Despite the Downturn, U.S. Sustainable Funds Notch a Record Quarter for Flows

ETFs, passive funds, and iShares dominate as U.S. ESG funds gather $10.5 billion in the first quarter.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

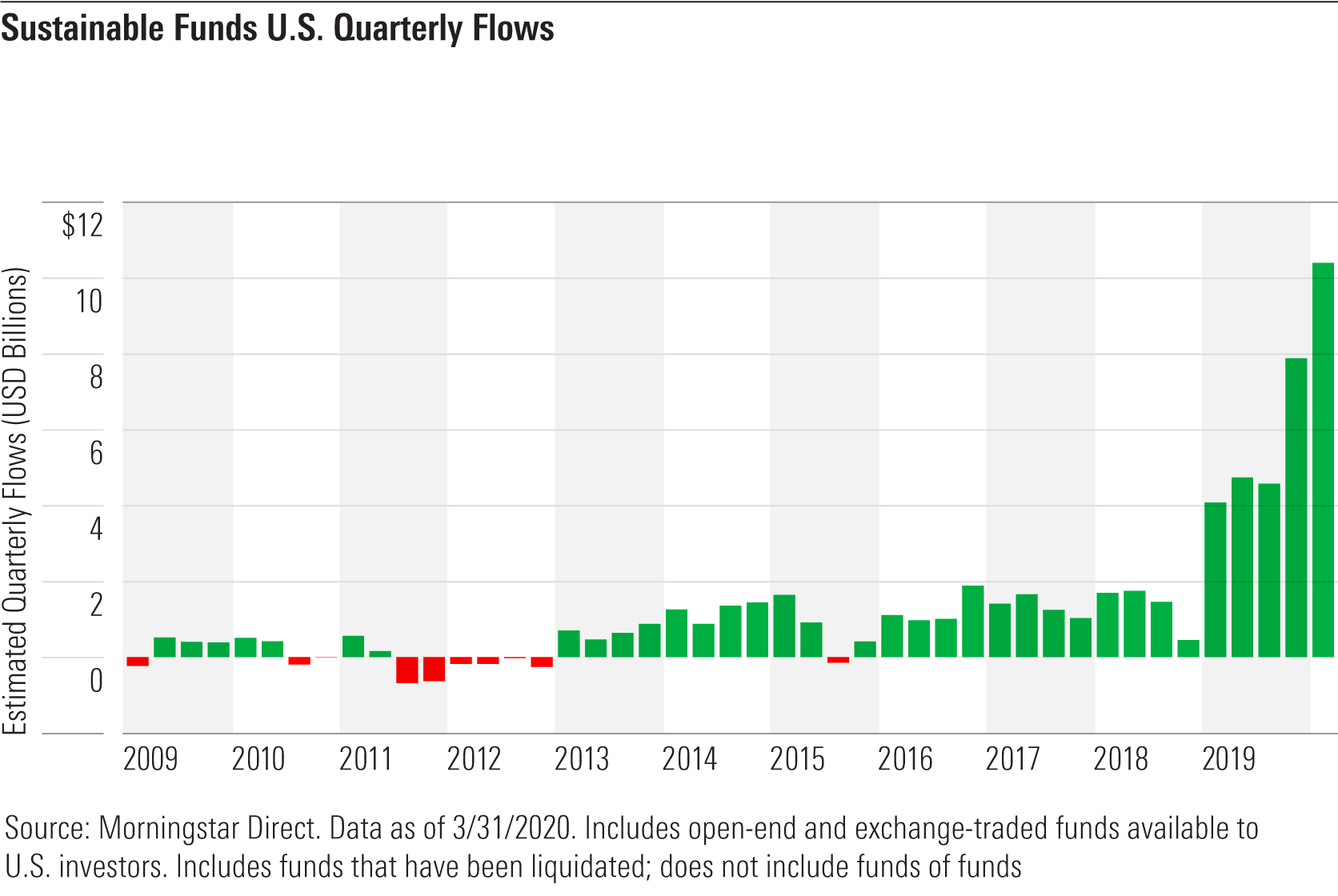

Sustainable funds in the United States set a record for flows in the first quarter.

Yes, you read that right. Despite the sudden descent of equities into a bear market halfway through the quarter, estimated net flows for the 314 open-end and exchange-traded sustainable funds available to U.S. investors reached $10.5 billion in the first quarter, easily eclipsing the previous quarterly record set in 2019's fourth quarter.

