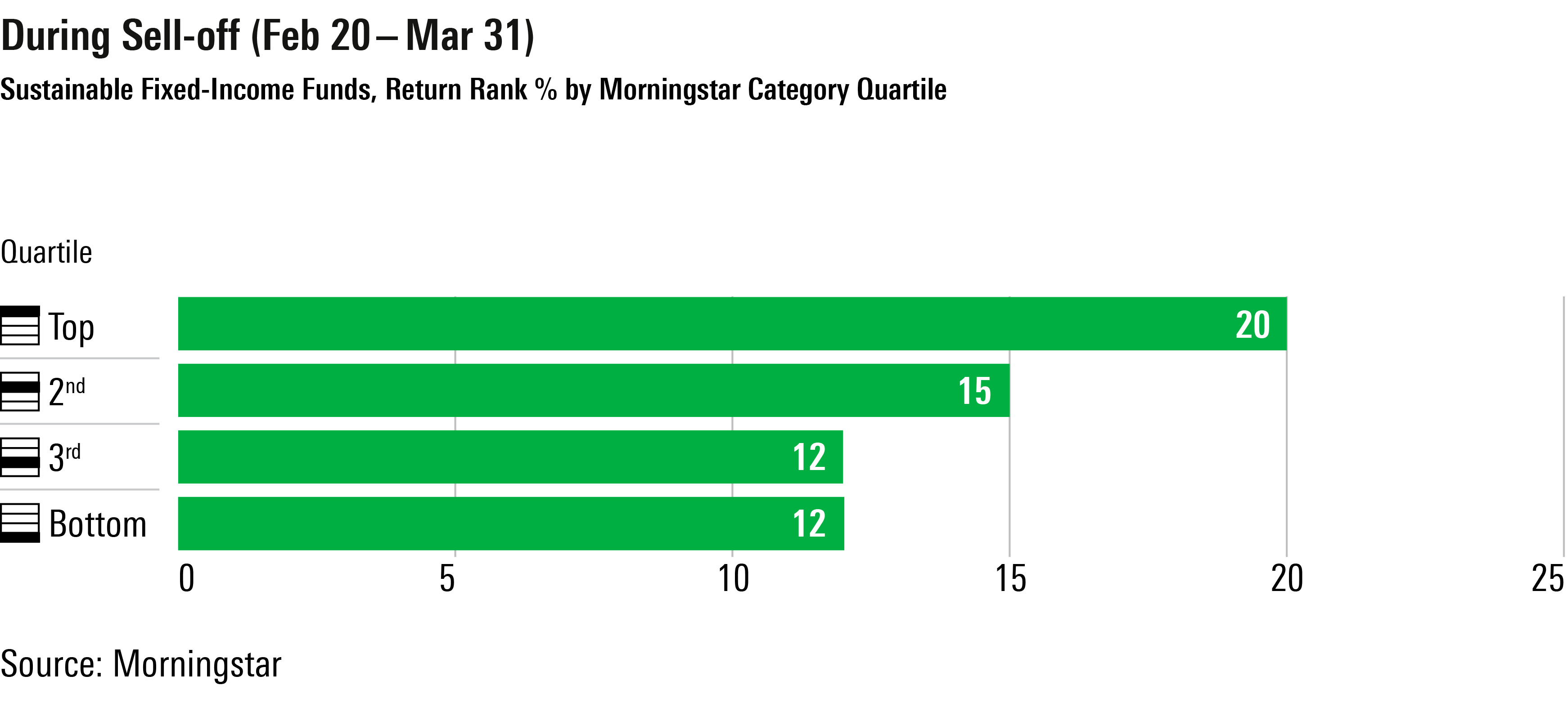

However, 2020’s first-quarter numbers tell a different story. Not only did sustainable fixed-income strategies stay ahead during the sell-off, but they also beat their conventional counterparts even more decisively over the first part of the quarter.

When fixed-income markets crashed between Feb. 20 and March 31, over a third of sustainable strategies ranked in the best quartile of their categories. Moreover, they were underrepresented in both the third and fourth quartiles.

This year started like a continuation of 2019, which was a strong year for credit markets. In 2019, 52% of sustainable fixed-income funds outperformed their respective category median and only 11.5% of them landed in their category’s bottom quartile.

From Jan. 1, 2020, through Feb. 19, 2020, the sustainable fixed-income strategies’ outperformance over their conventional peers is even more prominent than it was in 2019. Indeed, 66% of sustainable fixed-income funds landed in the top halves of their categories. By contrast, only 11% of them finished in their category's worst quartile.

Why Did Sustainable Fixed-Income Strategies Hold Up Better?

While the size of a strategy’s allocation to Treasuries and its overall credit quality are key drivers of performance during a market sell-off, sustainable fixed-income strategies that outperformed their conventional counterparts over 2020’s first quarter benefited more from investment process and security selection. For instance, within the high-yield bond Morningstar Category, Federated Hermes SDG Engagement High Yield Credit FHHIX underperformed 70% of its peers over 2020’s first quarter--the worst relative performance of the four sustainable fixed-income strategies in this category. The strategy lagged despite its higher credit-quality profile. Indeed, the fund’s exposure to BBB rated securities was on average 10 times larger than the category median’s, and the strategy had no exposure to bonds rated B or below, while its average competitor had over 10% of its assets invested in such securities. On the contrary, Calvert High Yield Bond CYBIX beat more than 80% of rivals over the same period despite an overweight in the lowest segment of the high-yield market and less exposure to securities rated BB or above than its category median.

Ultimately, the better relative performance of sustainable funds in the first quarter derives mainly from their investment process and security selection, which focuses on companies or countries that have stronger ESG profiles. Sustainable ETFs in our list, which for the most part screen the investment universe based on MSCI ESG scores, have done well over 2020’s first quarter relative to their category peers. Out of nine ETFs, the iShares ESG 1-5 Year USD Corporate Bond ETF SUSB is the only one that landed in the second half of its category over the first three months of the year. In the intermediate core bond Morningstar Category, iShares ESG U.S. Aggregate Bond ETF EAGG, which has a Morningstar Analyst Rating of Bronze, landed ahead of 80% of distinct peers, and its 3.2% return over the quarter outperformed its traditional version by 5 basis points, while Nuveen ESG U.S. Aggregate Bond ETF's NUBD 4% return beat 95% of its category peers.

As the ability to apply an ESG-scoring process to the underlying security is paramount to allow sustainable strategies to differentiate themselves from their conventional counterparts, some categories might be a better playground than others. Additionally, categories that tend to have a strong sector bias or concentrated opportunity set give sustainable strategies less opportunity to differentiate. While all four sustainable strategies in the world bond USD-hedged Morningstar Category and seven out of nine in the intermediate core Morningstar Category performed better than their category medians, only two out of six did so in the short-term bond Morningstar Category, and both multisector sustainable strategies lagged their typical peers.

/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)