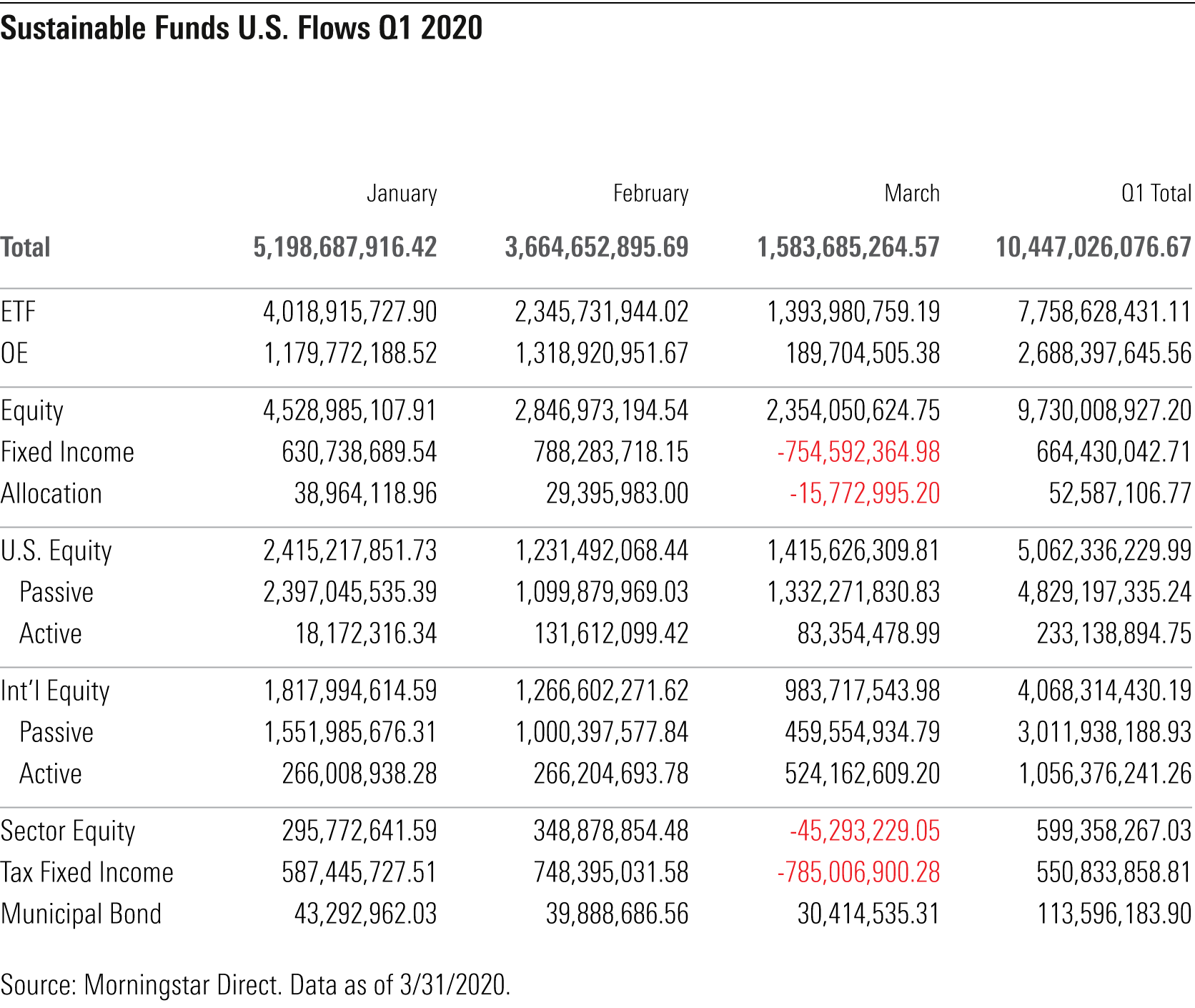

The global pandemic did have an impact, as flows moderated over the course of the quarter. In January, flows were $5.2 billion, an all-time monthly record. In February, flows cooled to $3.7 billion. And in March, which began with the market meltdown more than a week old, flows slowed further but remained positive at $1.6 billion.

About three fourths of net flows went to ETFs, and close to 80% went to index funds. That's up from last year, when environmental, social, and governance ETFs captured only about 40% of overall sustainable fund flows, and index funds about 60%.

While equity fund flows stayed positive all three months, fixed-income funds experienced outflows in March, mirroring the overall trend for fixed-income funds, which may have been driven by factors like quarter-end rebalancing after the sharp decline of equities and the need to raise cash in the new environment.

Among sustainable U.S. equity funds, passive funds garnered an overwhelming 94% of flows, while, unlike active funds overall, active sustainable funds managed to remain in positive flow territory. The story isn't quite as extreme for sustainable international-equity funds, where passive vehicles attracted about 75% of flows and active funds also saw positive flows.

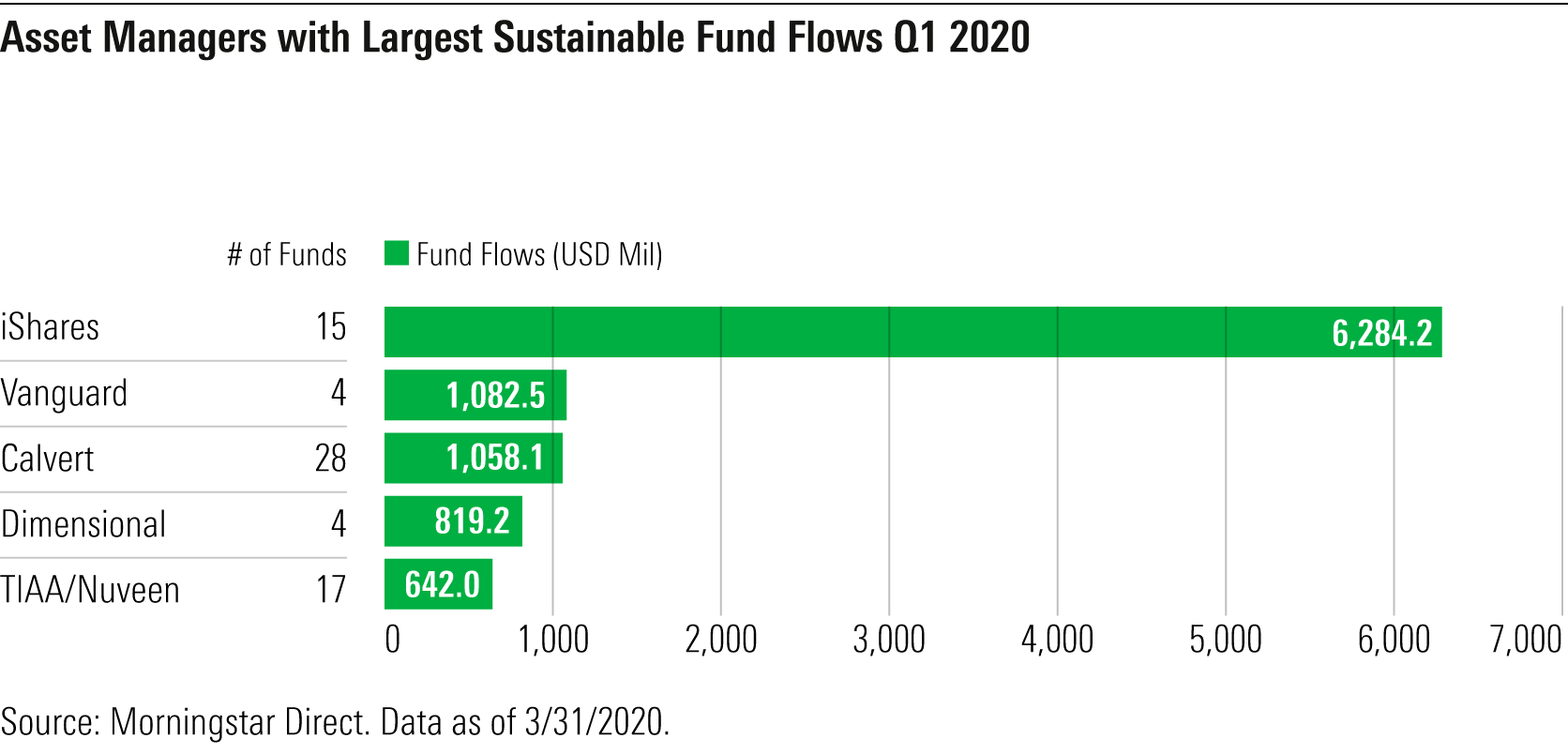

BlackRock commanded the sustainable-investing stage early in the year when CEO Larry Fink announced that sustainability would be BlackRock's new standard for investing. Then the firm's 16 iShares ESG ETFs proceeded to scoop up an astounding $6.3 billion during the quarter, accounting for 60% of the net flows into all sustainable funds in the U.S.

Even beyond BlackRock, the rich are getting richer as they reap most of the reward of sustainable investing's growing popularity. Vanguard collected the second-most flows for the quarter, with Dimensional and TIAA/Nuveen rounding out the top five ESG asset gatherers.

Hanging in there is Calvert, which is the only asset manager on the list with a long-standing firmwide commitment to sustainable and responsible investing. It has been helped by the additional distribution muscle of Eaton Vance, its parent since 2016.

Sustainable funds in the U.S. attracted $21.4 billion in net flows in 2019, 4 times the previous calendar-year record. With first-quarter 2020 flows already at half that amount, sustainable funds are on track to eclipse last year's mark, even considering that the ongoing pandemic could still wreak havoc with fund flows for the rest of 2020. From a performance standpoint, sustainable funds held up better than conventional funds in the first quarter, which is likely to help the group attract more flows going forward.

Correction: This article was updated with a correction to Exhibit 1.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)